Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

RWA Market Performance

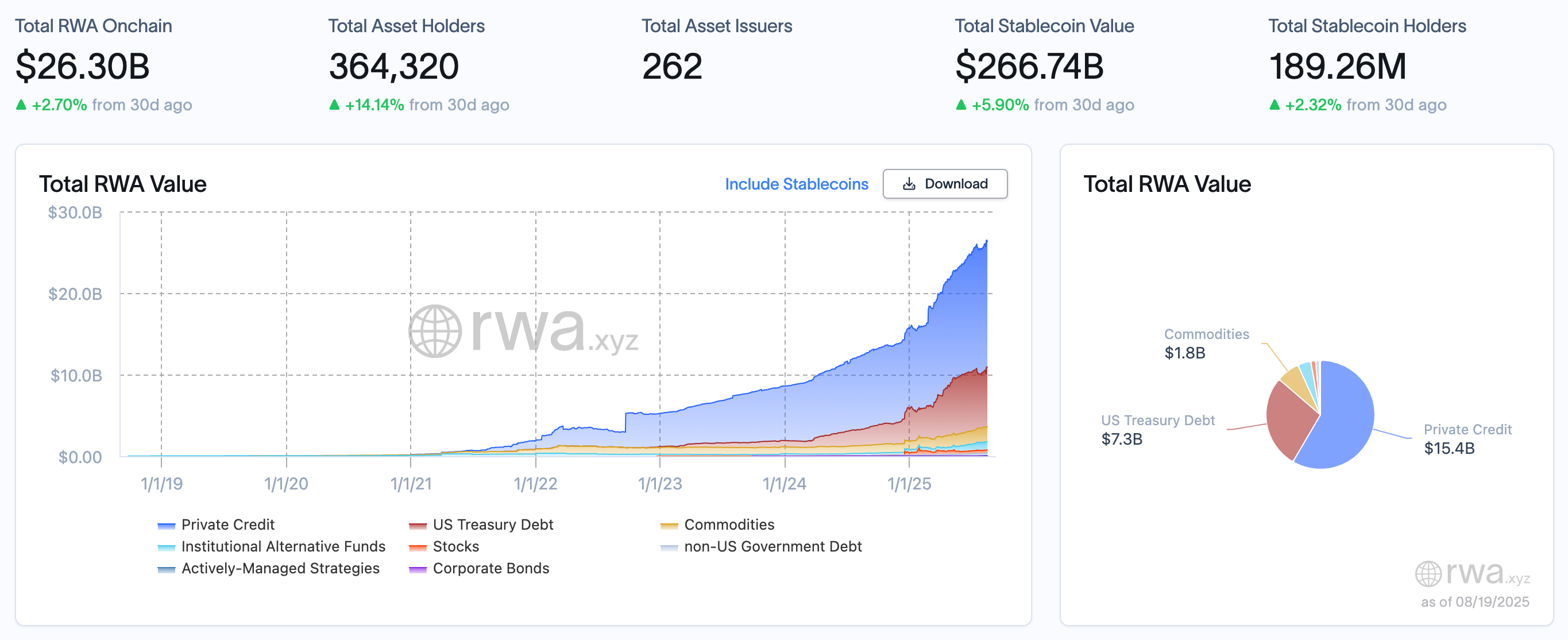

As of August 19, 2025, the total on-chain value of RWA is $26.3 billion, an increase of $680 million from $25.62 billion on August 12, with a weekly growth rate of 2.65%, reaching a new high for the past month. The number of on-chain asset holders rose from 349,057 to 364,320, with an increase of 15,263 in one week, a growth rate of 4.37%. The number of asset issuers also increased from 259 to 262, achieving positive growth for three consecutive weeks. In terms of stablecoins, the total value rose from $260.93 billion to $266.74 billion, an increase of $5.81 billion, with a growth rate of 2.23%; the number of holders remained stable, increasing slightly from 188.67 million to 189.26 million, a net increase of 590,000, or 0.31%, indicating that the existing user base is stabilizing, but the influx of funds remains significant.

