In the midst of strategizing, we can win from a thousand miles away. Hello everyone, I am Lin Chao, a global financial market observer, focusing on cryptocurrency market analysis, bringing you the most in-depth trading information analysis and technical teaching.

Recently, Lin Chao's focus has mainly been on the trend of ETH, as its performance during this round of increase is indeed eye-catching. However, what retail investors are really concerned about is actually concentrated on altcoin spot trading. After all, the "altcoin dream" that started years ago has deeply rooted in people's hearts, and everyone is eager to realize their wealth dreams through hundredfold altcoins. Even if they do not achieve financial freedom, making a hundredfold profit with a small investment can still improve their lives. But everyone has a "risk aversion," so conservative investors place their hopes on mainstream altcoins, such as SOL and XRP. This has also led to the sustained popularity of XRP and SOL in the market.

I know SOL is very popular, but it is not my first choice for short-term trading. The reason is that it is not a target for large capital intervention, and its narrative logic is different from the main lines of BTC and ETH. It is more influenced by market sentiment and manipulation. In any financial market, within relatively closed trading targets, all technical analysis is a paper tiger. This is also why SOL's volatility reached as high as 67.87% on January 13 of this year.

This does not mean that SOL has no growth potential. At least within this year, I believe it can be held as a main spot asset, mainly due to the hype surrounding its ETF listing. Therefore, its narrative revolves around the ETF, while other narratives can only serve as support. This is also why you can see that during the previous rise, SOL was always following rather than leading.

From the K-line situation, since the bull market that started in April of this year, SOL is still in an upward trajectory, but there is significant selling pressure around 210. Why? Because the market is waiting for the development of the main narrative. It cannot rise too fast or not rise at all. This is the current situation of SOL.

Many people have sent private messages asking Lin Chao how high SOL can go and when it can reach that point. Those who ask such questions are likely to have no trading plan. I kindly advise that if you have a few hundred or a few thousand USDT, use it to live well, eat and drink better, and don’t come to the market as cannon fodder. Mismatched cognition and action will undoubtedly lead to failure.

Lin Chao summarizes:

Currently, I can share the information I know with everyone.

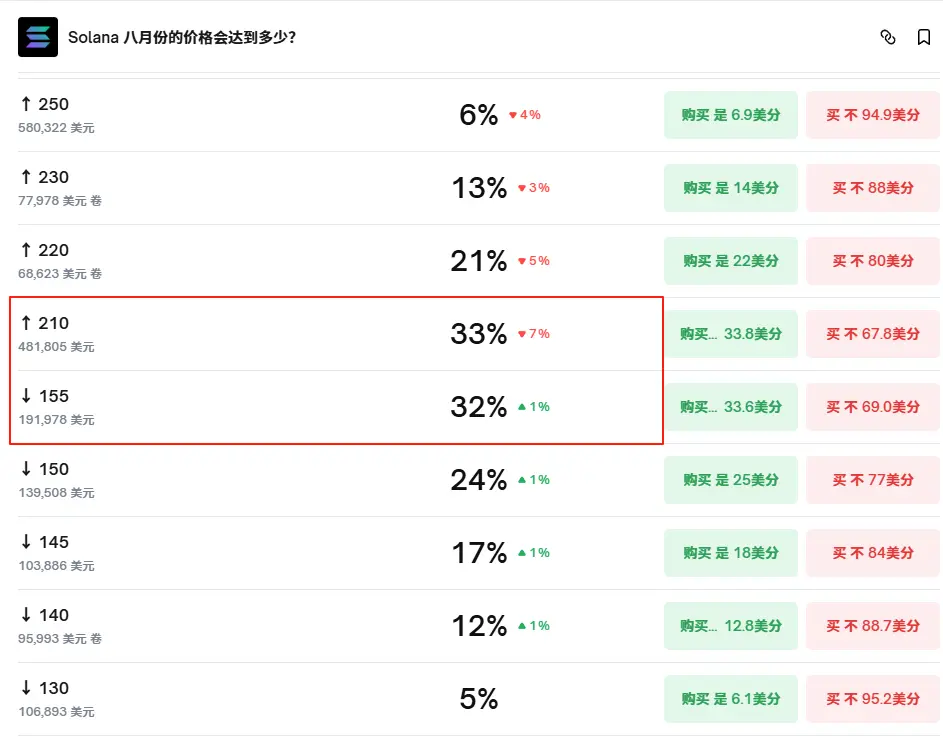

In this wave of market, the average cost of SOL is concentrated around 145. If you have acquired it below 160, you can hold it with confidence because the trend has not changed, and you are waiting for the later narrative to explode. In the Polymarket prediction market, bullish and bearish sentiments are almost balanced, proving that market sentiment is relatively calm.

If the SOL index stabilizes above 210, it has the potential to break the previous high. I believe that given the current situation, this optimistic expectation can still be maintained. As for what "stabilizing" means, that depends on each person's understanding. I will position myself in SOL's spot trading, but I need to act when the index pulls back to the level I have planned.

All of the above is just my personal trading model and may not be suitable for everyone. It is not necessarily a good choice to replicate it one-to-one; it is for your reference.

If you are feeling confused—don’t understand the technology, can’t read the charts, don’t know when to enter the market, don’t know how to set stop losses, don’t understand take profits, randomly increase positions, get stuck while trying to catch the bottom, can’t hold onto profits, miss out on market opportunities… these are common problems for retail investors. Lin Chao can help you establish the correct trading mindset. A single profitable trade is worth more than a thousand words, and finding the right direction is better than repeatedly facing defeat. Instead of frequent operations, it’s better to strike precisely, making each trade more valuable.

The success of investment depends not only on choosing good targets but also on when to buy and sell. Preserving capital and making good asset allocations are essential for steady progress in the ocean of investment. Life is like a long river flowing into the sea; what determines victory or defeat is never just the gains and losses of a single pass or moment, but rather a well-thought-out plan before action, knowing when to stop to gain.

The global market is ever-changing, and the world is a whole. Follow Lin Chao to gain a top-tier global financial perspective.

This article is merely a personal opinion and does not constitute any trading advice. The cryptocurrency market has risks; invest cautiously!

For real-time consultation, feel free to follow the public account: Lin Chao on Cryptocurrency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。