From Premium to Discount: Saylor's Financial Alchemy Approaches Its End

Author: Joseph Ayoub, Former Head of Crypto Research at Citigroup

Translation: Deep Tide TechFlow

Abstract: From premium to discount, Saylor's financial alchemy approaches its end.

Introduction

The last time cryptocurrency experienced a "traditional" bubble was in the fourth quarter of 2017, when the market saw astonishing double-digit and even triple-digit percentage daily gains. Exchanges were overwhelmed by surging demand, new participants flocked in, speculative ICOs (Initial Coin Offerings) emerged one after another, trading volumes hit historic highs, and the market welcomed a new paradigm, new heights, and even a first-class luxurious experience. This was the last mainstream, traditional retail bubble in the cryptocurrency space, nine years after the birth of the first "trustless" peer-to-peer currency.

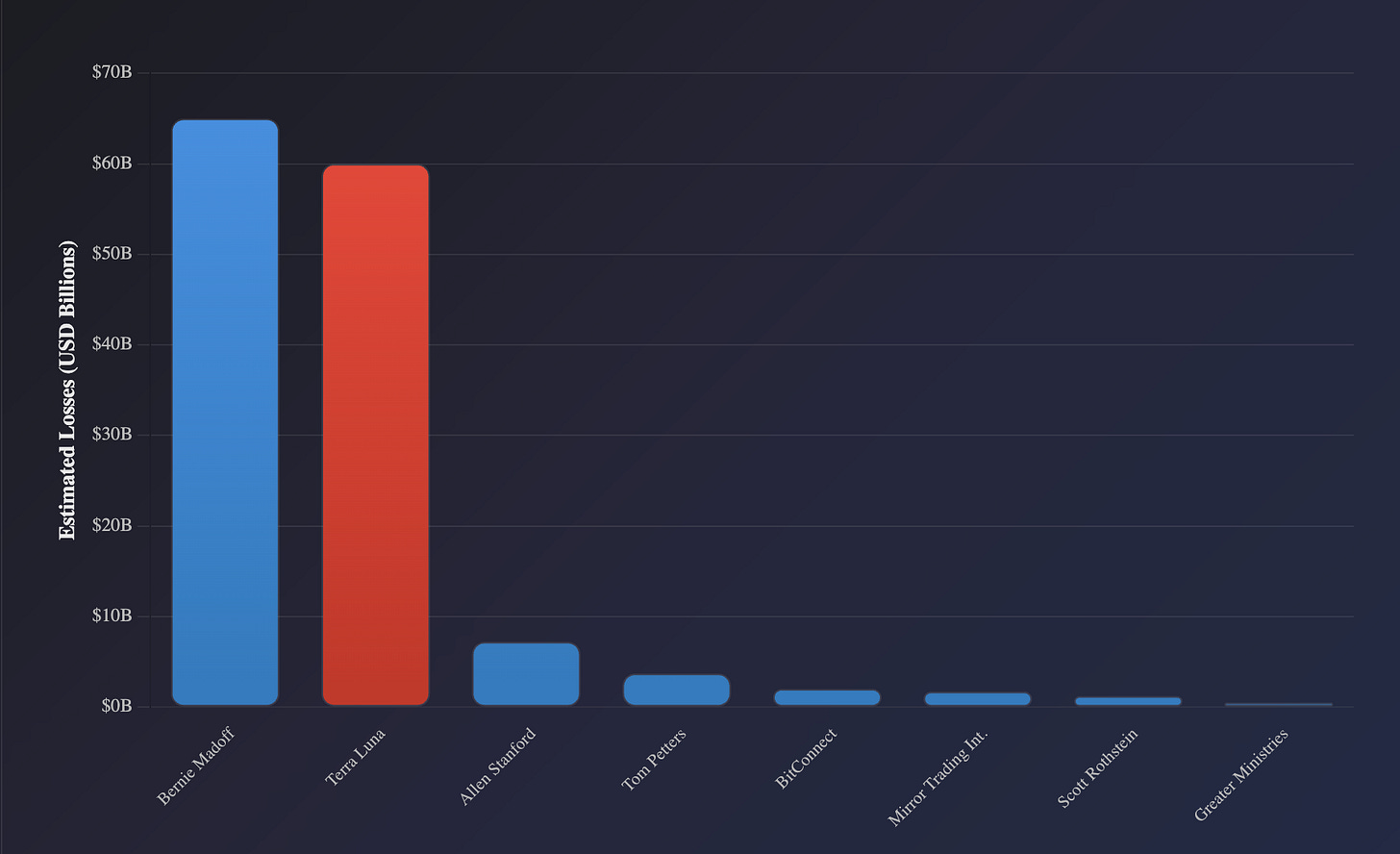

Fast forward four years, cryptocurrency has entered its second major bubble, this time larger and more complex, incorporating new paradigms like algorithmic stablecoins (such as Luna and Terra), along with some "rehypothecation" crimes (like FTX and Alameda). This so-called "innovation" is so complex that few truly understand how the largest Ponzi schemes among them operate. However, as with every new paradigm, participants firmly believe this is a new form of financial engineering, a new model of innovation, and if you don't understand it, no one has the time to explain it to you.

The Collapse of the Largest Retail Ponzi Scheme

The Era of DAT (2020-2025)

At the time, we did not realize that Michael Saylor's MicroStrategy, founded in 2020, would become the seed for institutional-level funds to reposition in Bitcoin, all starting with Bitcoin's dramatic crash in 2022 [1]. By 2025, Saylor's "financial alchemy" has become the core driving force behind today's marginal buyer demand for cryptocurrency. Similar to 2021, very few truly understand the mechanisms of this new paradigm of financial engineering. Nevertheless, those who have experienced the "dangerous atmosphere" of the past are gradually becoming more alert; however, the occurrence of this phenomenon and its secondary effects are precisely what distinguishes "knowing there might be a problem" from "profiting from it."

A New Paradigm of Financial Wisdom..?

What is the Basic Definition of DAT?

Digital Asset Treasuries (DATs) are a relatively simple tool. They are traditional equity companies whose sole purpose is to purchase digital assets. New DATs typically operate by raising funds from investors, selling company shares, and using the proceeds to buy digital assets. In some cases, they continue to sell equity, diluting existing shareholders' interests to raise more funds for purchasing digital assets.

