In the past two days of decline, there has been a common point: during the main trading hours in Asia, specifically during the daytime in Beijing time, the declines have been quite noticeable. Even this morning, such a situation occurred. The declines during Asian hours indeed correspond to the recent rises in the Shanghai and Shenzhen stock markets. Therefore, some investors believe that there are investors in the Asian time zone selling cryptocurrency assets and reallocating into A-shares.

It is difficult for me to make an accurate judgment on this possibility, but even compared to A-shares, cryptocurrencies are not very large assets. Moreover, even if there is some overlap, the number of cryptocurrency investors and A-share investors is not very high. Additionally, there was no significant decline in U.S. stock index futures on Monday and Tuesday, so the probability of selling U.S. stocks and cryptocurrencies to buy A-shares is not very high. The likelihood of solely selling cryptocurrencies, especially Bitcoin, to buy A-shares may be even lower.

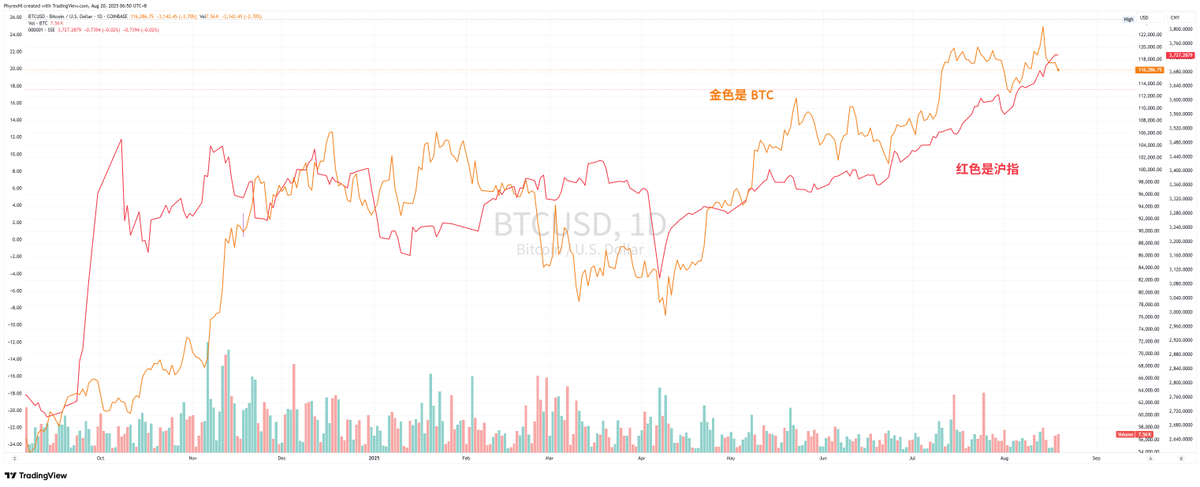

Furthermore, from the perspective of the Shanghai Composite Index and $BTC's trends, there has not been a clear opposing sentiment. In most cases, when the Shanghai Composite Index rises, BTC also follows suit. Even when BTC declines, the Shanghai Composite Index tends to decline as well.

Looking at more detailed data, although BTC led the decline significantly during the Asian time zone on Monday and Tuesday, the trading volume did not see a substantial increase. In fact, the trading volume on Monday and Tuesday was decreasing, while the U.S. time zone experienced greater trading volume and selling.

Today, not only has the decline in the Asian time zone lessened, but the trading volume has also further contracted. This indicates that either Asian investors have completed their hedging actions, and those who needed to sell have mostly done so, or Asian investors are well-prepared for hedging, having sufficient expectations for the Jackson Hole annual meeting.

Alternatively, Asian investors may believe that the current price of BTC has reached a low level, achieving a certain balance between buying power and selling. However, this possibility is still relatively low, as the trading volume has not increased.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。