Author: Nancy, PANews

As the price of cryptocurrencies approaches ATH, the ETH/BTC exchange rate has violently rebounded, and bullish sentiment around Ethereum is at an all-time high. However, Bitcoin maximalist Samson Mow has poured cold water on the situation, arguing that this market trend does not reflect a recognition of Ethereum's long-term value, but rather a short-term capital game aimed at acquiring more BTC. Currently, this capital-driven Ethereum feast is also facing market sentiment divergence, with institutions pushing for large-scale buying while short-term investors accelerate profit-taking.

Is the Rise Just to Exchange for More BTC? Ethereum's Value Questioned by Bitcoin Believers

In recent months, Ethereum has experienced a sustained explosive rise, with prices nearing historical highs. Market sentiment has been completely ignited, and Ethereum's target price has been continuously adjusted upward. However, steadfast Bitcoin supporter Samson Mow has taken a contrary stance.

A few days ago, Mow posted on social media stating that most ETH holders also possess a significant amount of BTC, including ICO participants and insiders, who are converting these BTC into ETH and using new narratives like the Ethereum treasury to drive up ETH prices. Once they push the price to a sufficiently high level, they will sell ETH, creating a new generation of "greater fools," and then convert the profits back into BTC.

Mow further stated that it would be difficult for ETH to break through its historical high because the closer it gets to psychological barriers, the stronger the motivation to sell becomes. This situation resembles a prisoner's dilemma, where the only choices are to sell or hold. In the long run, no one truly wants ETH. Bitcoin holders need not worry about the ETH/BTC breaking the downward trend line; Ethereum has always been a tool for acquiring more Bitcoin, as it was during the ICO era and still is today.

Mow also sharply quoted Ethereum founder Vitalik Buterin's remarks, exposing his "double standards" on treasury issues. Vitalik once criticized Bitcoin financial companies, claiming they "betrayed the original intent of cryptocurrency," but regarding similar trends within the Ethereum ecosystem, he stated, "this is beneficial and valuable." This inconsistency has further fueled Mow's doubts about ETH's long-term value.

Mow's faith in Bitcoin is almost religiously fervent; he has predicted that Bitcoin's price will reach $1 million, attributing this to Bitcoin's scarcity, institutional adoption, increased reserves by businesses and nations, and the unsustainability of the fiat currency system. In his view, "all factors unfavorable to Bitcoin are tending towards zero."

This Bitcoin OG actually immersed himself in the Bitcoin industry as early as 2015, joining Bitcoin exchanges and mining pools like BTCC and Bitcoin infrastructure development company Blockstream. In 2021, he founded JAN3, dedicated to accelerating Bitcoin's global adoption. Not only that, but he has also discussed the potential for Bitcoin mining and its use as legal tender with several countries, even being a key proponent of Bitcoin's legal tenderization in El Salvador.

Institutional Funds as a Frenzied Driving Force, Market Turnover Accelerates

Despite Ethereum being "bombarded" by Bitcoin believers, its market performance has significantly improved due to the influx of institutional funds.

The ETH/BTC ratio is a key indicator of Ethereum's price performance relative to Bitcoin. Since the ETH/BTC ratio briefly fell below 0.02 in April, marking a five-year low, it has now risen to a maximum of 0.039, nearly returning to mid-2021 levels. Price performance has also been impressive. According to Coinglass, Bitcoin's gains in Q2 and Q3 of this year were 29.74% and 11%, respectively, while Ethereum far outpaced it, rising 36.48% and 86.12%, strongly surpassing BTC.

Institutional power is the absolute driving force behind Ethereum's rise. Data shows that Ethereum spot ETFs are demonstrating an astonishing capital absorption rate, with a net inflow of over $2.91 billion in a single week, once reaching a single-day inflow of over $1 billion, surpassing Bitcoin's spot ETF's $560 million. Meanwhile, according to Ethereum supporter Anthony Sassano, the net issuance of ETH over the past 30 days was 74,000 coins, while funds and ETFs collectively bought 3.5 million ETH, 47 times the net issuance during the same period.

Clearly, the fundamentals of this Ethereum rise are different from before. In fact, compared to the on-chain frenzy driven by DeFi and NFT narratives in 2021, the on-chain demand in this cycle is relatively subdued. For example, in terms of the change in the number of addresses, Etherscan data shows that the number of independent Ethereum addresses has only increased by 3.1% in the past two months.

