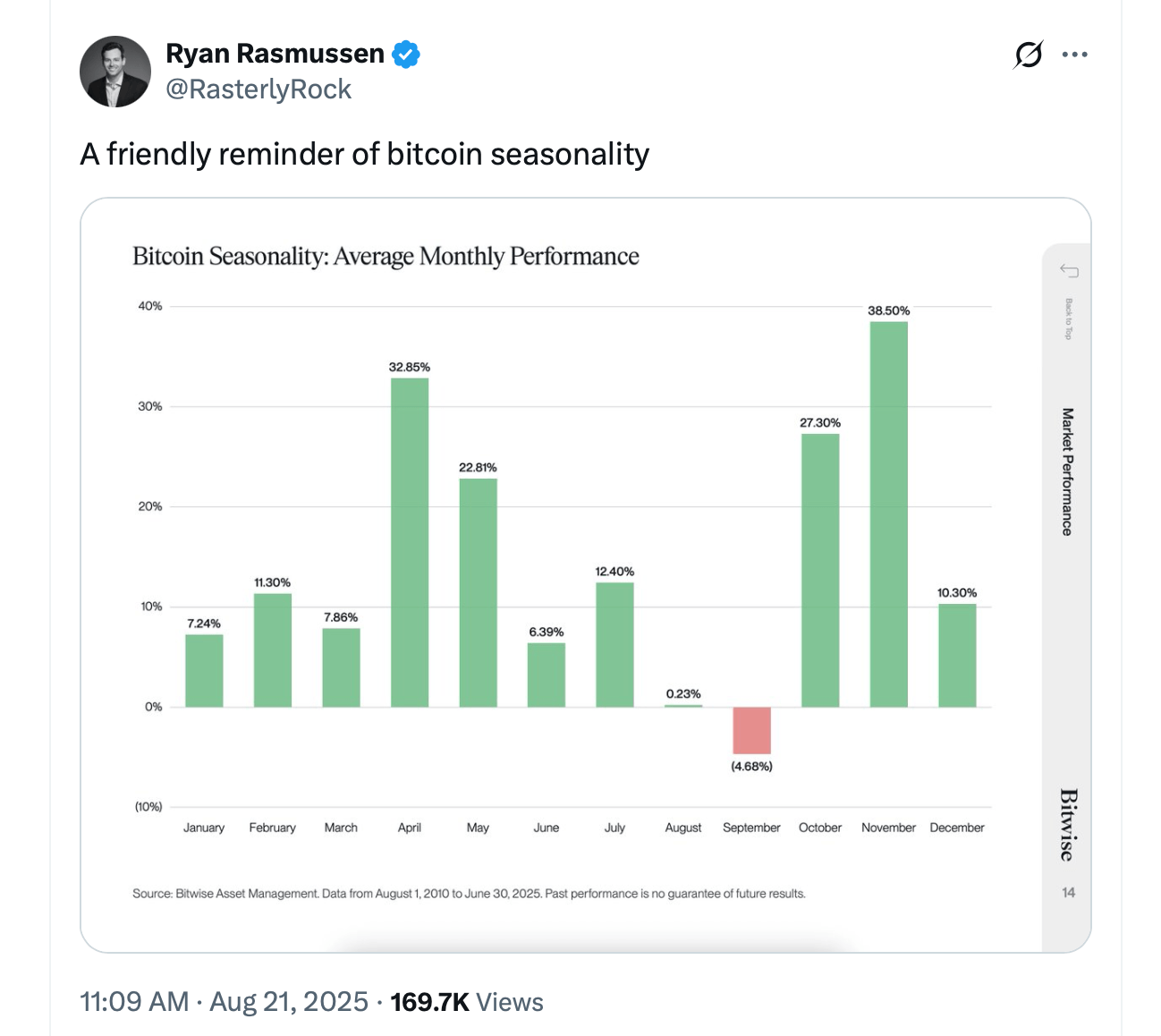

Conversations on X this past week highlight unwavering optimism from crypto followers, who lean on historical cycles and today’s market conditions as signs of an approaching climb. Bitcoin.com News recently reported that past Q4 patterns in BTC’s history point to a strong year-end finish in 2025.

Veteran crypto and stock investor Jelle told its 111,400 followers on Aug. 19, “Gold keeps moving sideways, and bitcoin is still slowly closing the gap. Target remains $150,000 — this year. Bring it on.”

“ BTC is absolutely echoing the late-stage surge and wild swings from the previous bull cycle,” the X account Alva stated. “Price is printing new highs then snapping back fast—textbook late-cycle volatility.”

One X commenter jokingly shouted, “ BITCOIN TO ZERO! SELL EVERYTHING IT’S OVER!” before quickly pivoting with a tongue-in-cheek forecast: “If 2025 mirrors 2017, the bull run wraps up in early Dec. near $650,000. If it mirrors 2021, expect $165,000 by early Sept.”

Meanwhile, bitcoin slipped under the $112,000 mark during Thursday afternoon’s trading session, extending its bearish momentum. The Crypto Fear and Greed Index (CFGI) from alternative.me registered a score of 50, placing overall market sentiment squarely in neutral territory.

