When market information floods in at an explosive speed, and project teams continuously release news to encourage output and expand influence, we often find it difficult to discern truth from falsehood, and even harder to resist the invasion of FOMO (Fear of Missing Out). The media's amplification, whether it is the embellishment of the "get rich overnight" myth or the magnification of market panic, invisibly stimulates our nerves, causing us to jump back and forth on the edge of trading. Those KOLs (Key Opinion Leaders) shrouded in a halo, with every promotion and advertisement, may become the last straw that breaks our rational defenses, pushing us into the abyss of emotional trading. These emotional trading behaviors ultimately lead to phenomena such as "chasing highs and cutting losses," "frequent trading," and "excessive speculation."

This manual is based on common trading psychology, combined with empirical data from traditional finance and the cryptocurrency industry, to help everyone avoid irrational decisions and use strategies to restrain human weaknesses.

Please boldly identify with the content!

1. “I sold too early again, should I buy back?”

“I sold too early again!” This may be a lament that every trader has uttered. When Bitcoin surged from $70,000 to its historical high of $100,000, and when Ethereum skyrocketed from $3,000 to $4,500, how many traders sold early when the market started to rise? Following this, a more dangerous thought often arises: “Should I buy back immediately?” This unbearable FOMO emotion is the main culprit behind ineffective trading and profit erosion.

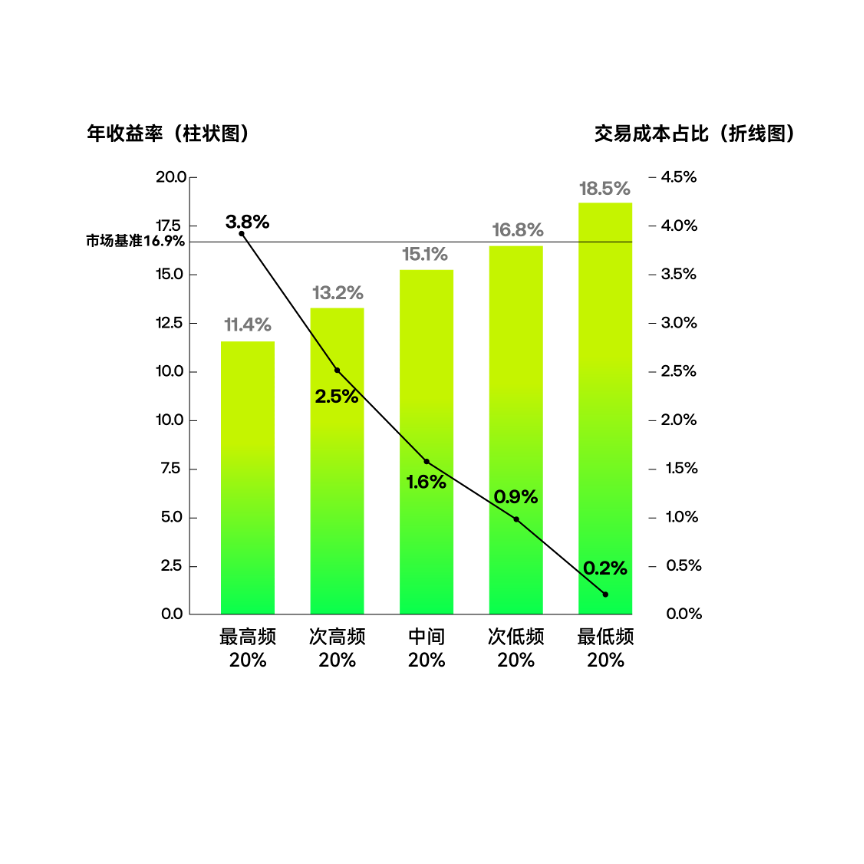

Data Insight: This data is based on research on the trading frequency of individual investors in traditional finance, analyzing the performance and trading cost differences of users in different trading frequency ranges. The lowest 20% of users by trading frequency achieved an annualized return of 18.5%, outperforming all other groups and even exceeding the market benchmark of 16.9%. In contrast, the highest frequency trading group, after incurring trading costs of up to 3.8%, ended up with a return of only 11.4%, significantly underperforming the market.

