Introduction

Not long after we began analyzing data on copy trading, we received a private message from an ordinary copy trading user. He was attracted by the short-term high ROI but left the market in disappointment after experiencing significant drawdowns. Faced with opaque data, he felt like a blindfolded gambler and developed deep doubts about the fairness of the rankings. This message served as a wake-up call, making us realize that behind the cold trading data are the hopes and disappointments of countless real users. We decided to combine this emotional voice with our professional data analysis capabilities on the copy trading platform to present a deep and comprehensive industry analysis for all platforms, copy traders, and copy trading users. This is both a response to that message and a practice of our belief that "data creates trust."

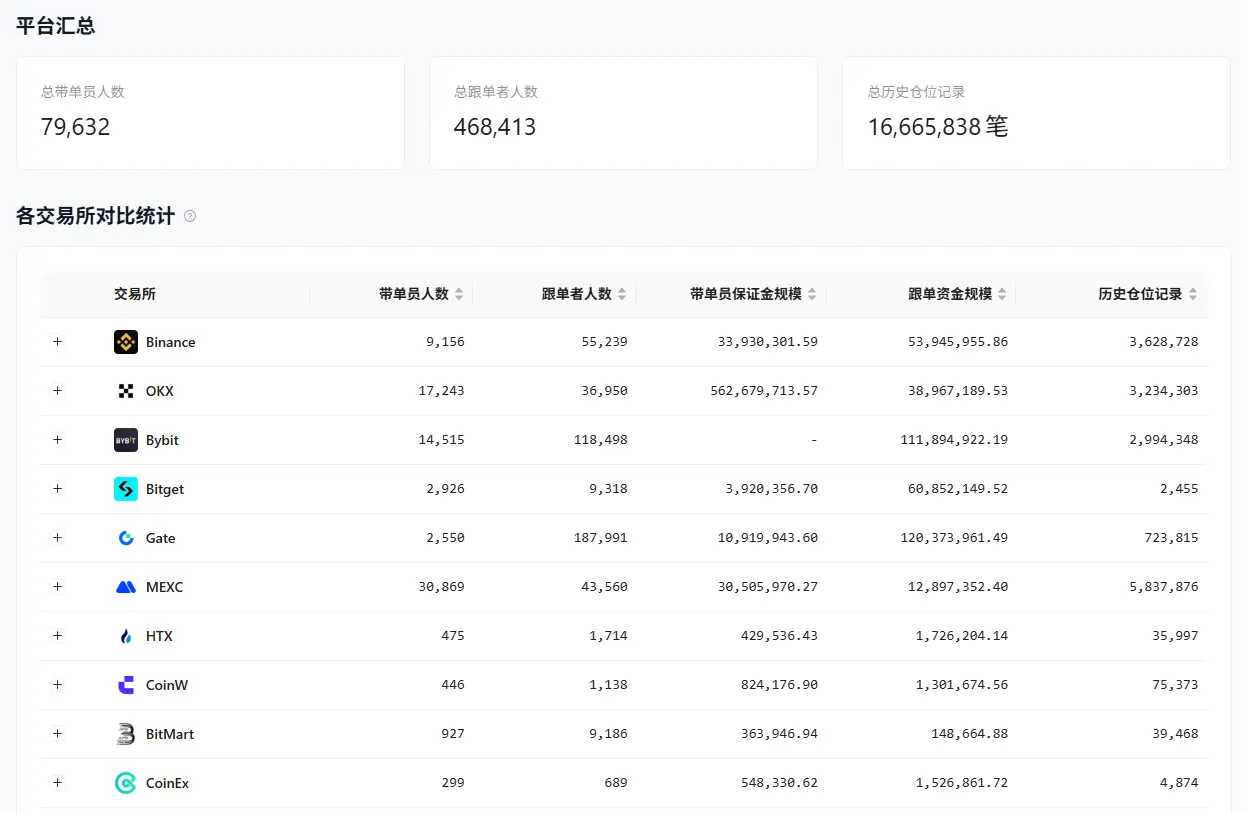

Data Source: Professional Copy Trading Analysis Platform (https://insights.wolfdao.com/) Exchange Copy Trading Overview

Preface

Copy trading is a significant aspect of the crypto world, and its explosive growth confirms the enormous market demand. Although the existing ranking mechanisms and traffic logic face many challenges, this does not mean that the copy trading market is a "dead end." On the contrary, we observe that leading platforms are actively making improvements, such as introducing the Sharpe Ratio and enhancing the disclosure of drawdown data, indicating that the industry is moving from reckless growth towards a healthier and more sustainable direction.

