Original Title: "Gemini Rushes to Nasdaq: $280 Million Loss in Six Months, Founders Once Hoarded 120,000 Bitcoins at $10 Each"

Original Author: Lei Jianping, Lei Di

Following stablecoin issuer Circle and cryptocurrency exchange Bullish, cryptocurrency exchange Gemini is also preparing to go public in the U.S.

Gemini recently submitted its prospectus, preparing to list on the Nasdaq in the U.S. under the ticker symbol "GEMI," with Goldman Sachs and Citigroup serving as lead underwriters.

Gemini stated that the proceeds from its IPO will be used for general corporate purposes and to repay all or part of third-party debts.

Revenue of $68.61 million in the first half of the year, net loss of $282 million

Gemini was founded in 2014 by billionaire twin brothers Tyler Winklevoss and Cameron Winklevoss, who gained fame for suing Facebook and its CEO Mark Zuckerberg for allegedly stealing their social network idea.

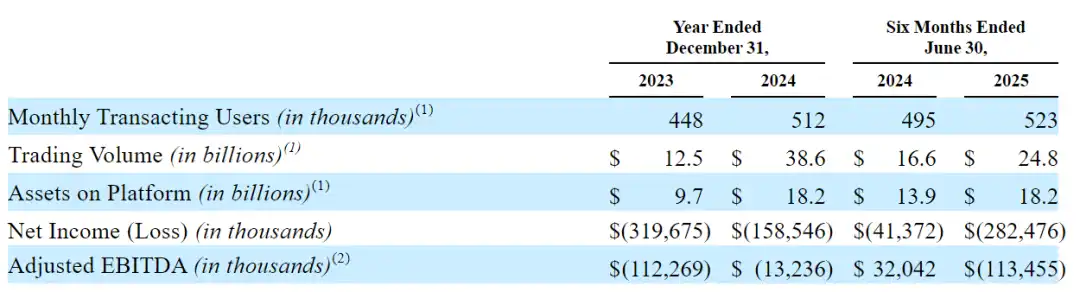

In 2008, they reached a settlement in cash and Facebook stock.

Gemini issues the Gemini Dollar (GUSD), a stablecoin pegged 1:1 to the U.S. dollar. Gemini also supports over 70 cryptocurrencies, operating in more than 60 countries/regions. As of June 30, 2025, Gemini serves approximately 523,000 MTUs and around 10,000 institutions in over 60 countries, with platform assets exceeding $18 billion and cumulative trading volume surpassing $285 billion, while the platform has processed over $800 billion in transfers.

Since its inception, as users explore the on-chain world, Gemini has witnessed the overall market capitalization of cryptocurrencies grow from less than $10 billion to over $3 trillion.