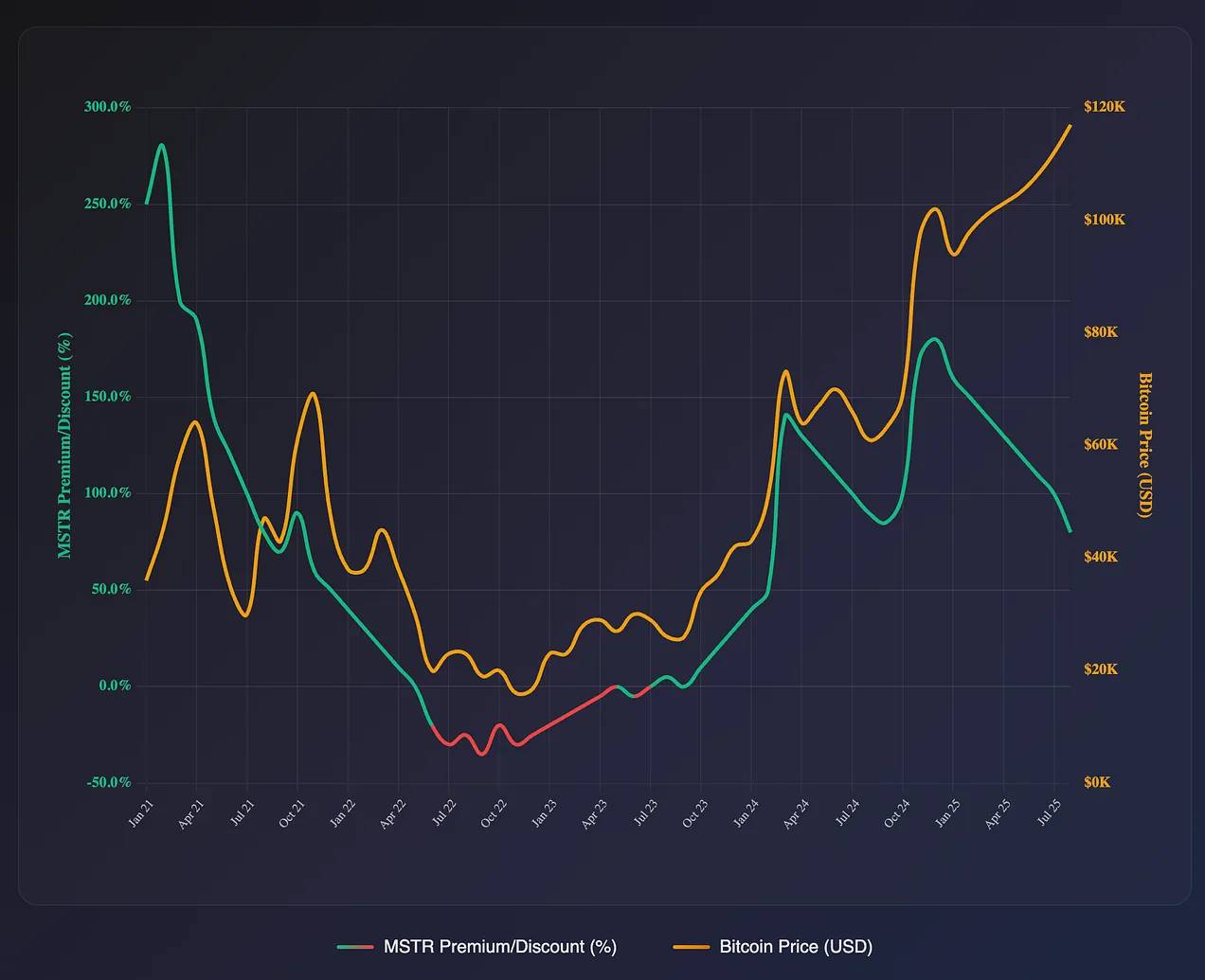

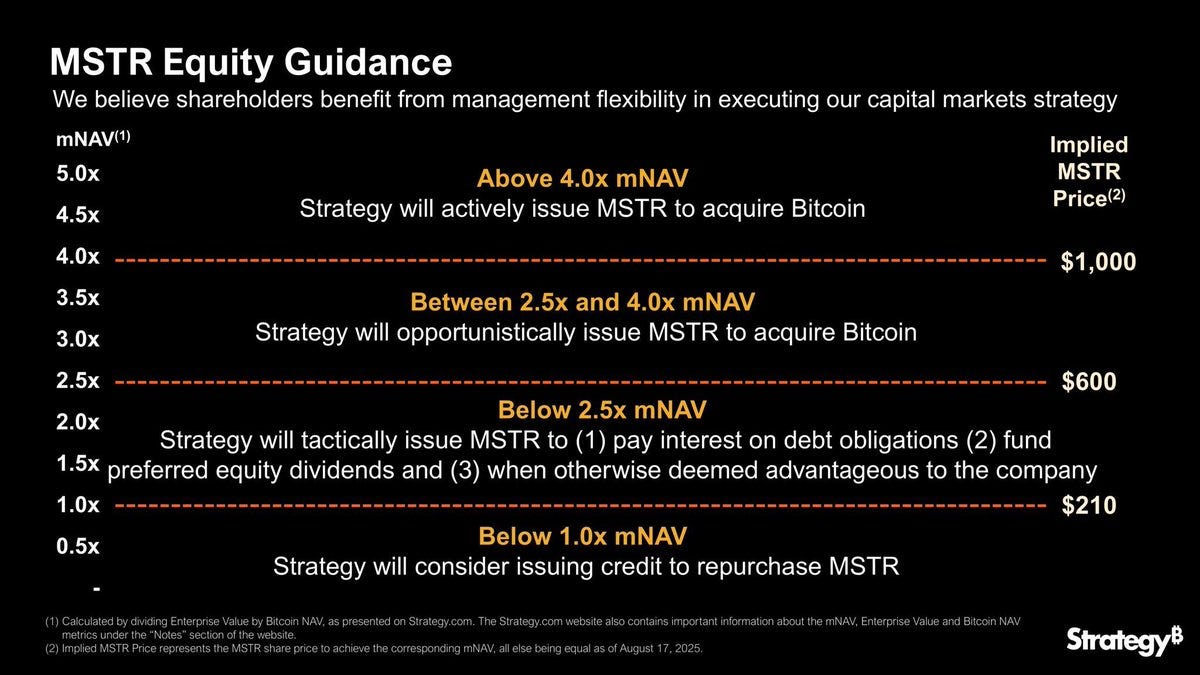

The calculation of a DAT's net asset value (NAV) is very straightforward: assets minus liabilities, divided by the number of shares. However, what is traded in the market is not the NAV, but the mNAV, which is the market's valuation of these shares relative to their underlying assets. If investors pay $2 for every $1 of Bitcoin exposure, that is a 100% premium. This is the so-called "alchemy": in a premium situation, the company can issue shares and purchase BTC at an appreciated value; in a discount situation, the logic reverses—buybacks or pressure from aggressive investors dominate.

