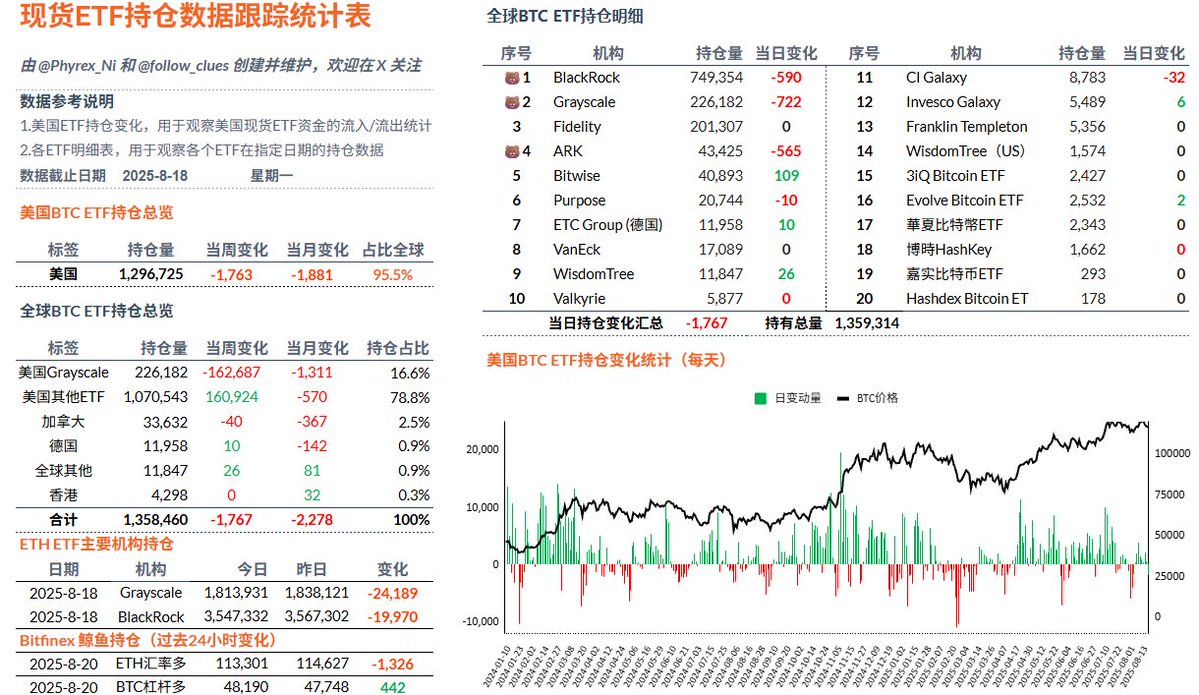

On Monday, the situation for the $BTC spot ETF was not good, with a significant reduction in holdings over the past two weeks. American investors sold 1,763 Bitcoins. Although this isn't a large number, it includes investors from BlackRock and Grayscale, which should be somewhat related to the current trend of BTC. The market has poor expectations for the Jackson Hole annual meeting on Friday.

The market is also very conflicted in its expectations. If Powell turns dovish, it is likely that there are problems in the U.S. economy, which is what investors are currently worried about. On the other hand, if Powell continues to hold firm against interest rate cuts, it may slightly ease the economic situation, but the impact of high interest rates will still be very complicated.

The ETF data reflects the sentiment of traditional investors. Currently, most traditional investors have not made clear statements, but it is evident that the sentiment is not very good. As we have mentioned many times, BTC itself does not have strong purchasing power; rather, it has low selling volume. Once market expectations turn pessimistic and selling volume increases, the impact could be even greater.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。