The native payment chain will become the currency operating system of the AI era, reconstructing the global financial underlying architecture.

Author: Simon Taylor

Translated by: Deep Tide TechFlow

According to Fortune, Stripe and Paradigm may be collaborating to develop a payment-centric blockchain, although this has not been officially confirmed. Assuming the news is true, what do these developments mean?

Let’s look at the big picture. Current payment infrastructure is still highly customized, fragile, and expensive to scale. If you believe that artificial intelligence will accelerate the growth of transaction volumes and agree with the view that "money is being software-ized," then the conclusion is obvious:

A native payment chain is imperative. The existing infrastructure, whether on-chain or off-chain, cannot meet future demands. Stablecoins, tokenized deposits, and on-chain finance are gradually becoming a reality.

The key question is: which network can standardize the underlying technology, allowing operators to win through software competition?

Editor’s Note: The author is an advisor to Paradigm, and the views expressed in this article are solely personal. This article aims to analyze the strategic logic of native payment blockchains and their impact on industry participants.

The "AWS Moment" in Payments:

Currently, there is no universal infrastructure in the payment processing field similar to AWS. Each payment processor is redundantly building the same tech stack, lacking a unified public tool layer. If there were a shared, neutral, high-throughput payment track, it could significantly reduce fixed operating costs and shift the competitive focus to software and workflow levels. Imagine such an infrastructure, but without Amazon involved—truly trustworthy and neutral.

Existing blockchains lack payment-native functionality. Imagine a payment processing tool with features like "EC2 for settlement," "S3 for receipts," and "IAM for compliance keys." The core of this competition is not to lower transaction costs but to enhance developer efficiency while addressing pain points such as fiat withdrawals.

Existing high-throughput networks (like Solana and Base) are powerful, capable of handling various transactions, including memecoins, but their multifunctionality may lead to congestion and usability issues in specific scenarios. For example, if a president suddenly announces a new token, it could affect the normal user experience of the network. A Swiss Army knife, while versatile, may not be the ideal machete.

We have already seen some blockchain projects focused on stablecoins, such as Tether's Plasma, and emerging companies like Codex and Conduit, which are trying to address issues in this area. Many teams are focusing on the same pain points, and the innovation space for native payment blockchains is gradually expanding.

A successful blockchain needs to have the following minimum viable feature set:

High sustained transaction processing capability (TPS), with predictable final confirmation under peak loads;

Backward compatibility with bank payment tracks and message formats;

Ability to cover the distribution areas that merchants already have;

Native compliance interfaces and auditability;

Fees payable in conventional currency (e.g., USD);

Clear neutrality guarantees: shared governance, limited sponsor privileges, and broad interoperability.

Having several large partners to help launch this network would be a highly influential marketing strategy, especially if it can achieve trustworthy neutrality. And I believe this is entirely feasible. (Today, Coinbase building Base is no longer a controversial topic, and even JPMorgan has established a partnership with it.)

What roles do deposit tokens, banks, and central banks play?

