With the explosive increase in the circulation of USD1, more and more people, including politicians, are beginning to question whether the Trump family is using its political position to gain commercial benefits.

Written by: FinTax

1. Rising Star: Rapid Expansion of USD1

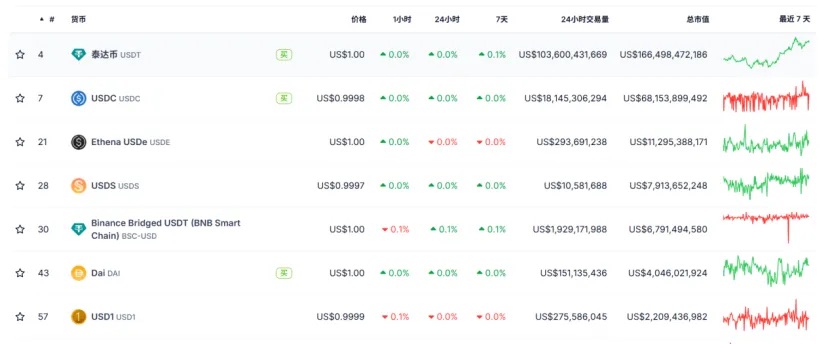

At the beginning of this year, WLF announced plans to launch the institutional stablecoin USD1 for the first time. USD1 is pegged to the value of the US dollar at a 1:1 ratio, with its asset reserves consisting of cash, US Treasury bonds, and equivalents. The asset custodian is BitGo, and the accounting firm Crowe LLP issues monthly reserve verification reports, which are generally considered to have high transparency and credibility. USD1 was officially issued in early March this year, with an initial supply of 3.5 million dollars. As of now, its market capitalization has exceeded 2.7 billion dollars, ranking seventh among stablecoins.

(Figure 1: Ranking of stablecoin market capitalization. Source: coingecko)

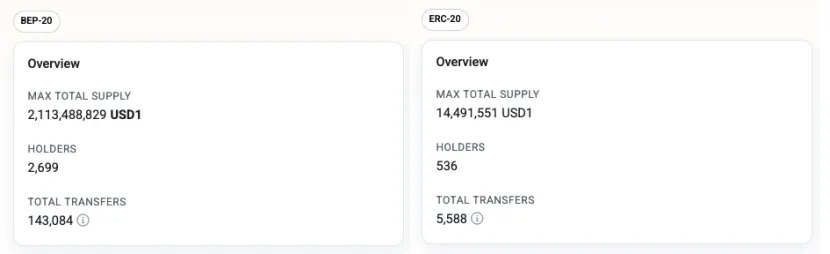

Since its inception, USD1 has attracted significant attention, and in recent months, it has rapidly risen due to its advantageous background. USD1 is almost entirely issued on the BNB chain. According to BscScan data, the supply of USD1 on the BNB chain has reached 2.1 billion dollars, accounting for over 99% of its total circulation, while according to Etherscan data, the Ethereum version has only 14.5 million dollars. Subsequently, major public chains with significant trading volumes, such as Tron, have also launched USD1 to meet on-chain funding demands. In just a few months, USD1 has been listed on major exchanges like Binance, Bitget, and Bybit, quickly entering multiple on-chain ecosystems.

(Figure 2: Comparison of USD1 on BNB Chain (BEP-20) and Ethereum (ERC-20). Source: BscScan, Etherscan)

The rapid expansion of USD1 is inseparable from the support of major exchanges. Binance was the first to list USD1 in April, followed by PancakeSwap, which increased exposure through promotional activities. Related memecoins quickly swept the market, such as the $B token, which broke $400M in just ten days, triggering another wave of excitement on the BNB chain. Bitget and Bybit subsequently listed USD1 in June and July, respectively, launching airdrop and reward programs to further enhance liquidity and user access.

2. Political Elements: Controversies Surrounding USD1

While focusing on the product design of USD1, users have also developed a strong interest in its political background. It is well known that USD1 comes from WIF, which is backed by the prominent Trump family. Therefore, one of the main characteristics of USD1 is its deep connection to the Trump family, which may also explain why USD1 has such strong market mobilization capabilities, even enabling the Abu Dhabi Investment Fund MGX to choose to invest approximately 2 billion USD1 in Binance. The resources of the Trump family, combined with the endorsement of international capital, have allowed USD1 to gain a growth environment that is different from most stablecoins from the very beginning.

However, as the circulation of USD1 skyrockets, more and more people, including politicians, are beginning to question whether the Trump family is using this move to leverage their political position for personal commercial gain. For example, several senators from the U.S. Senate Banking Committee have sent an open letter to regulatory agencies, calling for a review of USD1's compliance and potential conflicts of interest. They believe that if the presidential family directly profits from the stablecoin business, the independence of regulatory agencies may be severely compromised.

In fact, this concern is not unfounded. The sensational memecoin $TRUMP earlier this year raised similar questions. At that time, the token was believed to potentially bypass campaign finance regulations, becoming an important channel for the Trump family to obtain opaque profits or even political bribes. Although USD1 and Trump Coin differ significantly in positioning and nature, they share a similar core issue: Is the Trump presidential family gaining additional political or economic advantages through the cryptocurrency market? Some media have pointed out that the collaboration between USD1 and Binance may involve more exchanges of benefits, especially since Binance has long faced scrutiny from U.S. regulatory agencies, while Binance has been particularly proactive in promoting the application of USD1. There are widespread concerns that such practices could turn stablecoins into tools for politicians to seek rents, further increasing regulatory difficulties and undermining social fairness.

Currently, the U.S. Congress is pushing for new stablecoin legislation and more regulatory rules for cryptocurrency assets. Whether USD1 can successfully obtain and maintain compliance status will directly impact its long-term development. Particularly in the context of bipartisan struggles, some lawmakers may propose special restrictions on the Trump presidential family's management of cryptocurrency assets. As a "canary in the coal mine," USD1 faces certain political uncertainties and compliance risks.

Despite several controversies, USD1 continues to provide cryptocurrency investors with more alternative trading mediums and create a more convenient market environment, increasingly gaining favor among investors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。