The core of this "alchemy" lies in the fact that these are new products, characterized by:

A) Excitement (SBET skyrocketed 2,000% within a trading day)

B) High volatility

C) Viewed as a new paradigm of financial engineering

Reflexive Flywheel Mechanism

Thus, with this "alchemy," Saylor's MicroStrategy has been trading at a premium above its net asset value for the past two years, allowing Saylor to issue shares and buy more Bitcoin without significantly diluting shareholder equity or affecting the stock price premium. In this case, this mechanism is also highly reflexive:

MicroStrategy's acquisitions can be more aggressive during premium periods. In contrast, during discount periods, debt and convertible bonds become the main drivers.

_mNAV premium allows Saylor —> to issue stock —> to buy BTC —> BTC price rises → increases its NAV and stock price —> attracts more investment at a stable premium —> further financing and more purchases. _[2]

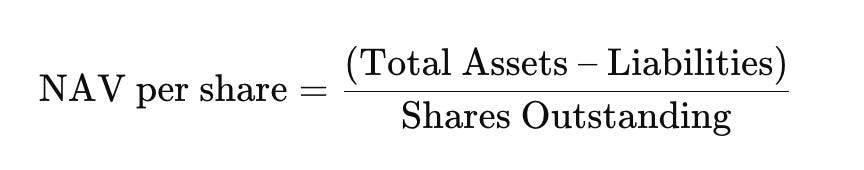

However, a phenomenon has emerged: a strong correlation between discount and Bitcoin price seems to have diverged; this may be a result of other DATs launching in the market. However, this could mark a critical turning point, as MicroStrategy's ability to maintain this flywheel mechanism through financing has weakened, and its premium has significantly decreased. This trend is worth close attention; in my view, this premium is unlikely to return significantly.

Comparison of MSTR Premium/Discount with Bitcoin Price

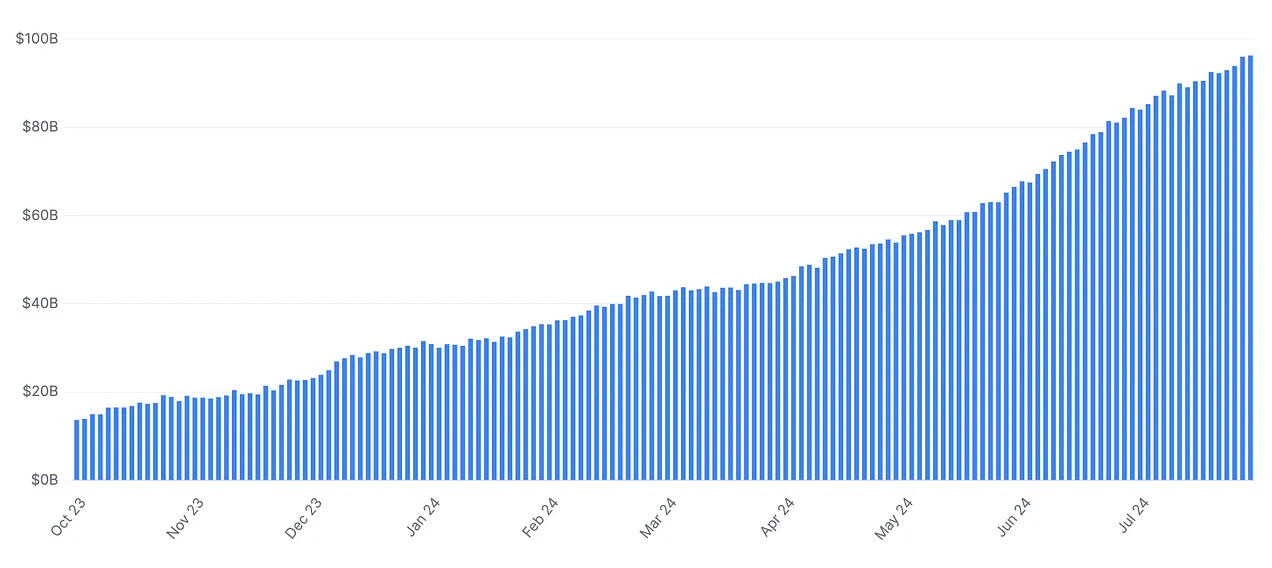

Undoubtedly, as the net asset value of DATs has grown from $10 billion in 2020 to over $100 billion today, this tool has provided significant liquidity to the market, comparable to the total of all Bitcoin ETFs at $150 billion. Under positive risk conditions, including Bitcoin, this mechanism has also injected a highly reflexive price mechanism into the underlying assets [3].

