Written by: Babywhale, Techub News

The cryptocurrency market has long been associated with a "four-year cycle theory." Since Bitcoin first broke the $1,000 mark in 2014, its price has followed a pattern of "three years of bull markets, one year of bear markets." Coincidentally, each transition between bull and bear markets has been closely related to changes in the macroeconomic environment, with some coincidental macro events seemingly aligning perfectly with the key nodes of the four-year cycle. If we refer to this standard, it has been less than three months since the four-year mark following the last bull market peak of $69,000 for Bitcoin (on November 10, 2021). If Bitcoin strictly adheres to this pattern in the current cycle, it is likely that it is about to enter a bear market.

Given that every bull market tends to feature voices proclaiming "eternal bull markets" or "this time is different," let's first review what has happened in the transitions between bull and bear markets from 2014 to the present.

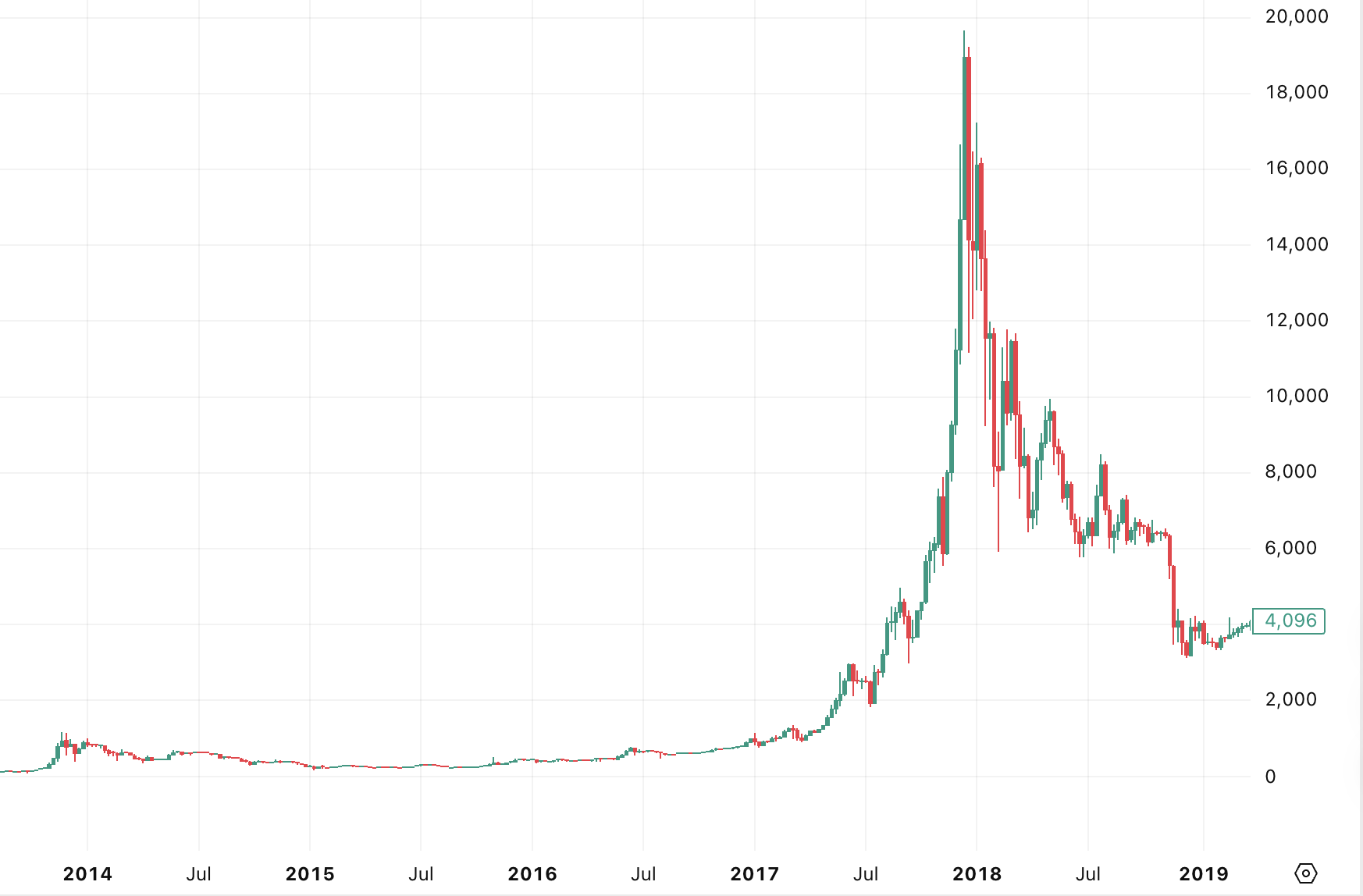

In November 2014, Bitcoin first broke the $1,000 mark, then fell sharply, reaching a low of $152 in January 2015. The subsequent nearly three years can be referred to as Bitcoin's "first bull market." During this period, Bitcoin's price rose from $152 to nearly $20,000. The driving factors behind this rise were largely the promotion of concepts like "blockchain" and "Bitcoin," along with the explosive growth of ICOs such as Ethereum and EOS, which fueled FOMO in the market and pushed Bitcoin's price up over 100 times.