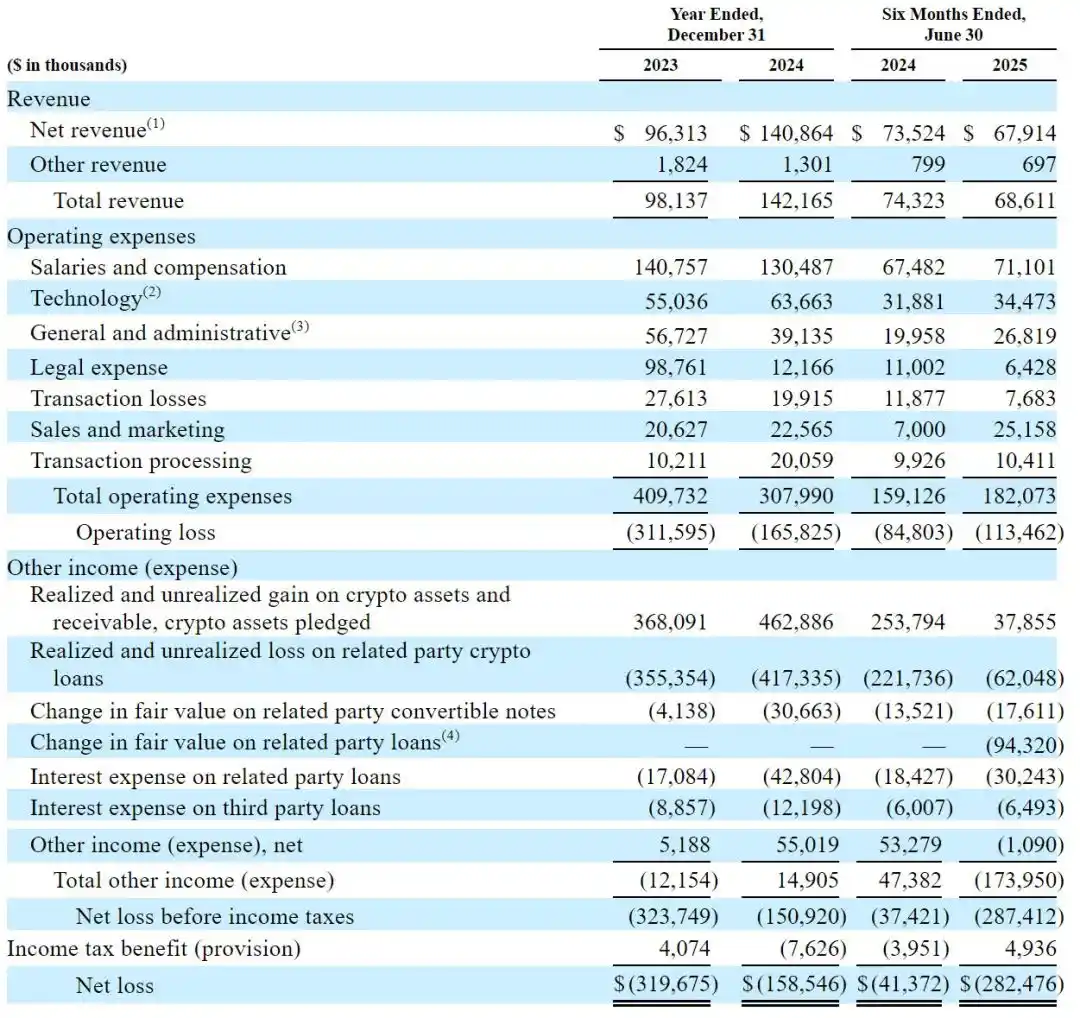

The prospectus shows that Gemini's revenue for 2023 and 2024 is projected to be $98.14 million and $142 million, respectively; operating losses are expected to be $312 million and $166 million; net losses are projected to be $320 million and $159 million.

In the first half of 2025, Gemini's revenue was $68.61 million, a decrease of 7.6% from $74.23 million in the same period last year; operating loss was $113 million, compared to an operating loss of $84.8 million in the same period last year; net loss was $282 million, compared to a net loss of $41.37 million in the same period last year.

Gemini's Adjusted EBITDA for the first half of 2025 was -$113 million, compared to $32.04 million in the same period last year.

Winklevoss Brothers Participated in the Olympics

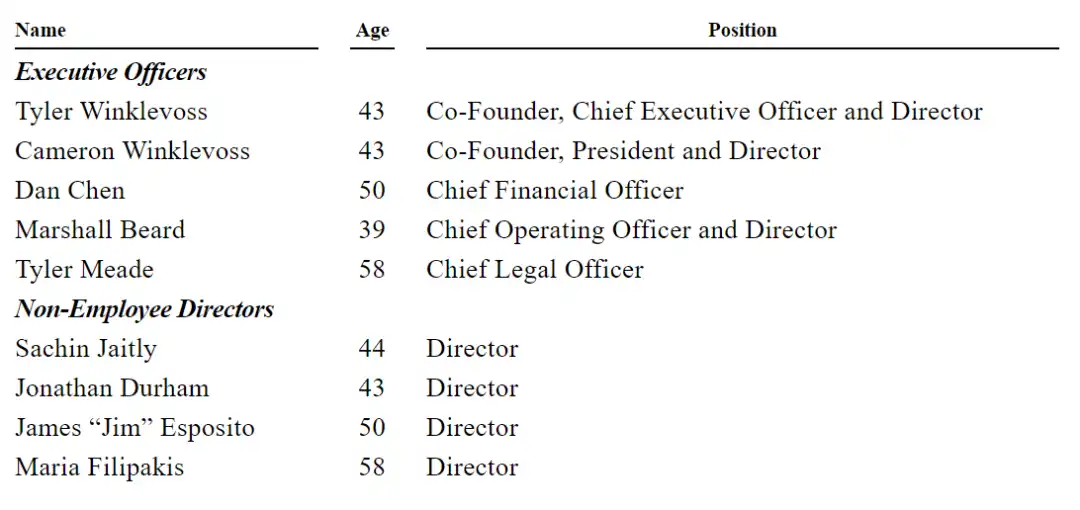

The co-founders of Gemini are brothers Tyler Winklevoss and Cameron Winklevoss, with Dan Chen serving as CFO.

