Are Crypto Market at Risk as Trump Attacks on Powell Intensify?

Trump attacks on Powell Again, Says High Rates Are Hurting Housing

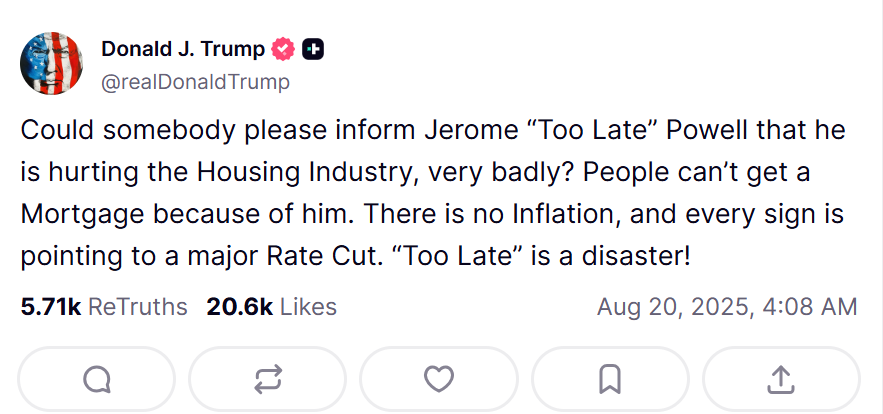

The US President has once again taken aim at the Federal Reserve Chair, accusing him of damaging the U.S. housing market with interest rate that remain too high. In a post on Truth Social, he complained that Americans are struggling to secure mortgages and pushed for aggressive cuts to borrowing costs.

Source : Truth Social

Trump attacks on Powell Before Jackson Hole Meeting: A Power Play

Attention now switches to Jerome's keynote address at the Jackson Hole conference on Friday, when investors will be looking for signals about future monetary policy. The next Fed policy meeting is scheduled for September 16-17, making remarks even more important.

Trump attacks on Powell are for major cuts, ranging from a few percentage points to more. Scott Bessent, the Treasury Secretary, has openly called for a half-point drop next month. With the prospect of another rate drop later in the year, the majority of investors and analysts anticipate that the Fed will lower tax by a quarter percentage point in September.

What Do Trump Attacks on Powell Reveal About U.S. Politics?

In recent years, the U.S. central bank has already taken important actions. Just before the presidential election in September of last year, it lowered rates by half a percentage point. Following Mr. Donald's win, it lowered rates by an additional half a point. However, the Fed has maintained rates in the 4.25%–4.50% range this year, citing concerns about tariff-induced inflation and confidence in the robustness of the job market.

Crypto Market Volatility Linked to Trump Attack on Powell

The Trump Attacks on Powell news and Jackson Hole Friday meeting is gaining interest from both crypto and traditional markets with investors expecting Federal Reserve Chairman Jerome's comments. Traditionally, Jackson Hole has shaped monetary policy cues, which tend to affect into risk assets such as Bitcoin and altcoins. If Jerome will be signaling continued higher interest rates, it might put pressure on crypto prices because of more liquidity. On the otherside, any dovish tone hinting at rate cuts or easing might trigger a bullish rally in Ethereum and Bitcoin. Traders are keenly observing volatility as Powell's position could dictate whether the crypto market experiences short-term gains or corrective action.

The president selected one of his economic advisors, Stephen Miran , earlier this month to take over as governor of the Federal Reserve. So he would receive an additional vote in support of interest rate reductions. The term as Fed chair expires in May of next year, but Trump attacks on Powell are not stopping and has threatened to fire him if he does not comply with his request to lower interest cuts.

Also read: Elon Musk Ditches 'America Party' Idea, Prioritizes Business免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。