XRP ETF Approval Timeframe Revealed as Asset Managers Update Filings

The race to crypto exchange-traded funds (ETFs) has taken another turn, and this time, it is all about XRP. Following Bitcoin and Ethereum, this digital asset is coming in as a possible contender for ETFs in 2024. A number of heavyweight asset managers have recently refreshed their prospectuses for a possible spot XRP ETF, renewing discussions that it may not be as far off as some might think.

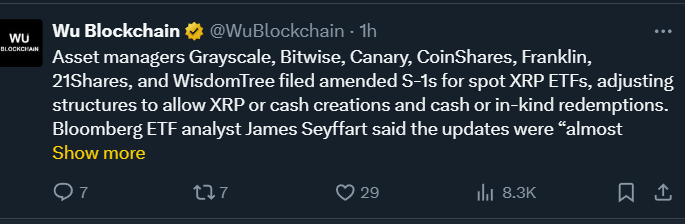

Source: Wu Blockchain X

What’s the News

On Friday, asset managers including Grayscale, Bitwise, Canary, CoinShares, Franklin Templeton, 21Shares, and WisdomTree filed amended S-1 registration statements with the U.S. Securities and Exchange Commission.

The most important difference in these updated filings is the structure of the funds. Rather than limiting the creation and redemptions to cash only, the proposed ETFs now permit spot crypto or cash creations and cash or in-kind redemptions. According to analysts, these adjustments are almost certainly in response to feedback from the SEC — a sign that active discussions are underway.

Bloomberg analyst James Seyffart described the updates as a “good sign, but mostly expected.” Similarly, Nate Geraci, president of NovaDius Wealth, called the cluster of filings “highly notable,” suggesting that asset managers are aligning themselves with regulatory requirements.

Source: X

SEC’s Stance on XRP ETF

The SEC has not yet approved any spot XRP ETF, though both spot and futures-based products have been proposed. The agency has been slow to approve crypto ETFs, with Bitcoin and Ethereum being approved after several years of back-and-forth with issuers.

But the history of the regulation is unique. In 2024, the SEC officially ruled that XRP is not a security, a decision later upheld by a federal court. The SEC and Ripple Case closed after 4 years , clearing significant hurdles that had previously stood in the way of approval.

Also in July 2025, the Securities Exchange Commission issued new guidelines to expedite ETF approvals, reducing the review time to 75 days, down from 240 days. This shift may expedite the decision-making on altcoin ETFs.

Public and Market Reaction

The community has reacted with enthusiasm and jokes. Influencer Wendy O joked, If this altcoin is the first crypto spot ETF to get approved, I will laugh so hard. A sentiment shared by many, as the chance of spot crypto being the first to cross the finish line is surprising.

Source: X

Meanwhile, the market reacted quickly. Amid a broader rally, XRP surged 7% to $3.08 at publication time. Analysts believe that approval could bring heightened volatility, but also new institutional capital into the token.

Interestingly, while firms like Grayscale and Franklin Templeton are pushing forward, BlackRock — the world’s largest ETF manager and issuer of Bitcoin and Ethereum ETFs — has said it has no current plans to file for a fund.

Will XRP ETF Approve?

While the cluster of updated filings is a strong signal, analysts caution that it doesn’t guarantee approval. As of now SEC delays ETF decisions . The regulators still question the liquidity of Ripples, custody, and the risks of market manipulation before approving the green light.

Nevertheless, the fact that several issuers are aligning their updates on the basis of SEC feedback is an indication that pressure is mounting. In case of approval, this altcoin would be the first other than Ethereum to have a spot ETF in the U.S. If approved, it could become the first altcoin beyond Ethereum in the U.S.

Conclusion

The story highlights how far crypto has come since the early days of regulatory uncertainty. R ecently, Tidal Trust became the first-ever leveraged XRP ETF . It is not yet clear whether the Securities Exchange Commission will make history by approving it, but one thing is certain: the crypto markets and the community are paying close attention.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。