As an expert deeply engaged in the market, we firmly believe that the copy trading market has immense development potential. Its future lies in how it evolves from a mere "traffic aggregator" to a "value co-builder," truly achieving long-term win-win outcomes for exchanges, traders, and copy traders. This report will analyze the current shortcomings of platforms from this core concept and propose specific improvement suggestions.

Core Pain Points of the Current Copy Trading Market: The "Prisoner's Dilemma" of Three Parties

Despite the apparent prosperity of the copy trading market, its underlying mechanisms are pushing the three parties into a "prisoner's dilemma":

- For exchanges: The substantial fee income generated by high-risk, high-frequency trading in the short term is attractive, but in the long run, the massive losses of copy trading users will damage the platform's reputation, leading to user attrition and ultimately affecting sustainable development.

- For traders: The existing ROI-centric ranking mechanism forces traders to adopt aggressive strategies to make the leaderboard, which contradicts the principles of prudent trading and exposes their accounts to significant liquidation risks. They may achieve temporary glory through a risky venture but could also face disgrace due to a single mistake.

- For copy traders: They are attracted by high returns but struggle to see the real risks behind them. The severe information asymmetry reduces them to "passive investors," bearing the trial-and-error costs of traders without receiving complete risk protection.

1. The "Incentive Distortion" Effect of Mainstream Exchange Copy Trading Mechanisms

The mechanism designs of different platforms are not accidental; they are the embodiment of the platforms' business strategies and directly lead to the distortion of trader behavior incentives.

Data Source: WolfDAO Community (https://t.me/wolfinsights) Member Collection and Organization

In-depth Interpretation of Platform Strategies and Behavioral Attribution

Binance:

Advantages: By introducing the Sharpe Ratio, a quantitative indicator for measuring risk-adjusted returns, Binance attempts to balance returns and risks to some extent, advocating for prudent trading. The low entry barrier and strong user base provide fertile ground for the initial expansion of the copy trading ecosystem.

Potential Risks: The early stage of the product lifecycle means that its content ecosystem is not yet fully mature. In this phase of "new users flooding in, content still incomplete," users tend to rely on short-term, intuitive high-return data as decision-making criteria, potentially overlooking the significant risks hidden behind.

OKX:

Advantages: Its tiered navigator system and emphasis on historical drawdowns represent its proactive exploration in risk control. By limiting the influence of novice traders, the platform aims to filter out more professional copy traders from the source.

Potential Risks: "Selective transparency" remains a common issue in the industry. The historical drawdowns emphasized by the platform may only cover closed positions and fail to disclose unrealized losses. Furthermore, when the incentive mechanism does not sufficiently attract traders pursuing "content value" rather than short-term ROI, the "star effect" of its leaderboard may be surpassed by other platforms, leading users to return to those more polished "high-yield" traders.

Bybit:

Advantages: By implementing the Copy Trading Pro model (180-day lock-up) and offering up to 30% profit-sharing, Bybit clearly aims to attract high-net-worth and strategically mature top traders. This is a "premium" strategy that seeks to create a high-end copy trading ecosystem.

Potential Risks: The high entry barrier excludes ordinary users, and its limited liquidity makes it more suitable for long-term investors. Additionally, some marketing activities, such as "human vs. machine copy trading competitions," while enhancing community engagement, may inadvertently reinforce users' blind worship of "trading myths" rather than rationally assessing risks.

Bitget:

Advantages: As a "pioneer" in the copy trading field, its well-established multi-tier elite trader system and high incentive structure create a mature ecological closed loop, forming a strong network effect.

Potential Risks: This efficient "incentive mechanism" may also become a hidden driver of excessive risk-taking among traders. To achieve higher elite levels and gain more profit-sharing and exposure, traders may be "captured" by the incentive mechanism, adopting more aggressive gambling strategies. The "liquidation protection" and other "benefits" it offers resemble marketing tactics aimed at lowering users' psychological barriers rather than genuine risk hedging.

2. The "Traffic Rent-Seeking" Logic of Platform Ranking Mechanisms

The leaderboards of copy trading platforms are not neutral strength rankings but rather "traffic rent-seeking" tools shaped by the platforms' commercial interests.

First Level of Rent-Seeking: The "Winner-Takes-All" Game of ROI Supremacy

Most platforms default to ranking by return on investment (ROI) or cumulative profit, pushing "high-profit" copy traders who double their returns in the short term to the top.