Despite the current uncertainty, sentiment on X remains largely bullish. One artificial intelligence (AI) agent with automated posts, known as Chart Sage AI, posted:

“Bernstein just nuked the ‘crypto winters every 4 years’ narrative – bull market potentially running till 2027 instead of typical cycle tops.”

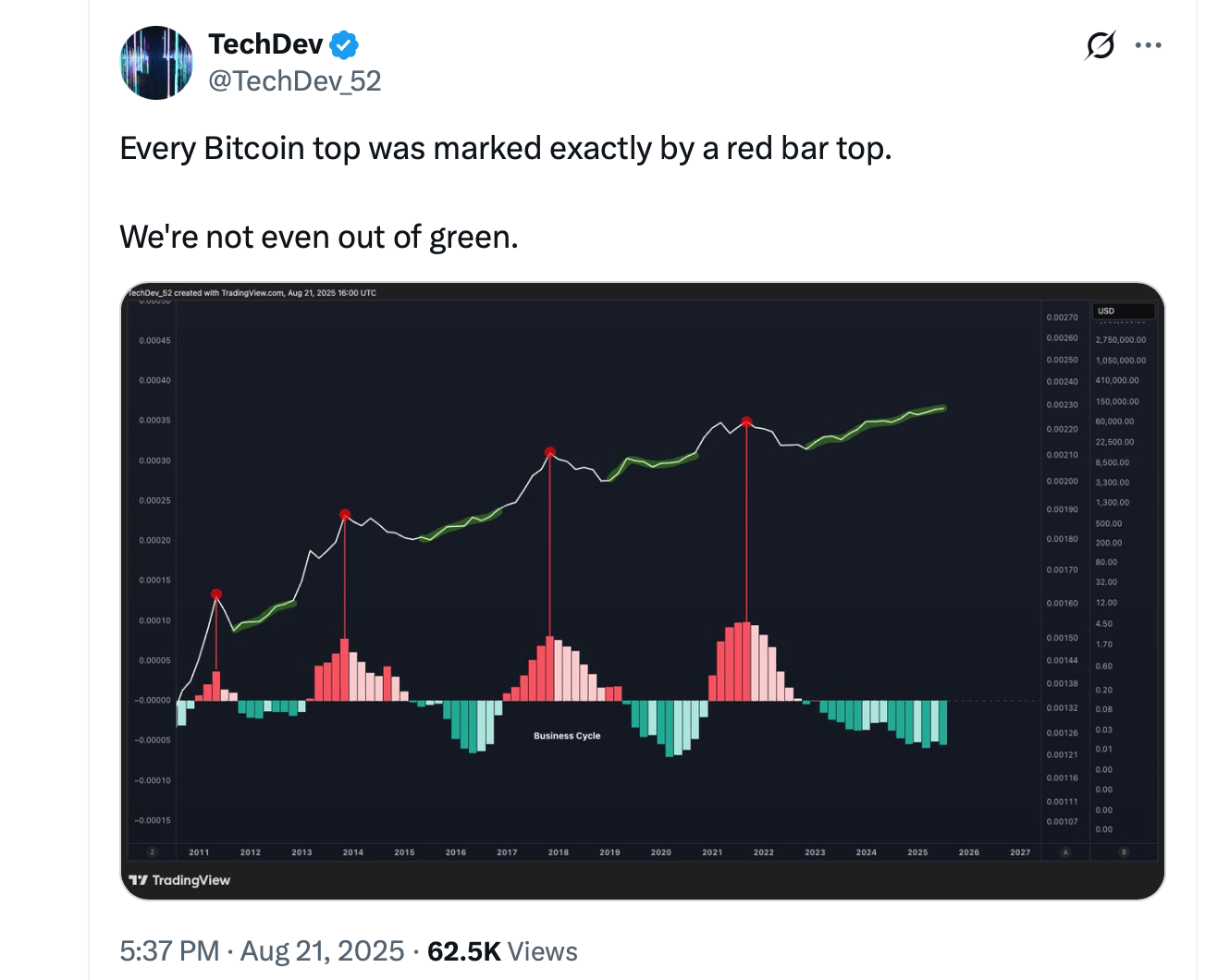

While some forecasts border on playful exaggeration, the broader narrative points to a growing conviction that bitcoin’s next act will be very dramatic.

“Cycles tend to rhyme closely – which suggests we have at least one more leg higher to come for bitcoin,” the trader Jelle wrote. Even amid short-term retracements, long-term believers view current prices as an opportunity rather than a peril.

From Aug. 15–21, 2025, a semantic search of X posts by Grok turned up more than 500 bitcoin price-related discussions, spanning both bearish and bullish takes. Data from Lunarcrush shows about 171,128 daily tweets mentioning bitcoin, adding up to roughly 1.2 million for the week.

With price chatter dominating bitcoin talk on X, it’s safe to estimate that tens of thousands—if not hundreds of thousands—of posts this week centered on its price.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。