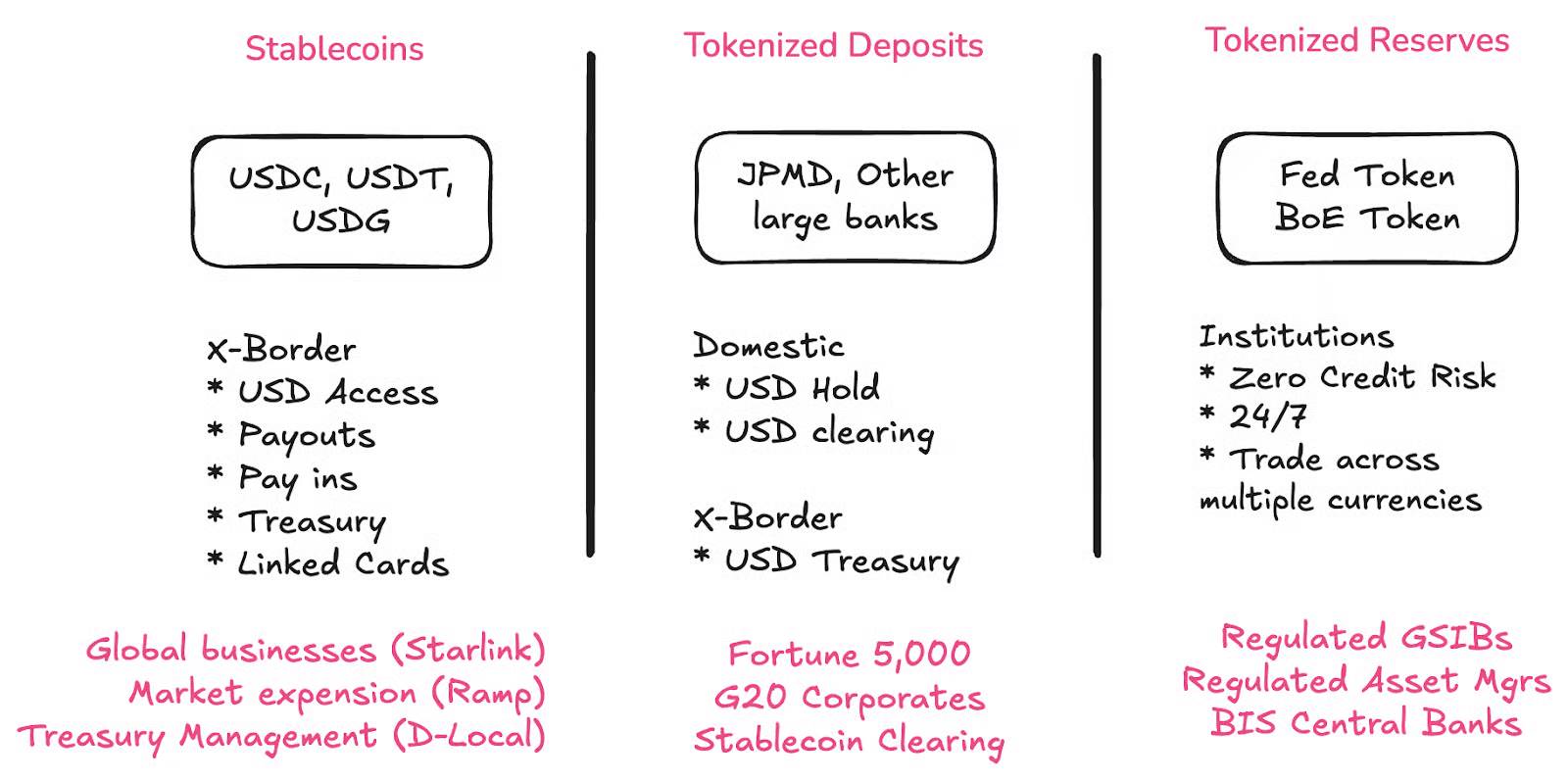

Stablecoins, deposit tokens, and Central Bank Digital Currencies (CBDCs) will coexist, addressing different issues for different groups. All three will enter the on-chain space.

Stablecoins provide new opportunities for non-bank institutions and organizations in the Global South to access dollars more easily.

Deposit tokens help larger organizations reintegrate into the commercial banking system.

Tokenized reserves assist large banks in settling with other banks and central banks both domestically and internationally.

Stablecoin settlement will present huge opportunities for banks. Just this week, I saw a founder mention that their collaboration with tier-one banks like Deutsche Bank, Wells Fargo, Bank of America, and JPMorgan has provided stronger structural security for their fiat withdrawal paths.

Every bank should launch tokenized deposits: this is the obvious choice. The future of payment infrastructure is on-chain, so your balance sheet should also be on-chain. I have recently spent a lot of time researching how to achieve this, so stay tuned for future "Brainfood" columns. Because the answer is not something that can be found through a simple Request for Proposal (RFP).

Tokenized deposits will make stablecoins backward compatible with traditional finance (TradFi). Tokenized deposits will enable stablecoins to achieve backward compatibility with traditional finance (TradFi). This is crucial. If all banks offer tokenized deposits (i.e., deposits on-chain), the fiat withdrawal path will no longer be necessary. This is the key to achieving backward compatibility.