Total Net Asset Value of Cryptocurrency Treasury Companies

Why It Will Collapse

I believe the development path of this matter is not complex; for me, there are only three paths and one logical conclusion:

DAT continues to trade at a premium above mNAV, the flywheel mechanism continues to operate, and insatiable demand drives cryptocurrency prices further up. This is a new paradigm driven by financial alchemy.

DAT begins to trade at a discount, leading the market to gradually unwind until forced liquidations and bankruptcy protection occur (Note: a chapter of U.S. bankruptcy law that provides a mechanism for bankruptcy protection), ultimately collapsing completely.

DAT begins to trade at a discount, being forced to sell underlying assets to repurchase shares, repay debts, and cover operating costs. This unwinding process becomes recursive until these DATs shrink in scale, ultimately becoming "zombie companies."

I believe the likelihood of DAT continuing to trade at a premium is extremely low; in my view, this premium is a result of risk assets benefiting from loose liquidity conditions, which have also allowed Nasdaq index stocks and overall stock prices to perform well. However, when liquidity conditions tightened in 2022/2023, it was evident that MSTR was not trading at a premium and even experienced discount trading in the short term. This is the first area where I believe there is mispricing—DAT companies should not exist at a premium; in fact, these companies should trade at a deep discount well below NAV.

The root cause is that the implied equity value of these companies depends on their ability to create value for shareholders; traditional companies achieve this through dividends, stock buybacks, acquisitions, business expansion, etc. However, DATs lack such capabilities; their only ability is to issue stock, issue debt, or engage in some minor financial maneuvers like pledging, but these have virtually no significant impact. So what value is there in holding shares of these companies? Theoretically, the value of these DATs lies in their ability to return their net asset value to shareholders; otherwise, their equity value is not very meaningful. However, given that these tools have failed to realize this potential, and some companies even promise never to sell their underlying assets, in this case, the value of these stocks depends solely on the price the market is willing to pay for them.

Ultimately, equity value now depends on:

The likelihood of future buyers creating a premium (based on DAT's ability to continue raising funds at a premium).

The price of the underlying assets and the liquidity of the market to absorb sales.

The implied probability that shares can be redeemed at net asset value.

If DAT can return capital to shareholders, it would be similar to an ETF. However, given that they cannot achieve this, I believe they are closer to closed-end funds. Why? Because they are a tool for holding underlying assets but lack any mechanism to distribute the value of these assets to investors. For those with good memories, this clearly reminds me of GBTC and ETHE, which experienced similar situations during the significant unwinding process in 2022, when the premiums of closed-end funds rapidly turned into discounts [4].

This unwinding is essentially priced based on the implied probability of liquidity and future conversion possibilities. Given that both GBTC and DAT cannot achieve redemption, during times of ample liquidity and strong demand, the market prices at a premium, but when the price of the underlying assets falls and begins to contract, this discount becomes very apparent, with the trust's discount even reaching 50% of NAV. Ultimately, this "discount" to NAV reflects the price investors are willing to pay for an asset that cannot logically or foreseeably distribute NAV value to trust holders; thus, pricing is based on its future potential to achieve this goal and the demand for liquidity.

Market confidence and liquidity tightening, Grayscale Bitcoin Trust market premium gradually collapses

Debt and Subordinate Risks

Similarly, apart from capital return, there are only two ways for DAT to create value for shareholders: through financial management (such as staking) or through borrowing. If we see DAT starting to borrow on a large scale, it will be a signal that a significant unwinding may be imminent, although I believe the likelihood of borrowing is low. In either case, these two methods of creating value are far from comparable to the equity value of the assets held by the company, which inevitably brings to mind GBTC. If this analysis holds, investors will eventually realize this, and the confidence bubble will be burst, leading to a transition from premium to discount, potentially triggering the sale of underlying assets.

