The game has changed in DeFi. The era of fake, inflationary yields is dead, replaced by a new generation of projects that share real revenue with their holders. As detailed in an in-depth research report by CoinLaunch, the projects that survive and thrive are those that operate like real businesses.

The Aerodrome crypto project has been a shining example of this model’s success. However, the same data-driven framework that highlights aerodrome finance crypto’s strengths also reveals potential limitations for new investors. This analysis suggests that a better alternative may be emerging: an under-the-radar token named $GOOD, which appears to offer a more attractive risk/reward profile, especially for those who weren’t early to the $AERO crypto space.

The market has shifted from unsustainable APY promises to real, revenue-based yields.

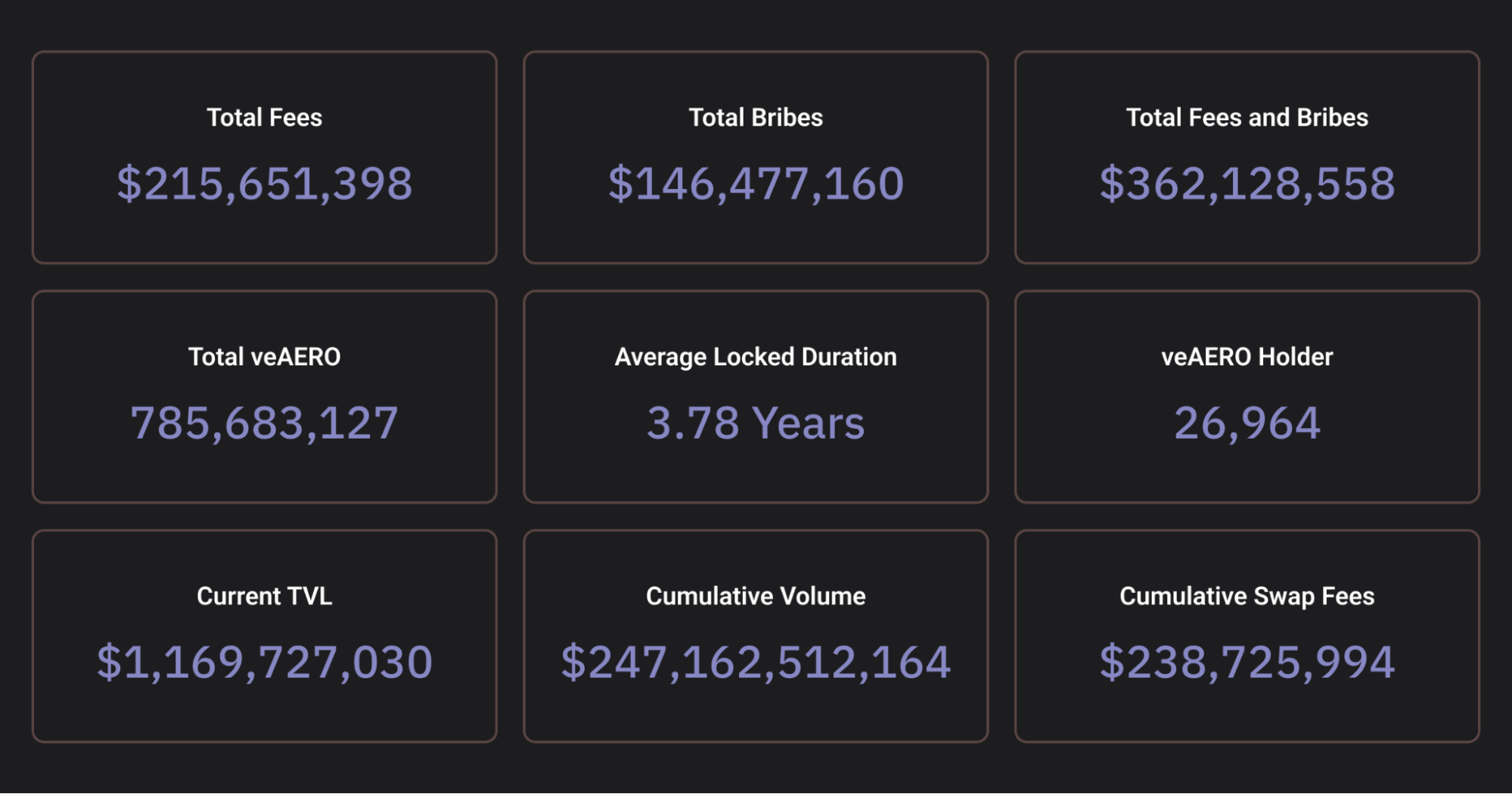

There’s no denying it: Aerodrome has been an absolute monster on the Base network. As the chain’s dominant DEX, it has become a central hub for liquidity and trading activity, distributing hundreds of millions of dollars in revenue to holders year-to-date.