From the asset structure perspective, private credit slightly declined from $15.6 billion to $15.4 billion, a month-on-month decrease of 1.28%, marking the first adjustment after several weeks of growth. U.S. Treasury bonds rose from $6.66 billion to $7.3 billion, with a weekly increase of 9.6%, becoming the core driving force behind this week's total market value increase. Commodity assets remained stable at $1.8 billion. Institutional alternative funds rebounded from $785 million to $1 billion, with a weekly increase of nearly 27%, indicating renewed interest in structured products.

Trends (Compared to Last Week)

This week, the RWA market continued its trend of "moderate expansion and structural adjustment." The number of on-chain users continued to grow, and the number of asset issuers also increased, maintaining a stable pace of ecological expansion. Structurally, funds have achieved simultaneous allocation between high-yield assets and defensive assets, with both private credit and U.S. Treasury bonds rebounding, indicating a balance between risk appetite and safety allocation. Commodity assets showed a slight upward trend, reflecting ongoing market interest in inflation hedging and diversified allocation against the backdrop of inflation and commodity price fluctuations. In contrast, institutional alternative funds saw a significant decline this week, which may suggest that some institutions are choosing to lock in profits or reallocate funds to more liquid and safer assets amid the overall steady rise in the market.

Overall, this week, the RWA market exhibited characteristics of "market capitalization rebound + structural switch." The number of users, the number of asset issuers, and the market value of stablecoins all increased simultaneously, indicating that ecological expansion and the influx of funds remain solid. Compared to last week, there was a clear structural differentiation in fund allocation: private credit, as a long-term core asset, experienced a slight pullback, suggesting that some funds chose to lock in profits after continuous allocation, while U.S. Treasury bonds and alternative funds became the main destinations for new incremental funds. The strong rebound of U.S. Treasury bonds reflects a reassessment of market interest rate expectations, with funds shifting back to safe asset allocations, possibly hedging against uncertainties in the short to medium-term macro environment.

Key Events Review

Circle to Launch Stablecoin-Specific Public Chain ARC, USDC as Native Gas Token

Circle announced in its Q2 financial report that it will launch a new public chain, ARC, positioned as a Layer 1 network for stablecoins and institutional finance. ARC is EVM-compatible, with USDC serving as the native gas token, featuring a built-in foreign exchange engine that supports sub-second settlement, providing payment, cross-border settlement, and capital market-level infrastructure. The ARC public testnet is expected to go live in the fall of 2025, with plans for full integration into the Circle ecosystem to achieve cross-chain interoperability, aiming to provide compliant, secure, and efficient stablecoin solutions for financial institutions and payment service providers.

Dinari to Launch Layer 1 Blockchain Dinari Financial Network

Startup Dinari, which provides blockchain-based U.S. stock trading services, announced it will launch the Layer 1 blockchain Dinari Financial Network. This network is designed to serve as a coordination and settlement layer for securities issued on other networks like Arbitrum and is custom-built using the Avalanche (AVAX) technology stack. The testnet is currently running, with plans for a public release in the coming weeks.

Fintech Company Stripe Partners with Paradigm to Develop Payment Blockchain Tempo

Fintech giant Stripe is collaborating with crypto venture firm Paradigm to develop a blockchain called Tempo, which is positioned as a high-performance, payment-focused Layer 1 blockchain that is compatible with Ethereum's programming language.

Tempo is currently in a secret development phase, with a team of 5 people. Previously, Stripe acquired stablecoin infrastructure company Bridge for $1.1 billion and crypto wallet developer Privy, further expanding its stablecoin technology footprint.

Digital Asset Completes On-Chain Financing of U.S. Treasury Bonds Against USDC on Canton Network

Digital Asset and several major Wall Street financial firms completed the first real-time, fully on-chain financing of U.S. Treasury bonds against USDC on the Canton Network. The repurchase transaction reportedly took place on Tradeweb and settled on Saturday, circumventing the traditional settlement system's weekday limitations, converting U.S. Treasury bonds held by the Depository Trust & Clearing Corporation (DTCC) into tokenized assets on Canton, which were then used as collateral for USDC-backed financing. Participating institutions included Bank of America (BAC), Circle (CRCL), Citadel, Cumberland DRW, DTCC, Hidden Road, Société Générale, Virtu Financial, and Tradeweb.

