Question: With a $500 million market liquidation, where are BTC and ETH headed?

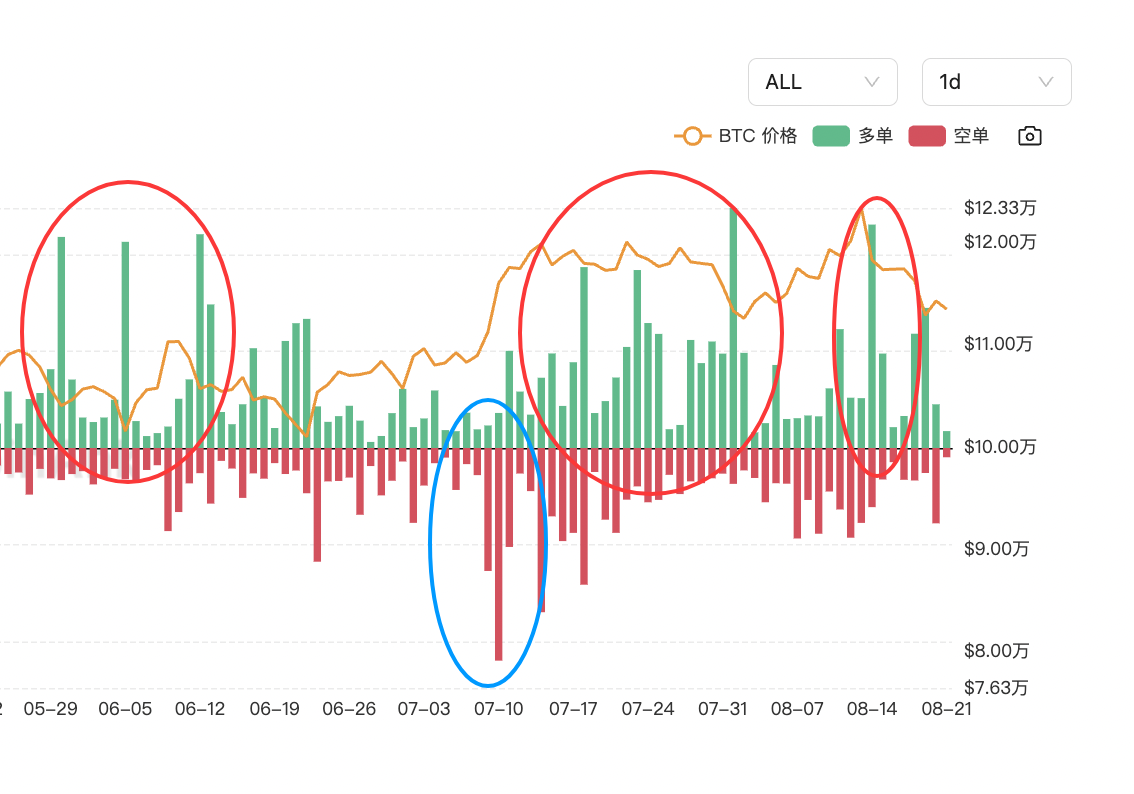

This question mentions a liquidation scale of $500 million, which is the data on liquidations within 24 hours after Bitcoin peaked and then sharply declined on August 14. I checked some tool applications, and different tools may show slightly different figures; the mainstream data is $584 million. A scale of over $500 million is relatively large, but a similar occurrence happened during the significant drop on August 1. In more recent times, similar scales of liquidation were seen on July 23 and July 18, and such events actually occur several times each month.

Additionally, considering that we have seen contract positions reaching historical highs daily, often around $70-80 billion, this liquidation volume is not particularly large. I personally estimate that it is more likely to be high-leverage players who chased the market at the top that got liquidated.

In this liquidation, ETH long positions accounted for nearly 50%, which is quite rare. This is also a normal clearing after excessive leverage, not indicative of a systemic risk outbreak. Historically, after similar liquidation events, the market has typically recovered its losses within 13 weeks. As I mentioned earlier, there are always a few days each month like this; I used to jokingly refer to it as "Aunt Flo's market."

Regarding liquidations, I won't digress too much; let's focus on the analysis of BTC and ETH's trends. Of course, this is just my personal opinion and is for reference only. I believe the market was too crazy recently, and this round is just a normal adjustment. The market is under short-term pressure, but there is considerable support below. BTC may continue to pull back and then consolidate at the bottom, while ETH's pullback space will depend on whether institutions continue to hype the narrative of accumulating and strategically reserving Ethereum, as well as whether staked Ethereum will continue to exit and the scale of that exit.

