Original Title: "The Future of Trillion-Dollar Stablecoin Factories"

Original Author: Sleepy.txt

One of the largest online payment infrastructures in the world, Stripe, has launched a stablecoin issuance platform called Bridge, which has partnered with the wallet application MetaMask, boasting over 30 million crypto users, to issue a native stablecoin, MetaMask USD (mUSD).

Bridge is responsible for the entire issuance process, from reserve custody and compliance audits to smart contract deployment, while MetaMask focuses on refining the front-end product interface and user experience.

This collaborative model is one of the most representative trends in the current stablecoin industry, as more and more brands choose to outsource the complex issuance process of stablecoins to professional "factories," much like Apple entrusting the production of iPhones to Foxconn.

Since the birth of the iPhone, Foxconn has almost always undertaken the core production tasks. Today, about 80% of iPhones are assembled in China, with over 70% coming from Foxconn's factories. Foxconn in Zhengzhou once accommodated over 300,000 workers during peak seasons, earning the nickname "iPhone City."

The collaboration between Apple and Foxconn is not merely a simple outsourcing relationship but a typical case of modern manufacturing division of labor.

Apple concentrates its resources on the user side, such as design, system experience, brand narrative, and sales channels. Manufacturing does not provide it with a differentiated advantage; rather, it entails significant capital expenditure and risk. Therefore, Apple has never owned its factories but has chosen to hand over production to professional partners.

Foxconn has built core capabilities in these "non-core" areas, establishing production lines from scratch, managing raw material procurement, process flows, inventory turnover, and shipping rhythms, continuously compressing manufacturing costs. It has developed a complete set of industrial processes in terms of supply chain stability, delivery reliability, and production capacity flexibility. For brand clients, this means a foundational guarantee for frictionless expansion.

The logic of this model is division of labor and collaboration. Apple does not have to bear the fixed burdens of factories and workers, nor does it have to shoulder manufacturing risks during market fluctuations; Foxconn, on the other hand, extracts overall profits from very low unit profits through economies of scale and multi-brand capacity utilization. Brands focus on creativity and consumer reach, while factories take on industrial efficiency and cost management, creating a win-win situation.

This model has not only changed the smartphone industry. Since the 2010s, computers, televisions, home appliances, and even automobiles have gradually moved towards an outsourcing model. Manufacturers like Foxconn, Quanta, Wistron, and Jabil have become key nodes in the global manufacturing restructuring. Manufacturing has been modularized and packaged, becoming a capability that can be scaled and sold externally.

Years later, this logic began to be transplanted into a seemingly unrelated field: stablecoins.

On the surface, issuing a stablecoin only requires minting on-chain. However, to truly make it operational, the work involved is far more complex than outsiders imagine. Compliance frameworks, bank custody, smart contract deployment, security audits, multi-chain compatibility, account system integration, KYC module integration—completing these steps requires long-term investment in financial strength and engineering capability.

We previously detailed this cost structure in "How Much Does It Cost to Issue a Stablecoin?": If an issuing institution starts from scratch, the initial investment often reaches the million-dollar level, mostly consisting of non-compressible fixed expenditures. After going live, annual operating costs can even reach tens of millions, covering various modules such as legal, auditing, operations, account security, and reserve management.

Now, some companies are beginning to package these complex processes into standardized services, providing plug-and-play solutions to banks, payment institutions, and brands. They may not necessarily appear in the spotlight, but behind a stablecoin issuance, their shadows are often visible.

In the world of stablecoins, "Foxconns" are also beginning to emerge.

The "Foxconns" of the Stablecoin World

In the past, issuing a stablecoin almost meant simultaneously playing three roles: financial institution, technology company, and compliance team. Project parties needed to negotiate with custodial banks, build cross-chain contract systems, complete compliance audits, and even handle licensing issues in different jurisdictions separately. For most companies, such a threshold is too high.

The emergence of the "factory" model is precisely to solve this problem. The so-called "stablecoin factory" refers to institutions that specialize in providing stablecoin issuance, management, and operational services for other companies. They are not responsible for creating the final user-facing brand but provide a complete set of infrastructure needed behind the scenes.

