Nasdaq Ticker GEMI Announced in Gemini IPO Filing News

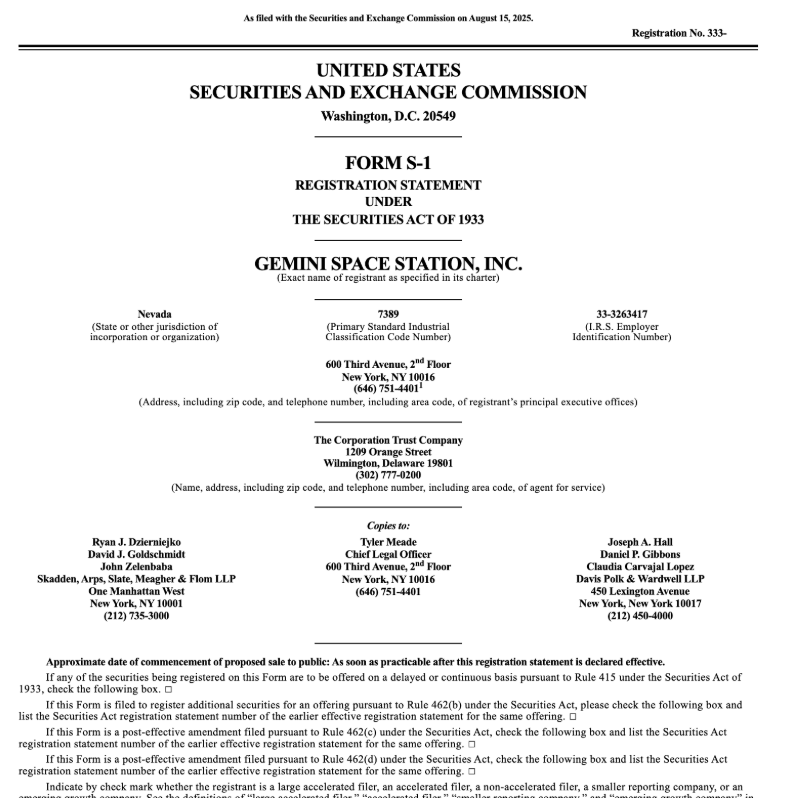

Gemini IPO Filing news is buzzing the crypto market. The Winklevoss twins company's S-1 form statement with an announcement of its Initial Public Offering made on Friday. The cryptocurrency exchange plans to trade on Nasdaq under the symbol GEMI. In the first half of 2025, the company's revenue dipped and its losses rose.

Source SEC Website

Terms of the offering were not disclosed in the Gemini IPO filing, made public on Friday. Earlier in June , a draft registration statement was filed in confidence. The left-lead bookrunner and cohort that will oversee the offering are Goldman, Citi, Morgan Stanley, and Cantor.

Financial Snapshot: Rising Losses, Declining Revenues

The Gemini IPO filing shows weaker financial numbers for the exchange than previously known. The company reported a net loss of $282.5 million on a total revenue of $68.6 million in the six months ended June 30, compared with a net loss of $41.4 million on a revenue of $74.3 million year earlier. According to Gemini IPO Filing, the net proceeds will be used for both general company objectives and the repayment of all or a portion of its debt to third parties.

The cryptoexchange also allows stablecoins on its platform, a feature that gained notice when the GENIUS Act, a new U.S. law that establishes a regulatory framework for stablecoins, was signed last month. The GUSD, a stablecoin that is 1:1 correlated with the US dollar, is issued by the crypto exchange.

It’s Ecosystem: From GUSD to Custody and Credit Cards

The Company has also launched OTC platform, Custody of Digital Assets, a GUSD Stablecoin, Staking of $ETH and $SOL, Credit Card (Mastercard), and Collector platform. The firm was founded in 2014 by the twin brothers Cameron and Tyler Winklevoss, best known for their early involvement in Facebook. The twin brothers recently have made a strategic investment in American Bitcoin, a mining company with direct ties to the Trump family.

Will the Gemini IPO Filing heat up Market

The firm will become the third public crypto exchange once it goes public. With the recent Bullish 's debut on Wednesday made it the second listed cryptocurrency exchange in the country after Coinbase Global (COIN.O), which opened a new tab. Such impressive results demonstrate the increasing appeal of investing in digital assets. Considering that market indicators heavily rely on cryptocurrency IPOs, there is a probability that the platform will reach massive range or higher.

Also read: Beetz Daily Combo 15 August 2025: Earn Tokens Easily免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。