Can stablecoins only be used like the US dollar? This may be our long-standing impression of stablecoins. With the advancement of compliance and mainstream narratives, the stablecoin sector is welcoming more and more projects, creating numerous opportunities for earning returns, and many stablecoins supported by top VCs are available for yield farming.

Here are the stablecoin projects currently worth paying attention to, compiled by BlockBeats.

cap

cap (@capmoney_) is a new stablecoin protocol on the Ethereum mainnet, officially launched on August 18. The project announced in April this year that it had completed a $11 million funding round, with participation from Franklin Templeton and Triton Capital.

This stablecoin protocol features a dollar-pegged stablecoin $cUSD minted through USDC, and a yield-bearing $stcUSD issued by staking $cUSD. Currently, the first phase of the protocol's points system "Caps" has begun with the launch of the protocol, allowing users to mint $cUSD to earn Caps points, which will last for 2 weeks.

As of now, its official website shows a TVL of approximately $15.5 million.

USD.AI

USD.AI (@USDai_Official) is a stablecoin protocol that provides credit for AI hardware (AI companies can obtain loans by collateralizing GPUs), officially launching today. The project announced on August 14 that it had completed a $13.4 million Series A funding round, led by Framework Ventures, with participation from Bullish, Dragonfly, Arbitrum, and others.

This stablecoin protocol features a dollar-pegged stablecoin $USDai minted through USDC, and a yield-bearing $sUSDai issued by staking $USDai. Along with the protocol's launch on the Arbitrum network today, there is also a points activity called "Allo."

This activity is divided into two parts: one part allows users to mint $USDai to earn future ICO allocations, while the other part allows users to stake $USDai to receive future airdrops. While staking can earn interest and airdrops, there is also a 30-day lock-up period.

The protocol currently has a total deposit cap of $100 million, and during the previous Beta phase, total deposits reached $50 million, leaving $50 million available for this public round. For the "Allo" activity, the project has given a valuation of $300 million FDV, and the activity will end when the protocol's total revenue payments reach $20 million.

Level

Level (@levelusd) is a stablecoin protocol fully backed by USDC and USDT, issuing $lvlUSD. By staking $lvlUSD, users can earn $slvlUSD and apply it in DeFi applications like Curve and Pendle for yield. On March 18, the protocol completed a $2.4 million funding round, with investors including Flowdesk, Echo's Native Crypto fund, Path's Feisty Collective, and other angel investors.

In August last year, the protocol developer Peregrine Exploration completed a $3.6 million funding round, led by Polychain Capital and Dragonfly, with participation from Robot Ventures, Pier Two, EIV, Global Coin Research, and angel investors like Balaji Srinivasan, Jeff Fang, Julian Koh, and Sidney Powell.

The protocol has a points system called "XP," where users can earn XP by depositing $lvlUSD or Curve LP tokens into the "XP Farm," or by providing Level assets as collateral on Morpho.

OpenEden

OpenEden (@OpenEden_X) is not just a stablecoin protocol but also a RWA platform. Its stablecoin $USDO can be minted through USDC and $TBILL, with reserves backed by tokenized U.S. Treasury bills and money market funds.

$TBILL is also OpenEden's own token, each backed by short-term U.S. Treasury bills and dollar reserves. On June 20, 2024, credit rating agency Moody's granted OpenEden's tokenized U.S. Treasury bill fund a "A" rating, making OpenEden's TBILL token the world's first tokenized U.S. Treasury bill product to receive an "investment grade" credit rating.

