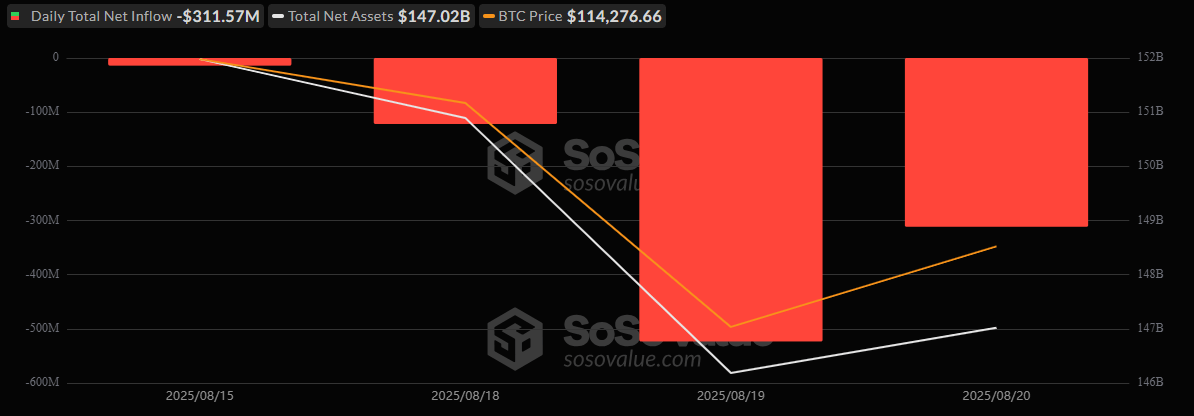

Bitcoin ETFs See $312 Million Exit, Ether Funds Lose $240 Million in Relentless Selloff

The selloff in crypto exchange-traded funds (ETFs) is showing no signs of slowing. For the fourth day in a row, both bitcoin and ether funds bled capital, with a combined $552 million flowing out on Wednesday, Aug. 20, alone. Investors, spooked by macro headwinds and risk-off sentiment, are now driving one of the heaviest weekly ETF outflow streaks in months.

Bitcoin ETFs recorded $311.57 million in net outflows. Institutional favorite, Blackrock’s IBIT was hit hardest, losing $220 million in a single session. Ark 21Shares’ ARKB followed with a $75.74 million exit, while Grayscale’s GBTC and Fidelity’s FBTC shed $8.98 million and $7.46 million, respectively.

Only Bitwise’s BITB managed to post a marginal inflow of $619.81K, barely denting the sea of red. Trading remained active at $3.44 billion, but net assets steadied at $147.02 billion.

Source: Sosovalue

Ether ETFs were not spared. They logged $240.14 million in outflows, led by a massive $257.78 million loss on Blackrock’s ETHA. Some relief came from inflows into Grayscale’s Ether Mini Trust (+$9 million) and Fidelity’s FETH (+$8.64 million), but it wasn’t enough to offset the damage. Trading volumes stood at $2.65 billion, with net assets at $26.86 billion.

In just four days, the damage has piled up. Together, bitcoin and ether ETFs have seen a staggering $1.9 billion in capital outflows, underscoring a sharp shift in investor sentiment after weeks of historic inflows.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。