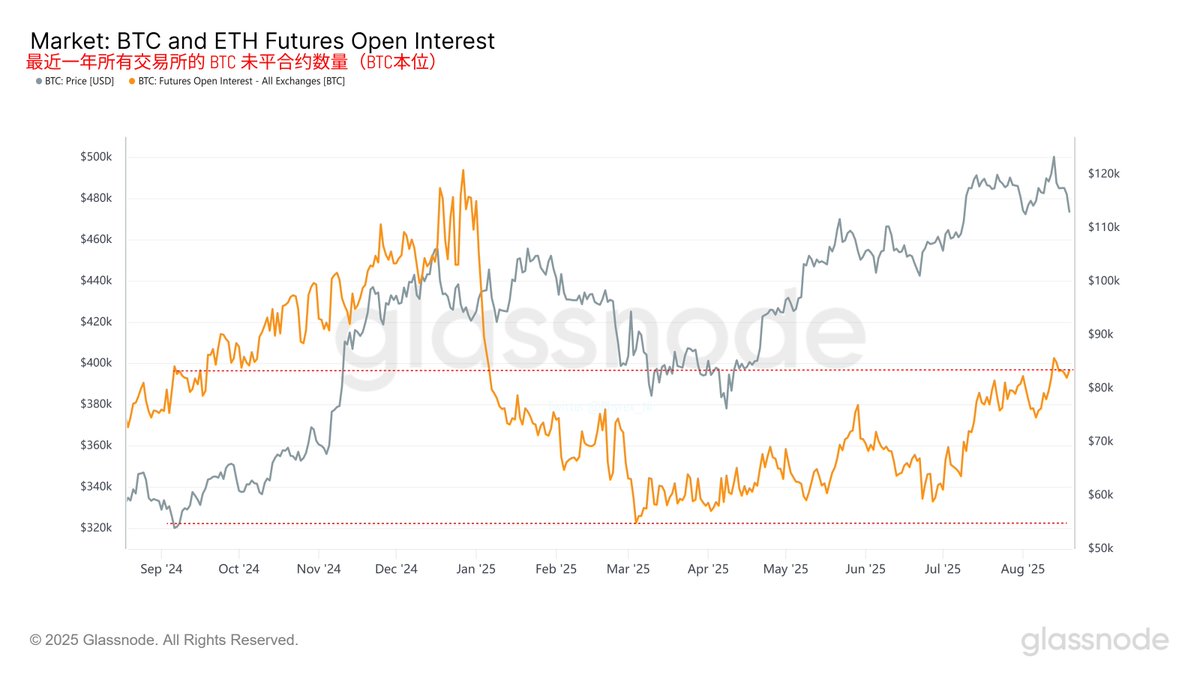

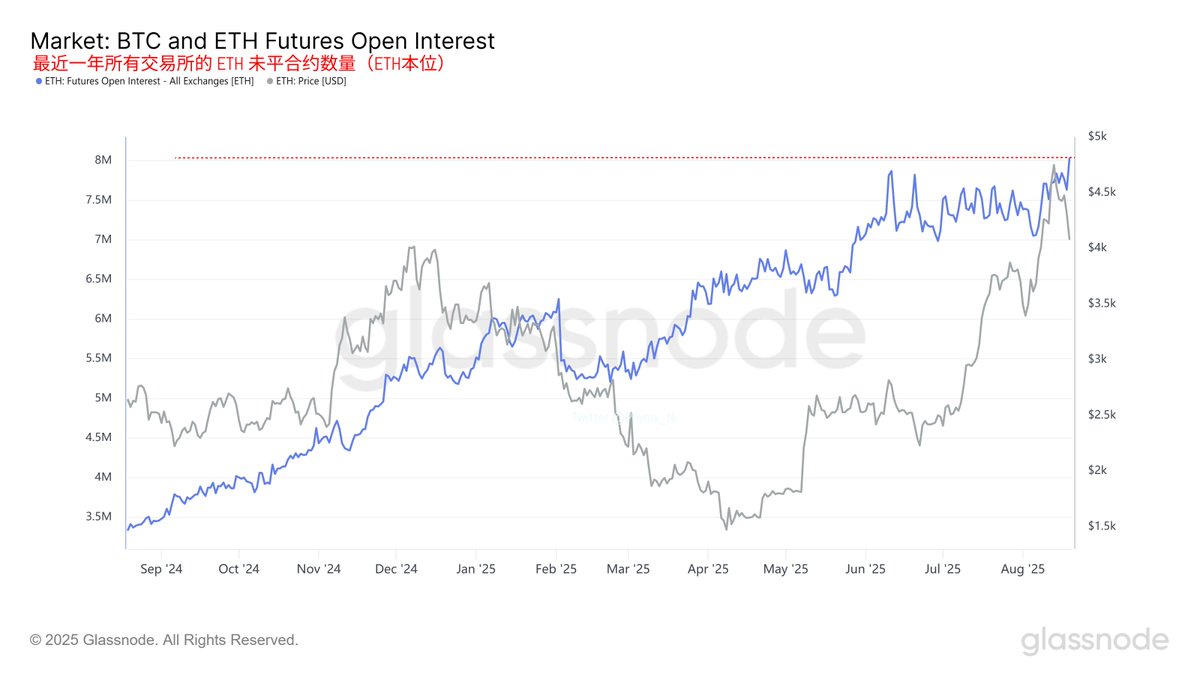

When it comes to risk, there are two sets of data that need to be emphasized, namely the open contract data for $BTC and $ETH. It is evident that with the rise in prices, both BTC and ETH have seen a significant increase in open contracts.

Previously, BTC had relatively few open contracts because investors were uncertain about the direction. However, especially in the last month, there has been a noticeable increase in open contracts.

For ETH, the situation is even more pronounced, as it has recently broken through the open contract highs of the past year. The increase in contracts indicates that investors are ramping up their use of leverage. Although market activity is increasing, the rise in open contracts often corresponds to a potential increase in volatility.

As more leveraged funds enter the market, the severe liquidations in both bullish and bearish directions will occur more frequently, leading to short-term sharp rises and falls.

From these two sets of data, BTC appears to be more spot-driven, with investors leaning towards long-term holding and stable buying in the spot market, while the leverage aspect remains relatively low, although it has seen some improvement.

In contrast, ETH is primarily driven by funds entering through futures and ETFs, with investors more willing to bet using leverage and derivatives, reflecting short-term speculation and FOMO sentiment.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。