This powerful capital effect has directly ignited market sentiment. Standard Chartered has raised its year-end target price for ETH to $7,500; BitMine Chairman Tom Lee has boldly predicted a potential surge to the $10,000 to $15,000 range by the end of the year; Placeholder VC partner Chris Burniske believes it could reach $6,900 to $8,000 in October.

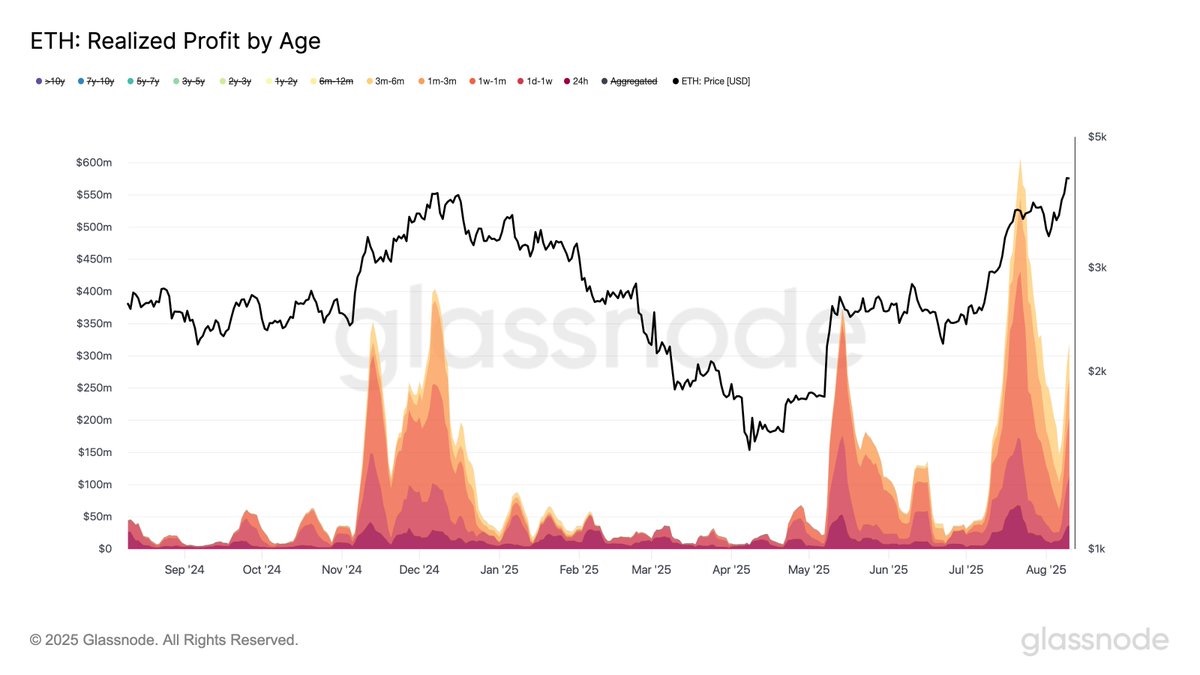

As institutional entry has driven up Ethereum prices, more holders are entering profit zones, and the market is accelerating into a turnover phase. Glassnode data shows that 98% of Ethereum supply is profitable, reaching a two-year high. The profit-taking amount for ETH (calculated on a 7-day moving average) peaked at $771 million per day in July, a new high since December 2024. It has currently fallen back to $553 million per day, with long-term holders' profit-taking amounts comparable to December 2024 levels, but short-term investors are realizing more profits.

