Original Author: BitMEX

In the past crypto cycles, market sentiment was often driven by FOMO and KOL-led trades. However, this time, the main players have changed: Digital Asset Treasury (DAT) stocks. These companies are continuously financing and making large-scale purchases, locking in Bitcoin, Ethereum, Solana, BNB, and other top assets. The explosion in trading volume has also made them a focal point in the market.

The question arises: Are DAT stocks truly a better solution for gaining exposure to cryptocurrency bullish positions? Or is it more cost-effective for investors to buy the underlying assets directly?

This article examines DAT stocks related to Bitcoin, Ethereum, Solana, and BNB. Our view is that: The era of DAT stocks consistently outperforming the underlying assets may be coming to an end.

When MicroStrategy ($MSTR) first pioneered this model, there were almost no competitors in the market. But today, DAT stocks have almost no entry barriers and are experiencing excessive expansion, with all projects scrambling to buy the same assets. This crowded competition has weakened the scarcity premium, and demand has clearly decreased compared to the early $MSTR days.

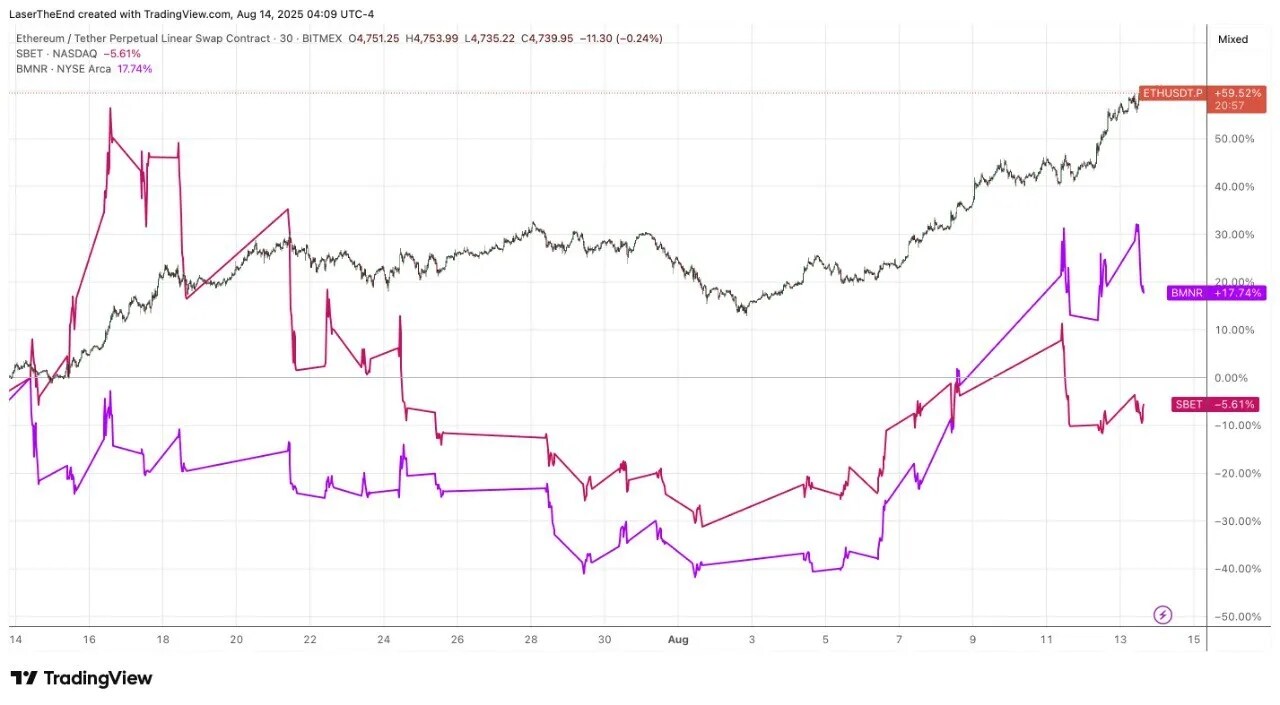

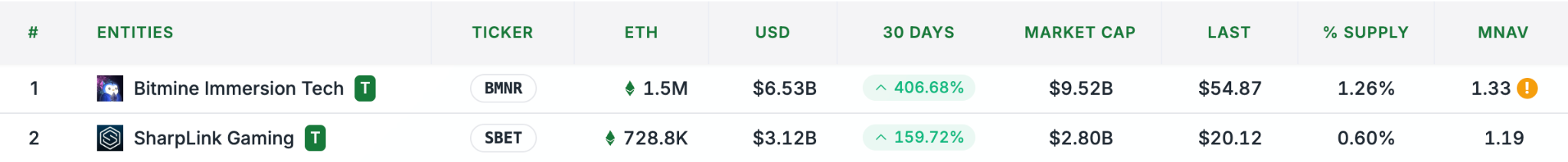

The evidence is also clear. Even the most well-known coin stocks $BMNR and $SBET have failed to outperform $ETH in the past month. A more extreme example is that BNB has reached an all-time high, but related coin stocks like $WINT have continued to decline.

When multiple DAT stocks are competing to accumulate the same cryptocurrency treasury, aggressive issuance and competition can erode their investment logic. In this case, if you are bullish on a particular asset, directly buying that cryptocurrency itself, rather than the stock shell, is often a better choice.

