Author: arndxt

Translation: Glendon, Techub News

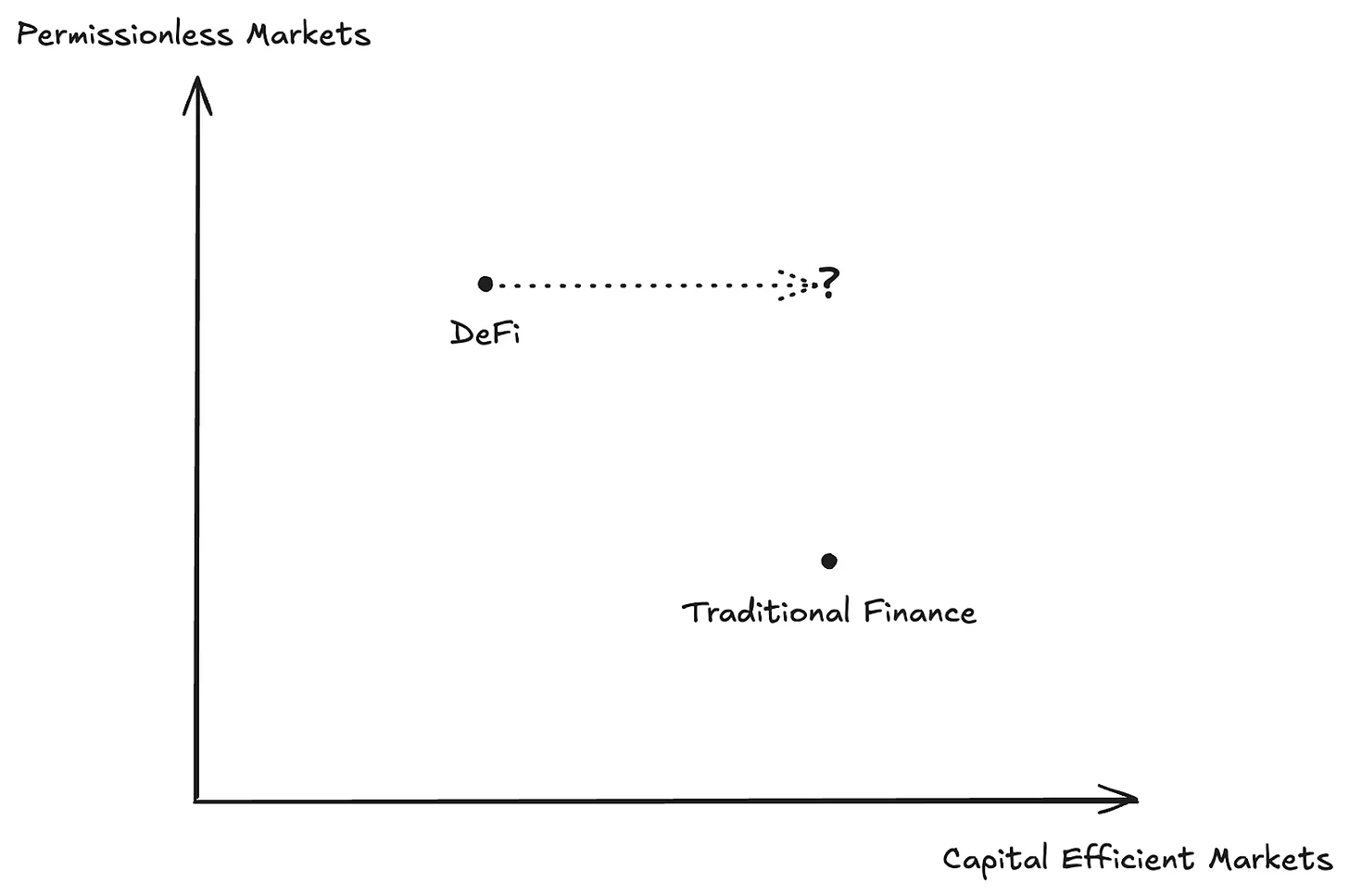

The cryptocurrency market is entering a new phase, characterized by significant features: yields are becoming fundamental, tokenized, transferable, and risks are disaggregated; at the same time, market liquidity is increasingly concentrated in stablecoins and real-world assets (RWA).