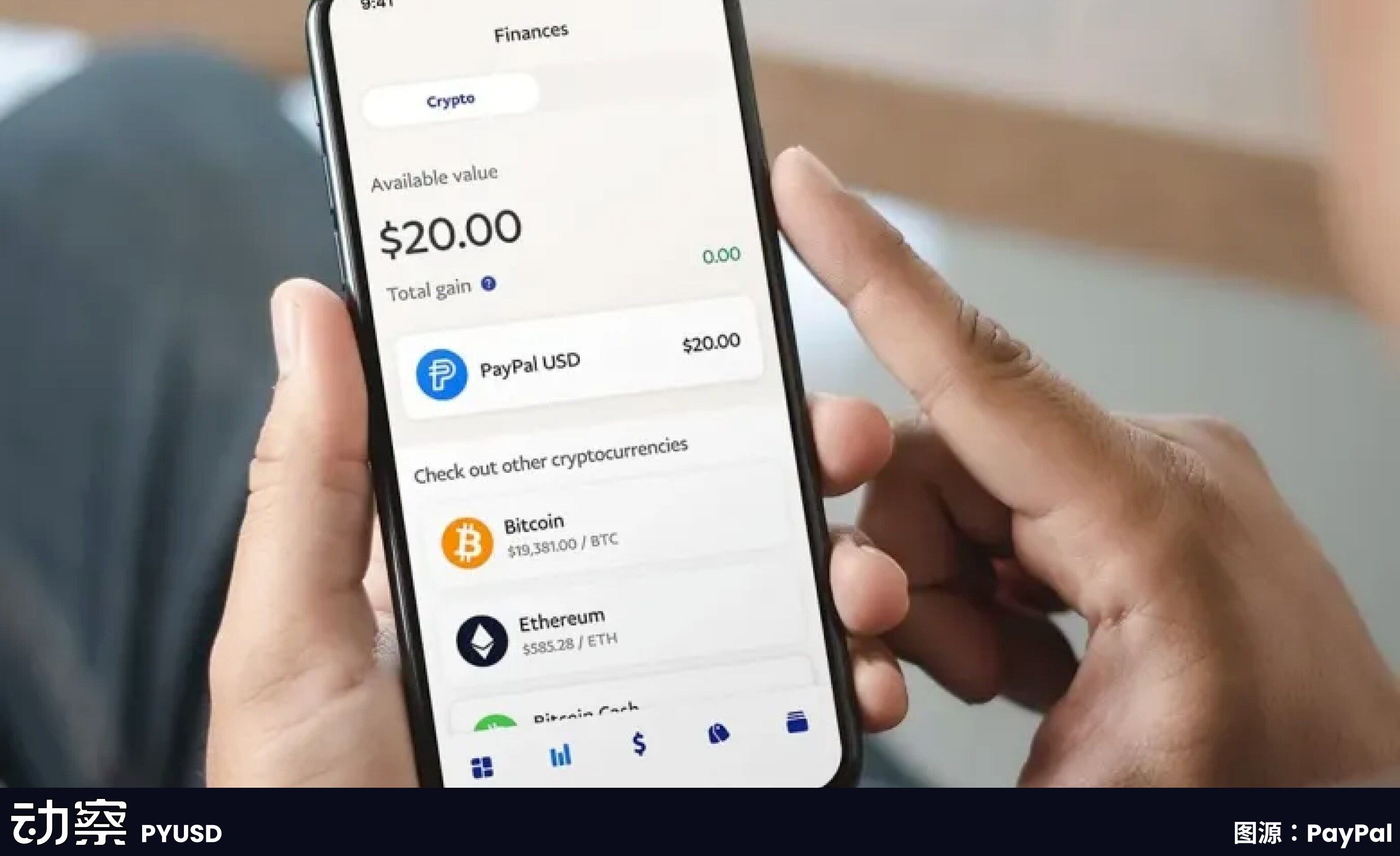

These companies are responsible for building a complete set of infrastructure from front-end wallets, KYC modules to back-end smart contracts, custody, and auditing. Clients only need to specify which type of coin to issue and in which markets to launch; other steps can be handed over to the factory. Paxos played such a role when collaborating with PayPal to issue PYUSD: it managed the dollar reserves, handled on-chain issuance, and completed compliance connections, while PayPal only needed to display the "stablecoin" option in its product interface.

