Historical data suggests a bull market in Q4, and the September pullback may be a buying opportunity.

Author: The DeFi Investor

Translated by: Blockchain in Plain Language

The changes in market sentiment are always fascinating. Just when everyone on Crypto Twitter was bullish on ETH, many suddenly turned bearish overnight. I want to share some market thoughts and discuss what might happen next. Let’s zoom out and look at the data.

Historical Background

Here is a chart showing BTC's price performance in past bull market cycles:

By studying past cycles, you will find that the timing of BTC cycle peaks is very consistent:

- In 2021, BTC peaked in November 2021

- In 2017, BTC peaked in December 2017

- In 2013, BTC peaked in December 2013

Each cycle's peak occurred in the fourth quarter (Q4) following the halving (2013, 2017, 2021, and now 2025).

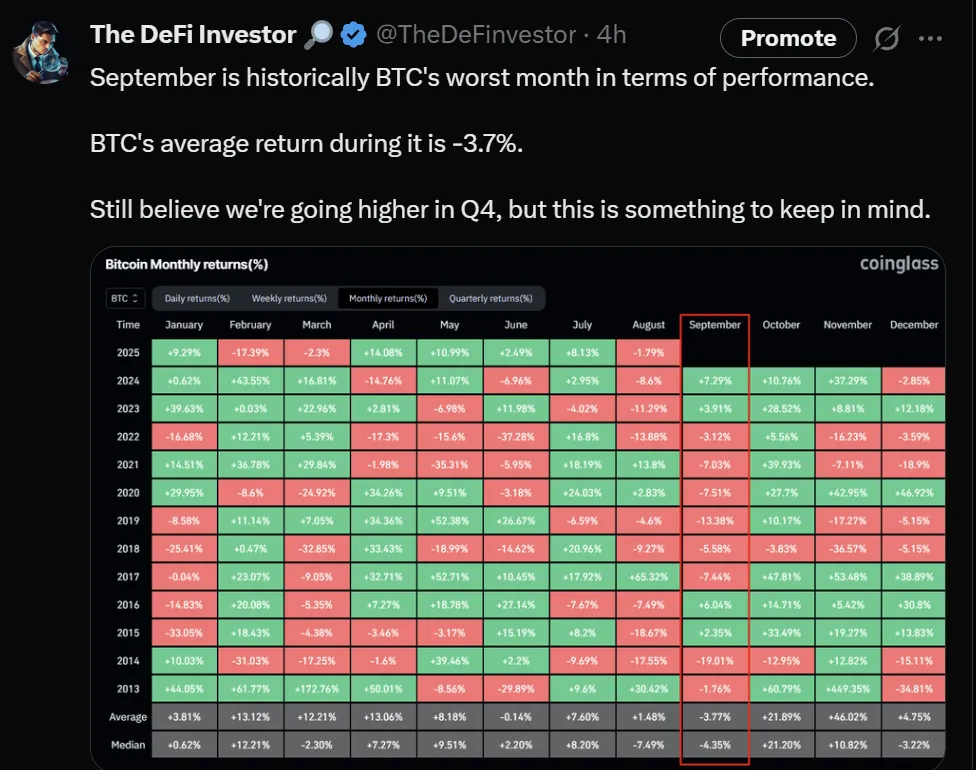

Another interesting observation is that although September is typically one of the weakest months for Bitcoin, October has historically been one of the strongest months.

While many are panicking due to the recent decline, market pullbacks at the end of Q3 (September) are not uncommon and even align with past occurrences. Does this mean this cycle will be exactly the same as before? Certainly not. But while history does not repeat itself, it often has similarities.

I have mixed feelings about September, as historically it has not performed well, but based on past cycles, I believe Q4 will be a good quarter for the cryptocurrency market, as the final phase of a bull market cycle usually sees significant gains.

In addition to seasonal factors, several other factors lead me to believe Q4 will be bullish:

1. Interest rate cuts are coming (this time it’s real)

Let’s temporarily step out of cryptocurrency and look at the macroeconomy. According to Polymarket, the probability of the Federal Reserve cutting rates in September is 64%. Why is this important?

Because when central banks lower interest rates, the cost of borrowing decreases, and lower bond yields push investors towards riskier assets like cryptocurrencies. Historically, significant rate cuts have been positive for risk assets (like cryptocurrencies).