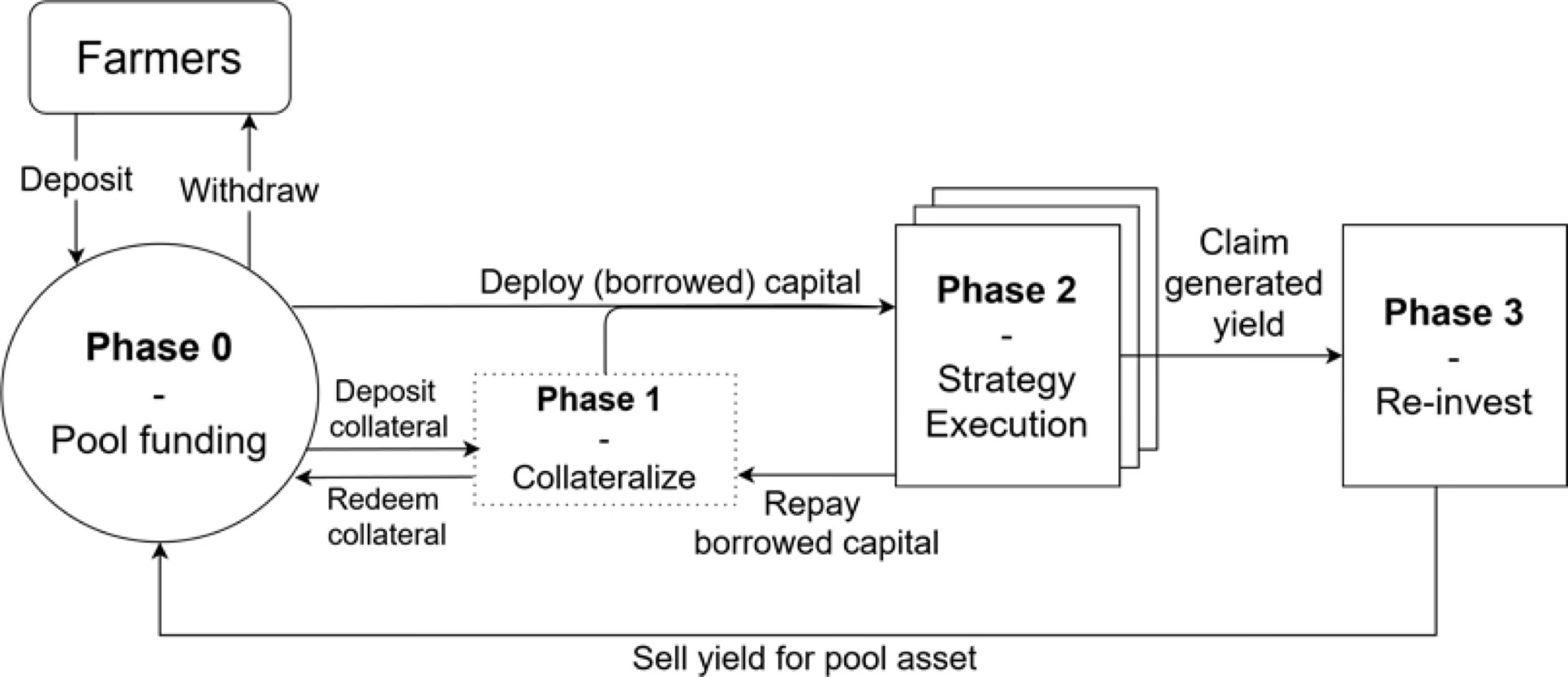

Currently, the goal of the infrastructure race is to elevate the on-chain experience to the level of centralized finance (CeFi) in terms of smoothness and throughput, while institutions are quietly laying out plans to build custody and fund management channels. In this context, there are three types of platforms that investors should focus on: first, platforms that can programmatically generate yields; second, platforms that can efficiently transfer yields across chains; and third, platforms that can sell these yields to new buyers (including institutions, applications, and RWA users).

Transferable Yields: Financing Equals Tokenization

Project Progress: Liminal and Hyperliquid jointly launched the xTokens series (including xHYPE, xBTC, xETH), using a delta-neutral strategy to create ERC-20 wrapping tools that package the funding fee yield from spot longs and perpetual shorts into ERC-20 tokens, allowing them to serve as collateral, AMM inventory, or Pendle-style yield-bearing leveraged assets in HyperEVM and EVM.