This performance has been a major driver of the AERO crypto price, which currently sits around $0.73 with a market cap of over $630 million and a Fully Diluted Valuation (FDV) of $1.24 billion. On-chain analytics from Dune show its dominance, commanding a 58.5% share of cumulative spot volume on Base, which has a TVL of over $4.1 billion.

On-chain data confirms Aerodrome’s impressive fee distribution to veAERO stakers.

While Aerodrome’s success is undeniable, a deeper analysis using the CoinLaunch research framework reveals a nuanced picture.

AERO’s Strengths:

- Fundamental Growth 🟢: As the top DEX on Base, its growth is directly tied to a thriving ecosystem with over 1 million daily users.

- Value Accrual 🟢: Its model is pure and effective, distributing 100% of trading fees directly to veAERO stakers.

AERO’s Challenges for New Investors:

- Token Growth Upside 🔴: With an FDV of $1.24 billion, the ship has already sailed a long way. The days of 10x or 100x returns are likely over, with price predictions suggesting modest gains.

- Demand on Revenue 🔴: The secret is out. With over 26,920 stakers already locking up ~50% of the total supply, you’re sharing the profits with a huge and growing crowd, which dilutes your individual share.

- Ecosystem Exposure 🟡: Its fate is tied exclusively to the Base ecosystem. On-chain data shows spot trading volume on Base has declined significantly since the start of the year, and it faces brutal competition from Uniswap, which holds a 41.4% market share.

- Staking Risk 🔴: To earn yield, you must lock your $AERO tokens for an average of 3.76 years. That’s a long time to be exposed to market risk without the ability to sell, a common pitfall in locked staking models noted by sources like Kraken.

- APY 🟡: The APY can swing wildly from 0.5% to 52%. Your yield growth depends entirely on the overall market and Base’s popularity, with no major product updates on the horizon.

