Bullish IPO Stablecoin Makes History With $1.15B NYSE Blockchain Deal

Wall Street just saw something no one expected so soon. A $1.15 billion initial public offering did not go through banks or wires—it settled fully in digital coins. The company behind this bold step is Bullish (NYSE: BLSH).

By using blockchain money instead of cash, Bullish IPO Stablecoin has linked the process with a new on-chain economy. This moment is being called the start of a different chapter for finance.

The First-Ever Stablecoin IPO $1.15B Shockwave

On August 14, 2025, this company became the first firm in the United States to complete an IPO with settlement in tokens like USDC, EURC, PYUSD, RLUSD, and USDG. Instead of dollars in a bank, digital equivalents powered the deal.

This is being called the first stablecoin IPO USA, a move that could transform how capital markets raise funds. It is not just Bullish IPO news today—it is a sign of how stocks and blockchain are starting to merge.

From Solana to Coinbase: The Billion-Dollar Stablecoin Settlement Engine

How did this actually happen?

-

Solana handled most of the minting, showing its ability to move money at high speed.

-

Jefferies, acting as billing and delivery agent, managed conversion and flow of funds.

-

Coinbase became the pubic offering custodian, holding the raised amount in USDC and EURC.

Coinbase exchange confirmed this in its X post: “Stablecoins are just better. Faster, cheaper, and more global, proven yet again by this crypto exchange company.”

This simple statement explains why traditional rails may soon be challenged. This cooperation brought together multiple players—Paxos, Ripple, Societe Generale-FORGE, and others—making the Bullish NYSE BLSH listing a global digital finance milestone .

Ripple Joins the Spotlight: RLUSD’s Role in the Initial Public Offering Settlement

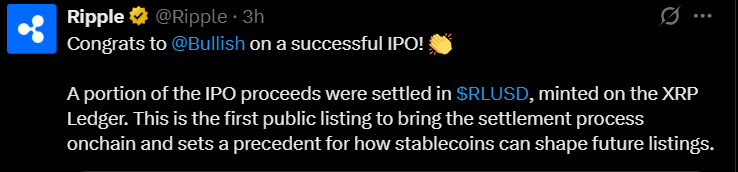

Ripple also celebrated the event. A part of the proceeds was paid in Ripple RLUSD IPO settlement, its token launched on the XRP Ledger.

Ripple’s official X post called this a historic step for capital markets. By showing that company’s RLUSD pegged currency, USDC, and EURC could all be used in one deal, the market saw a multi-chain future in action.

Stable assets are no longer tied to one network—Solana stablecoin settlement and XRP Ledger tokens both played a role. This adds weight to the top analysts' belief that more issuers will soon launch their own trusted coins for such events.

The Road Ahead: Will Stablecoin IPOs Become Wall Street’s New Normal?

The Bullish IPO Stablecoin moment is bigger than one listing . It proves that digital assets can handle billion-dollar operations.

Why is this powerful?

-

Speed: Unlike wires, coins settle instantly.

-

Lower fees: Transactions cost less than old banking methods.

-

Global use: Investors from multiple regions can join without cross-border pain.

Crypto Exhcange Comapny CFO David Bonanno explained:

“We view stablecoins as one of the most transformative and widespread use cases for digital assets.”

For many, this was more than Bullish stock news . It was proof that Wall Street blockchain intial public offering events are no longer a dream. If others follow, the next decade of public listings could look very different.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。