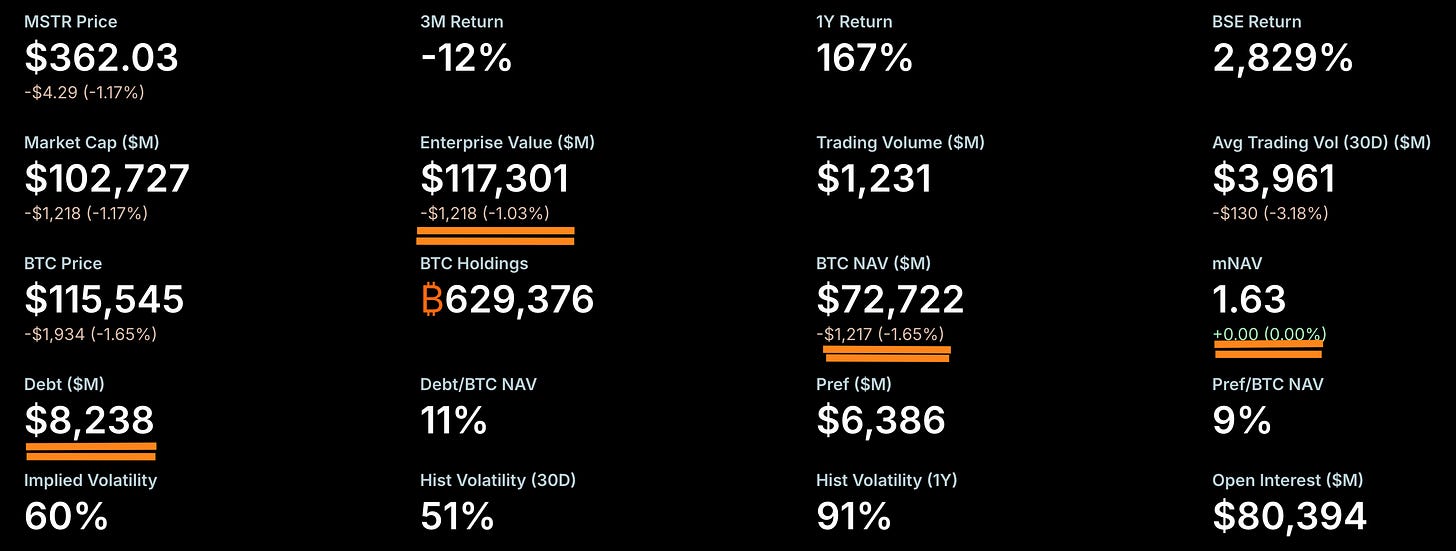

Currently, I believe the likelihood of forced liquidation or bankruptcy protection due to leverage or debt liquidation is also very low. This is because the current level of debt is not sufficient to pose a problem for MicroStrategy or other DATs, considering that these trusts are more inclined to finance through equity issuance. Taking MicroStrategy as an example, its debt is $8.2 billion, holding 630,000 Bitcoins, and the price of Bitcoin would need to fall below $13,000 for the debt to exceed the assets, which I believe is extremely unlikely [5]. BMNR and other Ethereum-related DATs have almost no leverage, so forced liquidation is also unlikely to become a major risk. In contrast, other DATs, apart from MSTR, are more likely to gradually liquidate through aggressive acquisitions or shareholder votes, returning capital to shareholders. All acquired Bitcoins and Ethereum may directly return to the market for re-circulation.

Saylor's Choices

Although Saylor holds only about 20% of MicroStrategy's equity, he possesses over 50% of the voting rights. Therefore, it is almost impossible for activist funds or investor coalitions to force a sale of shares. The potential consequence of this situation is that if MSTR begins to trade at a significant discount, and investors cannot force a buyback of shares, there may be investor lawsuits or regulatory scrutiny, which could further negatively impact the stock price.

Debt remains well below net asset value, mNAV is still at a premium.

Overall, my concern is that the market may reach a saturation point, at which point additional DATs will no longer impact prices, thereby enhancing the reflexivity of these mechanisms. When the market supply is sufficient to absorb artificially created and immature DAT demand, the unwinding process will begin. In my view, such a future may not be far off. It seems to be just around the corner.

Nevertheless, Saylor's "debt" theory is greatly exaggerated. His current shareholding is not significant enough to pose a problem in the short term. In my view, his convertible bonds will ultimately have to be redeemed at face value in cash, because if the adjusted net asset value (mNAV) turns to a discount, his equity may drop significantly.

