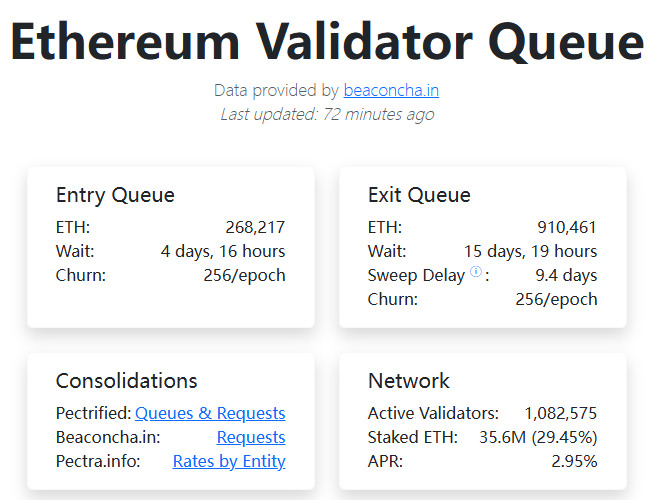

The record-breaking exit queue of Ethereum validators, totaling 910,000 ETH, is primarily driven by Coinbase and Lido. The former withdrew 430,000 ETH due to business restructuring, while the latter continues to rotate validators due to technical upgrades.

Written by: Luke, Mars Finance

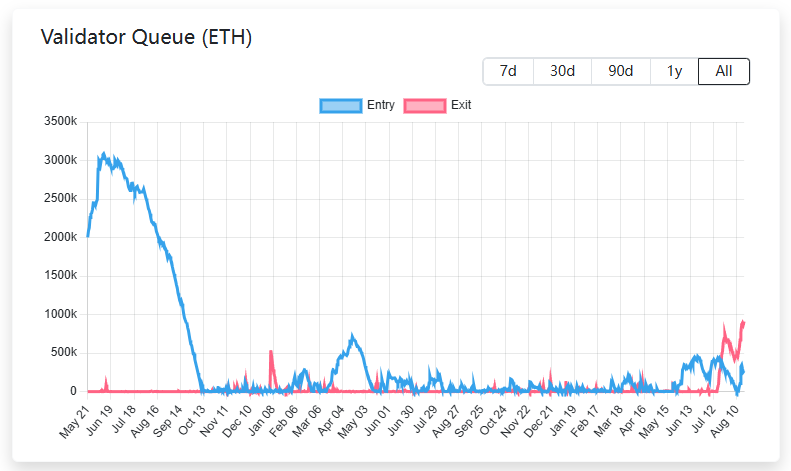

As the number of Ethereum validators in the exit queue climbs to a record 910,000 ETH (worth nearly four billion dollars), the market's instinctive reaction is to seek the reasons: is it panic selling or profit-taking? However, the latest evidence reveals a simpler and more impactful answer: this is not a collective action of thousands of retail investors, but rather a planned maneuver by a few of the industry's largest "whales."

This unprecedented wave of exits is less a vote of pessimism permeating the market and more a large-scale backend infrastructure reorganization led by centralized giants. Understanding this allows us to clear the fog and see the truth of the event.

Understanding the "Queue": A Carefully Designed Relief Valve

To unravel the mystery of this withdrawal wave, we first need to shift our focus from the noisy market to the underlying design of the Ethereum protocol. There, a mechanism known as the "validator exit queue" plays a crucial role. Rather than being an instant-response ATM, it resembles a sophisticated reservoir dam, whose primary task is to regulate flow rather than meet immediate demand.

When a validator decides to stop serving and withdraw its staked 32 ETH, it does not complete the process immediately. Instead, it enters an orderly queue. The Ethereum protocol strictly controls the number of validators that can enter and exit the network each day through a mechanism called the "Churn Limit." This limit is dynamically adjusted based on the total number of active validators.

According to the latest on-chain data, the Ethereum network currently has about 1.082 million active validators. Based on the protocol's calculation formula floor(active validators total / 65536), only 16 validators are allowed to exit per epoch (approximately 6.4 minutes). This means that, under ideal conditions, a maximum of about 16 * 225 * 32 = 115,200 ETH can exit in a day.