In this process, a more important strategy lies in distribution. Once "native exchange yields" can be tokenized and transferred, they are no longer limited to the perpetual contract market but can flow like today's stablecoins—portable, integrable, and infinitely reusable. This unlocks a new level of financialization, allowing developers to easily design yield-based products just like those based on USDC.

However, this also requires a new risk framework. The transferability of yields only works when the market can quantify and price its vulnerabilities: What happens when capital flows reverse? What happens when liquidity shrinks? At this point, the importance of on-chain risk engines becomes increasingly prominent, as they can provide critical oracle data, build effective volatility management mechanisms, and set reasonable inventory buffers.

In short, yields themselves are gradually becoming infrastructure. Liminal's xTokens mark a significant shift from earning yields to transferring yields, and protocols that master this transferability will shape the next cycle of DeFi composability.

Key Points

Financialization Unlock: Packaging basis/funding into transferable ERC-20 tokens, converting instantaneous trading gains and losses into composable collateral;

Distribution Unlock: Once "local exchange yield" can be transferred, it can flow into lending markets, structured products, and real-world assets;

Risk Model: Capital flips, liquidity depth, and execution quality become quantifiable inputs for on-chain risk engines.

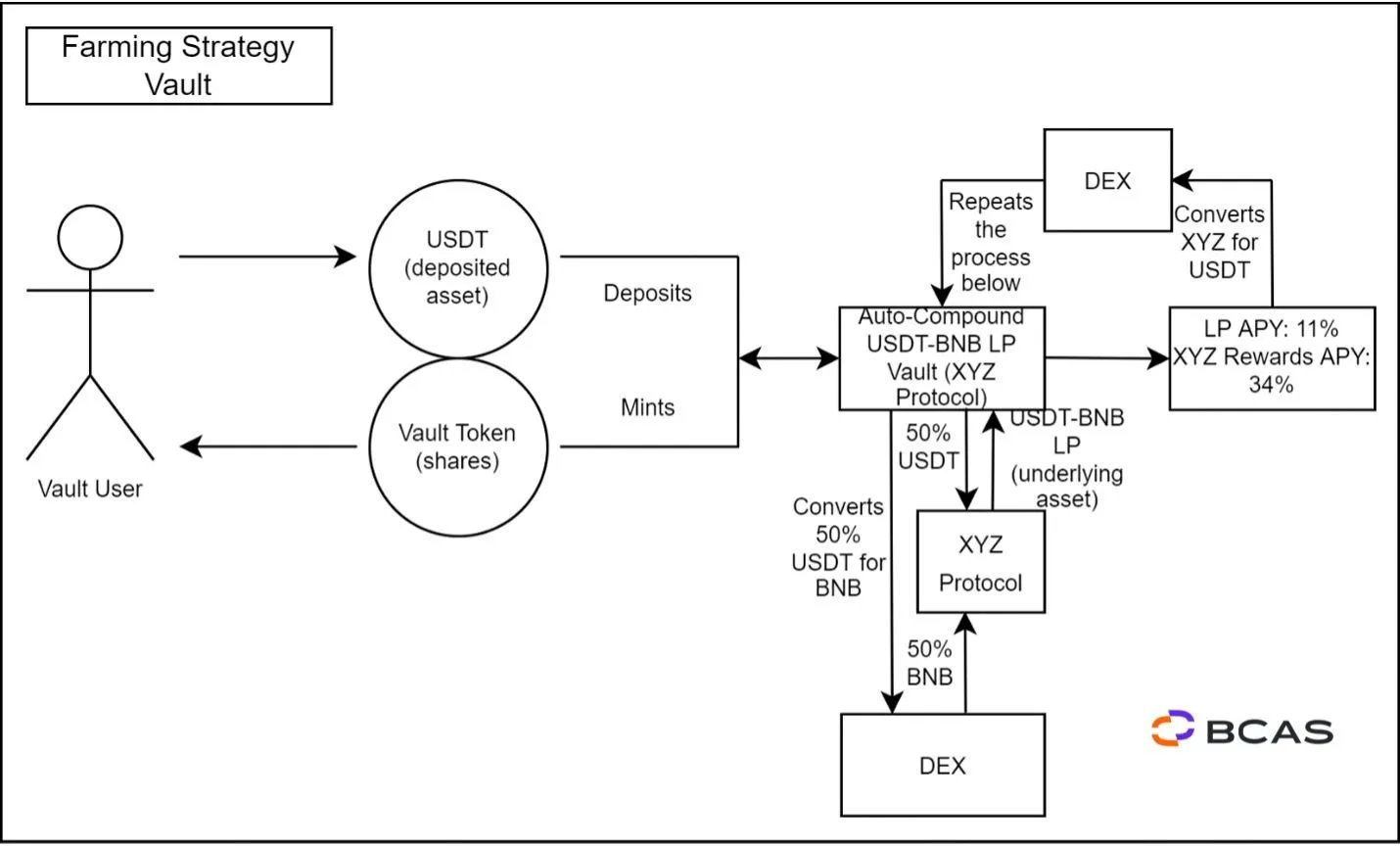

Stablecoin Liquidity War 2.0

Project Progress: Coinbase has initiated a stablecoin liquidity support fund to deepen USDC liquidity in protocols like Aave, Morpho, Kamino, and Jupiter. Meanwhile, new vaults and tiered products are continuously launching high-yield stablecoin products with incentives. For example, Yearn's USDS yield reaches up to 14%, Dolomite's srUSD achieves a yield of 27% after incentives, and Pendle's syrupUSDC can exceed 27% with combined incentives.