A key point to focus on is whether Saylor will issue more debt to repurchase shares when the adjusted net asset value falls below 1. I believe the likelihood of this method solving the mNAV issue is very low, as once investor confidence is damaged, it is difficult to restore. Therefore, continuously issuing debt to cover the mNAV issue may be a risky path. Additionally, if mNAV continues to decline, MSTR's ability to issue more debt to cover its obligations will become increasingly difficult, further affecting its credit rating and investor demand for its products. In this scenario, issuing more debt may trigger a reflexive downward spiral:

mNAV declines → Investor confidence declines → Saylor issues debt to repurchase shares → Investor confidence remains low → mNAV continues to decline → Pressure increases → More debt issuance (debt must reach significant leverage levels in the short term to pose danger).

Saylor considers share repurchase through debt issuance—a potentially dangerous path

Regulation and Historical Precedents

In the current situation, two more likely scenarios could occur:

MicroStrategy faces a collective lawsuit from investors demanding the return of shareholder capital to net asset value;

Regulatory scrutiny. The first of these two situations is relatively intuitive and may occur at a significant discount (below 0.7 times mNAV). The second situation is more complex and has historical precedents.

History shows that when a company superficially masquerades as an operating business but actually acts as an investment vehicle, regulators may intervene. For example, in the 1940s, Tonopah Mining Company was ruled to be an investment company due to its primary holdings in securities [6]. In 2021, GBTC and ETHE traded at extremely high premiums but subsequently collapsed to a 50% discount. When investors were profiting, regulators chose to look the other way, but when retail investors fell into losses, the narrative shifted, ultimately forcing a conversion to an ETF.

MicroStrategy's situation is similar. While it still claims to be a software company, 99% of its value comes from Bitcoin. In reality, its equity acts as an unregistered closed-end fund, with no redemption mechanism. This distinction can only be maintained when the market is strong.

If DAT continues to trade at a discount, regulators may reclassify it as an investment company, restricting leverage, imposing fiduciary duties, or enforcing redemptions. They may even completely shut down the equity issuance "flywheel" model. What was once viewed as financial alchemy during premium times may be defined as predatory behavior during discount times. This may be Saylor's true vulnerability.

What Are the Headlines?

I have hinted at possible scenarios, and now I will make some direct predictions:

More DATs will continue to launch targeting higher-risk, more speculative assets, signaling that the liquidity cycle is about to peak.

- Pepe, Bonk, Fartcoin, and others

Competition among DATs will dilute and saturate the market, leading to a significant decline in mNAV premiums.

The valuation dynamics of DATs will gradually approach those of closed-end funds

This trend can be captured through trades that "short equity/long underlying assets" to exploit mNAV premiums

- Such trades will come with funding costs and execution risks. Additionally, using OTM (out-of-the-money) options is a simpler way to express this.

Within the next 12 months, most DATs will trade at a discount below mNAV, marking a key point for the cryptocurrency market's price turning bearish.

- Stock issuance will stop. Without new capital inflows, these companies will become "zombie companies" with static balance sheets. No growth flywheel → No new buyers → Discount continues.

MicroStrategy may face a collective lawsuit from investors or regulatory scrutiny, which could call into question its commitment to "never sell Bitcoin."

- This marks the beginning of the end.

As prices exert reflexive effects on underlying assets during the downturn, positive evaluations of financial engineering and "alchemy" will quickly turn negative.

- Perceptions of Saylor, Tom Lee, and others will shift from "genius" to "fraud."

Some DATs may use debt instruments during the market unwinding process, either for share repurchases or for purchasing more assets → This is a signal of impending collapse.

- The relevant trading strategy is to leverage debt and increase short premium positions.

An activist fund may acquire shares of a DAT at a discount and pressure or force its liquidation and asset distribution.

- At least one activist fund (such as Elliott and Fir Tree) will buy DAT positions at a significant discount, inciting liquidation and forcing BTC/ETH to be returned to shareholders. This will set a precedent.

Regulatory intervention:

- The SEC may enforce disclosure rules or investor protection measures. Historically, persistently discounted closed-end funds have prompted regulatory reform.

Sources

[1] MicroStrategy Press Release

[2] MicroStrategy SEC 10-K (2023)

[3] Bloomberg – “Crypto Treasury Companies Now Control $100bn in Digital Assets”

[4] Financial Times – “Grayscale Bitcoin Trust Slides to 50% Discount” (Dec 2022).

[5] MicroStrategy Q2 2025 10-Q filing.

[6] SEC v. Tonopah Mining Co. (1940s ruling on investment company status).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。