Wyoming Stablecoin WYST Set to Launch on August 20

The Wyoming Stablecoin Committee announced plans to officially launch its official stablecoin WYST at the Wyoming Blockchain Symposium in Jackson on August 20, 2025.

Hot Project Updates

MyStonks (STONKS)

One-Sentence Introduction:

MyStonks is a community-driven DeFi platform focused on tokenizing U.S. stocks and enabling on-chain trading. The platform partners with Fidelity to achieve 1:1 physical custody and token issuance, allowing users to mint stock tokens like AAPL.M and MSFT.M using stablecoins such as USDC, USDT, and USD 1, and trade them on the Base blockchain around the clock. All transactions, minting, and redemption processes are executed by smart contracts, ensuring transparency, security, and auditability. MyStonks aims to bridge the gap between TradFi and DeFi, providing users with a high-liquidity, low-barrier entry for U.S. stock investments on-chain, building a "NASDAQ of the crypto world."

Latest Updates:

On August 13, MyStonks platform saw a 24-hour trading volume surpassing $97 million. The MyStonks platform has officially launched a public test for contract trading, supporting perpetual contract trading for RWA sector U.S. stock tokens with leverage configurations of 1–20 times, optimizing the matching engine for millisecond-level transaction feedback.

On August 14, MyStonks released an announcement regarding cooperation with regulatory investigations and ensuring the safety of normal user funds; on the same day, MyStonks founder Bruce J responded to recent platform controversies, stating that the compliance team received a law enforcement request last week to provide information on a single customer and suspend that user's withdrawals. He emphasized that this action was not a voluntary decision by the platform and that their brokerage account was also restricted. He stressed that assisting regulatory investigations is a legal responsibility of the exchange, and targeted investigations do not imply issues with the source of customer funds, urging the public not to overinterpret and spread false rumors. Bruce J stated that MyStonks has completed compliance filing in the U.S., with over 20,000 registered users and a valuation exceeding $50 million, and will continue to adhere to a compliance route, focusing on RWA business development and customer service.

Plume Network (PLUME)

One-Sentence Introduction:

Plume Network is a modular Layer 1 blockchain platform focused on the tokenization of real-world assets (RWA). It aims to transform traditional assets (such as real estate, artwork, equity, etc.) into digital assets through blockchain technology, lowering investment barriers and increasing asset liquidity. Plume provides a customizable framework that supports developers in building decentralized applications (dApps) related to RWA, integrating DeFi and traditional finance through its ecosystem. Plume Network emphasizes compliance and security, dedicated to providing solutions that bridge traditional finance and the crypto economy for institutional and retail investors.

Recent Updates:

On August 18, according to an official announcement, Binance HODLer airdrop launched Plume (PLUME). Following this news, OKX market data shows that PLUME briefly surged over 15%, with a 24-hour increase of 8.5%.

Related Links

Summarizing the latest insights and market data in the RWA sector.

With an asset management scale exceeding 130 billion yuan, CMB International enters the on-chain money market with CMBMINT.

《$350 Million New Starting Point: Arbitrum's RWA Ecosystem Blueprint and Wealth Code》

In the struggle between traditional finance and the on-chain world, Arbitrum has pushed RWA TVL to $350 million in one year. Its key actions, the deep logic of institutional entry, and the real breakthrough points are yet to be revealed.

《Global RWA New Asset Landscape: The River of Capital is Changing Course》

RWA is quietly rewriting the flow of capital, making government bonds and stablecoins the riverbed that supports the most stable foundation; it allows industrial assets to branch out, turning research, computing power, and properties into transferable nutrients; it causes exchanges to create huge waves, sweeping both high risks and high premiums into the torrent.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。