Marshall Beard is the CTO, and Tyler Meade is the Chief Legal Officer.

Tyler Winklevoss and Cameron Winklevoss are the actual controllers of the company. The brothers were inseparable, attending Harvard together, always going to class, eating, and exercising together.

The two brothers were always "bound" together, and the outside world gradually referred to them as the Winklevoss brothers. Initially, the Winklevoss brothers had an idea to design a social networking site for Harvard students called HarvardConnection, and they even hired Facebook founder Mark Zuckerberg to help with programming. However, the brothers later fell out with Zuckerberg, accusing him of stealing their idea to create Facebook. In 2012, they obtained a cash and stock settlement through litigation, totaling $65 million, of which $20 million was cash, and the rest was paid in stock.

In 2012, the Winklevoss brothers began hoarding Bitcoin using part of their Facebook settlement money, purchasing about 120,000 coins at a price of less than $10 each. They co-founded Gemini in 2014.

The Winklevoss brothers are not only exceptionally intelligent in the tech field but are also athletic; they participated in the men's double sculls event at the 2008 Beijing Olympics and finished in sixth place.

Circle and Bullish Go Public in the U.S.

Cryptocurrency exchange operator Bullish, backed by Silicon Valley investor billionaire Peter Thiel, went public on the NYSE last week.

Bullish's offering price was $37, significantly higher than the previous range of $28 to $31. Bullish expanded its offering size to 30 million shares, raising a total of $1.11 billion.

Bullish opened at $90, a 143% increase from the offering price; it peaked at $118 during the day, a 219% increase from the offering price; and closed at $68, an 84% increase from the offering price. Based on the closing price, the company's market capitalization is $9.94 billion. As of Friday's close, Bullish's market capitalization is $10.2 billion.

Thomas W. Farley is the Chairman and CEO of Bullish; he was previously the president of the NYSE. Bullish stated in its filings that it holds over $3 billion in liquid assets, including 24,000 Bitcoins, 12,600 Ether, and over $418 million in cash and stablecoins.

Earlier, USDC stablecoin issuer Circle went public on the NYSE, offering a total of 34 million shares and raising a total of $1.054 billion; of this, Circle sold 14.8 million shares in this IPO, raising $459 million; existing shareholders, including the CEO, sold 19.2 million shares, cashing out nearly $600 million.