The narrative here is the concept of "distribution" as a moat. Just as traditional finance exchanges compete for order flow, DeFi protocols are now vying to become the default "savings account" for stablecoin capital. Protocols that hold stablecoin "parking rights" can control downstream capital flows, routing, spreads, income capture, and governance leverage. Importantly, the buyer pool is continuously expanding. Conservative yields in the range of 8% to 14%, especially under transparent and programmatic execution, will continue to attract off-chain capital, not only from cryptocurrency-native users but also from a new class of asset allocators seeking predictable, auditable returns without fully exposing themselves to the risks of token volatility.

Thus, this forms a composability flywheel: as stablecoin liquidity deepens, the spreads of AMMs and perpetual contracts narrow, thereby strengthening financing and vault strategies, which in turn brings more attractive arbitrage products to the market. This cycle continuously reinforces itself, and those protocols linked to the depth of stablecoin liquidity will ultimately become "systemic winners."

Stablecoins have long been a pillar of the cryptocurrency space, but they are now becoming an arena where yields, distribution, and user trust converge. The "liquidity war" is not just about yields; it is about building the default savings channel for on-chain capital.

Key Points:

Distribution as a Moat: Whoever controls the "parking" position of stablecoin liquidity controls order routing, spreads, and fee capture.

New Buyer Pool: Conservative yields with transparent mechanisms (8-14%) will continue to attract capital from off-chain.

Composability Flywheel: Stablecoin liquidity brings better AMM and perpetual contract depth, leading to improved funding and vault economics.