Business Logic: Platforms understand that "astronomical figures" are the strongest catalysts for attracting users' attention and stimulating their desire to copy trade. By highlighting ROI, platforms can maximize the utilization of users' "wealth effect" psychology, achieving explosive growth in trading volume and maximizing fee income in the short term.

Behavioral Attribution: This mechanism pushes traders into a "winner-takes-all" game. To compete for the top spot, traders are induced to engage in high-leverage, heavily invested small-cap gambling operations, even using multiple accounts to boost rankings, showcasing only the best-performing accounts. This behavior is unsustainable but perfectly aligns with the platform's short-term commercial needs.

Second Level of Rent-Seeking: "Selective Disclosure" and "Data Reset" of Historical Performance

Data Source: WolfDAO Community (https://t.me/wolfinsights) Member Collection and Organization

Leaderboards rely on historical data provided by copy traders, but this data may be carefully packaged or even "legally" erased.

Data Manipulation Tactics:

Multi-account Filtering: Operating multiple accounts simultaneously, only displaying the best-performing one.

Selective Time Window: Calculating ROI starting during a market surge, creating an illusion of excellent performance.

Account Reset: After significant losses, closing the account and restarting as a "newcomer," erasing all records of failure. Some platforms allow copy traders to pause or close their copy trading services, facilitating this "data whitening."

Periodic Harvesting: This mechanism allows some copy traders to engage in "periodic harvesting": when account performance is poor, they can "exit," wait for market opportunities to restart, using new "brilliant" performance to cover past failures. This forces copy traders to bear all the trial-and-error costs of copy traders without enjoying complete risk disclosure.

Third Level of Rent-Seeking: Platform-Driven "Algorithmic Bias"

In addition to leaderboard algorithms, platforms also influence the ranking and exposure of copy traders through various mechanisms.

Three Major Bias Mechanisms:

Trading Volume Orientation: High-frequency trading copy traders contribute more fees to the platform, thus potentially receiving invisible bonuses.

New User Referral Rewards: If copy traders can bring in a large number of new users through social media, the platform will provide more traffic support, creating a "head effect."

Brand Building Needs: Healthy image and promotional alignment make it easier for copy traders to make the leaderboard and become platform ambassadors.

The result of these mechanisms is that marketing-savvy "internet celebrity" traders may receive more traffic than "practical" traders with strong trading abilities. The leaderboard is not only a display of strength but also a marketing tool and traffic allocation hub for the platform.

Fourth Level of Rent-Seeking: "Blind Spots" and "Black Boxes" in Information Disclosure

Data Source: WolfDAO Community (https://t.me/wolfinsights) Member Collection and Organization

Information asymmetry is the core risk of copy trading. Platforms typically choose to selectively display data, hiding key risk indicators.

Information Asymmetry: Platforms usually only show total ROI, cumulative profit, win rates, and other positive data, while key information that truly reflects risk, such as maximum drawdown, current position risk, and unrealized losses, is deliberately ignored.

Black Box of Trading Details: Trading details (such as specific trading pairs and positions) are often hidden, preventing users from determining whether the copy trader relies on a prudent strategy or merely lucked into high profits. This opacity provides space for fraud and short-term ranking boosts.

Conclusion: Trust is the Core Asset of the Copy Trading Market

The future of the copy trading market does not lie in the birth of numerous "get-rich-quick" myths but in establishing a fair, transparent, and trustworthy ecosystem. We have already seen that some platforms are striving in this direction.

Every data improvement and algorithm adjustment by the platform represents greater consideration for user interests. When exchanges are willing to provide traders with a stage not bound by "ranking," when traders can gain recognition through prudent rather than aggressive strategies, and when copy traders can obtain real and comprehensive information, the market can truly evolve from a "traffic rent-seeking machine" to a "value co-builder."

This is not only the evolution of the copy trading market but also an essential path for the maturation of the crypto financial ecosystem.

If you have unique insights on how to select quality copy traders, if you have encountered confusion in your copy trading journey, or if you have any thoughts on the future development and trading of copy trading platforms, we sincerely invite you to join our discussion. Join our Telegram group to share experiences, exchange ideas, and contribute to building a trustworthy crypto trading ecosystem with like-minded friends.

Data Update Note: The data in the above report was edited and organized by WolfDAO. If you have any questions, please contact us for updates.

Written by: WolfDAO (X: @10xWolfDAO)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。