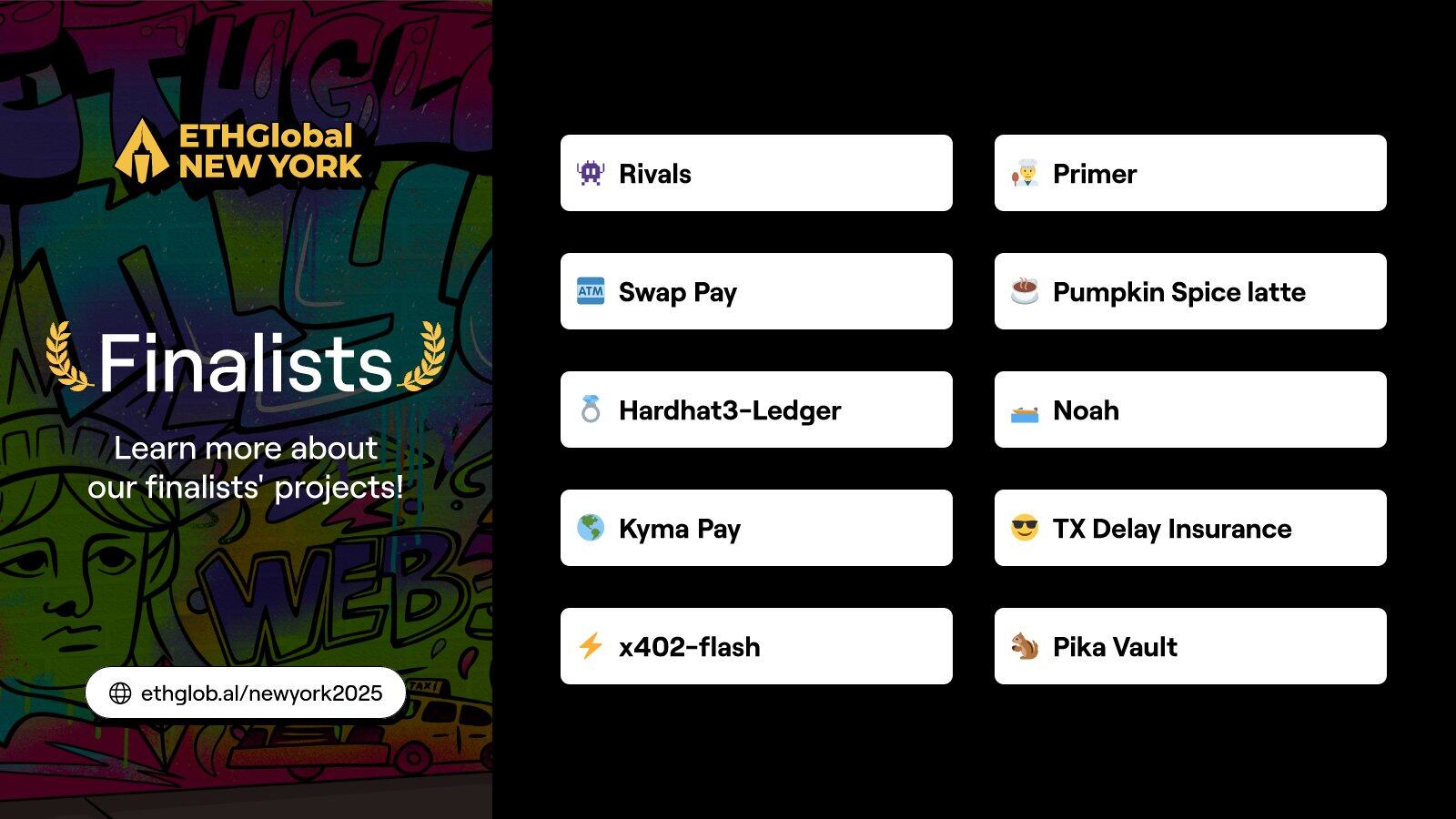

The ETHGlobal New York 2025 hackathon, lasting an entire weekend, has officially concluded. As one of the major Web3 developer events globally, this hackathon attracted numerous developer teams to explore new application scenarios for blockchain technology. After evaluation, ten projects received final awards, covering various fields such as gaming, payments, DeFi, and development tools.

ETHGlobal New York provided developers with a platform to experiment with Web 3 technologies, allowing participants to develop innovative projects, learn new skills, expand their professional networks, and engage with peers. During the event, developers built projects encompassing multiple application scenarios using various blockchain protocols and tools.

Odaily participated in the ETHGlobal New York-related activities and will introduce the award-winning projects below.

Rivals: Augmented Reality Shooting Game

Rivals is a multiplayer shooting game that combines AR technology with blockchain economics. Players combat AI-controlled zombies in real environments using their smartphones, earning RIVAL token rewards for defeating zombies, while losing a portion of their token balance upon death. The game utilizes Unity AR Foundation for environmental recognition, allowing virtual zombies to navigate and interact within the player's actual space.

The game features a geolocation trap system, enabling players to set traps at specific GPS coordinates to affect other players. The project supports multiple blockchain networks, including Flow and Chiliz, and employs a cross-chain token economic model. This design integrates location services, AR technology, and cryptocurrency incentives to create a new mobile gaming experience.

Primer: Cryptocurrency Shopping Payment Method

Primer is a Chrome browser extension that allows users to make purchases on Amazon using cryptocurrency. Since Amazon does not directly support digital asset payments, the extension facilitates payment conversion through gift cards as an intermediary layer. After clicking the injected "Cryptocurrency Checkout" button, users can complete payments using stablecoins like USDC.