2. Cryptocurrency companies continue to buy in large quantities

The data is shocking. According to https://www.strategicethreserve.xyz/, over 532,000 ETH (currently worth over $2 billion) were purchased by cryptocurrency companies through their asset reserves just last week.

It’s worth noting that a staking Ethereum ETF has not yet been approved.

$2 billion in weekly buying pressure is a huge tailwind for ETH and other tokens. While these companies may eventually run out of funds, I believe that given the current inflow, the peak of this bull market has not yet arrived.

3. Top signals have not fully appeared

Recently, the search volume for "crypto" hit a four-year high, and Jim Cramer has turned bullish, which led me to take some profits earlier this week. However, other "top signals" mentioned last week have not yet appeared. For example:

Coinbase's App Store ranking is still outside the top 200, while in the last cycle it topped the App Store.

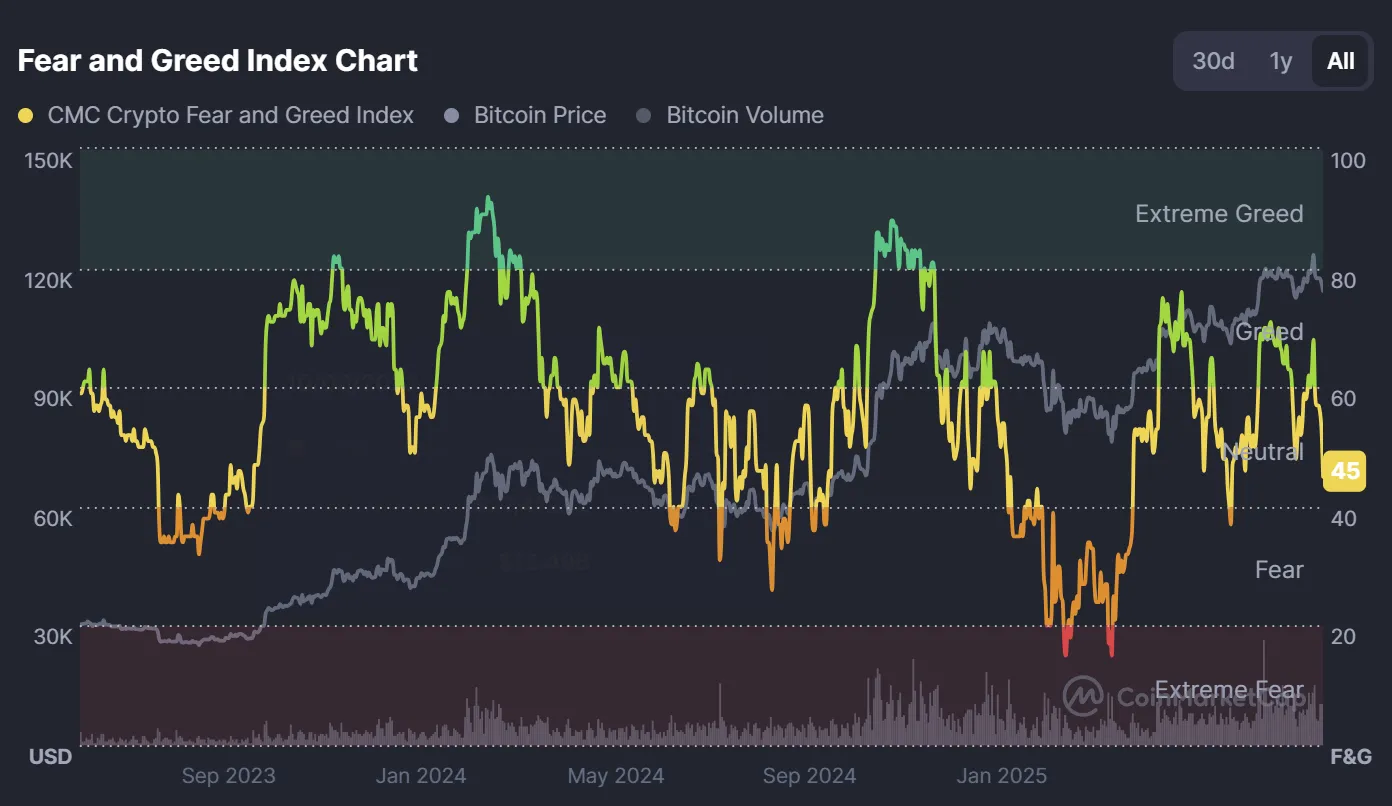

The Fear and Greed Index still looks healthy. Despite the recent market rise, it has not reached extreme euphoria levels.