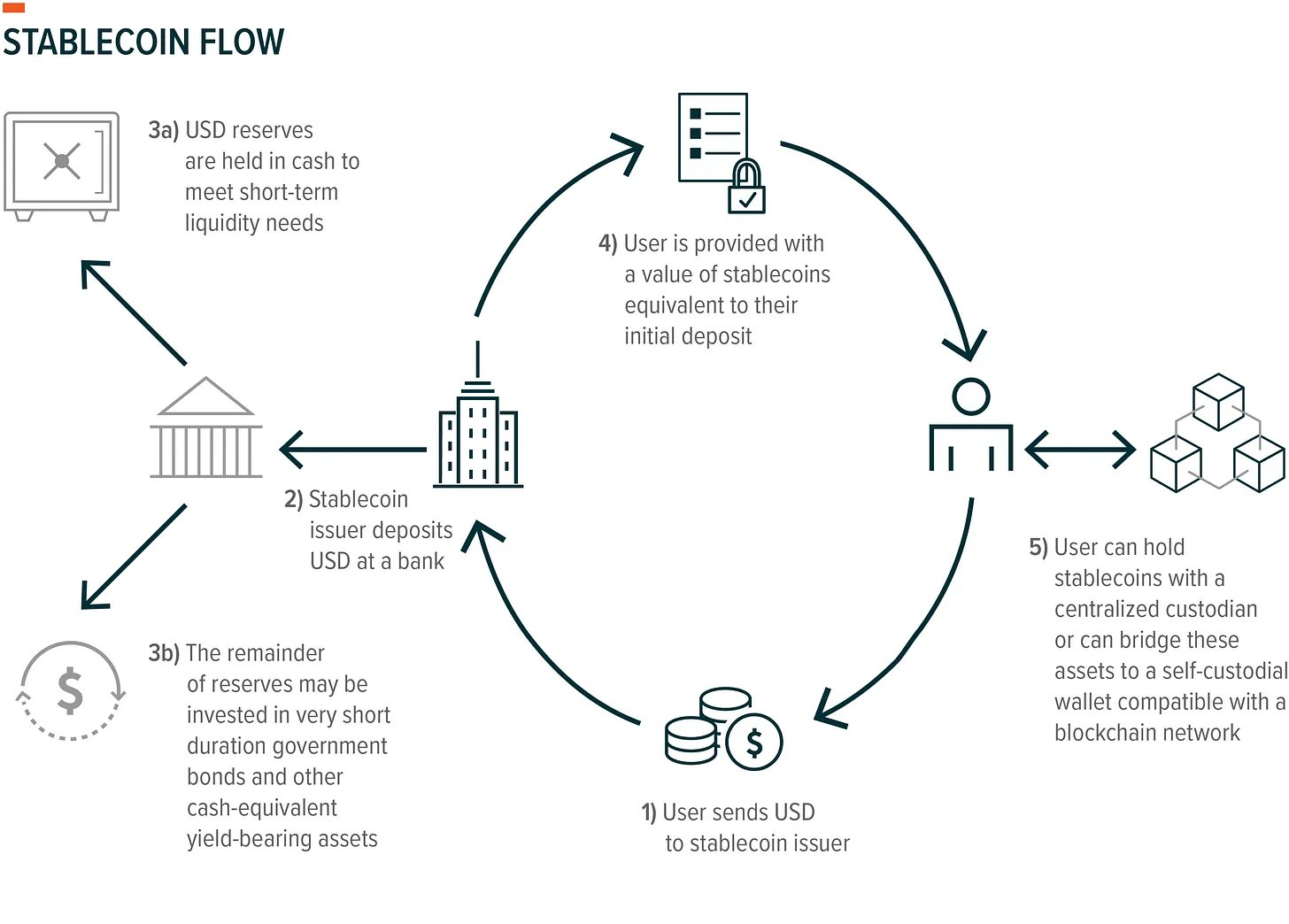

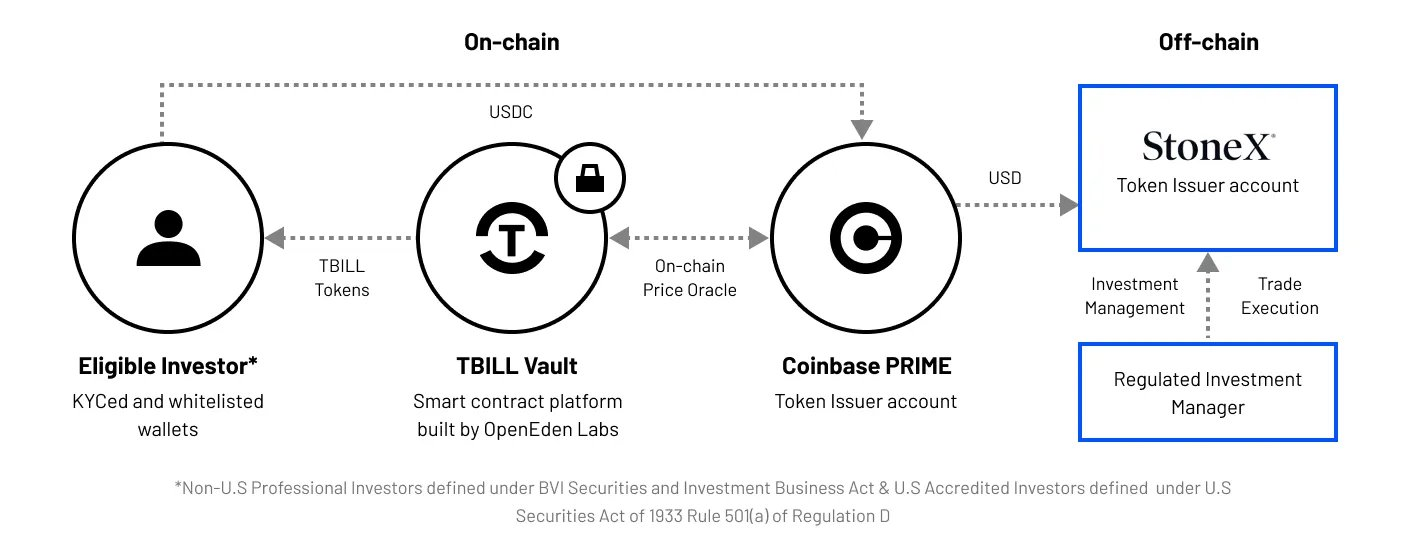

Real-World Assets: From Tokenized Treasuries to Tradable Risk Exposures

Project Progress: OpenEden launched the governance token EDEN (for governance, staking, incentives, and buybacks) and introduced a fully unlocked 7.5% treasury activity airdrop, along with HODLer rewards; GMX launched RWA perpetual contracts on Solana (covering SPY, QQQ, AAPL, NVDA, etc.); Dinari launched a compliant stock L1 on Avalanche for issuance, settlement, and transfer, governed by institutions Gemini, BitGo, and VanEck, aiming to become the backbone for cross-chain tokenized stocks.

Based on the above narrative, it can be seen that real-world assets (RWA) are evolving into a layered stack ecosystem:

Issuance Layer (Dinari provides compliant channels);

Yield Packaging Layer (OpenEden converts treasuries into programmable collateral);

Derivative Distribution Layer (GMX packages RWAs into the perpetual market).

The significance lies in that RWA tokens finally achieve a linkage between token design and real economic cash flows. Buybacks, staking dividends, and fee orientation can now be quantified and priced based on actual economic activities, rather than merely speculative narratives. With the introduction of institutional custody and governance, these products will transition from isolated experiments to replicable, trustworthy distribution channels.

Next Steps: Builders are expected to design basis trading between spot RWA yields and synthetic RWA derivatives or design tiered structured products that grade U.S. stocks based on different risk preferences of investors. Worthwhile directions include the clearing layer, which will unify multi-chain liquidity, compliance, and distribution into a repeatable standard. Meanwhile, RWAs are growing from a singular "tokenized treasury" phase into a complete parallel capital market that is regulated and composably scalable.

Key Points:

Full-Stack Moment: RWA now encompasses issuance (Dinari), yield packaging (OpenEden), and derivative distribution (GMX);

Income Design: Tokens guiding cash flows (buybacks/fees) can be priced based on actual activities, not just narratives;