Comparison of Returns and Cost Proportions at Different Trading Frequencies

In-depth Analysis: Excessive trading frequency significantly reduces overall returns, caused by missing a few key up days. Over the long term, holding mainstream assets like Bitcoin for years often yields substantial returns, while frequent trading may weaken profitability. This indicates that "selling too early" is more a psychological factor leading to strategic errors.

In this long-distance race of trading, less action often beats more action. The small "waves" we try to capture through frequent operations ultimately cause us to miss the grand "tide" of asset value growth, and we ruthlessly "donate" the profits that should belong to us to the market's friction costs.

Solution: Overcome impulse with discipline. If you are worried about missing the peak but afraid of a roller coaster ride, you can use tools like grid trading to set staggered take-profit points.

Strategy Suggestions:

When predicting that an asset is in a fluctuating upward range, use a spot grid strategy to automatically execute low buys and high sells within preset "grid lines," allowing disciplined automated trading to gradually realize profits during the rise, continuously reducing holding costs. More importantly, it ensures that the core position is always retained, preventing the regret of "selling too early" due to hesitation or mistakes in manual operations. The grid makes "passively harvesting segment profits" a reality.

Set a holding plan in advance. For example, establish a response strategy for significant negative news, or only reduce positions when the expected target price is reached. Use data-driven strategies to overcome emotional impulses.

2. “Should I really go all in?”

“This opportunity is rare, while others are fearful, I am greedy; it’s time to go all in!” “Small bets can lead to big wins” “Heavy positions can turn things around” — this excessive confidence that amplifies a single opportunity is the biggest risk source leading to account wipeouts. The most important aspect of investment psychology is the respect for risk.

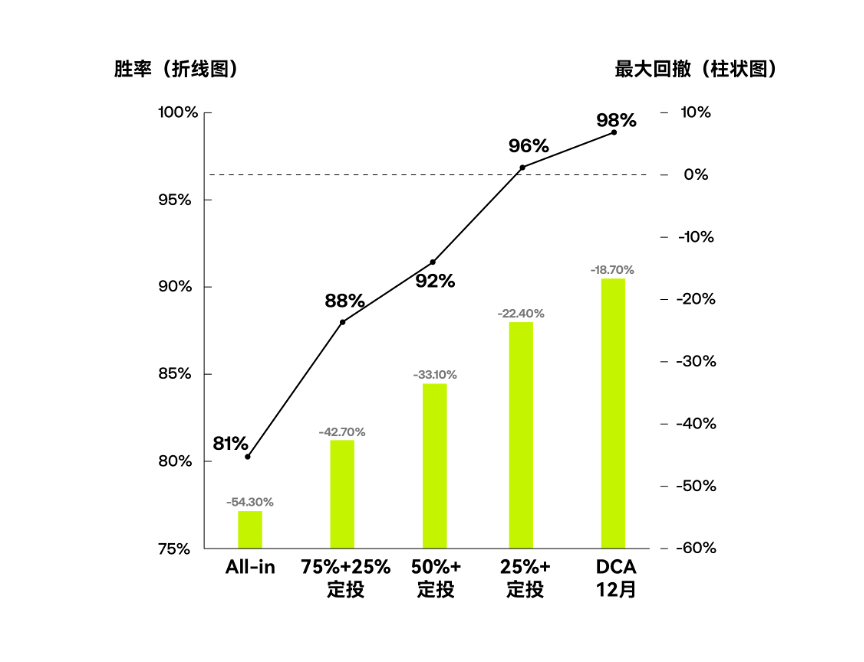

Data Insight: This data is based on institutional simulations of long-term data from the U.S. stock market, analyzing the drawdown performance and trading win rates of different position-building strategies in extreme market conditions. The "all in" strategy, while capable of recording the highest returns in certain extreme situations, also has the highest corresponding "maximum drawdown," reaching -54%, with the historical win rate line positioned at the bottom. In contrast, combining dollar-cost averaging (DCA) strategies keeps the maximum drawdown within a more acceptable range, with a more stable win rate.

Comparison of Position-Building Strategy Performance: Maximum Drawdown and Win Rate

In-depth Analysis: The essence of going all in is to gamble for a theoretical high return with an extremely low win rate, but this comes with an unbearable risk for traders. As Warren Buffett said, the first principle of investing is "never lose money." Any strategy that could lead to a permanent and significant loss of principal should not appear in a rational toolbox.