Case Breakdown

Bitcoin – MicroStrategy ($MSTR)

- Since 2024, $MSTR has outperformed $BTC by over 250%.

- However, in the past month, $MSTR has underperformed Bitcoin by 17%.

MSTR was once synonymous with coin stocks. With continuous Bitcoin purchases and the additional leverage from mNAV premiums, it became a myth of outperforming BTC.

However, as more DATs emerge, investor interest has shifted towards directly holding coins, and its mNAV premium has dropped to 1.6 times, nearing historical lows. Even the oldest players find it hard to maintain their former advantages.

Ethereum – SharpLink ($SBET) vs BitMine Immersion ($BMNR)

- In the past month, ETH has outperformed both by over 40%.

The DAT war for Ethereum is currently one of the most intense in the market. SharpLink (SBET) and BitMine Immersion (BMNR) have both publicly announced their ambitions to become the world's largest ETH treasury. Their strategies are almost identical:

- Raise as much capital as possible through ATM issuance and targeted financing;

- Then directly invest the funds to purchase ETH.

This model may not be beneficial for shareholders, but rather favors ETH holders. As long as mNAV is above 1.0, both companies have the incentive to continue issuing new shares to buy ETH, but this will continuously dilute the rights of existing shareholders.

- Currently, SBET's mNAV is close to 1, limiting flexibility;

- While BMNR is still actively issuing and buying.

Meanwhile, ETH itself is the biggest beneficiary: it receives continuous and substantial buying support. For investors, this raises a question: when multiple companies are buying ETH in large quantities almost every day, who is the most direct winner? The answer is ETH itself.