This is distinctly different from the Banking as a Service (BaaS) era. In that era, small banks engaged in "innovation activities" but became a significant risk to fintech companies and the stablecoin ecosystem. Today, we have laws specifically targeting stablecoins, attracting large banks to join and promoting the robust development of the industry.

Yes, because this is a business opportunity.

But the key is that this business opportunity has a clear regulatory framework.

Can openness survive in branded rails?

One major concern is that the "Stripe chain" and related efforts from platforms like Robinhood and Coinbase may re-centralize the internet, seemingly contradicting the original intent of on-chain finance. However, Cristian Catalini's thoughtful article presents an opposing viewpoint.

Catalini argues that platforms like Coinbase or Robinhood pay for decentralization because it protects them from the threat of platform monopolies.

New L1 payment chains need trustworthy neutrality.

How can we determine if a chain has trustworthy neutrality? There are three criteria:

Shared governance

Limited role of parent companies

Broad and inclusive interoperability

As the Paradigm* project gradually takes shape, these will be interesting topics worth revisiting and exploring in depth.

The commoditization of payment processing—an era of software competition

The motivation to commoditize payment processing infrastructure is becoming evident, but many may not yet realize this trend. These "branded rails" are a deliberate strategy aimed at commoditizing the operating expenses (opex) of fixed infrastructure, much like Amazon did with AWS.

When Stripe acquired Bridge, I proposed a point: Stripe is transforming into a software company. They are not competing in the low-cost processing space but creating value by solving workflow issues, such as refunds, retries, and looping logic. The reason for this is that there are vulnerabilities in payment infrastructure, and these hidden issues are not obvious to those outside the industry.

Imagine if payment infrastructure were no longer fragmented.

What if you had a commoditized infrastructure that could achieve instant processing, operate around the clock, and is tailored for ultra-high transaction volumes and throughput for payment companies and their customers? This is clearly something existing blockchains cannot achieve.

However, the issue with incentives is that they always tempt people toward the "dark side"—creating a closed ecosystem to capture more economic benefits at the cost of becoming a truly open network. I agree that this is indeed a significant risk.