Although ETH has seen significant gains in recent weeks, a short-term pullback is normal, but unless this is the worst cycle ever, I believe the best is yet to come.

My Positioning Strategy

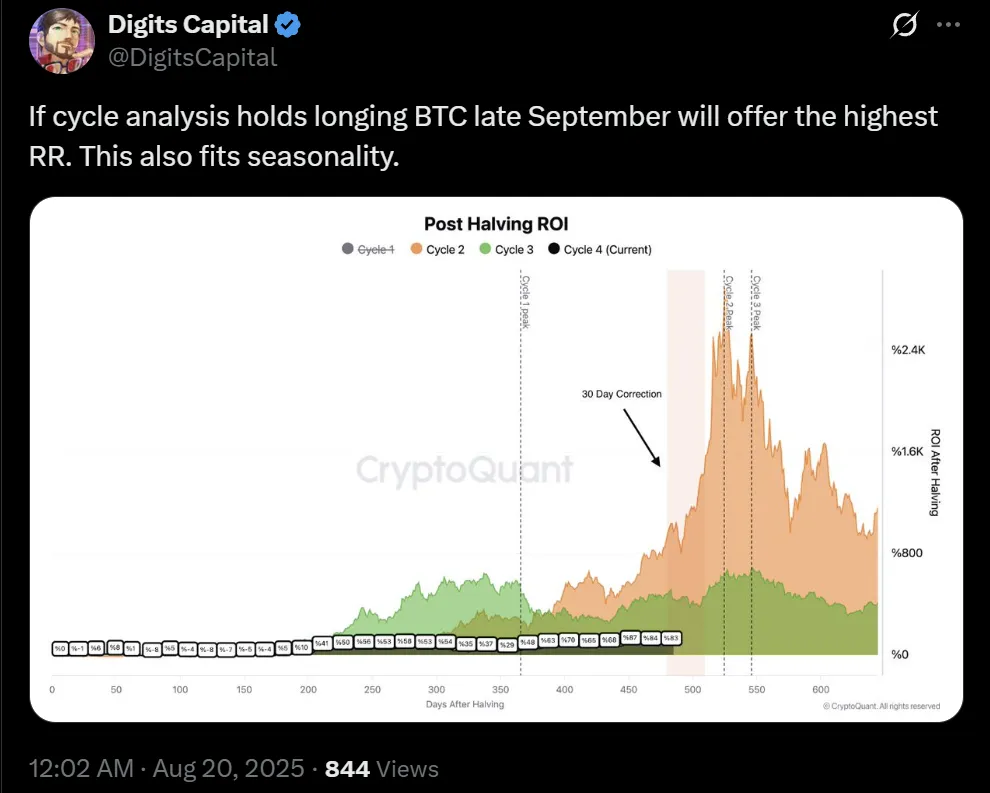

As mentioned, historically, the best buying opportunity after a halving usually occurs at the end of September in the second year after the halving (the last halving will occur in 2024), as October is typically a strong month for BTC.

That’s exactly my plan.

Based on the popular narratives at the end of September, I will choose some hot tokens at that time, taking advantage of the big drop to increase my positions, preparing for Q4. If there is no major pullback, I will continue to hold my existing positions. Then, I plan to gradually take profits in Q4 and significantly reduce my cryptocurrency exposure by the end of the year (if everything goes as expected).

That’s my current plan.

But remember, this is a probability game, and things may change significantly in a few months. As investors/traders, our job is to continuously adjust our strategies based on new information.

My advice is: Build your own investment logic based on your expectations. But regardless of what you think will happen in the coming months, risk management is always a top priority.

I have said many times: The hardest part is not making money, but keeping the money you’ve made.

Article link: https://www.hellobtc.com/kp/du/08/6008.html

Source: https://www.thedefinvestor.com/p/where-are-we-in-the-cycle-2bf

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。