This is not just a convenience; it is a symbol of the times—a digital revolution belonging to Southeast Asia is quietly taking place.

The Southeast Asian region has a population of over 600 million, with a young demographic, widespread smartphone usage, and a high level of internet consumption accessibility. It boasts a large population of internet consumers, while traditional banking services are insufficiently covered, creating an urgent need for new payment alternatives. This makes it one of the most promising digital payment markets globally. At this moment, cryptocurrency services provide significant convenience to these regions.

Singapore's "licensing system," Vietnam's "gray area," and the Philippines' sandbox, along with their promotion or restriction of development, have not hindered Southeast Asian users from adopting cryptocurrency payments. Looking at the Southeast Asian crypto blitz, its trading volume has surpassed that of Europe and the United States, and the next digital gold mine has emerged.

Cryptocurrency QR Code Payments: Disrupting Traditional Payments

If traditional payment methods involve complex bank transfers, then cryptocurrency QR code payments make transactions as simple as breathing. In Southeast Asia, young consumers are using their smartphones to scan QR codes for payments, whether buying a cup of coffee or purchasing cross-border goods. This method is gradually replacing cash and bank cards.

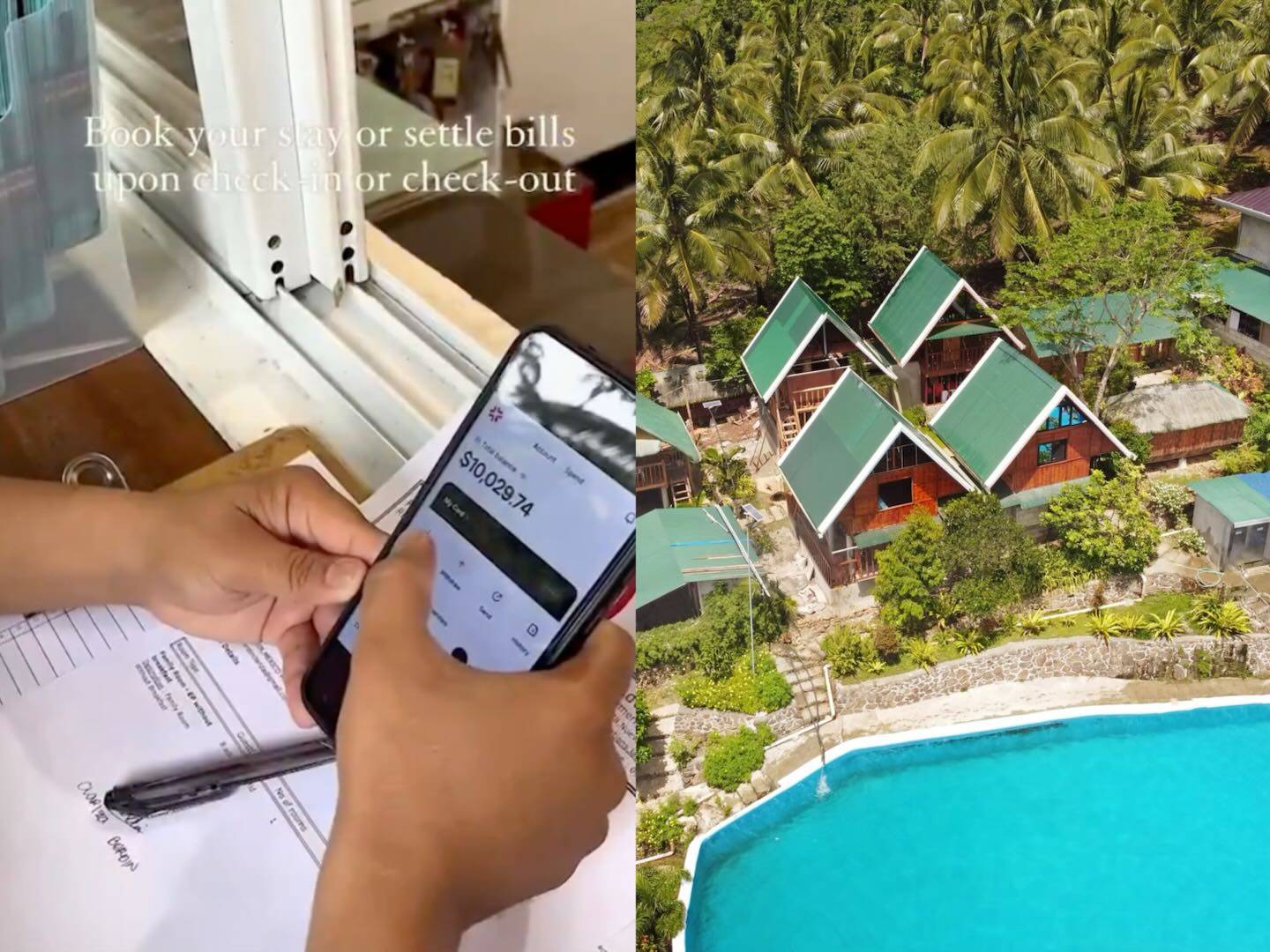

This change is not just a technological advancement; it is a cultural transformation. The widespread acceptance of cryptocurrency QR code payments reflects Southeast Asia's embrace of a digital lifestyle. For example, in the Philippines, visitors at La Vie Adventure Trails resort can use TabiPay to pay directly with cryptocurrency, eliminating the need for complicated currency exchanges and transaction fees. This experience not only simplifies payments but also allows merchants to better serve global consumers. The resort has also launched video tutorials on digital currency payments, using TabiPay as a case study.