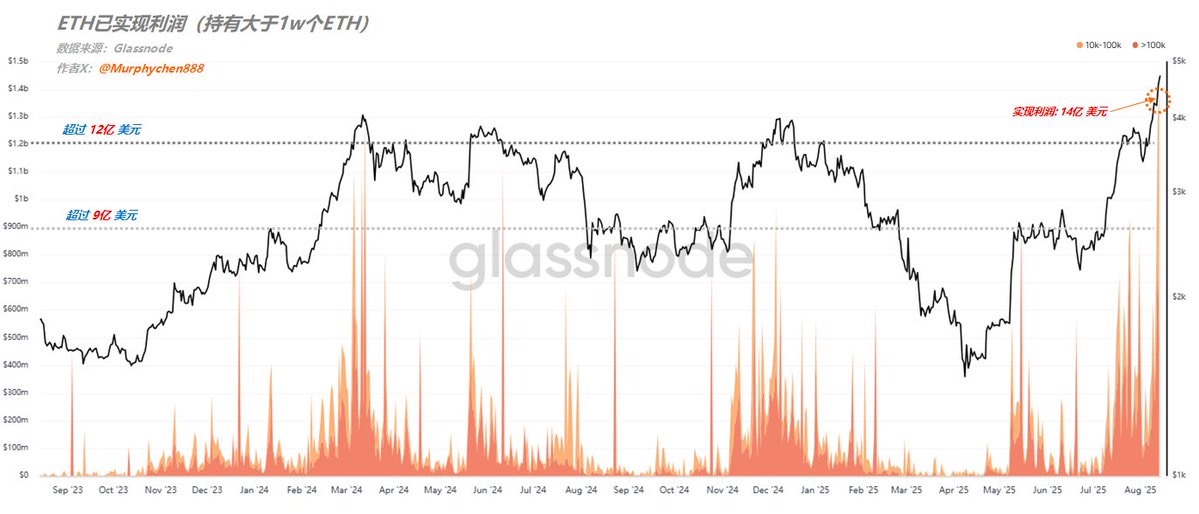

Whale activity is particularly noteworthy. According to Twitter user @Murphychen888, citing Glassnode data from August 14, addresses holding over 10,000 ETH realized profits of $1.4 billion in a single day, marking the largest scale of whale cashing out in nearly two years. The scale of chips cashing out with profits exceeding 100% also reached a two-year high, but "old coins" with profit margins exceeding 300% have not been very sensitive to current prices, and there has not been a large-scale cashing out like in March and June of last year; only the selling volume is gradually increasing. This also means that during this wave of ETH rise, many medium- to short-term holding whales are choosing to cash out at high levels.

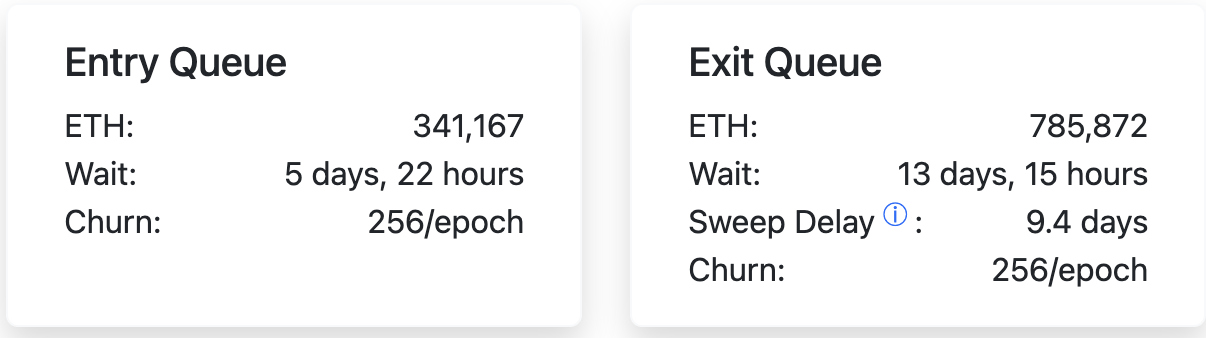

Ethereum staking behavior is also showing divergence. According to validatorqueue data, as of August 15, over 785,000 ETH worth approximately $3.6 billion have exited the Ethereum network, setting a historical record for exit scale in terms of currency value, but about 341,000 ETH are waiting to join the network. This situation reflects that some stakers have chosen to cash out after prices rebounded over 160% from the April lows, while new funds driven by regulatory benefits and institutional demand are continuously entering the market, including publicly listed companies like SharpLink Gaming and BitMine Immersion, which have recently significantly increased their ETH holdings and engaged in staking.

Overall, this round of Ethereum's rise is primarily driven by institutional liquidity. Although short-term prices and sentiment are forming positive feedback, the on-chain activity and user demand have limited increases, making it difficult to sustain long-term market confidence. Therefore, short-term turnover games are also intensifying.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。