Original | Odaily Planet Daily (@OdailyChina)

On the evening of August 22, Federal Reserve Chairman Powell's last appearance at Jackson Hole during his term opened the door for a potential interest rate cut, with the last rate cut announced by Powell occurring on December 18, 2024. After a long drought, the market responded positively. The three major U.S. stock indices closed higher, with the Dow Jones initially rising by 1.89%, the S&P 500 index up 1.52%, and the Nasdaq Composite index up 1.88%. At the same time, several stocks in the U.S. crypto sector rebounded, with SharpLink rising 15.69%, Bitmine up 12.07%, Coinbase up 6.52%, Circle up 2.46%, and Strategy up 6.09%.

The crypto market also performed impressively, with the total market capitalization of cryptocurrencies returning to $4.1 trillion, mainly driven by Ethereum. On August 22, ETH rose over 14.33%, reaching a peak price of $4,887.5, setting a new historical high after 3 years and 9 months. Additionally, influenced by ETH's new high, multiple tokens in ETH Layer 2, staking, and infrastructure sectors experienced widespread gains, with SSV rising over 25.54% in 24 hours, ETHFI up 20.67%, ENA up 17.58%, and ARB up 9.53%.

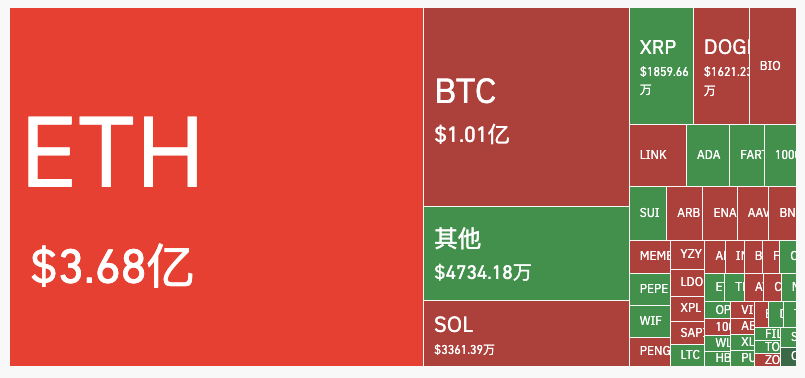

According to Coinglass data, the liquidation amount for ETH in the past 24 hours surpassed that of BTC, with the majority being short positions (amounting to $368 million).

Powell's Dovish Remarks Spark Market Frenzy

The market is anticipating interest rate cuts from the Federal Reserve in 2025 to stimulate the economy, but since January, Powell has not hinted at any rate cut signals in his public speeches. The most anxious about Powell's "stubbornness" is none other than U.S. President Trump, who has been pressuring Powell to cut rates since taking office this year, even going so far as to declare he would fire Powell.

However, the Federal Reserve has also been "cornered" this year, facing rising price pressures and intensified inflation from Trump's tariff policies on one side, and signs of a cooling labor market on the other. If they choose to raise rates to stabilize inflation, it could lead to soaring interest rates and trigger "financial panic," but if the Fed cuts rates too early to stimulate the economy, it could result in uncontrollable inflation expectations.

In this dilemma, many expected Powell to lean towards a hawkish stance. BitMEX co-founder Arthur Hayes even predicted that Powell would become "Volcker 2.0" (Note: Volcker was the Federal Reserve Chairman in the 1970s and 80s, who used extremely tough monetary policies to reverse the high inflation crisis and thereby restored the Fed's credibility and independence).

However, Powell's speech on the evening of August 22 surprised the market, with the probability of a 25 basis point rate cut in September soaring from 75.5% before Powell's speech to 91.1%. In his remarks, Powell stated, "Given that the labor market is not particularly tight and faces increasing downside risks, (the outcome of sustained inflation) seems unlikely," and directly declared, "If a tight labor market poses a risk to price stability, it may be necessary to take preemptive action."

These statements indicate that Powell is shifting towards a dovish stance, expecting the inflation effects of tariffs to gradually dissipate, while the weakness in the labor market will push the Fed to cut rates to support the weakening job market.

Powell's shift has sparked tremendous enthusiasm in the market, which became a major driver for ETH's daily rise of over 10%. Nevertheless, the proud Trump mocked after Powell's speech, saying, "Powell should have cut rates a year ago; it's too late to signal a rate cut now."

What’s Next for ETH?

With ETH's rise, Ethereum's market capitalization has surpassed that of payment giant Mastercard, ranking 26th globally in asset market value. Yesterday, ETH rose over 10% and briefly broke new highs. Besides the favorable impact of Powell's dovish remarks, some believe that the direct reason for ETH's new high is actually market short squeezes. So, after the temporary emotional surge, how should ETH perform in the future?

Many remain optimistic. Tom Lee posted after Powell's speech, stating that Powell's remarks were interpreted as dovish, which was expected and favorable for cryptocurrencies (BTC, ETH). "Marshal e" Liquid Capital (formerly LD Capital) founder Yi Lihua also posted, "ETH has ended a week-long bear market, consistent with our expectation of a confirmed rate cut, welcoming a new round of increases together."

Although Arthur Hayes initially believed there would be no rate cut signals before Powell's speech, he still stated in an interview, "As long as ETH breaks its historical high, the upward space is completely opened, and the price will reach $10,000 – $20,000."

On-chain Whales Switching to ETH

On-chain whales have also begun to vote with their feet. After Powell's speech, as ETH's price broke new highs, a certain Bitcoin OG deposited 300 BTC into Hyperliquid to switch to ETH, having already gained over $160 million in unrealized profits, now holding 118,277 ETH and a long position of 135,265 ETH.

At the same time, a much-discussed "whale" betting on a $125,000 rolling long position on ETH bet on a rate cut before Powell's speech. With the nighttime surge, he increased his position through unrealized profits, raising his ETH holdings from 4,000 at the opening on the morning of August 22 to 25,100, with a position value of $120 million and unrealized profits of $5.5 million, currently with a liquidation price of $4,666.

The "Maji Brother" Huang Licheng, who has "infinite bullets," has also closed his long positions in BTC, HYPE, PUMP, YZY, etc., at a loss. The only position left is a 25x leveraged long position in ETH, with unrealized profits exceeding $3 million and total profits around $37 million, indicating his continued optimism for ETH's future.

However, there are signs of overheating in the market, and traders should remain rational. A certain FOMO trader sold 2,277 ETH (worth $9.57 million) at a price of $4,203 five days ago, but about six hours ago, due to FOMO, he bought 1,966 ETH (worth $9.57 million) at a price of $4,869. Currently, he has already lost about 311 ETH (worth $1.5 million).

Although Powell has sent positive signals for a rate cut, the actual outcome remains uncertain. Federal Reserve's Harker cautiously stated after Powell's speech, "I heard that Federal Reserve Chairman Powell is 'open-minded' about the policy outlook, but the Fed should stick to a moderately tight monetary policy." Federal Reserve's Musalem also added this morning, "Whether to cut rates should focus on the entire interest rate path, not just the rate decision of a particular meeting. Inflation is above target levels and there are ongoing risks. The next employment report may be sufficient to prove the need for a rate cut, or it may not, depending on the specifics of the report."

How the crypto market and ETH will perform in the future remains to be seen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。