Aug 11–Aug 17, 2025 #LookonchainWeeklyReport

🟢 Onchain Overview

Last week was defined by a massive influx of institutional capital, with major firms acquiring over $4.7B in $ETH and the stablecoin market cap expanding by $6.7B.

This flood of liquidity ignited explosive growth in DEX trading volumes, contrasted by strategic profit-taking from early investors and brutal liquidations for high-leverage traders.

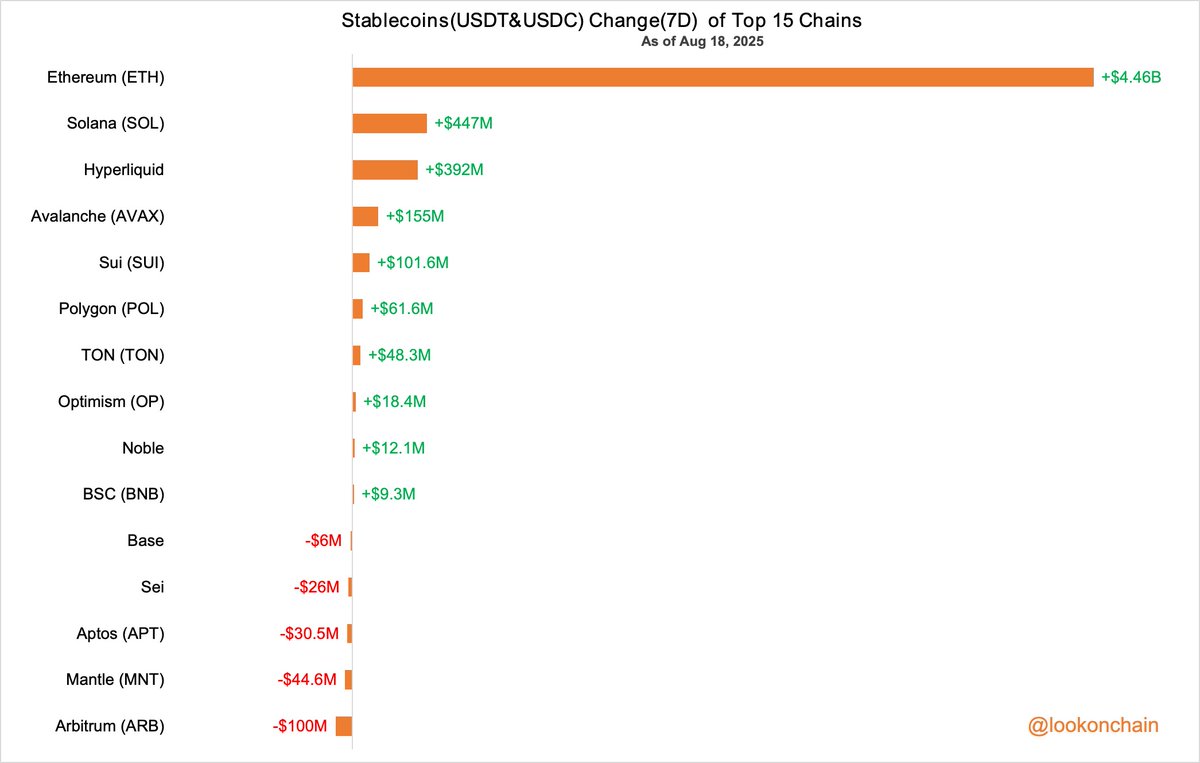

🟢 Stablecoin Market

The total stablecoin market cap increased by $6.72B. Stablecoins(USDT&USDC) on #Ethereum increased by $4.46B.

🟢 Spot & Perps Trading Volume on DEXs

The DEX spot trading volume reached $124.264B last week, up 29.47% from the previous week.

Breakdown:

Uniswap: $37.842B (WoW +34.04%)

PancakeSwap: $13.287B (WoW +13.02%)

Raydium: $6.47B (WoW +6.38%)

Meanwhile, DEX perps trading volume totaled $164.684B, a 48.64% increase week-over-week.