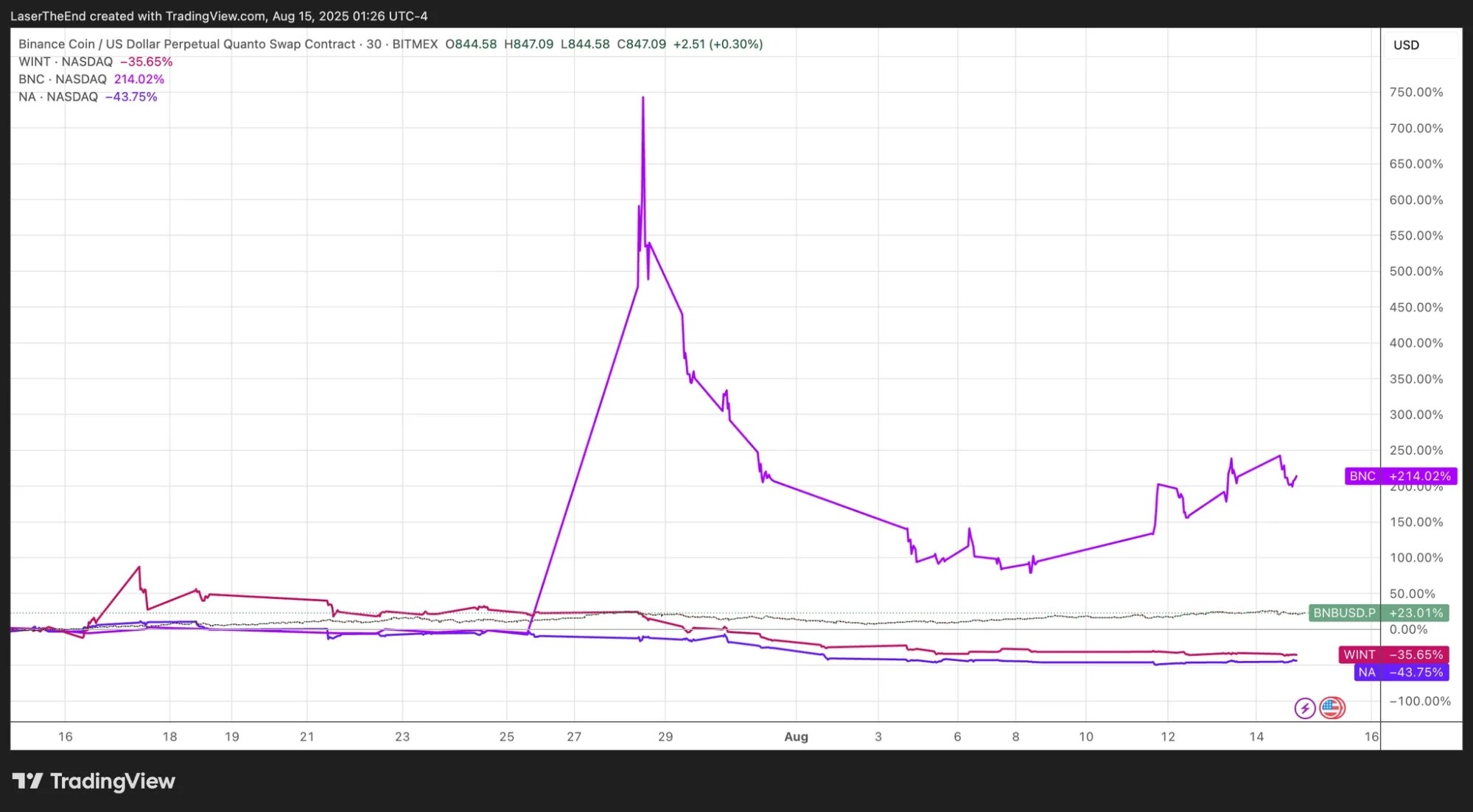

BNB – Dysfunctional Logic in a Crowded Field

Recent performance over the past month: $BNB reached an all-time high, but $WINT and $NA are still declining.

Recent performance over the past month: $BNB reached an all-time high, but $WINT and $NA are still declining.- Note: BNC announced PIPE financing on July 28, but its stock price, after an initial rise, still underperformed $BNB.

BNB's DAT stocks are more fragmented, with at least three major players, each managing or planning to manage over $300 million in treasury. The result is that none can monopolize the scarcity premium, and investment demand is dispersed among multiple stock shells.

Major participants include:

- Windtree Therapeutics (WINT) — plans to raise $200–700 million to purchase BNB.

- CEA Industries / BNB Network Company (BNC) — restructuring to become the "largest publicly traded BNB treasury," has secured $500 million PIPE + $750 million warrants, and continues to acquire BNB through ATM issuance.

- Nano Labs (NA) — a chip manufacturer based in Hong Kong, targeting $1 billion in BNB acquisitions, with financing sourced from $500 million in interest-free convertible bonds.

But the results are not ideal: While BNB reached a new high, $WINT and $NA have been declining. In such a crowded field, each DAT must continuously issue stocks or debt to expand their treasury, but lacks the scarcity premium seen in early Bitcoin DATs. For traders bullish on BNB, directly buying and staking BNB is a more straightforward approach.

