Defai is the next step and future of DeFi, and the only question is, how do we get there?

From a technical perspective, the current development of Defai can be divided into two factions:

Infrastructure faction: Focused on building AI-driven underlying protocols.

Application layer faction: Overlaying AI functionalities on existing DeFi protocols, such as optimizing trading strategies.

I believe the application layer will break through first. The reason is simple: users need immediately usable value.

However, there are exceptions. @gizatechxyz, as a Defai infrastructure, belongs to the type that "grabs with both hands." To make a long story short, Giza has built:

Production-grade infrastructure, namely the DeFAi underlying protocol Giza Protocol, whose core architecture includes three levels: semantic abstraction layer, proxy authorization layer, and decentralized execution layer, allowing various AI agents to thrive based on its underlying architecture.

It has also created:

A flagship application with strong market appeal, namely the flagship AI agent ARMA, which scans all Base lending platforms' lending pools in real-time, continuously monitors and evaluates protocols like AAVE, Morpho, Compound, and Moonwell, analyzes APR changes and Gas cost fluctuations, providing users with optimal stablecoin yields.

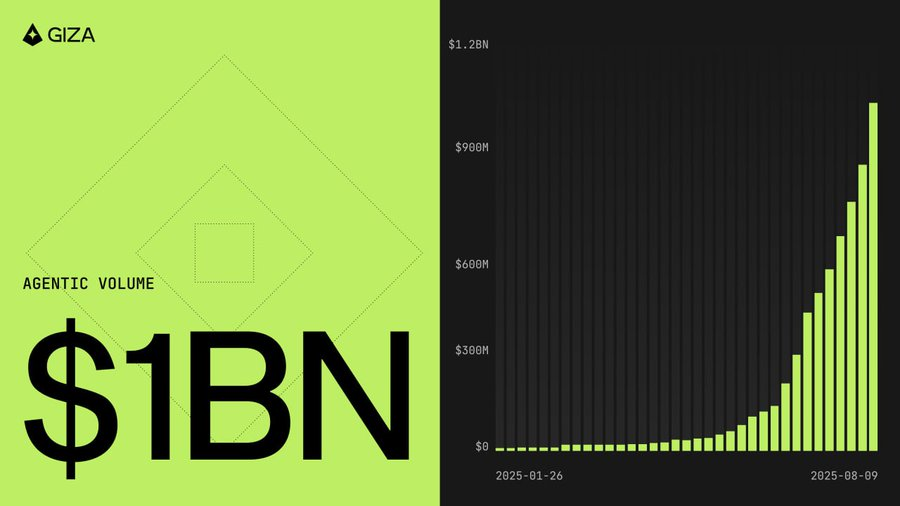

On August 11, ARMA's trading volume surpassed $1 billion. This means that billions of dollars in trading volume have been optimized without any human intervention. The journey to $1 billion was not achieved overnight; Giza spent:

A full 8 months (starting from December 24 when it was made public to users)

Over 300,000 transactions

Continuous integration from Aave to Compound to Morpho

Giza's strategy is essentially "prove value first, then expand infrastructure." Through flagship products like ARMA, they first validated the actual value of AI in DeFi—$1 billion in trading volume is not fake; it is real market validation.

However, ARMA's success has also created a "sweet burden." In many people's minds, Giza is merely a "stablecoin yield agent," forgetting Giza Protocol's grander mission as a "trustless, context-aware, and permissionless agent infrastructure." This is both a moat and a ceiling. The deeper reason is that the current DeFAI market is still in the education stage. Users find it easier to understand specific application scenarios rather than abstract infrastructure concepts.

There is only one solution: to create more "representative works," launching more diverse use cases that cover a larger user base and solve more practical problems. This is precisely the direction the Giza team is working towards.

Recently, Giza's official channels have been continuously hinting that something big is about to happen. If I’m not mistaken, the second flagship AI agent is on the way. The upcoming second agent will likely choose a field completely different from stablecoin yields—such as cross-chain arbitrage or meme coin trend capturing. Such a combination can showcase the versatility of Giza's infrastructure rather than being limited to a single scenario.

In summary, Giza is on a correct but challenging path: educating the market with concrete success stories while building the underlying support for a larger market cap imagination space.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。