Still optimistic about Q4 as the peak of this round, the market still has a wave of upward momentum, just wait and see.

Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $4.02 trillion, with BTC accounting for 57.7%, which is $2.32 trillion. The market cap of stablecoins is $276.3 billion, with a recent 7-day increase of 0.45%, of which USDT accounts for 60.39%.

Among the top 200 projects on CoinMarketCap, most have risen while a few have fallen, including: OKB with a 7-day increase of 123.59%, MORPHO with a 7-day increase of 35.13%, BIO with a 7-day increase of 131.53%, QTUM with a 7-day increase of 29.34%, and ZEC with a 7-day increase of 18.29%.

This week, there was a net outflow of $1.178 billion from U.S. Bitcoin spot ETFs; a net outflow of $233 million from U.S. Ethereum spot ETFs.

Market Forecast (August 25 - August 29) :

This week, stablecoins have been issued, and there has been a significant net outflow from U.S. Bitcoin and Ethereum spot ETFs, with platform tokens like $OKB experiencing significant gains this week. The RSI index is at 58.39, showing a neutral to strong bullish trend. The Fear and Greed Index is at 59 (consistent with last week).

Core fluctuation range for BTC: $112,000 - $117,000

Core fluctuation range for ETH: $4,200 - $4,700

On August 22, Federal Reserve Chairman Powell stated at the Jackson Hole annual meeting that "the situation indicates that the downside risk to employment is increasing," which the market interprets as Powell seemingly preparing for a rate cut in September. After his speech, the probability of a rate cut in September increased to 91.2%. With less than a month until the September interest rate decision, key inflation data during this period will influence the final decision. Still optimistic about Q4 as the peak of this round, the market still has a wave of upward momentum, just wait and see.

Understanding Now

Review of Major Events of the Week

On August 18, according to Ark Invest Daily, Cathie Wood's Ark Invest ARKK fund has a holding ratio where Coinbase accounts for 6.28%, Robinhood for 3.84%, Bitmine for 3.22%, and Circle for 3.17%;

On August 18, according to Jupiter data, in the market share ranking of Solana token issuance platforms over the past 24 hours, pump.fun ranked first with 79.4%, Letsbonk ranked second with 12.9%, and BAGS ranked third with 3.08%;

On August 19, Bloomberg reported that blockchain lending company Figure Technology Solutions Inc. has publicly submitted an IPO application to the U.S. Securities and Exchange Commission (SEC), planning to trade on NASDAQ under the code FIGR;

On August 20, ALT5 Sigma stated that Jon Isaac is not and has never been the president of ALT5 Sigma, nor is he a company advisor. The company is unaware of any investigations currently being conducted by the SEC regarding its activities;

On August 21, the number of initial jobless claims in the U.S. for the week ending August 16 was 235,000, expected to be 225,000, and the previous value was 224,000.

Macroeconomics

On August 29, the Reserve Bank of New Zealand decided to cut interest rates by 25 basis points, bringing the rate to 3%;

On August 22, Federal Reserve Chairman Powell stated at the Jackson Hole annual meeting that a shift in risk balance may require policy adjustments, indicating that the downside risk to employment is increasing. The market interprets this as Powell seemingly preparing for a rate cut in September;

On August 22, according to CME "FedWatch" data, after Powell's speech, the probability of a rate cut in September increased to 91.2%.

ETF

According to statistics, from August 18 to August 22, the net outflow from U.S. Bitcoin spot ETFs was $1.178 billion; as of August 22, GBTC (Grayscale) had a total outflow of $23.876 billion, currently holding $20.869 billion, and IBIT (BlackRock) currently holds $87.209 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $152.474 billion.