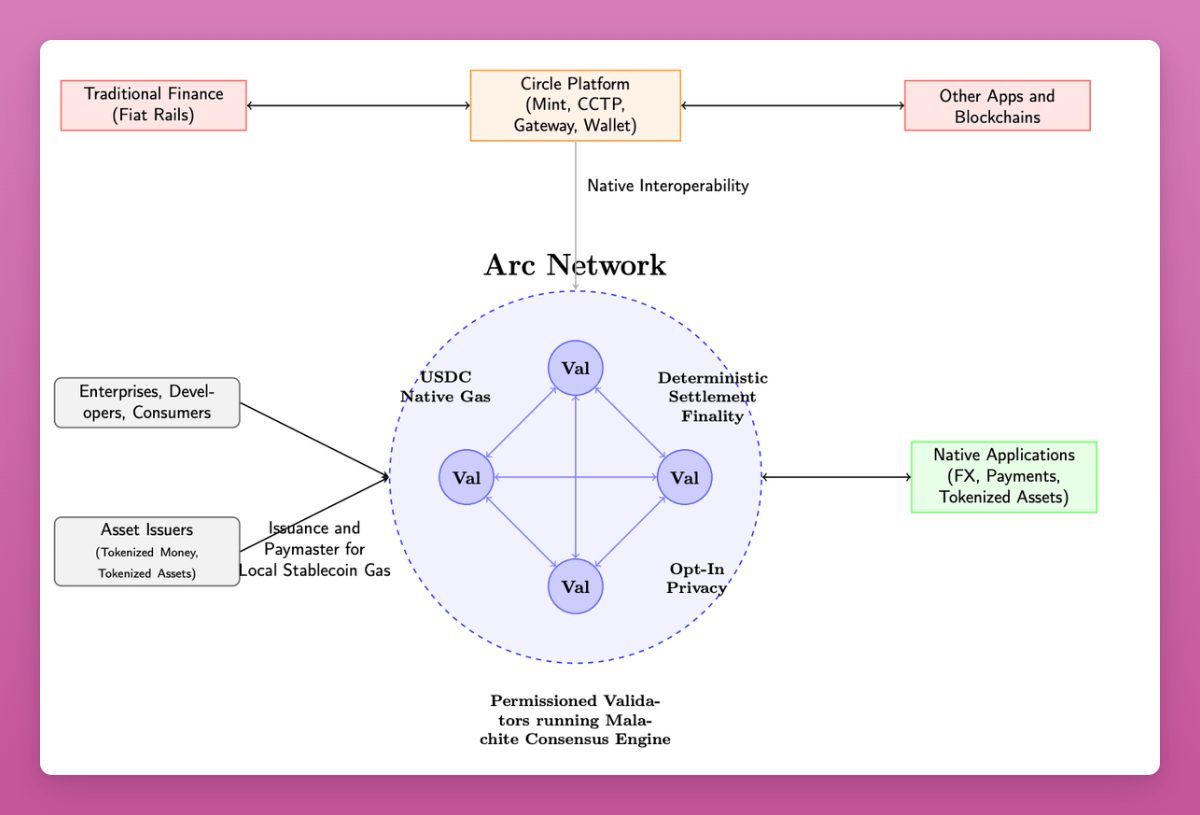

Circle launching Arc in the same week is no coincidence

This proves that leaders in the stablecoin industry see the same trend as Stripe. Circle has likely been researching and developing Arc for several years.

After experiencing a stellar performance in the public markets, Circle is now facing pressure from declining interest rates while needing to find new sources of revenue (the vast majority of Circle's revenue comes from treasury yields, 80% of which is allocated to its co-issuing partners).

Compared to networks like Base, Ethereum, or Solana, Circle's new network has several features that are friendly to financial institutions and the payment industry.

Here is a list of features from its white paper. Although most features will not be launched on the first day, it clearly demonstrates Circle's strategic direction:

Pay transaction fees (Gas) using USDC

Validation nodes operated by regulated entities

Faster throughput (3,000 to 10,000 TPS)

Optional privacy features: Payment amounts are hidden, addresses are visible but not identifiable to the public

Optional disclosure features: Regulators can access transaction information via "view keys"

Launch of USYC (Treasury Token): On-chain collateral and margin functionalities

Bridging functionality using Circle's proprietary Gateway and CCTP: Circle has supported a large circulation of USDC on-chain, and they will reuse this foundation

Roadmap includes institutional-level foreign exchange capabilities

Payment features: Such as additional invoicing, as well as on-chain refund and dispute resolution mechanisms

This white paper is clearly more of a feature vision list rather than a currently available product, but it explicitly shows Circle's intentions and the direction of the entire industry.

My observations:

Many of these features target participants in the capital markets, such as collateral, margin, and regulators.

There is a lot of language aimed at risk management groups, such as "institutional-level" and "consumer protection."

Circle sacrifices issuance profits for distribution: They share the vast majority of their revenue with Coinbase and Binance. The launch of new products helps improve this situation.

But can Circle meet everyone's needs? They do have a first-mover advantage and market recognition, but do we need clearer functional divisions?

Rob Hadik from Dragonfly has a pessimistic view:

So, to win now, Circle must compete with Stripe in the merchant or SME space, or with Kinexys in the large enterprise space, and win the ultimate customer relationships? It’s hard to imagine how they can win this battle.

— Rob Hadik

(Although Hadik has invested in Circle's competitors, his analysis is often very accurate.)

My view is: the future of on-chain finance is still full of opportunities. Circle has every reason to make bold attempts due to its first-mover advantage.

Winners may be few, and all companies wisely try to expand their markets. Fortunately, we have moved beyond the stage of sacrificing the infrastructure that can truly support global market scale for the sake of so-called "decentralized performance."

If you seek decentralization, Bitcoin exists for that purpose.