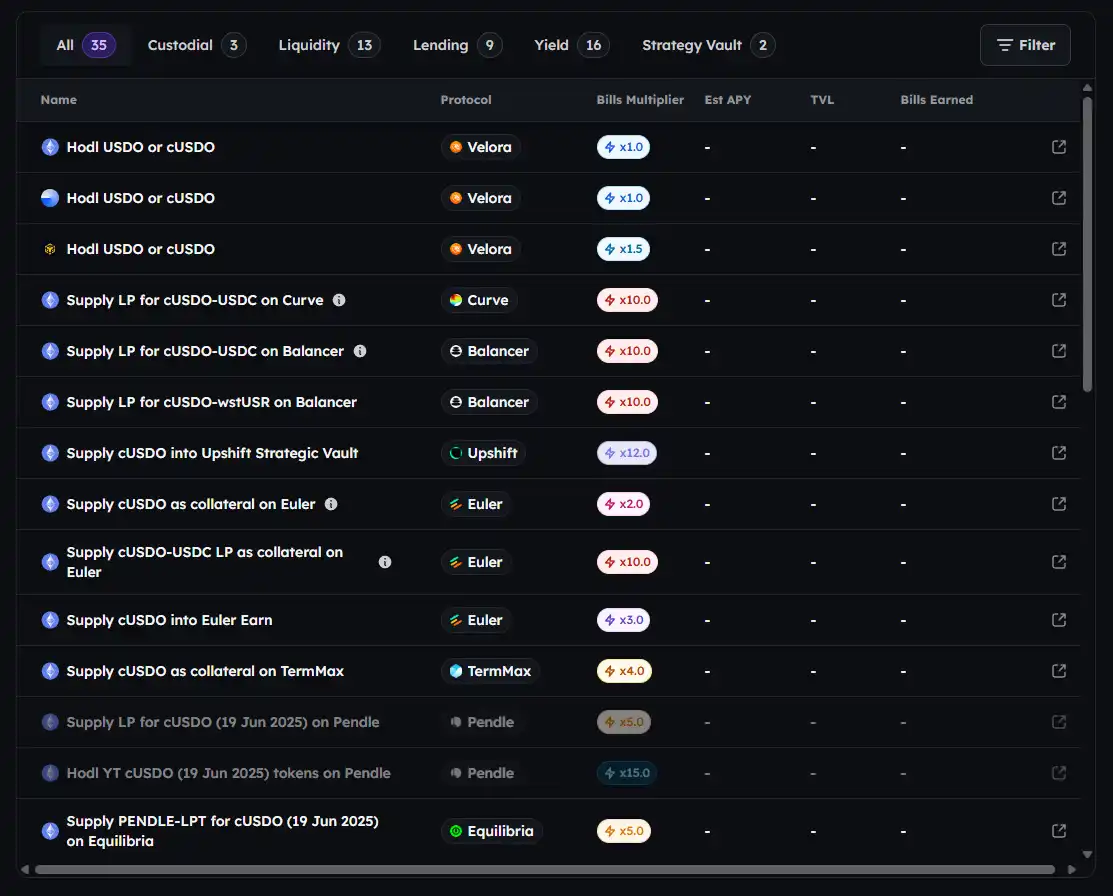

The project has received investment from Yzi Labs, and the TVL of $TBILL is currently nearing $300 million. On August 14, OpenEden announced the launch of its native token $EDEN, with 7.5% of $EDEN allocated to participants in the "Bills" activity. A series of activities related to $USDO and $cUSDO can earn Bills points.