This number is crucial. It tells us that although there is a backlog of ETH worth nearly four billion dollars in the queue, they will not flood the market like a mountain torrent. Instead, this force will be dispersed over more than 15 days, released slowly in a controlled and predictable manner.

The Whales' Maneuver: Decoding the True Drivers of the Queue Surge

Previous analyses regarding leveraged liquidations and shifts to re-staking, while explaining some background, failed to touch the core of this event. According to reports from several crypto media outlets citing on-chain data, the vast majority of ETH in the queue comes from two sources: Coinbase and Lido.

First, and the primary force, comes from Coinbase, the largest cryptocurrency exchange in the U.S. According to reports from CoinGape, Watcher.Guru, and others, Coinbase recently initiated a large-scale unstaking operation, withdrawing up to 430,000 ETH from its staking pool, worth nearly $1.85 billion. This operation accounts for nearly half of the entire exit queue. Coinbase explained that this is a "restructuring of its institutional staking services," part of an internal business adjustment. This means that these funds are not leaving due to a bearish market but are more likely to re-enter the staking network through new validator addresses after the adjustment.

Secondly, the largest liquid staking protocol, Lido, is conducting its "routine operations." Reports from The Block indicate that Lido has been implementing a continuous "validator rotation strategy." To adapt to its latest V2 withdrawal standards and improve node performance, Lido's node operators need to regularly exit old validators and start new validators compatible with the new standards. Although the volume of each operation is not as massive as Coinbase's, its continuity contributes significantly to the exit queue.

So, what are the returns from staking 32 ETH? When discussing the actions of these giants, it is necessary to understand the basic returns of native staking. According to real-time data from beaconcha.in, the current annual percentage rate (APR) for independently running a 32 ETH validator node on the Ethereum network is about 2.95%. This return comes directly from the protocol itself, as a reward for validators maintaining network security and processing transactions. This is a relatively stable but not particularly high return rate, which explains why the market has given rise to complex strategies such as liquid staking, leveraged staking, and re-staking in pursuit of higher compounded returns.

Therefore, the truth of this event gradually becomes clear: it is not a collective exit by thousands of independent validators due to market panic or meager returns, but rather a combination of Coinbase's one-time large-scale business restructuring and Lido's ongoing technical upgrades. Other retail profit-taking and small leveraged position liquidations merely constitute "background noise" in the queue.

We can see that the nature of the current event is more akin to a planned "maintenance" rather than a market-driven "stampede."

Market Impact: Loud Thunder, Small Rain

Since the root of the queue surge is institutional backend operations, the market's reaction should naturally be more rational. While the headline of four billion dollars is shocking, the actual impact may not be as significant as it sounds.

As we calculated, the maximum daily outflow of about 115,200 ETH, at the current price of approximately $4,300, equates to about $500 million in potential liquidity per day. While this number is not small, it needs to be viewed in a broader context. According to TradingView data, Ethereum's 24-hour spot trading volume on mainstream exchanges typically ranges from $20 billion to $40 billion. This means that even if these institutions choose to sell after unlocking (which is unlikely), their daily impact would only account for 1.2% to 2.5% of the total trading volume.

The market's depth and liquidity are likely able to absorb this predictable, gradual release. Moreover, it is highly probable that these funds will not actually flow into the secondary market. Whether it is Coinbase's business restructuring or Lido's technical upgrades, the ultimate goal is to allow validators to re-enter service in a new, optimized form.

From a technical analysis perspective, the market has also built corresponding defensive positions. Currently, Ethereum's key support levels are mainly concentrated around the psychological and technical thresholds of $4,200 and $4,000. The former is the lower edge of the recent consolidation range, while the latter is a significant integer level and a key Fibonacci retracement level from earlier. As long as the price can hold these areas, the bullish structure of the market will not be easily damaged. The resistance above is located around $4,500 and near the historical high of $4,800.

In summary, the record number of Ethereum validator exits ultimately proves to be an event orchestrated by industry giants behind the scenes, characterized by "loud thunder, small rain." It reveals the significant influence of large staking service providers on the network and reaffirms the excellent design of the Ethereum exit queue mechanism in maintaining market stability. For investors, learning to distinguish between the surface of on-chain data and the underlying real-world actions is key to maintaining a clear perspective in the increasingly complex world of crypto.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。