Solution: Use the art of "position management" to hedge against the risks of a "gambler's mentality."

Strategy Suggestions:

Use dollar-cost averaging tools to forcibly break down trading plans. Invest a fixed amount at fixed intervals, and the OKX dollar-cost averaging feature allows users to set price ranges for each dollar-cost averaging pair, executing operations only within those price ranges. This continuously lowers the average cost during the market's long fluctuations, forcibly extending your trading behavior over the entire time dimension, using the compounding effect of time to smooth price fluctuations. This is the most robust way to build a "core position" and resist the risks of going all in.

Flexibly use mixed strategies: Strategies are not either/or; you can divide planned trading funds into two parts, for example, one part invested all at once in assets at a reasonable current price, while the remainder is dollar-cost averaged weekly or monthly. When the market is favorable, you can enjoy the rise with an existing position; if a short-term decline occurs, you still have subsequent funds to buy the dip and lower the average cost.

Regardless of the method used, set a maximum drawdown ratio that you can tolerate. For example, do not invest all your tradable assets at once; reserve a portion of funds as backup. If a significant loss occurs after a lump-sum investment, you can stop and switch to a dollar-cost averaging approach to lower costs, avoiding emotional over-investment or stop-loss.

3. “I really can’t help it, can I enter?”

When a token goes from professional communities to your casual chat groups, when a group chat that has been quiet for three months suddenly becomes wildly active, when the Google search index skyrockets, the intense FOMO emotion can consume all rationality. “Should I buy or not?” This thought repeatedly appears in your mind. However, historical data repeatedly proves that the peak of enthusiasm is often the starting point of a crash.