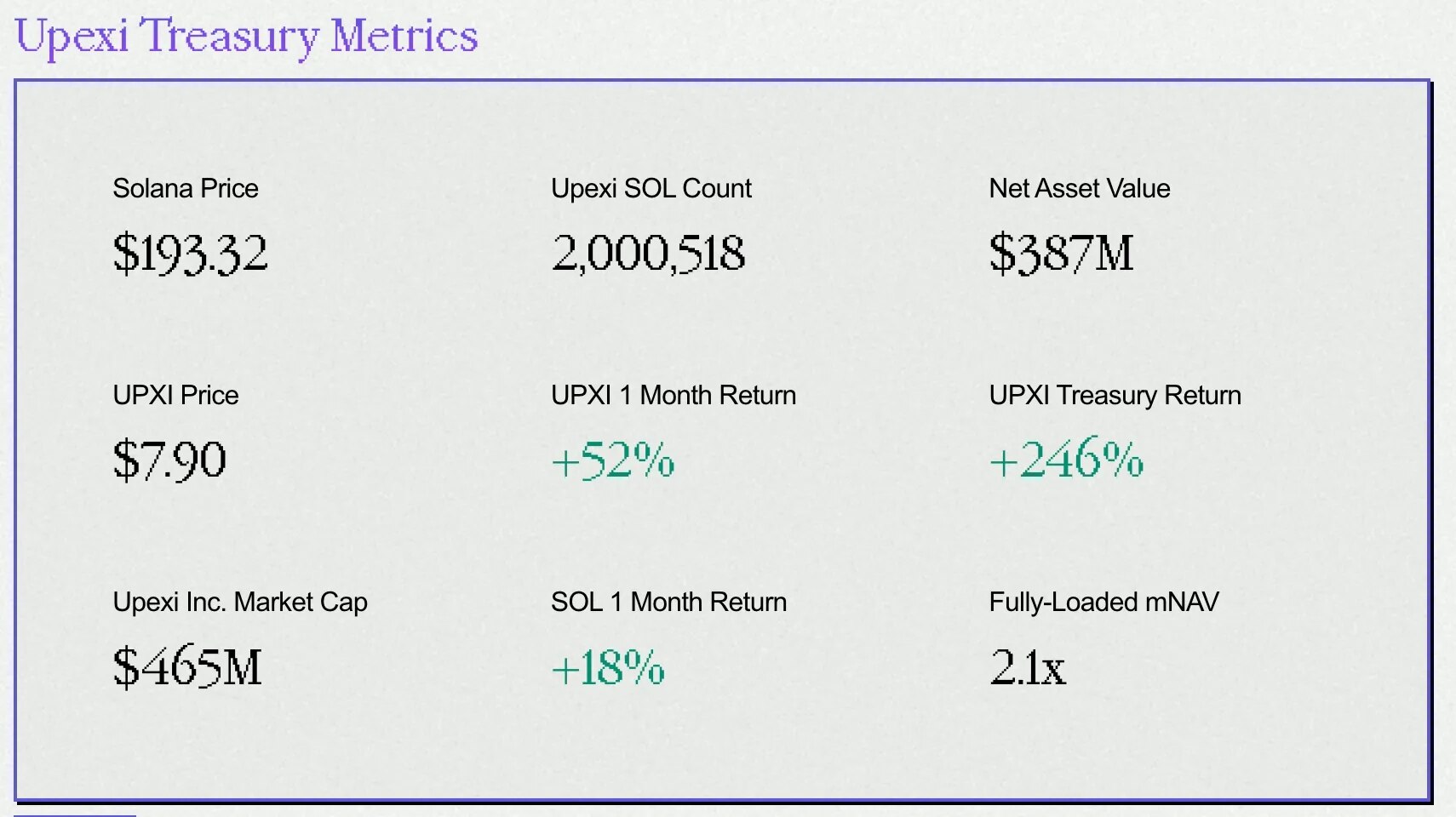

Solana – Upexi (UPXI), One of the Few Winners

In the past month, UPXI has outperformed SOL by 34%.

In the past month, UPXI has outperformed SOL by 34%.

Upexi (UPXI) and Solana present a rare case: DAT stocks have actually outperformed the underlying asset. UPXI's mNAV premium is as high as 2.1 times, meaning its market value exceeds the value of its held SOL by more than one time.

We believe that UPXI can maintain its high premium due to:

- It has not yet encountered competitors with similar financing scales;

- It has not purchased SOL through ATM financing for nearly a month;

- It recently hired Arthur Hayes as an advisor, further increasing market attention.

This explains UPXI's high premium, but we do not believe its advantage can be sustained long-term. As there are no entry barriers for coin stocks, new competitors may emerge at any time, and the premium advantage could quickly disappear.

Conclusion: The Cryptocurrency Assets Themselves Are the "Kings"

DAT stocks have indeed brought a new wave of buying, but current cases are indicating that this model has significant limitations.

- Ethereum and BNB Tracks: The competition among multiple coin stocks has evolved into an arms race of financing and issuance, ultimately benefiting the underlying assets.

- Bitcoin Track: MSTR's once high premium has now compressed to near historical lows, and it has underperformed BTC in the past month.

- Solana Track: UPXI is currently an exception, but its advantage may be fleeting.

For traders, the conclusion is simple: If you are bullish on a particular cryptocurrency and the DAT track for that asset is already crowded, then directly buying the underlying asset itself is the cleanest and most certain way. Coin stocks may still provide short-term opportunities amid premium fluctuations, but in the long-term landscape, the underlying assets remain the kings.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。