Blast Network Experiences 97% Decline in TVL

The Blast Ethereum Layer 2 network has experienced a sharp and sustained decline in its market position, causing concern within the DeFi community. The project was once hailed as quite promising to scale Ethereum with fast and cheap transactions, yet now, its future looks bleak.

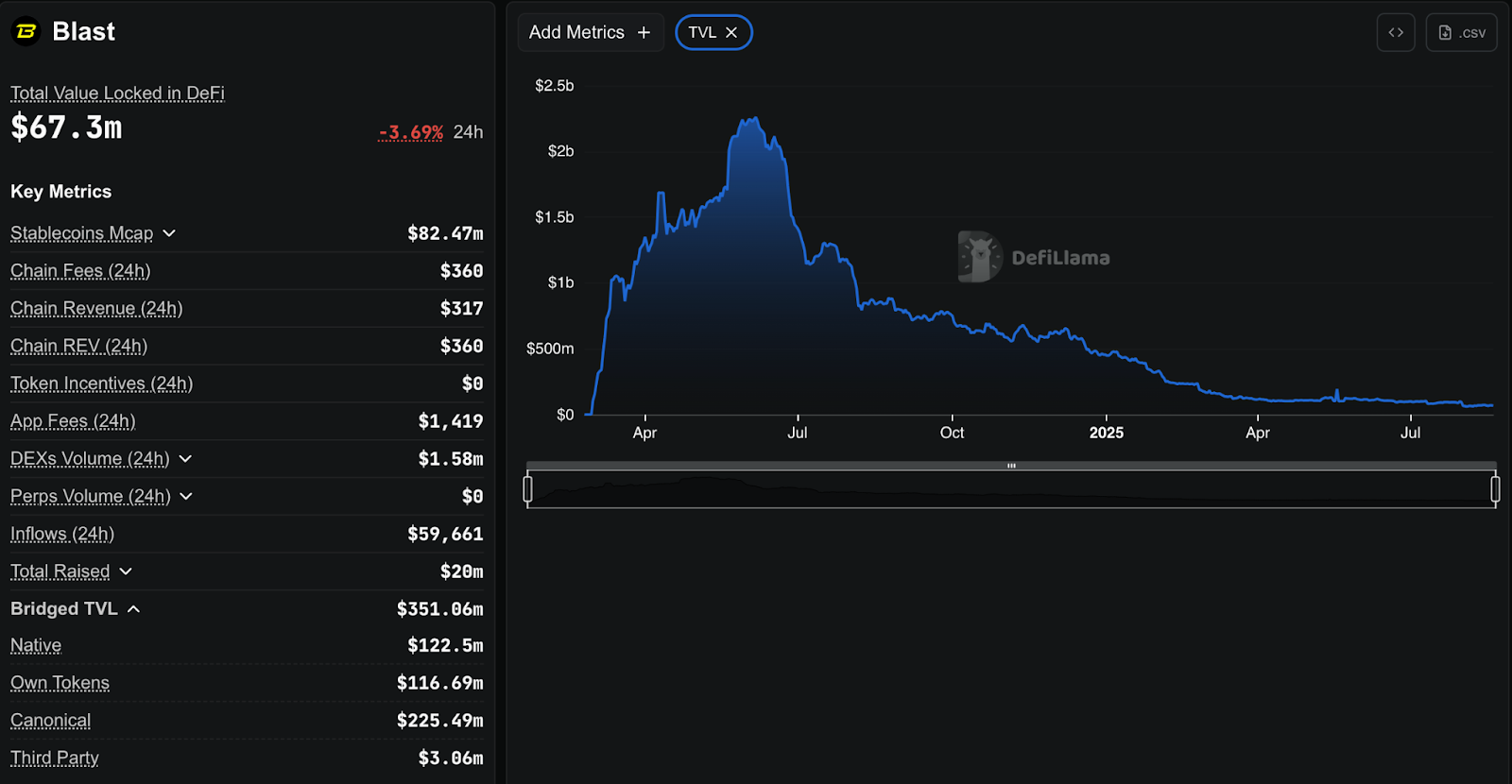

BlastNetwork observed the sharp downfall of its Total Value Locked, with only $67 million in August 2025, a whopping 97% drop from its $2.2 billion top in June 2024. This drastic shift marks the onset of falling confidence and liquidity and thus shows instability and consolidation in the DeFi space.

Source: DefiLlama

Sharp Decline in Total Value Locked (TVL)

A sudden downfall in TVL is one of the sharpest indicators for an eroding market presence for Blast. At its TVL peak in June 2024, the network was awash with capital promising to scale the number of Ethereum transactions at cheaper costs. However, the climax was short-lived, with the TVL plunging throughout mid-2025, eventually resting at just $67 million.

This 97% drop signals a huge change in user behavior, with liquidity providers increasingly locking out their funds from Blast. The sudden drop in Total Value Locked) marks the stormy waters within the entire DeFi ecosystem where several other projects either stumbled or failed to maintain their steam.

The Blast network , despite decreasing TVL, is still attracting some DEX volume. According to the recent numbers, the 24-hour DEX volume is now near $1.58 million. Yet, given how massive it was before, this shows that only some activity remains while the ecosystem on the whole loses attractiveness. The fall in Total Value Locked) and overall transactions implies that the users are now preferring safer and more secure alternatives, forcing one to wonder if can ever regain the heights it once enjoyed.

Waning Engagement and Communication Issues

One of the most disturbing aspects of Blasts decline is the prolonged silence in many official channels. It now stands at three months of inactivity on both the project's Twitter account and the founder's, Pacman. In an ever-quick sphere such as DeFi, communication acts as glue for user trust and interest.

Regular updates and open dialogue about development progress go a long way in reassuring users about the future of a project. However, the absence of any new content or announcements from the team has cast a shadow of doubt within the community. Users have started to feel unclear about where the project heads and if it ever will deliver meaningful updates or improvements.

Another hit to the network reputation came from the vacuum in communication. If the team is still working behind screens, they have been at best distant and largely disengaged from their community, raising doubts about their long-term commitment in an increasingly competitive market.

Bridged TVL and Remaining Activity

While the network has seen a dramatic decline in its total TVL , Blast still maintains a bridged Total Value Locked) of around $351 million. This portion of its value is largely derived from native tokens and contributions from other platforms. Although Blast has seen a significant reduction in its overall market presence, this bridged TVL suggests that the network has not entirely disappeared.

However, this figure does not indicate a full recovery for the Blast network. With ongoing decreases in activity and engagement, it seems increasingly unlikely that Blast will regain its former market position without significant intervention or a clear shift in its development approach.

Also read: What Happened in Crypto Today? Will ETFs Exit Trigger More Crash?免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。