The core value of this model is reflected in three aspects.

First is cost reduction. If a financial institution were to build a stablecoin system from scratch, the initial investment could easily exceed a million dollars. Compliance licensing, technology development, security audits, and bank cooperation each require separate investments. Factories can compress the marginal cost for individual clients to far below that of building in-house by standardizing the process.

Second is time reduction. The launch cycle for traditional financial products often spans "years," while a stablecoin project following a fully self-developed path could take 12–18 months to materialize. The factory model allows clients to launch products within a few months. Stably's co-founder has publicly stated that their API integration model can enable a company to complete the launch of a white-label stablecoin in a matter of weeks.

Third is risk transfer. The biggest challenge for stablecoins lies not in technology but in compliance and reserve management. The Office of the Comptroller of the Currency (OCC) and the New York State Department of Financial Services (NYDFS) have very strict regulatory requirements for custody and reserves. For most companies looking to test the waters, bearing all compliance responsibilities is unrealistic. Paxos has been able to secure major clients like PayPal and Nubank precisely because it holds a New York state trust license, allowing it to legally manage dollar reserves and assume disclosure obligations to regulators.

Thus, the emergence of stablecoin factories has, to some extent, changed the industry's entry threshold. The high upfront investments that only a few giants could previously afford can now be disassembled, packaged, and sold to more financial or payment institutions with demand.

1|Paxos: Turning Processes into Products, Making Compliance a Business

Paxos set its business direction early on. It does not emphasize branding or pursue market share but builds capabilities around one thing: turning the issuance of stablecoins into a standardized process that others can purchase.

The story begins in New York. In 2015, the New York State Department of Financial Services (NYDFS) opened digital asset licenses, and Paxos became one of the first licensed limited-purpose trust companies. That license is not just symbolic; it means Paxos can manage client funds, operate blockchain networks, and execute asset settlements. Few companies in the U.S. can obtain such qualifications.

In 2018, Paxos launched the USDP stablecoin, placing the entire process under regulatory oversight: reserves held in banks, monthly audit disclosures, and minting and redemption mechanisms written on-chain. Few have followed this approach due to high compliance costs and slow progress. However, it did create a clear and controllable structure, breaking down the birth process of a stablecoin into several standardizable modules.

Later, Paxos did not focus on promoting its own coin but packaged this set of modules into services for others to use.

Two of its most representative clients are Binance and PayPal.

BUSD is the stablecoin service Paxos provides for Binance. Binance controls the brand and traffic, while Paxos assumes the responsibilities of issuance, custody, and compliance. This model operated for several years until 2023, when the NYDFS required Paxos to stop new minting due to insufficient anti-money laundering reviews. After this incident, the public began to notice that BUSD was issued by Paxos behind the scenes.

A few months later, PayPal launched PYUSD, with the issuer still listed as Paxos Trust Company. PayPal has users and a network but lacks regulatory qualifications and does not intend to build its own. Through Paxos, PYUSD can be launched legally and compliantly in the U.S. market. This is a representative demonstration of Paxos's "factory" capabilities.

This model is also being replicated overseas.

Paxos obtained a major payment institution license from the Monetary Authority of Singapore (MAS) and based on this, issued the stablecoin USDG. This was Paxos's first complete process outside the U.S. It also established Paxos International in Abu Dhabi, focusing on overseas business, launching a yield-bearing dollar stablecoin USDL using local licensing to avoid U.S. regulation.

The purpose of this multi-jurisdictional structure is straightforward: different clients and markets require different compliant and feasible issuance paths.

In 2024, Paxos launched a stablecoin payment platform, beginning to undertake enterprise collection and settlement services, and participated in building the Global Dollar Network, aiming to connect stablecoins from different brands and systems to facilitate clearing. It seeks to provide a more complete backend infrastructure.

However, the closer it gets to regulation, the more susceptible it is to regulatory scrutiny. The NYDFS has previously pointed out its insufficient anti-money laundering due diligence in the BUSD project. Paxos was fined and required to submit rectifications. While this was not a fatal blow, it indicates that Paxos's path cannot be lightweight and lacks ambiguous space. It can only continuously strengthen compliance and clarify boundaries. It turns every regulatory requirement and security step into part of the product process. When others come to use it, they only need to attach their brand to issue stablecoins. The rest is handled by Paxos. This is its positioning and a business model deeply tied to technology and regulation.