Let's also discuss the technical aspect. BTC has a potential "double top" pattern, or a daily 2B top, and this round of market has broken the upward trend line since the April low of $75,000. If this 2B top is confirmed and effectively breaks below $111,850, it could potentially drop by an equal amplitude of that height. Roughly calculating, that would mean a drop of $12,624 from $111,850, bringing it down to $99,226, considering the price differences between different platforms and spot contracts, it would be in the range of $99,000 to $100,000. This would represent a pullback of about 20%, which is not large compared to the previous pullbacks of around 32-33% during this bull market. If we also reference the maximum pullback of 33.58% since the end of 2022 in this bull market, the current pullback could potentially drop to around $82,850.

However, we must also consider the possibility of the bull market ending, which could lead to a larger potential drop. For example, looking at previous bear markets, the drop after the peak in 2021 was 77.42%; the drop after the peak in 2019 was around 73%; and the drop after the peak in 2017 was about 84%. If we calculate based on these figures, it could ultimately drop to $33,500 or even $20,000 in the long term, which may be far below the current mining costs. At an electricity price of $0.05, the mining cost for mainstream mining machines is around $40,000 to $60,000, which is also a very strong support level. Currently, the coin price is still at $110,000 to $120,000, at historical highs. My long-term view may sound alarming, and this is not a process that happens overnight, so I won't elaborate further. Additionally, the current ETF and institutional narratives provide much stronger support than in previous bull markets, with the maximum pullback during this period being only around 33.58%, so there is no need to worry excessively for now.

Of course, if $111,850 can hold and does not form a daily top pattern, it may continue to maintain a high-level consolidation in the short to medium term. Even if it breaks below, $100,000 is a key psychological level, and $90,000 has strong support, making the probability of a mid-term break lower.

On the macro front, BTC is increasingly "becoming like U.S. stocks." The expectation of interest rate cuts by the Federal Reserve and the inflow of institutional ETF funds create a "supply-demand imbalance," which can also hedge against short-term selling pressure. However, if the U.S. stock market peaks in this phase, Bitcoin may also be affected and decline alongside it.

Additionally, ETH has a foundation for an independent market this round. Despite the large liquidation scale, the narrative of institutional accumulation and strategic reserve plans for ETH has led to a pullback that is significantly lower than historical levels. Using Bitcoin as a reference, BTC has pulled back about 10% this round, while ETH, including yesterday's rebound, has also only pulled back about 10%. In the past, a 10% pullback in BTC could have meant a pullback of over 20% for ETH.

Therefore, in the short to medium term, the market is in a healthy adjustment cycle. There is no need to worry too much for the mid-term unless there are significant pattern breaks or changes in the macro environment.

Now let's look at this question: Why is ETH performing strongly during the market pullback? Is it a fleeting moment or does it have unlimited potential?

I have taken too long earlier, so let's briefly discuss why ETH rebounded strongly after the pullback. If we pay attention to news and data daily, we can easily find the answer.

For example, the ETH holdings of 69 Ethereum treasury companies have surpassed 4 million coins, with the top three companies holding over $10 billion in ETH. These institutions' strategic reserve plans are unlikely to sell in the short term, continuously providing momentum for ETH.

For instance, ETF fund data shows that in September, the proportion of Ethereum ETF holdings will exceed that of Bitcoin ETF. Recently, the inflow of spot Ethereum ETF funds has been strong, with a net increase of $3.1 billion over seven days, accounting for 10% of its historical total inflow, highlighting the increased market enthusiasm. Additionally, ETH has attracted $2.3 billion recently, pushing the total inflow this year to over $10.5 billion.

On-chain data shows that U.S. spot Ethereum ETFs hold 6.3 million ETH, valued at approximately $26.7 billion, accounting for 5.1% of Ethereum's current total supply.

Moreover, regarding the ratio of Ethereum to Bitcoin, I don't know if everyone usually pays attention to the exchange rate between the two. The ETH/BTC ratio has now reached a new high since the end of 2024. I used to frequently monitor the exchange rate between the two; since the peak of the bull market at the end of 2021, ETH has been in a downtrend relative to BTC. However, starting from April this year, the exchange rate has rebounded significantly from a low of 0.001766, with a magnitude and duration of rebound that have not been seen before. This is also the most intuitive indicator of the strength of the two, following the Matthew effect where the strong get stronger. Therefore, after this round of decline, ETH's rebound has also been quite strong.

By the way, I saw a few days ago that the scale of staked ETH waiting to exit is decreasing, which also alleviates the potential increase in market circulation and selling pressure. Additionally, the institutional holdings from ETFs have led to an annualized deflation rate of over 3% for ETH, combined with the on-chain burning mechanism, resulting in a continuous contraction of actual circulation, forming rigid price support. The issuance of stablecoins is 60% based on the ETH chain, with daily settlement volume exceeding that of Bitcoin by three times, supporting the coin price with real demand.

The Ethereum Foundation has recently been active in technical iterations, and Vitalik Buterin's recent influence, along with the U.S. government's recent favorable stance on Ethereum regulation, has all contributed to the strong performance of ETH this round. Therefore, I am very optimistic about Ethereum's potential in the future.

Alright, let's stop here for today. Thank you, everyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。