Falcon Finance

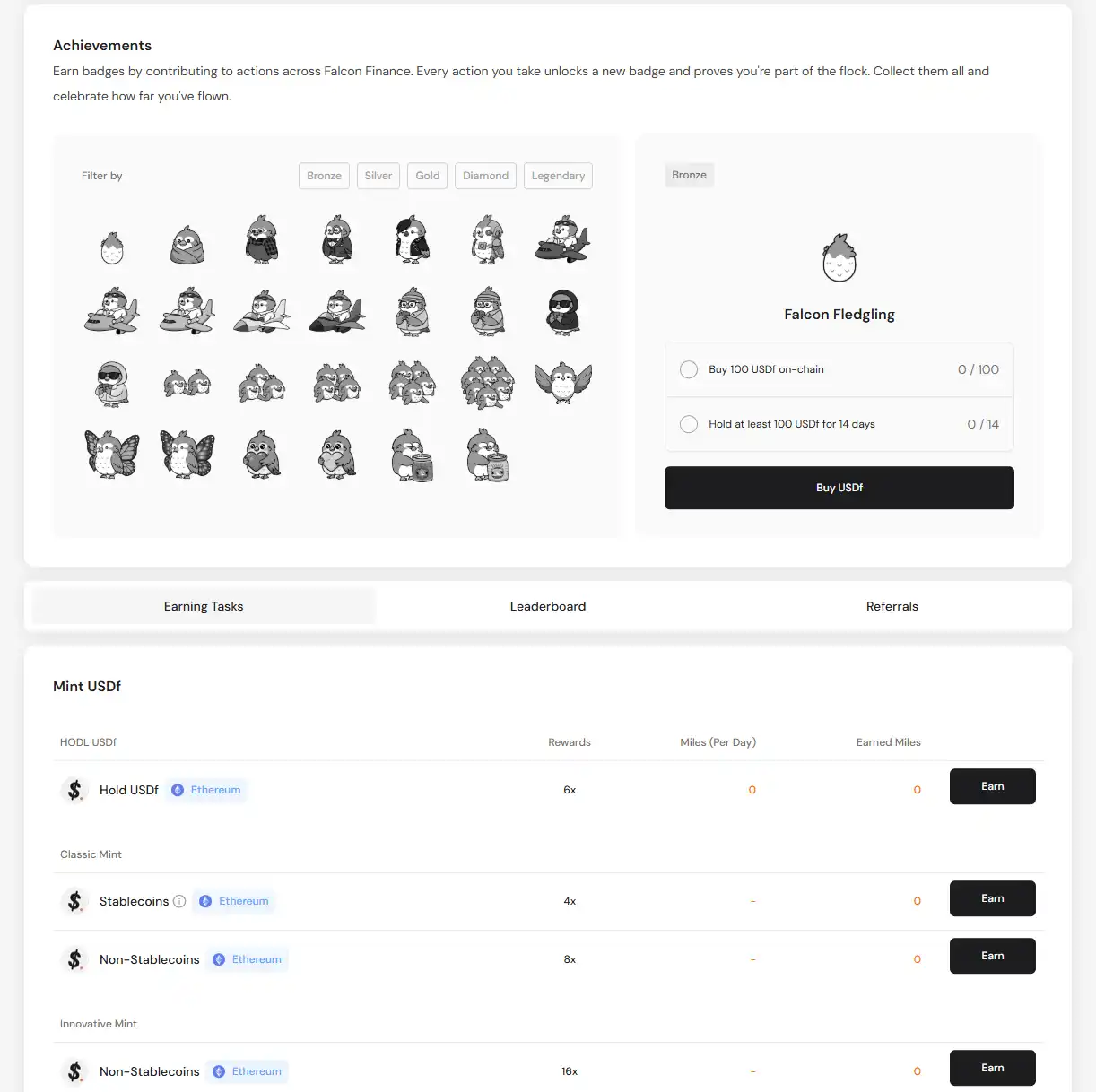

Falcon Finance (@FalconStable) is a synthetic dollar stablecoin protocol launched by DWF Labs. Currently, the protocol's TVL has reached $1.4 billion.

The protocol has a points system called "Miles," where users can earn badges by participating in various Falcon Finance activities, as well as earn points by engaging in a series of activities related to $USDf and $sUSDf.

Perena

Perena is a stablecoin infrastructure protocol in the Solana ecosystem. On December 11 last year, Perena, founded by Anna Yuan, former stablecoin head of the Solana Foundation, completed approximately $3 million in Pre-Seed funding, led by Borderless Capital. On July 3 this year, Perena announced the completion of a new funding round, attracting over 350 supporters, including institutions like Susquehanna, Native CryptoX, and Hermeneutic Investments.