2|Bridge: A Heavyweight Factory Brought by Stripe

The addition of Bridge marks the first appearance of a true giant in the stablecoin factory space.

It was acquired by Stripe in February 2025. Stripe is one of the largest online payment infrastructures globally, processing billions of transactions daily and serving millions of merchants. Compliance, risk control, and global operations—these paths that Stripe has already navigated are now being transplanted onto the blockchain through Bridge.

Bridge's positioning is straightforward: it provides complete stablecoin issuance capabilities for enterprises and financial institutions. It is not merely a technology outsourcing service; rather, it modularizes the mature segments of the traditional payment industry and packages them into standardized services. Reserve custody, compliance audits, and contract deployment are all managed by Bridge, allowing clients to simply call an interface to integrate stablecoin functionality into their front-end products.

The collaboration with MetaMask exemplifies this point. As one of the largest Web 3 wallets globally, it has over 30 million users but lacks the financial licenses and reserve management qualifications. Through Bridge, MetaMask can launch mUSD within a few months without spending years building a compliance and financial system.

Bridge's chosen business model is platform-based. It is not tailored for a single client but aims to build a standardized issuance platform. The logic is consistent with Stripe's approach in payments, lowering the threshold through APIs and allowing clients to focus on their core business. Just as countless e-commerce platforms and applications integrated credit card payments in the past, companies can now issue stablecoins in a similar manner.

Bridge's advantages stem from its parent company. Stripe has established a compliance cooperation network globally, facilitating Bridge's entry into new markets. Additionally, Stripe's built-in merchant network constitutes a natural pool of potential clients. For those looking to explore stablecoin business but lacking on-chain technology or financial qualifications, Bridge offers a ready-made solution.

However, limitations exist. As a subsidiary of a traditional payment company, Bridge may be more conservative than crypto-native enterprises, and its iteration speed may not be fast enough. In the crypto community, Stripe's brand influence is also not as strong as in the mainstream business world.

Bridge's market positioning leans more towards traditional finance and corporate clients. MetaMask's choice illustrates this point; it needs a trustworthy financial partner, not just a technology supplier.

The entry of Bridge signifies that stablecoin factories are gaining attention from traditional finance. As more players with similar backgrounds join, competition in this space will intensify, but it will also drive the industry towards maturity and standardization.

3|Stably: Building Lightweight Production Lines for the Mid-Market

Stably was founded in 2018 and is headquartered in Seattle. Like many similar companies, it started with the issuance of its own stablecoin, Stably USD. However, the market quickly proved that this path was difficult to break through. Competing with Tether and USDC seemed almost impossible, so Stably pivoted its focus to another blank space: helping others issue stablecoins.

Its business is directly stated on its homepage as a "white-label stablecoin issuance platform." This means that clients do not need a development team or to write contracts themselves; they can issue a stablecoin bearing their name within weeks simply by calling an API. The choice of blockchain, coin name, and brand symbols are all determined by the client, while Stably is responsible for connecting the backend systems.

This logic distinguishes it from Paxos. Paxos's path is compliance-heavy, requiring all reserves to enter a trust account managed by itself, with interest also going to Paxos. Stably's approach is much lighter. Reserves remain in the client's bank account as long as they meet custody standards.

Stably does not touch the funds and does not provide custody; its revenue comes from technology and operational service fees. This way, the reserve income is retained by the client, while the factory only collects "wages."

For many small and medium-sized institutions, this is crucial. The interest on reserves often far exceeds the income from issuance itself. If handed over to larger firms like Paxos, it would mean ceding that portion of revenue. Stably's solution allows clients to retain interest while quickly launching at a lower cost.

Speed is another selling point. Stably promises "launch within 2 months" and has demonstrated actual deployment cycles of 4 to 6 weeks in multiple cases. In contrast, Paxos often takes several months or longer. For payment companies or local banks that only want to conduct regional pilot projects, the difference in pace translates to a difference in cost.