Compliance Track: Institutional governance and custody will transform RWAs from point solutions into replicable distribution channels.

Hyperliquid/HyperEVM: From DeFi Playground to Institutional Settlement Layer

Project Progress: Compliant custodian Anchorage Digital will host HYPE on HyperEVM; Kinetiq collaborates with Anchorage to provide guarantees for kHYPE deposits; Squid adds HyperEVM bridging and HYPE/PURR/USDT0 cross-chain trading; HyperLend uses PT-kHYPE as collateral; Balancer announces expansion to HyperEVM.

The above narrative is all about upgrading the venue. HyperEVM and its ecosystem are transforming from a DeFi playground into a settlement venue where traders and institutions can safely store, transfer, and appreciate capital. As xTokens, liquid staking tokens, and perpetual contracts mutually reinforce each other, this ecosystem forms a self-circulating yield flywheel: liquidity generates yields, yields are tokenized into new assets, and these assets further deepen liquidity.

Key Points:

Institution-Ready: Qualified custody is key to unlocking vaults, funds, and listed entities;

Liquidity Depth: Blue-chip AMM (Balancer) + bridging liquidity (Squid) marks the venue upgrade;

Yield Stack: Through xTokens + LSTs + perpetual contracts, HyperEVM establishes a self-reinforcing yield cycle.

User Experience and Speed: On-Chain CeFi Level Experience

Project Progress: Coinbase has integrated Aerodrome for direct access to DEX; Sky has added batch trading (multiple operations with a single confirmation); Unichain's Flashblocks (achieving 200 ms sub-blocks through TEEs) and Puffer Finance's UniFi V2 (with confirmations under 10 ms and atomic exits) minimize delays; Sunrise has launched as an "Interliquidity" L1.

The CeFi-level user experience and speed are being replicated on-chain, with deeper implications for market quality. Faster execution speeds, prioritization, and atomic exits mean smaller spreads, less slippage, and more stable liquidity provider (LP) yields. This directly improves the economic efficiency of market-making and lending strategies, attracting larger capital allocators who previously left the market due to inefficiencies.