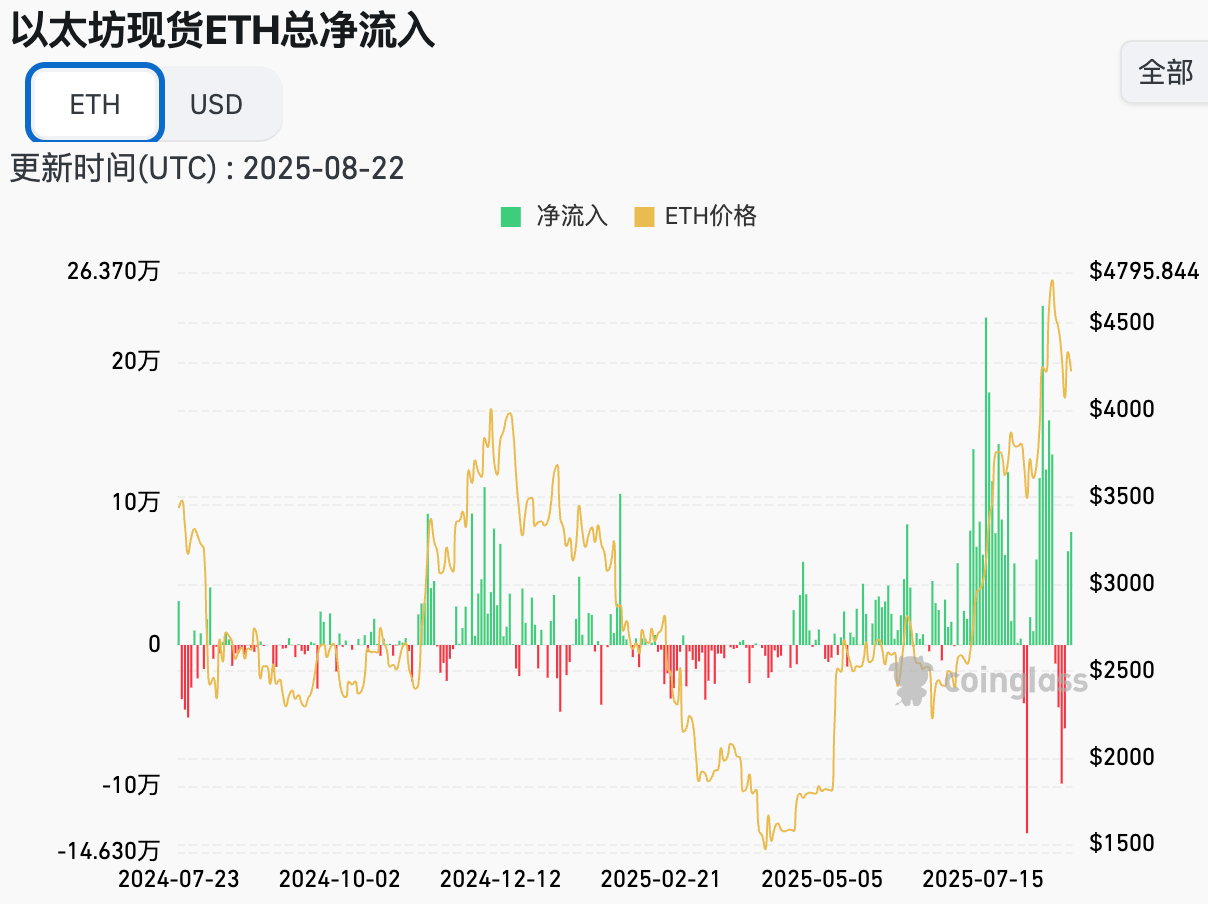

The net outflow from U.S. Ethereum spot ETFs was $233 million.

Envisioning the Future

Upcoming Events

WebX Asia 2025 will be held from August 25 to 26 in Tokyo, Japan;

Bitcoin Asia 2025 will be held from August 28 to 29 at the Hong Kong Convention and Exhibition Centre;

Taipei Blockchain Week 2025 will be held from September 4 to 6 in Taipei;

EDCON 2025 will be held from September 16 to 19 in Osaka, Japan, gathering members of the global Ethereum community to discuss protocol updates, ecosystem development, and the future of Web3;

Korea Blockchain Week 2025 will be held from September 22 to 28 in South Korea.

Project Progress

Gryphon shareholders will vote on the merger with American Bitcoin on August 27;

CUDIS airdrop claims are open until August 31 at 20:00, users need to connect a previously confirmed Solana wallet to claim the S1 airdrop.

Important Events

On August 26 at 9:30, the Reserve Bank of Australia will release the minutes of the August monetary policy meeting;

On August 28 at 20:30, the U.S. will announce the number of initial jobless claims for the week ending August 23 (in thousands);

On August 29 at 20:30, the U.S. will announce the year-on-year core PCE price index for July.

Token Unlocking

Velo (VELO) will unlock 182 million tokens on August 25, valued at approximately $2.88 million, accounting for 0.83% of the circulating supply;

Venom (VENOM) will unlock 59.26 million tokens on August 25, valued at approximately $9.55 million, accounting for 2.28% of the circulating supply;

Artificial Superintelligence Alliance (FET) will unlock 3 million tokens on August 28, valued at approximately $2.04 million, accounting for 0.14% of the circulating supply;

Jupiter (JUP) will unlock 53.49 million tokens on August 28, valued at approximately $27.55 million, accounting for 1.78% of the circulating supply;

Optimism (OP) will unlock 31.24 million tokens on August 31, valued at approximately $24.11 million, accounting for 1.9% of the circulating supply.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. We analyze market trends through "Weekly Insights" and "In-Depth Reports"; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening) to identify potential assets and reduce trial and error costs. Each week, our researchers will also interact with you live, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize value opportunities in Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investment carries risks. We strongly recommend that investors fully understand these risks and invest within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail: labs@hotcoin.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。