If successful in going public, Gemini will become the third cryptocurrency exchange to list on the U.S. stock market, following Coinbase and Bullish.

Comprehensive | Prospectus Zhenxing Capital Financial News

Editor | Echo

*This article is for informational purposes only and does not constitute any trading advice.

Against the backdrop of favorable cryptocurrency policies and a surge in U.S. IPO activity, cryptocurrency exchange Gemini recently submitted its prospectus, preparing to list on the NASDAQ in the United States under the stock code "GEMI," with Goldman Sachs and Citigroup serving as lead underwriters.

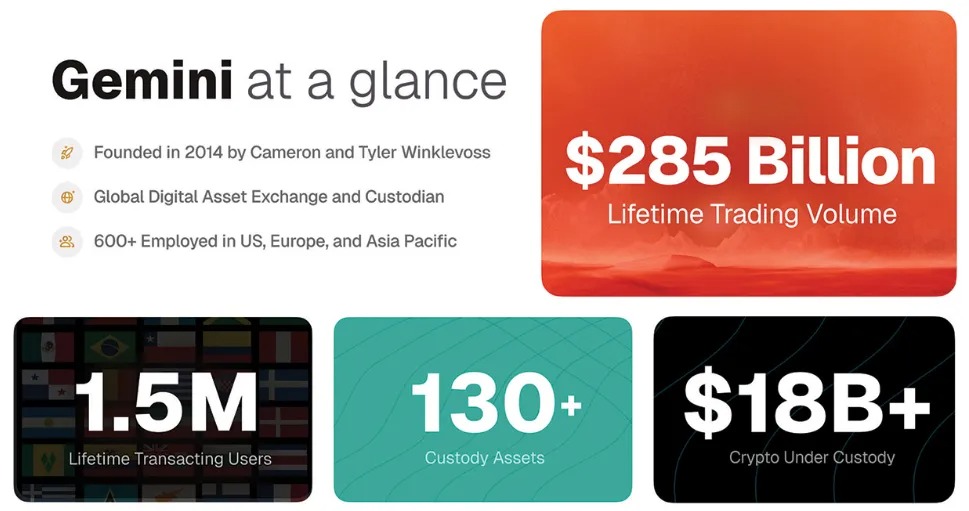

Founded in 2014 by the Winklevoss twins, Gemini is led by President Cameron Winklevoss and CEO Tyler Winklevoss.

According to data provider Kaiko, Gemini is one of the largest cryptocurrency trading platforms in the U.S. by trading volume, with approximately $18 billion in assets under custody and a historical cumulative trading volume of about $285 billion. Its services include over-the-counter (OTC) trading, credit card services for U.S. customers, and trading of assets such as Bitcoin, Ethereum, and various stablecoins, catering to both retail and institutional clients, with primary revenue coming from trading fees based on transaction volume.

In addition to operating a cryptocurrency exchange, Gemini also offers crypto staking services and a credit card that provides cryptocurrency rewards, as well as crypto custody and OTC trading services for institutions.

Currently, Gemini has over 13 million users and $50 billion in assets under custody, ranking among the top ten cryptocurrency custody platforms globally.

Gemini issues the Gemini Dollar (GUSD), a stablecoin pegged 1:1 to the U.S. dollar. Gemini also supports over 70 cryptocurrencies, with operations in more than 60 countries/regions.

If successful in going public, Gemini will become the third cryptocurrency exchange to list on the U.S. stock market, following Coinbase and Bullish.

The prospectus shows that Gemini's revenue for 2023 and 2024 is projected to be $98.14 million and $142 million, respectively; operating losses are expected to be $312 million and $166 million; and net losses are projected to be $320 million and $159 million, respectively.

In the first half of 2025, Gemini's revenue was $68.61 million, a 7.6% decrease from $74.23 million in the same period last year; operating losses were $113 million, compared to $84.8 million in the same period last year; and net losses were $282 million, compared to $41.37 million in the same period last year.

Notably, at the end of 2002, twin brothers Cameron Winklevoss and Tyler Winklevoss sought to establish a social network called ConnectU aimed at U.S. college students. It is said that they brought in Zuckerberg to help develop the site, and in 2004, they accused Zuckerberg of stealing their idea for Facebook and using the source code developed during their collaboration.

Reports indicate that Facebook ultimately paid $65 million in a "cash + stock" settlement. The brothers reportedly used part of the settlement to accumulate Bitcoin, currently holding a total of 70,000 Bitcoins, valued at over $8 billion.

The Winklevoss twins also participated in the men's double sculls event at the 2008 Beijing Olympics, finishing in sixth place.

After Trump announced his support for cryptocurrencies, the Winklevoss twins became supporters of him and donated Bitcoin exceeding the legal maximum value to Trump's campaign (the excess was returned). They also attended the ceremony in July when Trump signed the stablecoin bill, where he publicly promoted the Gemini exchange.

Despite significant financial pressure, Gemini's timing for the IPO is still seen as a wise move. In the first half of 2025, the overall cryptocurrency market is recovering, with Bitcoin prices stabilizing above $80,000 and a surge in DeFi applications following Ethereum's upgrade, providing a favorable window for cryptocurrency companies to go public.

In recent years, the U.S. SEC has increased its regulatory scrutiny of the cryptocurrency industry, and Gemini's BitLicense and SOC 2 compliance certification serve as a protective moat for its IPO. Market analysts predict that Gemini's IPO valuation could range from $5 billion to $10 billion, depending on the performance during the roadshow and market sentiment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。