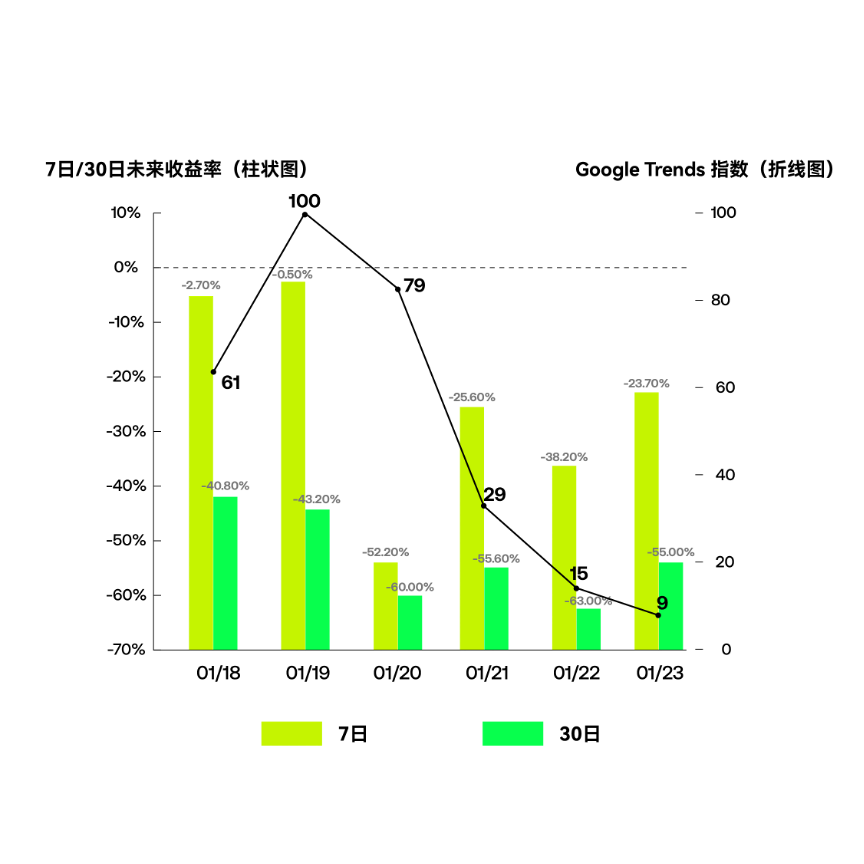

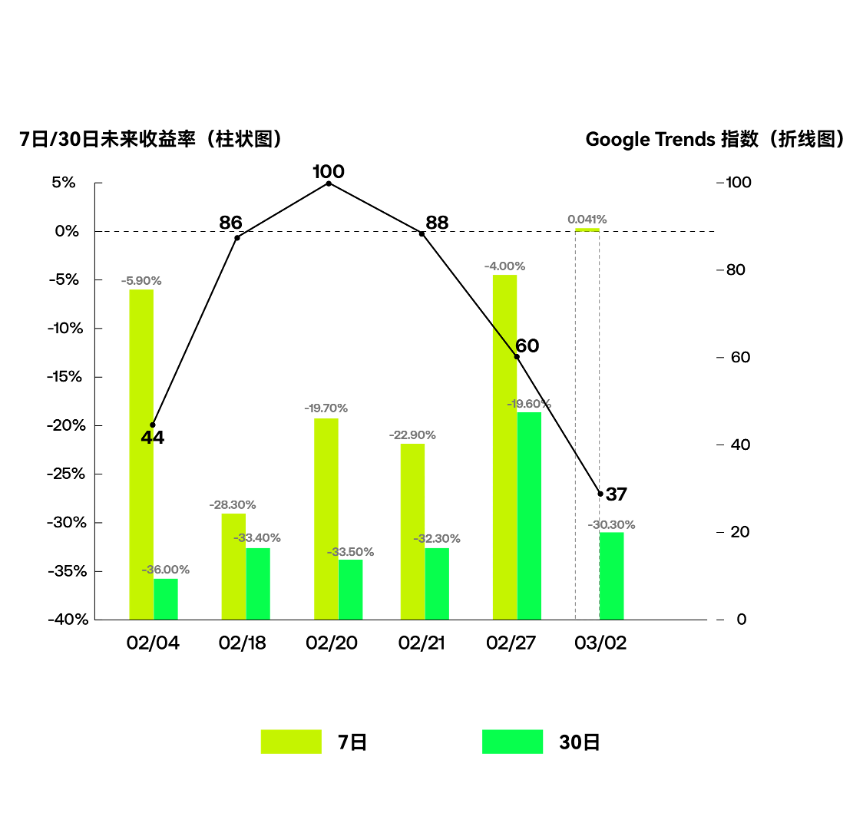

Data Insight: This data analysis studied the Google search popularity of cryptocurrencies (using DOGE and TRUMP tokens as examples) and the 7-day/30-day performance of investors entering the market on the same day. Reviewing past data of DOGE and TRUMP tokens, when their Google Trends popularity reached a peak of 100, the subsequent 7-day and 30-day forward returns were invariably significantly negative. Public sentiment fuels asset prices, but when the fuel burns at its most intense moment, it also means it is about to run out. When all potential buyers have entered the market, it loses the momentum to continue rising, leaving only profit-taking and panic selling.

$DOGE Google Trends Index and 7-day/30-day Return Analysis

$TRUMP Google Trends Index and 7-day/30-day Return Analysis

Solution: Use strategies to buffer against the risks of chasing highs.

When judging that the market trend has not ended, how to enter the market becomes the key issue, requiring a set of scientific and risk-controlled follow-up operational plans.

Strategy Suggestions:

Set objective heat index warning lines: Traders can pay attention to Google Trends indices, Twitter discussion volumes, and other data. When a coin's search index approaches historical peaks or social media sentiment indices are extremely optimistic, treat the impulse to chase highs with caution.

Use staggered entry and take-profit/loss strategies: If you judge that enthusiasm is high but the trend may not be over, you can use a spot Martingale strategy to control risks — the Martingale strategy is more flexible in cost control. Divide the planned funds for chasing highs into several parts, buying in after the price drops by a fixed percentage. The core goal is to lower the holding cost. At the same time, set tight stop-loss or take-profit points for the positions entered, and when reaching suitable selling points or expected profit ratios, the Martingale strategy will automatically execute sell operations.

If what you are interested in is not the price itself but the market opportunities brought by enthusiasm, you can adopt a more robust "risk-neutral" strategy. When a coin is extremely popular, it usually means strong bullish sentiment, and the funding rate in the futures market will be very considerable. We can use OKX's smart arbitrage to strip away the risks of price fluctuations and specifically earn the "rent" paid by market sentiment.

4. “Will this time be another peak?”

