Crypto ETFs Diverge: Ether Scores $288 Million Inflow While Bitcoin Bleeds $194 Million

The mood in crypto ETFs split in two directions on Thursday, Aug. 21. While bitcoin funds extended their losing streak to five days with a $194.32 million exit, ether funds staged a powerful recovery, luring $287.61 million in new inflows. The divergence highlights a growing gap in investor appetite for the two dominant crypto assets.

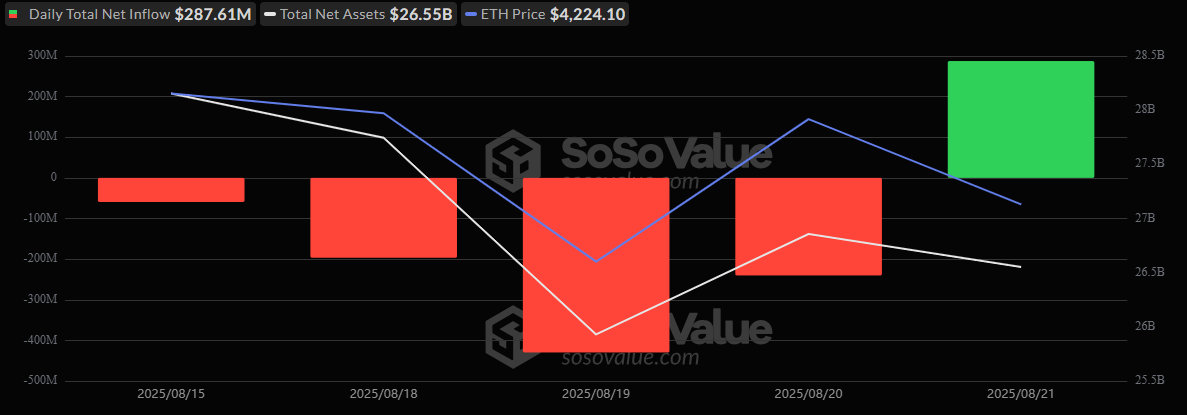

Ether ETFs posted a strong recovery, with the group attracting a hefty $287.61 million in inflows. This was powered mainly by BlackRock’s ETHA, which brought in $233.59 million. Fidelity’s FETH followed with $28.53 million, while Bitwise’s ETHW added $6.99 million.

Smaller yet steady entries came from Grayscale’s Ether Mini Trust (+$6.36 million), ETHE (+$5.92 million), and VanEck’s ETHV (+$6.21 million). Ether trading hit $1.63 billion, with net assets holding at $26.55 billion.

Source: Sosovalue

Bitcoin ETFs told a different story. Blackrock’s IBIT led the outflows with a $127.49 million exit. Ark 21Shares’ ARKB shed $43.28 million, and Fidelity’s FBTC lost $31.77 million. A couple of modest gains via $4.97 million into Grayscale’s Bitcoin Mini Trust and $3.25 million into Franklin’s EZBC offered little relief. Total trading activity reached $2.85 billion, with net assets slipping to $144.48 billion.

With bitcoin continuing to bleed and ether bouncing back strongly, Thursday’s flows suggest investors may be rotating their risk, dialing back exposure to BTC while leaning into ETH’s growing momentum.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。