The inspired design space includes: market structures for specific applications, such as instant settlement for games with sub-second confirmations and modular rollups, real-world asset (RWA) trading without delays, and structured products that can create new conditional execution forms. The former limiting factor of "latency" is now becoming a differentiating factor.

Thus, DeFi is no longer just competing on yields but on experiences. The winners will be those protocols and blockchains that can narrow the user experience gap while retaining the composability that CeFi cannot match.

Key Points:

Conversion Rate Improvement: One-click, one-screen processes reduce retail churn and expand TAM;

Market Quality: Lower latency + prioritization = smaller spreads, more stable pricing, better LP economics;

Design Space: Faster finality combined with plug-and-play rollups will introduce application-specific market structures (e.g., gaming, RWA).

Non-Governance Security and Structured Risk

Project Progress: Aave's security module Umbrella has launched on DeFi Saver, featuring indicative yields (e.g., approximately 3.2% for ETH, 8-12% for stablecoins), with a 20-day cooling-off period and a 2-day withdrawal window; Strata has introduced a risk-layering mechanism on Ethena assets, providing options for users with different risk tolerances; Bedrock continues to expand BTC liquid staking (e.g., brBTC/uniBTC with OP incentives).

The narrative here is about the maturation of risk architecture. DeFi is transitioning from informal, patchwork protection mechanisms to structured, scalable systems:

Security modules act as insurance channels with transparent economics;

Layering mechanisms allow protocols to diversify their depositor base;

The depth of collateral supported by BTC and ETH liquid staking derivatives underpins structured yield products.

The end result is that what once seemed like a binary (secure until it is not) portfolio is being replaced by portfolios with tiered risk levels. Conservative investors can hold priority shares, while crypto natives can leverage secondary yields, allowing protocols to broaden their user base and benefit from wider participation. This is the yield of risk pricing, which makes it investable at scale.

Key Points:

Reliable Backing: Light governance security modules are becoming actual insurance channels for depositors;

Portfolio Construction: The layering mechanism makes it easier to sell priority shares to conservative buyers and leverage secondary notes for crypto-native yields.

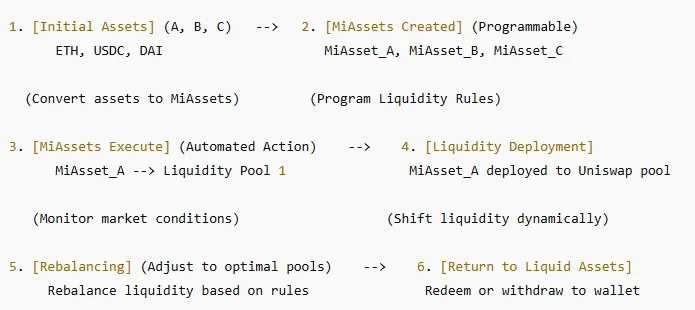

Programmable Liquidity Policies

Project Progress: Limit Break has launched LBAMM (programmable hooks for fees, access, and liquidity rules); Usual uses Bunni for efficient concentrated liquidity on Uniswap v4; Rabby Wallet supports fully decoded LP transactions; Shadow Exchange has added decentralized limit orders with TWAP.

The core concept here is "protocol as policy," which opens a new governance model: teams can predefine how capital interacts with their protocols, who can access the protocols, how pricing is determined, and how fees are adjusted in real-time.

The second-order effect is scalable capital efficiency. When $5 million can replicate the slippage of a $60 million pool, yields will significantly increase. This will change how LPs think about capital allocation and how protocols guide deep liquidity without paying excessive incentives. Thus, efficiency will become a moat.

This also indicates that AMMs are evolving from markets to institutions. They regulate, protect, and guide market capital. In this way, they become the de facto monetary policy of their ecosystems. In other words, programmable liquidity blurs the lines between code and governance, transforming AMMs into autonomous policy engines that set on-chain capital rules.

Key Points:

Protocol as Strategy: Hooks allow teams to execute fee schedules, access controls, and liquidity protections at the AMM layer;

Capital Efficiency: Matching $5 million in liquidity to the slippage of a $60 million pool is a design victory for yields.

Conclusion

The market is shifting from yield discovery to yield distribution. The winners will no longer be single-site dApps but more like supply chains: yield sources → yield packaging → yield routing → final buyers. The future winners of the DeFi yield market will be those protocols that can bridge the experience gap between CeFi and DeFi while providing structured risk management and liquidity governance policies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。