Stably's client profile is clearly different from Paxos. Paxos serves global platforms like PayPal and Nubank; Stably targets the mid-market: regional financial institutions, cross-border payment providers, Web 3 wallet service providers, and e-commerce payment interface companies. They do not require top-tier compliance and do not plan to cover the globe immediately, as long as they can operate within their own scenarios.

From a technical implementation perspective, Stably has made blockchain compatibility broader. ETH, Polygon, BNB, Arbitrum, and Base are all within its support range. It continuously expands its network to ensure that clients can have ready-made interfaces for any blockchain they wish to issue on, laying out a lightweight, replicable template network.

However, limitations are also evident. Stably lacks endorsements from large clients, does not have strong regulatory qualifications, and does not possess sufficient brand recognition. It primarily attracts clients sensitive to speed and revenue but with lower compliance requirements. This means it struggles to take on truly large banks and payment giants, but it still has its own survival space in the mid-market.

The industry generally believes that potential issuers of stablecoins are not limited to giants. Besides names like PayPal and Binance, there are numerous second-tier payment institutions, regional banks, and B2B platforms that may not develop blockchain systems themselves but need stablecoins to run their businesses. Stably's existence provides these clients with a fast, cost-effective, and risk-bearing path.

If Paxos's value lies in establishing a heavy compliance production line, then Stably's significance is in proving that there is indeed another type of demand in the market; they do not seek the safest, most standardized system but rather a low-threshold shortcut for issuance.

4|Agora: A Lightweight Stablecoin Issuance Platform from Wall Street

Agora's story cannot be separated from its founder, Nick van Eck. Behind this name is the family background of the globally renowned asset management company VanEck. VanEck manages a large scale of ETF and fund assets and has long held a strong position in the traditional financial market. Nick emerged from this background, bringing traditional financial resources into the crypto space to establish Agora.

From the outset, Agora received support from top venture capital firm Paradigm. Paradigm is one of the most active crypto funds in the industry, having previously backed projects like Coinbase, Uniswap, and Blur. This investment signal quickly drew market attention to Agora, which has both Wall Street family resources and backing from Silicon Valley crypto capital.

Agora aims to solve not just the pain points of a single institution but the entry barriers for the entire industry. Its vision is straightforward: to make issuing stablecoins as easy as registering a domain name. For most companies, applying for licenses, building compliance frameworks, and developing smart contracts entail high financial and time costs. Agora offers a plug-and-play white-label stablecoin issuance platform.

Clients only need to decide on the coin type, brand, and use case; the remaining modules are already packaged: account systems, reserve custody interfaces, contract deployment and redemption logic, and information disclosure processes. Agora is responsible for connecting these steps, allowing clients to quickly generate a stablecoin as if opening a SaaS account.

Compared to Paxos's heavy compliance route, Agora's path is lighter, attempting to make stablecoin issuance a standardized service. It emphasizes not license advantages but the reduction of experience barriers. For potential clients, the advantages lie in fast launch and low costs, while the risks and compliance aspects are backed by Agora's backend.

This type of model is inherently attractive. There are many small and medium-sized payment companies, regional banks, and even e-commerce platforms in the market that have a demand for stablecoins but cannot build systems themselves. The interfaces provided by Agora turn these potential clients into possibilities.

However, there is still a long way to go between vision and reality. First, how compliance is implemented remains key. Stablecoins cannot legally exist solely based on the logic of registering a domain name. Regulatory requirements vary significantly across different markets, and for Agora to truly replicate its model, it must meet legal and financial requirements in multiple jurisdictions simultaneously.

Secondly, it does not yet have large-scale client cases in the industry; Paradigm's investment and Nick van Eck's surname are more of a potential endorsement.

In the established tracks of Paxos, Stably, and BitGo, Agora appears as a new challenger. It does not emphasize secure custody or accumulate licensing barriers but attempts to use a set of extremely simple interfaces to make issuance a public service. Whether it can succeed remains to be seen. However, from a vision standpoint, its goal points to another possibility in the stablecoin industry, making issuance a standardized business akin to domain name registration.

The Next Stop for Stablecoin "Outsourcing"

The stablecoin outsourcing model is still in its early stages, but it has already shown a trend: when issuance becomes an outsourced capability, the market's imagination extends beyond issuance itself to more commercial applications.