Breakdown:

Hyperliquid: $104.467B (WoW +52.61%)

edgeX: $9.287B (WoW +12.07%)

Jupiter: $6.83B (WoW +66.06%)

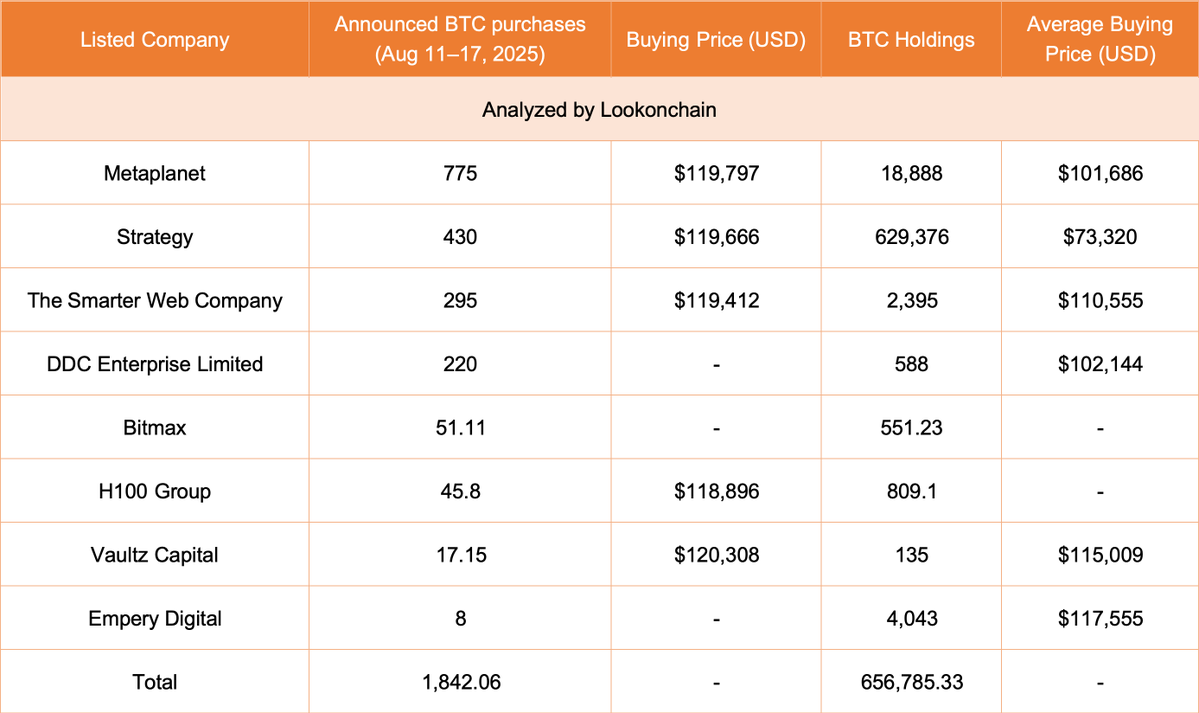

🟢 $BTC purchases

8 listed companies purchased 1,842.06 $BTC($212M) last week.

🟢 $ETH purchases

Last week, three entities – #BlackRock, #Bitmine, and #SharpLink – bought 1,096,368 $ETH($4.72B), 0.91% of the total supply.

🟢 Institutional/Whale Activity

Multiple whales were buying $LINK last week.

https://x.com/lookonchain/status/1956920547692122563

https://x.com/lookonchain/status/1954822105117409569

Ethereum ICO participants and the #EthereumFoundation-linked wallets sold some of their $ETH to profit as the price of $ETH rose.

https://x.com/lookonchain/status/1954769794445738489

https://x.com/lookonchain/status/1955603445119160487

https://x.com/lookonchain/status/1956655191450595624

Following #JamesWynn and #qwatio, #AguilaTrades also lost everything on #Hyperliquid due to high leverage.

https://x.com/lookonchain/status/1955978341649146202

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。