The dilemma after making a profit is no less painful than the suffering of losses. There is both the fear of "locking in profits" and the greed of "missing out on a fortune." This human game often causes us to miss the best selling points in hesitation. In fact, human nature often struggles to overcome the weakness of greed, making it nearly impossible to manually liquidate at the market's highest point.

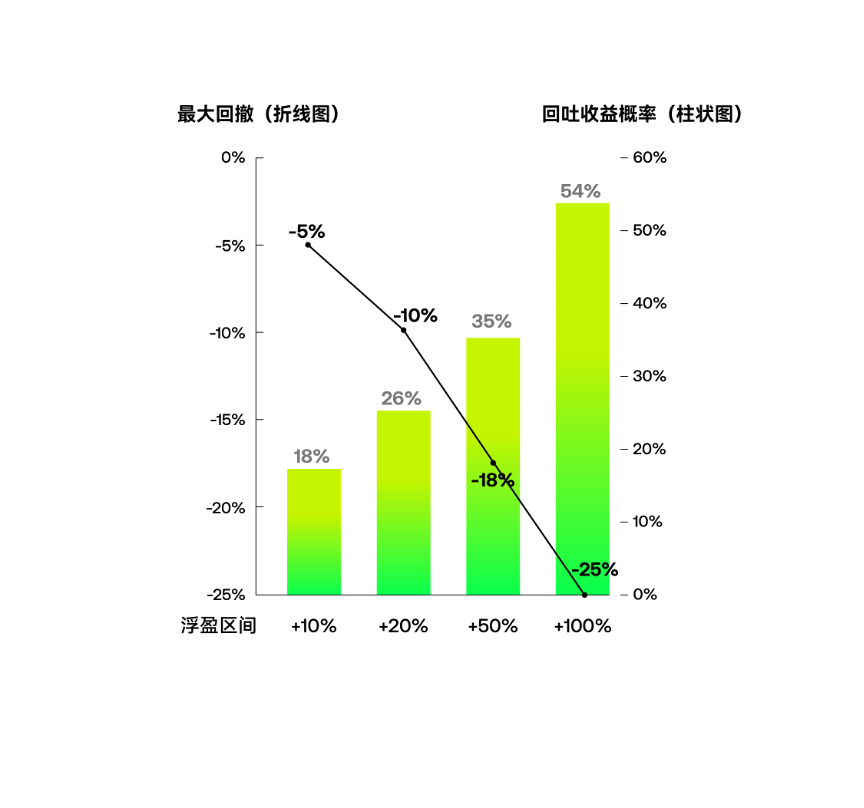

Data Insight: This data is based on behavioral finance papers, analyzing the relationship between different floating profit ranges and the average drawdown and probability of profit retracement (over 15%) in the following 30 days. When the floating profit of a portfolio exceeds +50%, the average maximum drawdown in the following 30 days reaches 25%, while the probability of significant profit retracement (over 15%) sharply rises to 54%. Classic papers in behavioral finance also point out that individual traders often sell too late due to "greed," leading to significant shrinkage of profits.

Future Returns and Retracement Risks at Different Floating Profit Ranges

In-depth Analysis: When the risk-reward ratio starts to become unfavorable, disciplined staggered profit-taking is the only way to convert "paper wealth" into real wealth.

Solution: Let the robot help you "lock in profits." Manual profit-taking is the ultimate test of human nature. Strategy tools can perfectly execute this discipline.

Strategy Suggestions:

For ordinary traders, a more realistic and wiser choice is to abandon the obsession with "selling at the highest point" and instead pursue "selling at a relatively high price range," using automated strategy tools to gradually lock in profits. In contrast to building positions, when the price enters the "bubble zone" or reaches profit target zones, a "reverse pyramid" selling strategy can be employed. This means that as the price continues to rise, the share sold each time increases. For example, sell 10% at $100,000, 20% at $110,000, and 30% at $120,000. This method ensures that the largest position is sold at the peak.

5. “Wait to break even before selling? Should I cut my losses?”

"Loss aversion" is a psychological bias ingrained in human genes. We would rather endure the long-term pain of being stuck than accept the short-term pain of "cutting losses," which acknowledges failure. However, data tells us that for deeply trapped assets, time is often poison rather than a cure. Traders tend to remain inactive or double down to lower costs when facing losses, unwilling to decisively cut losses, leading to the common phenomenon of holding onto losing assets. This behavior is known as the Disposition Effect: traders often sell profitable positions too early while holding onto losing positions for a long time, hoping to break even one day.