Cross-border payments are the most direct scenario. Today, most global cross-border transactions still rely on the SWIFT system, which is slow, costly, and cannot operate 24/7. Even among large banks, fund settlements can take several days.

The emergence of stablecoins provides a faster alternative. Through standardized interfaces provided by factories, regional banks or payment companies can quickly connect to stablecoin settlement networks, allowing corporate clients to make cross-border remittances in real-time. This means that financial infrastructure, once the domain of giants, may be opened up with lower thresholds.

Another potential direction is corporate cash management. For most companies, the flow and management efficiency of funds on their accounts have long been underestimated. If stablecoins can be embedded in corporate cash pools, they can bring new tools to supply chain finance, cross-border trade, and daily payments.

For example, companies can use stablecoins to allocate funds between different subsidiaries, reducing waiting periods and making fund statuses more transparent. The value of the factory model lies in enabling small and medium-sized banks and B2B platforms to provide such services more quickly without needing to build systems from scratch.

Market opportunities are also changing. In recent years, stablecoins have primarily been experiments for crypto-native enterprises. However, as regulations become clearer, traditional financial institutions are being drawn in. Banks, clearing networks, and regional financial platforms are beginning to explore embedding stablecoins within their systems.

For them, the risks of building in-house are too high, while the compliant modules and custody interfaces provided by factories are precisely the easiest way to enter. Once these clients come on board, the scale and use cases of stablecoins will be rapidly expanded.

From a technical perspective, cross-chain interoperability is a problem that must be solved in the coming years. Currently, stablecoins are still scattered across different blockchains and are incompatible with each other. For end users, this means trouble, as the same stablecoin may exist in two versions on Ethereum and BNB Chain.

Outsourcing factories are attempting to standardize cross-chain transfers and settlements, allowing assets on different chains to flow seamlessly. If this layer is opened up, the liquidity and application scope of stablecoins will see a qualitative improvement.

The business model will also evolve accordingly. Most outsourcing factories are still in the customization stage, with one client corresponding to one solution. However, as demand increases, standardized products will gradually replace high-cost custom services. Just as cloud computing initially started with hosting and privatization solutions, it later evolved into one-click SaaS platforms. The issuance of stablecoins will follow a similar trajectory, transitioning from high-threshold project collaborations to low-threshold productized calls. Lowering the threshold means more potential clients can enter the market.

In other words, future stablecoin outsourcing factories will not only help others issue stablecoins but will gradually build a global financial network. Their ultimate competitive edge will not only be in compliance and custody capabilities but also in who can embed stablecoins into real business chains faster and at a lower cost.

Conclusion

Foxconn did not design the iPhone, but it made the global proliferation of the iPhone possible. The role of stablecoin outsourcing factories is similar. They do not seek to establish independent brands but complete the most challenging work in the background, bringing a stablecoin from concept to reality.

In recent years, the threshold for issuing stablecoins has been continuously rising. Regulatory requirements are becoming more detailed, and compliance steps are increasing: license applications, reserve custody, cross-border disclosures, deployment and auditing of smart contracts… Any one of these steps could halt a project. For most institutions, directly entering the market means a budget of tens of millions of dollars, a preparation period of a year or even longer, and a policy environment that may change at any time. The significance of outsourcing factories lies in transforming these burdens into optional services.

This is also why PayPal chose Paxos, MetaMask partnered with Bridge, and companies like Agora have begun to offer white-label stablecoin issuance solutions. Their logic is akin to Foxconn's, breaking down complex processes into reusable modules through standardization and scaling. Clients only need to define the market and brand, while the rest is handled by the outsourcing factory.

As regulations gradually take shape, this track is gaining clearer market boundaries. The U.S. GENIUS Act and Hong Kong's stablecoin licensing system are both pushing "stablecoin issuance" out of the gray area and onto the institutional stage. Once the rules are clear, demand will grow even faster. Whether it is payment companies packaging dollars as on-chain assets or emerging market banks attempting to launch regional stablecoins, they may become the next batch of clients.

These "Foxconn factories of stablecoins" are becoming the invisible infrastructure of the financial foundation. They possess compliance templates, auditing standards, and cross-chain tools, controlling the pathways for digital assets to enter the real world. Just as Foxconn built an invisible hardware supply chain, stablecoin outsourcing factories are also constructing a production line for digital finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。