Here’s Why TRX Price Has Room to Reach a Local Top

TRON (TRX) has been on an upward trajectory in recent days, sparking growing interest among traders and investors. Despite this rise, the futures data surrounding TRX suggests a stable market environment with no immediate signs of overheating.

The token's recent past price action, combined with a neutral futures positioning setup, indicates a nice buildup of price momentum. This could mean further upward movement with no destabilizing factors.

Price Performance and Market Sentiment

Between August 9th and August 15th, TRON price remained fairly bullish with a parabolic run toward mid-August. Over this past week, TRX has appreciated by 4.7%, while its 30-day performance is even more impressive at 18%.

This means, in the short and medium-term, the token has been gaining from its outperformance. Analysts assert that the movement of TRX could be stimulated by favorable sentiment in recent positive developments regarding this asset.

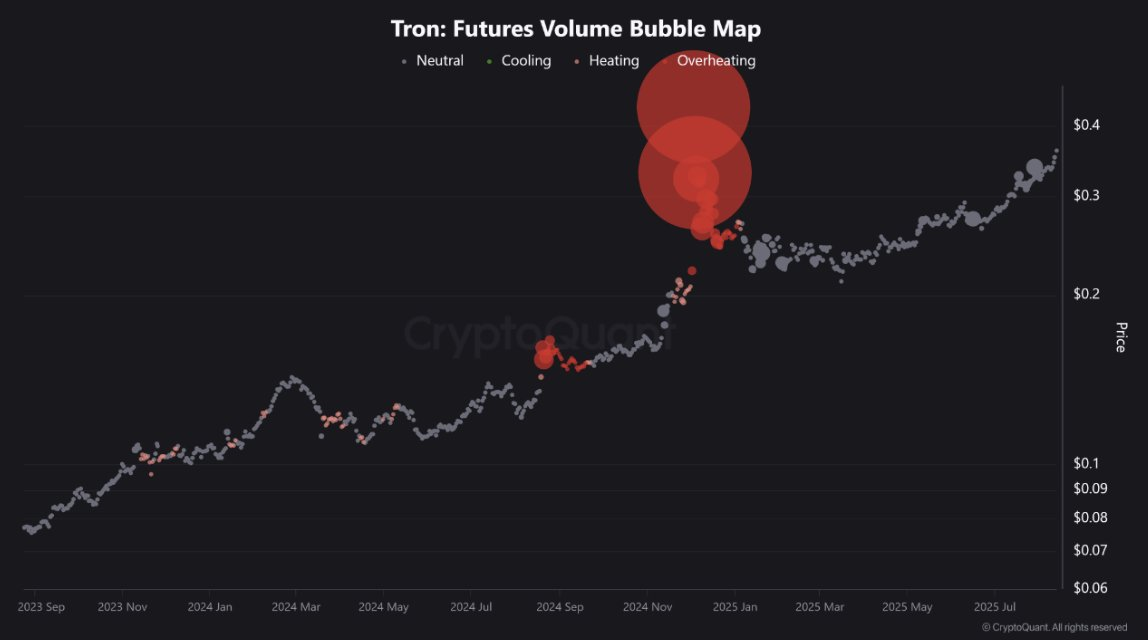

Importantly, according to data provided by CryptoQuant, the market positioning of TRX remains within a healthy range in the neutral. According to TRON Futures Volume Bubble Map, the asset is nowhere near overbought.

Inherently, the neutrality offers a good prognosis for further upward movement from TRON without triggering any kinds of risks of instability. The recent periods of consolidation hence help further to build the sentiment, thereby indicating that the price trajectory of the token still lies on safe grounds.

Long vs. Short Position Trends

With the most recent data, the Long/Short ratio stands at 0.8369 for TRX during the 24-hour period considered. This implies that short positions are somewhat higher in number against long positions, which may suggest bearish sentiment over the short term.

Still, with no significant imbalance detectable in the ratio itself, the market sentiment has kept itself in check. Exchanges such as Binance, OKX, and Bybit exhibit certain degrees of bias toward either the long or short side, with Binance displaying a significant long bias.

A variety of investors create an environment that sustains a balance, so that one particular group is not able to take exaggerated positions. As such, the futures market is not overly skewed in any direction, keeping volatility in check. At the same time, moderate leverage keeps aggressive short-term positions in check, leaving some room still for overall sentiment to remain stable.

Funding Rates and Liquidation Activity

An additional aspect for the price performance of TRX is the OI-Weighted Funding Rate . This measure showed that funding costs remained fairly stable over recent weeks, with minor fluctuations coinciding with spikes in price volatility.

There was also a dip observed in the funding rate between the 7th and 9th of August, which in itself was an interesting sign of some market repositioning, probably forced by the unwinding of large positions. Currently, the funding rate is close to 0.005%, with neither bullish nor bearish views by the market.

On the other hand, the liquidation data disclose a remarkable trend. Liquidations totaling $743.98K have occurred within the last 24 hours, mostly from the long side. Long traders were caught off guard due to the recent volatility, causing significant forced sell-offs.

Short-term liquidations on the short side total $5.27K, but the overall liquidation trend signals ongoing market uncertainty, which remains a concern for some.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。