After peaking in December 2017, Bitcoin entered a bear market that lasted a year. When discussing this bear market, it is important to note that, in addition to the cooling of an overheated market, it was also the first time Bitcoin's price began to be influenced by the macroeconomic environment. The Federal Reserve began its interest rate hike cycle in 2015, conducting a total of nine rate hikes by the end of 2018, with seven of those occurring in 2017 and 2018. As an asset extremely sensitive to liquidity, this round of rate hikes became one of the important factors for Bitcoin's decline.

In December 2018, Bitcoin briefly fell to around $3,000, after which its price continued to fluctuate. In March 2020, following a flash crash in global risk asset markets due to the pandemic, the Federal Reserve initiated unlimited QE to protect the economy. After Bitcoin's price plummeted from $8,000 to below $4,000, it once again began the process of entering a bull market.

Although the price increase in this bull market was not as significant as before, the rise of concepts such as DeFi, new public chains, and NFTs led to an unprecedented explosion of "altcoins," marking a bull market that blossomed in many areas. This bull market experienced a correction of over 50% in April and May, but in the second half of the year, the launch of the first Bitcoin futures ETF and positive news such as El Salvador adopting Bitcoin as legal tender propelled Bitcoin to a new high of $69,000 in November 2021.

The subsequent events are likely familiar to everyone. With U.S. inflation data skyrocketing, the Federal Reserve initiated a rare and significant interest rate hike in the following year. Under a sluggish macroeconomic environment, the cryptocurrency market also experienced the collapse of Terra, the bankruptcy of numerous investment institutions and lending companies due to excessive leverage, and the FTX crisis at the end of the year. Bitcoin's price plummeted from $69,000 to around $15,000 within a year.

The market cycle we are currently in began at the end of 2022 when Bitcoin was at $15,000, and Bitcoin recently set a new historical high of over $124,000 this month. In fact, not only the cryptocurrency market but also major U.S. stock indices have recently reached historical highs, as have stock indices in several major countries around the world, seemingly indicating a prosperous scene.

However, the prices of risk assets are not always a barometer of the economy. During economic booms, the premiums on risk assets often do not rise significantly because, for large funds, the stability of profits from primary markets or certain real industries far outweighs that of secondary markets. Conversely, when the economy begins to decline, risk asset markets, including the stock market, often rise against the trend. This may be because, during economic downturns, so-called "risk assets" could be the least risky investment targets. Considering the current global economic environment, I am more inclined to believe that the "prosperous scene" we are facing may just be a "mirage."

Although the economic data from the U.S. this year has not clearly shown signs of recession, I want to remind readers that once an economic recession can be reflected in the data, it often becomes an irreversible trend. Just as the U.S. experienced the dot-com bubble and the subprime mortgage crisis, both collapsed suddenly amidst apparent prosperity rather than gradually disintegrating under clear signs. While we should remain optimistic about the increasingly mature economic system, caution is also necessary.

According to data from layoffs.fyi, 585 tech companies laid off a total of 150,000 employees in 2023, and so far this year, 186 tech companies have laid off over 80,000 people. Although U.S. employment data has not shown significant weakness, the downward revisions of over 100,000 in new jobs for May and June may indicate that U.S. statistical agencies are intentionally downplaying the situation. Goldman Sachs predicts that the annual downward revision of non-farm payrolls could reach 950,000, the largest adjustment since 2010. This suggests that the actual state of the U.S. labor market may be much weaker than the surface data indicates.

The upcoming interest rate cuts may be the reason many believe the market will remain resilient. However, it is worth noting that although most of 2023 is still within the interest rate hike cycle, Bitcoin's price has still risen by more than 100%. The prices of risk assets often depend more on expectations than on reality, so if the market generally expects that the interest rate cuts for the remainder of the year are merely to reduce financing costs in the financial market, and that potential inflation expectations due to uncertainties such as tariffs are not alleviated, then interest rate cuts may only soothe the market in the short term and are unlikely to provide long-term support.

On the U.S. stock market side, a research report from MIT states that 95% of tech companies have not seen any returns from the generative AI investments that have driven U.S. stocks to new highs in recent months, with only 5% of AI pilot projects creating value. Torsten Slok, chief economist at Apollo Global Management, also stated that the current AI boom may even surpass the internet bubble of the 1990s, with the valuation levels of the top ten companies in the S&P 500 relative to their fundamentals exceeding those at the peak of the internet bubble.

I learned last year that some domestic financial institutions were discussing the AI bubble, believing that the main reason for the bubble's formation lies in the actual demand being insufficient on the demand side, and the role of AI being overly exaggerated.

Of course, regardless of how we discuss potential risks, the market's enthusiasm is unlikely to dissipate suddenly in the short term. The prices of Bitcoin, Ethereum, and others may still reach new highs in the remaining time of this year or even next year. However, both the micro-level individual experiences and the macro-level data showing signs of decline suggest that the cryptocurrency market may soon face its first global economic slowdown test since its inception. The recent mass sell-off by ancient whales holding Bitcoin is also a signal worth noting.

If the "four-year agreement" is once again fulfilled in this cycle, it may still resonate with the macroeconomic cycle by coincidence. The black swan may not arrive tomorrow, but there are still ample reasons for us to remain vigilant at this moment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。