If every company creates its own blockchain, will we return to square one?

If every company builds its own chain, are we merely recreating today’s reconciliation chaos with new technology?

The answer is no.

The value of tokenization does not depend on a single chain but on scale and programmability.

Distribution is crucial.

Circle is willing to give up 80% of its revenue in exchange for distribution channels. If Binance and Coinbase can continue to dominate and successfully pivot to new revenue sources, that would be reasonable. But other participants in the market also have their own distribution methods.

The outcomes are rarely black and white.

Looking back at 2017 and 2021, I often felt the phenomenon of "another blockchain." Indeed, there are many such examples (does anyone remember EOS?).

But once upon a time, Solana was also just "another blockchain."

Our innovation is not over, and we are facing one of the most revolutionary technological changes in human history—the rise of artificial intelligence.

Building payment infrastructure for the explosive growth of AI

With the rise of AI tools, subscriptions as the default payment mechanism are facing challenges.

High-frequency users break traditional models: For example, companies like Anthropic have begun to set usage limits because a few high-frequency users can incur massive costs, leading to resource allocation imbalances.

The costs of AI tools are difficult to track: Behind the subscription model are hidden inference costs (GPU fees), cloud platform fees, and token usage costs for AI models. Tracking these costs is very complex (companies like Lava Payments and Polar are working to solve this issue).

Profitability dilemmas intensify: Many AI tools are facing huge losses, with reports indicating that programming tools like Cursor and Windsurf are in severe deficit.

The costs of AI models will decrease over time, but cutting-edge models do not follow this trend. The subscription model cannot cover the costs of high-frequency users. If we want to drive the AI revolution, we need more AI usage, not less.

This means we indeed need to understand the underlying transaction costs, but more importantly, we need a super-fast, ultra-low-cost, and programmable payment infrastructure.

The rise of AI will increase payment transaction volumes by an order of magnitude.

AI labs, venture capital, and payment companies are all preparing for a brand new world—one where the speed of capital flow far exceeds human comprehension. **When AI agents pay each other for computing resources, tokens, and service fees, they will need a payment system that is closer to commoditization to support this **high-frequency trading.

The ultimate battle for seizing the AI-native payment track

Stablecoins are coming into play.

Today's stablecoins are often more cost-effective for international remittances, but in domestic payment scenarios, traditional payment methods are often faster, cheaper, or superior. Most existing blockchain designs aim to meet multiple needs and perform well in this regard.

The problem is that the processing capacity of Ethereum at 15 to 30 transactions per second (TPS) or Solana at 3,000 TPS is still insufficient to handle today's peak payment loads. If agent-to-agent payments become widespread, total payment volume (TPV) could grow tenfold or even a hundredfold.

These payment-focused blockchains are far more than "just another blockchain"; they could become an important part of the future market structure after payments enter the AI-native era.

The goal of AI-native financial infrastructure is not merely to pursue complete decentralization or extreme speed, but to build a system that is both fast enough and decentralized enough to meet the upcoming challenges. To think that this task is already complete would undoubtedly be a grave mistake.

The attention on stablecoins is reaching a fever pitch. Undoubtedly, like AI, we may be in a bubble phase in the short term. But looking at the long term, it’s worth considering how the infrastructure and partner ecosystem will evolve in the next 2 to 3 years.

Deposits will be tokenized: This means that traditional "off-ramps" will no longer be necessary, as they will inherently exist on-chain.

The competitiveness of stablecoins will further enhance: This means that many current drawbacks regarding speed and cost will gradually disappear.

Every digital bank, service provider, and traditional bank will achieve integration: This means that our performance demands for stablecoins will significantly increase.

AI will require 10 to 100 times the payment capacity: This means that today’s settlement infrastructure will not meet future demands.

We need to build entirely new infrastructure for this new era.

This means that if you have not yet adopted stablecoins in your daily workflows,

or have not clearly planned their position in your future roadmap,

if you still view stablecoins as a speculative tool, you are essentially ignoring the monetary value brought by the operating system upgrade itself.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。