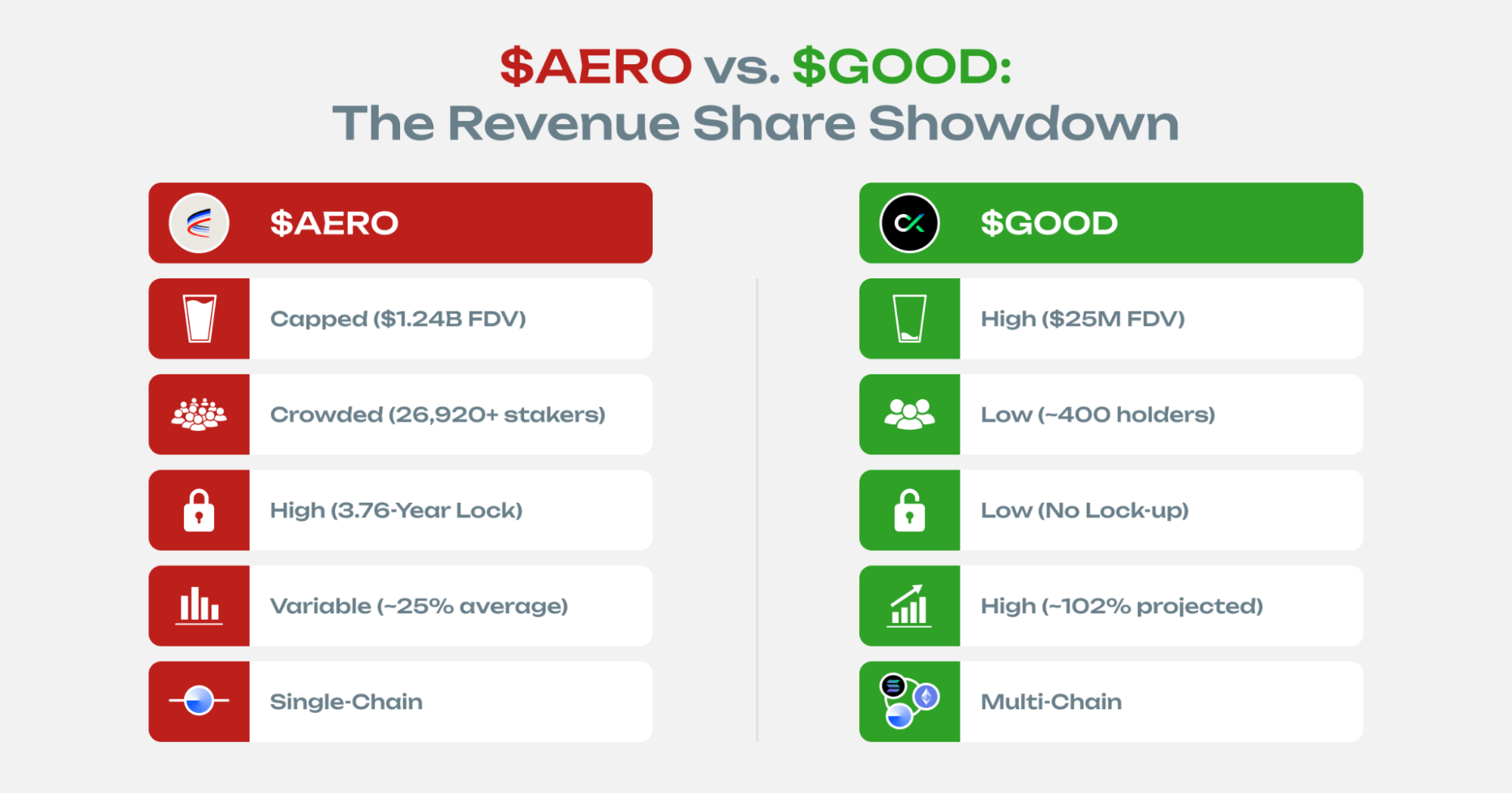

So if aerodrome finance crypto is the established giant with limitations for new growth, where do investors look? The research points to an under-the-radar project called goodcryptoX ($GOOD).

goodcryptoX is a trading platform for both CEXs and DEXs with 400k users and over $5 billion traded through its app. Its breakthrough is bringing CEX-grade algorithmic trading bots (like DCA and Grid) to DEXes across five major chains.

The platform’s 9.3x DEX volume growth from March to July was directly fueled by new product launches. And here’s the real alpha: the biggest growth drivers—the integration with perpetuals DEXs and the launch of its most popular CEX bots—haven’t even happened on DEX yet. The current growth is just the warm-up act.

- Massive 🟢 Token Growth Upside: $GOOD is launching with a tiny initial market cap of $531,250 and an FDV of just $25 million, according to its tokenomics data. Compared to AERO’s $1.24 billion FDV, the room for growth is astronomical.

- Low 🟢 Demand on Revenue (The Alpha): At launch, only ~400 presale investors will be eligible for revenue share. This means a significant investment could potentially claim a large portion of the entire revenue pool. You’re not fighting a crowd.

- Lower 🟢 Risk: There is no mandatory lock-up period. You can earn revenue just by holding $GOOD in your wallet within the app and can stop at any time.

- Multi-Chain 🟢 Advantage: Unlike AERO, goodcryptoX is not dependent on a single chain. It’s available on Solana, Base, ETH, BSC, and more, meaning it wins no matter which ecosystem is hot. This sets it apart from revenue sharing competitors like Aerodrome’s AERO.

- Higher & More Stable 🟢 APY: Based on current DEX volume, the projected APY for $GOOD holders is ~101%. This APY has huge growth potential as the platform rolls out its proven CEX features. Furthermore, if the $GOOD price were to dip, the APY would rise fueling buying pressure, and creating a natural price floor.

| Category | $AERO (Aerodrome Crypto) | $GOOD (goodcryptoX) |

|---|---|---|

| Fundamental Growth | 🟢 Strong (Base ecosystem, $4.1B TVL) | 🟢 Strong (9.3x volume growth to $3.4M in July) |

| Value Accrual | 🟢 High (100% fee share) | 🟢 High (50% revenue + burns) |

| Ecosystem Exposure | 🟡 Medium (Base-dependent, 50% volume decline YTD) | 🟢 High (Multi-chain, no single dependency) |

| Token Growth Upside | 🔴 Limited ($1.24B FDV) | 🟢 Significant ($25M FDV) |

| Demand on Revenue | 🔴 High (26,920 stakers, diluted shares) | 🟢 Low (~400 holders, easy to seize large share) |

| Risk | 🔴 High (3.76-year lock) | 🟢 Low (No lock, non-custodial) |

| APY | 🟡 Variable (20-25% average) | 🟢 High (~101% with growth factors) |

| Competition | 🟡 Stiff (Uniswap 41.4% share) | 🟢 Advantageous (Unique bots vs. rivals) |

The data presents two very different opportunities. The choice isn’t about which project is “good” or “bad,” but which one aligns with a specific investment strategy.

On one hand, Aerodrome ($AERO) stands as an established leader. It’s a proven, high-revenue protocol that has delivered substantial returns. For an investor seeking a relatively stable “blue-chip” position in the Base ecosystem, AERO is a clear contender. However, the data also suggests that its highest growth phase may be in the past.

On the other hand, a project like goodcryptoX ($GOOD) represents an early-stage, high-growth alternative. The analysis shows it scores highly on metrics that are critical for future upside: a very low valuation, a small pool of initial holders, a multi-chain strategy that reduces risk, and a higher, more predictable APY. While it carries the inherent risks of any new project, it also offers the asymmetric return potential that is no longer present with a mature asset like AERO.

A side-by-side data comparison reveals the different risk and reward profiles of $AERO and $GOOD.

Ultimately, the underlying data suggests that while aerodrome crypto news will likely continue to be positive, investors looking for the next big opportunity in revenue sharing may find a more compelling case in emerging projects like $GOOD, which exhibit more favorable early-stage dynamics.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。