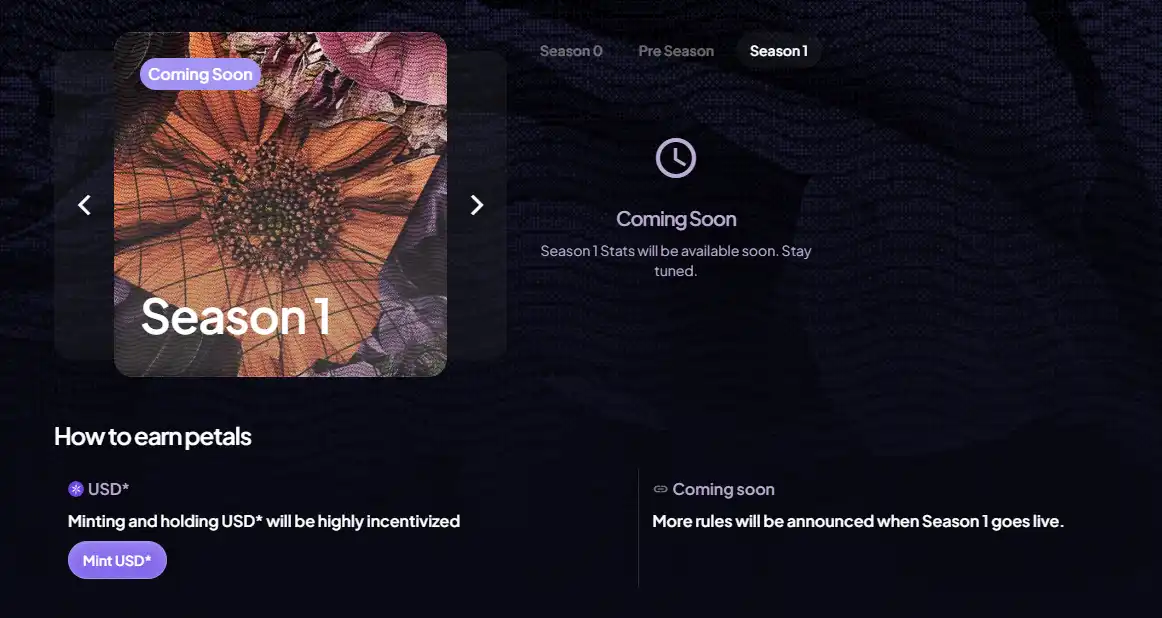

The protocol's $USD* is backed by USDC, USDT, and PYUSD. When users deposit USDC, USDT, or PYUSD into Perena's seed pool, they receive $USD* in return.

The protocol has a points system called "petals," and the first two phases of activities have been completed. Currently, a new round of activities has not yet started, but the project team indicates that minting and holding $USD* will be the main incentive for the new round of activities.