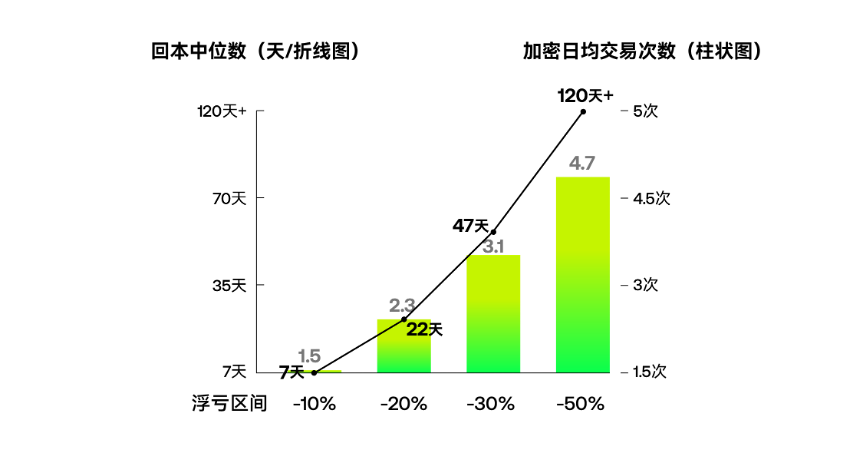

Data Insight: This data is based on U.S. stock and cryptocurrency market data, analyzing the correlation between trading behavior under different loss conditions and the days required to break even. The deeper the floating loss of an asset, the lower the historical probability of successfully breaking even, while the time required to break even grows exponentially. When losses reach -50%, to break even, the asset price needs to rise by 100%, often taking more than 120 days. In the cryptocurrency market, this means waiting for the next bull market cycle, with significant time and opportunity costs. Additionally, the number of trades increases significantly in a loss state, and emotional trading can exacerbate losses.

Correlation Between Trading Behavior in Loss State and Days to Break Even

In-depth Analysis: Passive "holding on" is essentially a paralysis of decision-making. It locks valuable funds in inefficient or even "zero" assets, causing us to miss other potential opportunities in the market. Active risk management and proactive position optimization are far more valuable than hopeless waiting.

Some traders become passive after incurring losses, almost stopping any operations, hoping for a miraculous rebound; another group experiences intensified trading impulses, frequently engaging in short-term operations to "average down" or quickly recover losses. Both behaviors can be irrational. The former misses the opportunity cost of cutting losses and switching assets or dynamically adjusting, while the latter is prone to exacerbating losses due to emotional trading.

Solution: Scientific "self-rescue," not passive "holding on."

Strategy Suggestions:

Set clear stop-loss and dynamic adjustment principles: Plan for the worst-case scenario when buying: if the price drops beyond a certain percentage or if certain negative changes in fundamentals occur, exit unconditionally. A staggered stop-loss strategy can also be employed: for example, sell part of the position at a certain resistance level during a rebound, or reduce the position further when breaking new support levels, spreading the risk. Quantifying discipline can avoid falling into the subjective delay of waiting to break even. After cutting losses, maintain a period of calm to prevent immediately making emotional purchases of other coins, leading to repeated mistakes.

Minimize losses rather than obsess over breaking even: Shift focus from "breaking even" to "how to minimize losses and regain profitability." Sometimes, acknowledging losses and reallocating remaining funds into more promising assets is more likely to recover losses. For instance, instead of being deeply trapped in a certain altcoin for a long time, it may be better to cut losses and buy into more promising coins at lower prices, allowing for quicker recovery in the next market cycle.

Disclaimer:

This article is for reference only. It represents the author's views and does not reflect the position of OKX. This article does not intend to provide (i) investment advice or recommendations; (ii) offers or solicitations to buy, sell, or hold digital assets; (iii) financial, accounting, legal, or tax advice. We do not guarantee the accuracy, completeness, or usefulness of such information. Holding digital assets (including stablecoins and NFTs) involves high risks and may fluctuate significantly. Past performance does not guarantee future results, and historical returns do not represent future outcomes. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. Please consult your legal/tax/investment professionals regarding your specific circumstances. You are responsible for understanding and complying with applicable local laws and regulations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。