The system automatically converts cryptocurrency into Amazon gift cards in the background and applies them to the order, making the entire process transparent to the user. The extension integrates mainstream wallets such as Coinbase Wallet, MetaMask, and Phantom, using the Coinbase CDP API for transaction verification. This method bypasses the limitations of traditional e-commerce platforms that do not support cryptocurrency, providing a new consumption channel for digital asset holders.

Swap Pay: Multi-Token Combination Payment

Swap Pay addresses the token compatibility issue in Web 3 payments. This SDK allows users to pay using a combination of multiple tokens in their wallets without needing to convert them in advance to a single token specified by the merchant. The system uses Chainlink data sources to provide real-time token valuations, allowing users to select different token amounts to meet the total payment.

Through the EIP-5792 standard, all authorization, conversion, and transfer operations are bundled into a single transaction execution, simplifying the payment process. The final settlement uses PYUSD, and if the total value of the selected tokens exceeds the required amount, the system automatically refunds the difference. This design reduces operational complexity in Web3 commerce, enabling decentralized token balances to be used more effectively for payments.

Pumpkin Spice Latte: Reward-Based Savings Application

Pumpkin Spice Latte combines DeFi yields with a lottery mechanism to create a new savings incentive model. Users deposit stablecoins into a shared fund pool, keeping the principal safe while all earnings generated from deposits are pooled for regular lottery draws. Winners receive excess yield rewards, while non-winners retain their full principal.

The project supports yield sources compliant with the ERC 4626 standard, including DeFi protocols like Morpho and Kinetic. Random number generation uses Flare and Flow's VRF services to ensure fairness. This model aims to make saving more attractive while providing users with a way to participate without principal risk.

Hardhat 3-Ledger: Hardware Wallet Development Integration

Hardhat 3-Ledger adds Ledger hardware wallet support to the latest version of the Hardhat development framework. Developers can securely sign smart contract deployment transactions using Ledger devices, avoiding exposure of private keys in the development environment. The integration uses Ledger's device management toolkit, supports TypeScript, and completes testing on Ledger Flex devices.

The project team also provided improvement suggestions for Ledger developer documentation, including code example optimization and document structure adjustments. This integration is practically valuable for blockchain project development requiring high security standards, allowing developers to use modern development tools while maintaining security.

Noah: Digital Asset Inheritance Solution

Noah offers a digital asset inheritance solution that automates estate transfer through smart contracts. The system uses a "dead man's switch" mechanism, automatically transferring assets to designated beneficiaries if the user is inactive for a set period. The project supports various liquidation methods, including Dutch auctions and Uniswap trades.

The system can convert digital assets into USDC or PYUSD, or directly into USD through the Fern service. For users choosing fiat currency withdrawals, beneficiaries do not even need to understand cryptocurrency to inherit the assets. Noah also supports ENS domain name inheritance and has been deployed on multiple blockchain networks, including Flow, Chiliz, and Katana.

Kyma Pay: Merchant Stablecoin Payment Infrastructure

Kyma Pay provides merchants with stablecoin payment processing services compliant with the GENIUS Act, with a fee rate of 0.15%, significantly lower than the 1.5% fees charged by traditional payment providers like Stripe. The system supports major stablecoins such as PYUSD, USDC, USDT, and USDe, using an AMM based on Orbital design for efficient stablecoin swaps.

The project integrates the HTTP 402 payment protocol, returning a 402 status code containing payment information when customers attempt to make a purchase, with payment verification handled by Coinbase x 402 Facilitator. The system also includes a stablecoin risk assessment feature, providing merchants with risk scores based on reserve assets, audit history, and other data. This design aims to offer merchants a more economical digital currency payment option.

TX Delay Insurance: Transaction Delay Insurance

TX Delay Insurance provides insurance services for transaction delays on EVM networks. Users can purchase insurance for time-sensitive transactions, receiving economic compensation if the transaction is delayed due to network congestion. The system records the broadcast and execution timestamps of transactions through RPC proxies as proof of delay.

The insurance contract allows users to purchase delay protection for specific transactions, with claims based on verifiable timestamp data. This mechanism is practically valuable for time-sensitive scenarios such as DeFi operations and arbitrage trading, providing users with tools to combat network uncertainties.

x 402-flash: Micro-Payment Delay Optimization

x 402-flash addresses the delay issue in the x 402 micropayment standard through a hosted contract system. Traditional x 402 requires waiting for blockchain transaction confirmations to respond to API requests, while the flash solution allows clients to pre-lock funds in a hosted contract, enabling servers to respond to requests immediately, accelerating the payment process with small insurance.

Actual payments are processed asynchronously in the background, and if the client's balance is insufficient, the hosted contract automatically deducts from the pre-stored funds. This design reduces payment delays from 200 milliseconds to double-digit milliseconds, making high-frequency API calls possible. The project integrates Circle Paymaster, supporting gas fee payments with USDC, simplifying the user experience.

Pika Vault: Cross-Chain Asset Management Vault

Pika Vault implements cross-chain asset management, allowing users to access assets on any supported blockchain, while the vault holds and reconfigures portfolios across multiple chains. The system is based on the ERC-4626 standard and supports asynchronous redemption features of ERC-7540. Unlike solutions relying on synthetic assets or complex bridging, Pika Vault uses native USDC and Circle CCTP for cross-chain transfers.

The architecture separates the control plane from the value plane, with LayerZero handling cross-chain coordination and Chainlink CCIP providing price data. The system supports qualified custodial addresses, meeting regulatory requirements for institutional investors. This design achieves true cross-chain asset management, avoiding single-chain limitations and synthetic asset risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。