Noble

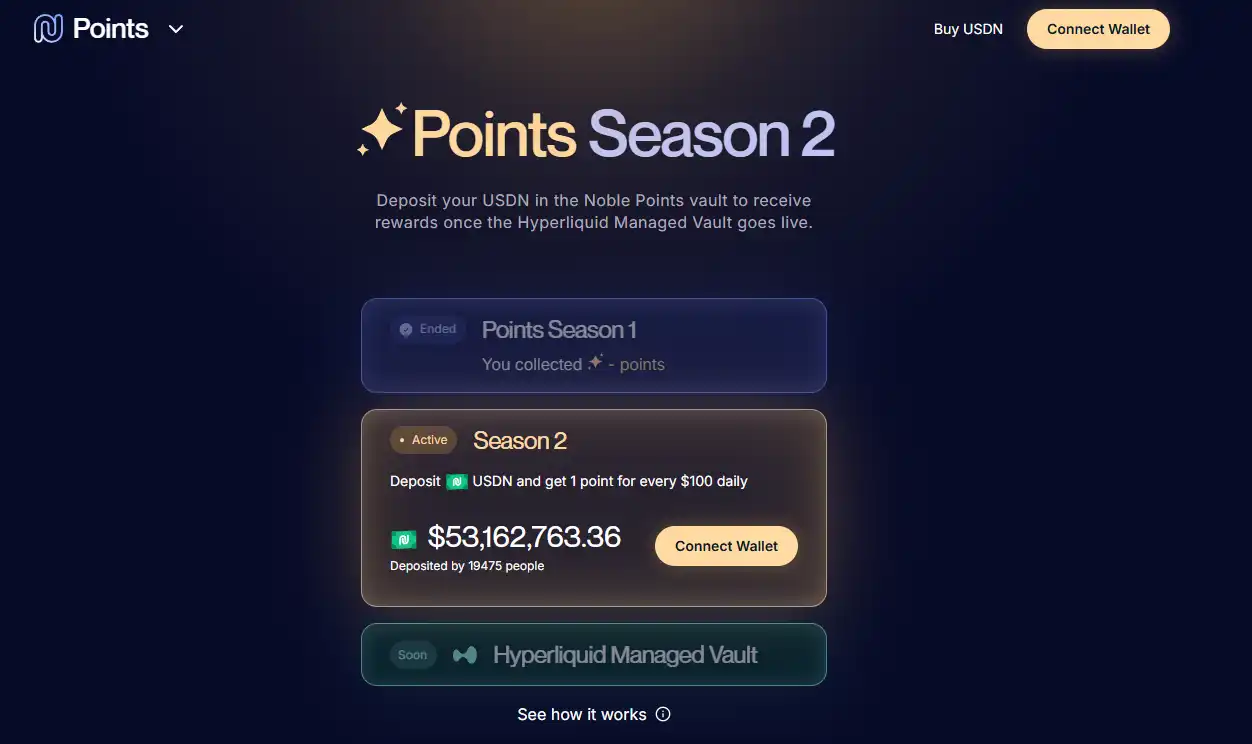

On November 19, 2024, according to Fortune, the stablecoin company Noble completed a $15 million Series A funding round, led by Paradigm. This project is a chain specifically designed for stablecoins and RWAs, but it has also launched its own stablecoin $USDN.

The project has a points system, currently in its second season, where points can be earned by depositing $USDN into the official points pool. So far, over $53 million of $USDN has been deposited to earn points.