La Vie Adventure Trails is an iconic destination in the Philippines' cultural tourism industry, attracting over 40% of its overseas visitors due to its unique natural resources and cultural experiences, including distinctive Filipino-style accommodations and cuisine. Some of these visitors are selecting souvenirs in gift shops, while others are ordering coconut juice in restaurants, and the payment process is remarkably simple—they just open their phones and complete the transaction through TabiPay. No cash is needed, and there’s no worry about the complexities of currency exchange; this convenient experience makes their journey easier and significantly enhances the resort's operational efficiency.

Recently, the resort announced a partnership with Tabichain to fully integrate the TabiPay payment solution. This decision not only responds to the payment needs of visitors but also explores the digital transformation of the Philippine tourism industry.

"We want visitors to enjoy their travels more and not waste time on currency exchanges and payment processes," said the resort's management. "TabiPay makes payments simple while reducing our operational costs. It is not just a technological tool; it is a way to enhance service quality."

For developing countries like the Philippines, the application of blockchain technology has even deeper significance. It not only optimizes payment processes but also offers potential solutions to the problem of inadequate financial services. Through TabiPay, transactions between tourists and merchants become more transparent and efficient, and the successful application of this technology provides a reference for other industries.

Bangladesh: How Payment Method Reforms Integrate into Every Corner of Urban Life

Customers of Bangladesh's Aspire Developers & Properties Ltd. are also enjoying the convenience brought by cryptocurrency payments. The company is known for developing landmark high-end residential properties and resorts in Bangladesh. Its major shareholder, Sunny, publicly stated on X that consumers can directly use cryptocurrency to purchase properties through TabiPay's offline payment gateway, without worrying about exchange rate fluctuations or bank processing times. This innovative payment method is quietly transforming the business ecosystem in Southeast Asia, making transactions more efficient and transparent. This move is not only a technological attempt but also a response to changing consumer payment habits.

Bangladesh's urbanization process is accelerating, and young people's acceptance of digital payments is continuously increasing. People are no longer satisfied with the cumbersome processes of traditional banking systems; they want to complete property transactions as simply as buying a hot fried cake on the street. TabiPay provides Aspire's customers with options for cryptocurrency and fiat payments through its offline payment gateway and global card system. Consumers can complete transactions in just a few steps, without worrying about exchange rates or waiting for bank processing.

"Our customers are increasingly inclined to use Visa and Mastercard for payments, but centralized payment systems can sometimes bring unnecessary troubles," said Aspire's management. "The introduction of TabiPay allows us to offer more choices, including cryptocurrency payment cards, which is particularly important for young consumers."

This collaboration is not just a business decision for a real estate company; it is a microcosm of the payment method reforms in Bangladesh. It demonstrates how blockchain technology can fundamentally change transaction processes, making digital payments not just exclusive to the high-tech field but a part of everyday life for ordinary people.

How Cryptocurrency Payments Are Transforming Daily Life in Southeast Asia: From Buying Durian to Cross-Border Remittances, A Silent Digital Revolution

On the streets of Southeast Asia, the owner of Durianss2 durian stall skillfully peels open the golden flesh, releasing a fragrant aroma that attracts passersby. Customers pull out their phones, scan a QR code, and complete their payments. This scene may seem ordinary, but it quietly showcases the economic transformation in Southeast Asia—from cash to digital payments, from traditional to innovative, with blockchain technology and cryptocurrency payments becoming the driving forces behind this change.

The owner notes that foreign tourists make up more than half of the total customer base, and he has observed that many use digital currency for payments while traveling. Some of these users are utilizing TabiPay for QR code payments with digital currency. Among these tourists are many travel bloggers and content creators. Digital currency payments make it convenient for tourists to pay in different countries without needing to go to a bank for currency exchange; they can simply scan the local international payment code to use stablecoins to pay for durians.

Southeast Asia has the world's youngest consumer demographic and rapidly expanding internet services. From street vendors to cross-border trade, from cultural tourism to real estate investment, changes in payment methods are not only impacting the economy but also altering people's daily lives. The blockchain payment platform TabiPay is injecting new possibilities into Southeast Asia's future through technological innovation and collaboration.

How cryptocurrency payments are changing daily life in Southeast Asia, the digital payment ecosystem in the region is rapidly developing.

Statistics show that over 140 million people are using digital payment services, and blockchain technology is injecting new momentum into this trend. From real estate in Bangladesh to the tourism industry in the Philippines, TabiPay's application cases demonstrate how cryptocurrency payments are transitioning from technological innovation to everyday life.

This is not just a technological revolution; it is a cultural shift. It makes payments feel as natural as breathing, transforming transactions from a burden into an experience. From buying durians on the street to cross-border remittances, cryptocurrency payments are changing the lifestyles of people in Southeast Asia while providing important insights for the future of the global digital economy.

Perhaps next time, when you buy durians in a market in Southeast Asia, you will find that you no longer need cash but can complete the transaction through blockchain payments. This is not just a convenience; it is a symbol of the times—a digital revolution belonging to Southeast Asia is quietly taking place.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。