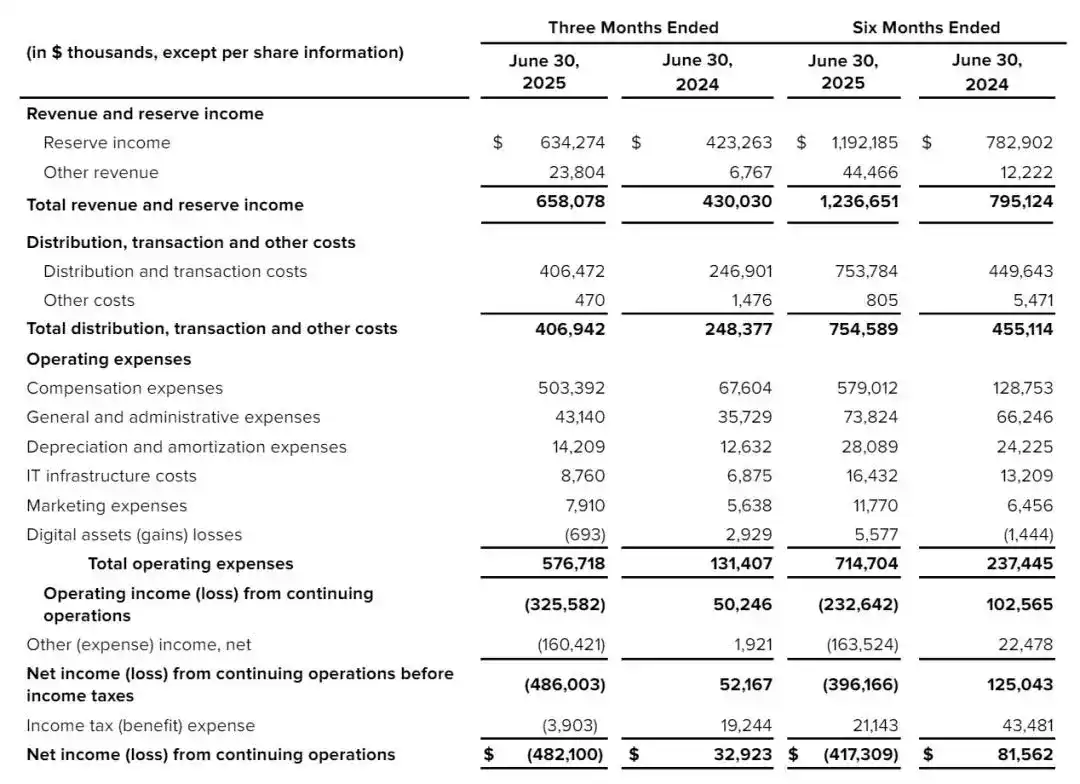

According to financial reports, Circle's total revenue and reserve revenue for the first half of 2025 was $1.237 billion, compared to $795 million in the same period last year; net loss was $417 million, compared to $81.56 million in the same period last year.

Circle's revenue for the second quarter of 2025 was $658 million in total revenue and reserve revenue, a 53% increase from $430 million in the same period last year.

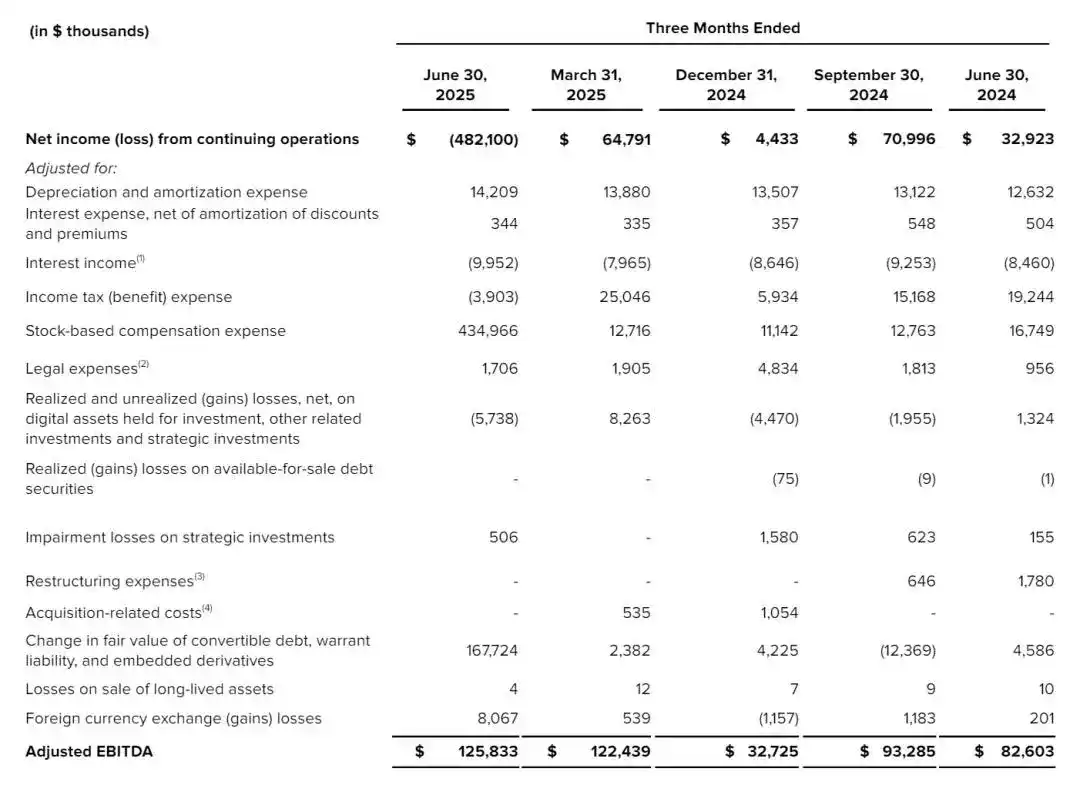

Circle's net profit from continuing operations for the second quarter of 2025 was -$482 million, compared to $32.92 million in the same period last year. Circle's losses were primarily impacted by substantial IPO expenses, totaling $591 million: of which $424 million was for stock compensation related to IPO conditions. Due to the rise in stock prices, the fair value of Circle's convertible bonds increased by $167 million.

Circle's Adjusted EBITDA for the second quarter of 2025 was $126 million, a 52% increase from $82.6 million in the same period last year; the Adjusted EBITDA margin was 40%.

As of June 30, 2025, the circulation of USDC increased by 90% year-on-year, reaching $61.3 billion; as of August 10, 2025, the circulation of USDC further increased by 6.4%, reaching $65.2 billion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。