Resolv

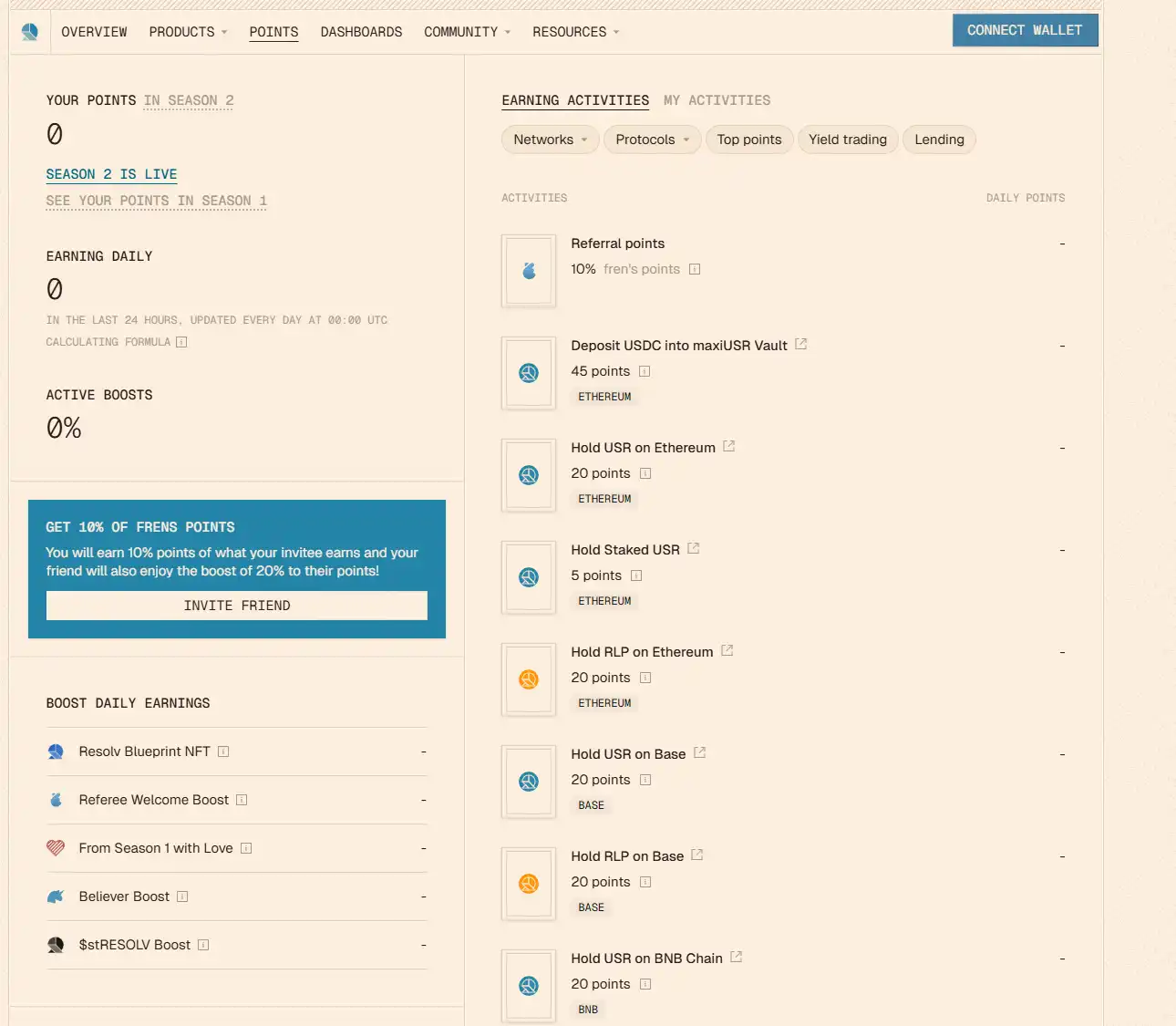

Resolv is a stablecoin protocol issuing $USR, which is pegged to the dollar and 100% backed by ETH, hedging ETH price fluctuations through perpetual futures. On April 16, CoinDesk reported that Resolv Labs announced the completion of a $10 million seed funding round, co-led by Cyber.Fund and Maven11, with participation from Coinbase Ventures, Susquehanna, Arrington Capital, and Animoca Ventures.

The protocol has a points system, and the points activity is currently in its second season, where completing a series of tasks set by the project team can earn points.

Conclusion

In addition to the aforementioned stablecoin-related projects with direct points systems for interaction, there are many other noteworthy stablecoin projects that are even more significant. For example, Bitcoin L2 Plasma, supported directly by Tether and featuring a "no-fee stablecoin chain," the L1 chain Stable supported by Tether and unified liquidity protocol USDT0 from Bitfinex and USDT, and Circle's "first stock of stablecoins," which will announce a new public chain Arc dedicated to stablecoins in its Q2 2025 financial report.

Additionally, the high-performance, payment-focused blockchain Tempo, built in collaboration between Paradigm and Stripe, is also under development, and the Trump family company WLFI has issued a compliant stablecoin USD1 on the BNB Chain.

As the next "battleground" for compliance and mainstream adoption, the stablecoin sector deserves our increased attention.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。