Original Author: 1912212.eth, Foresight News

"Cooperation" in the crypto field is the norm, and "conflict" is no exception. Recently, the proposal dispute between World Liberty Financial (WLFI) and Aave has attracted market attention. This incident originated from a seemingly mutually beneficial DeFi cooperation proposal but sparked a huge uproar due to information asymmetry and denial statements, leading to a short-term drop of over 8% in the price of AAVE tokens.

WLFI, an open finance project backed by the Trump family, intended to leverage Aave's DeFi infrastructure to expand its influence, but the dispute exposed the pain points of governance transparency in the crypto ecosystem.

Token Revenue Sharing Proposal Becomes a Bubble?

The WLFI project is set to launch in 2024, driven by members of the Trump family. Its total token supply is 100 billion, and as an emerging project, WLFI previously sought to collaborate with mature DeFi protocols to enhance liquidity.

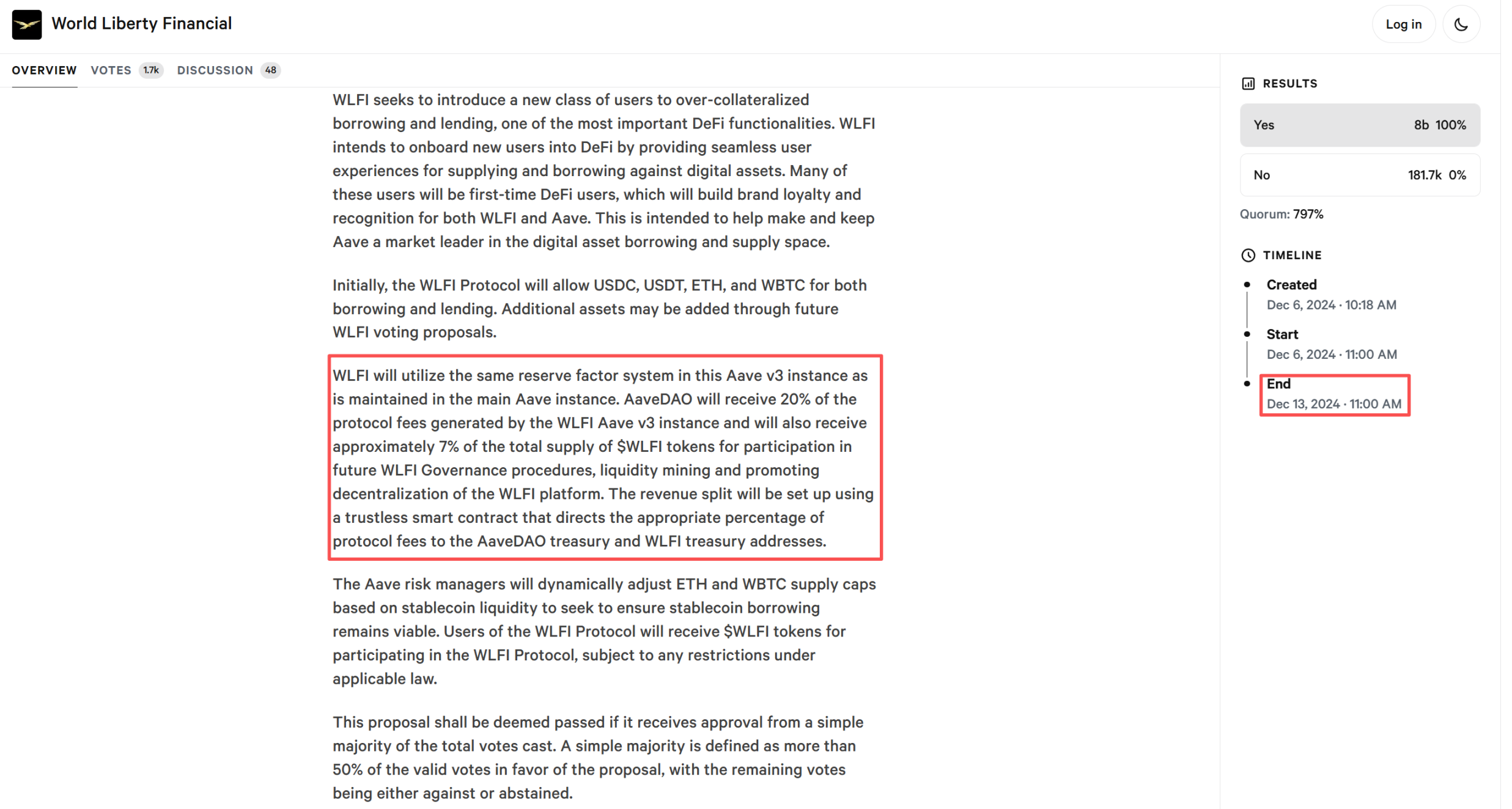

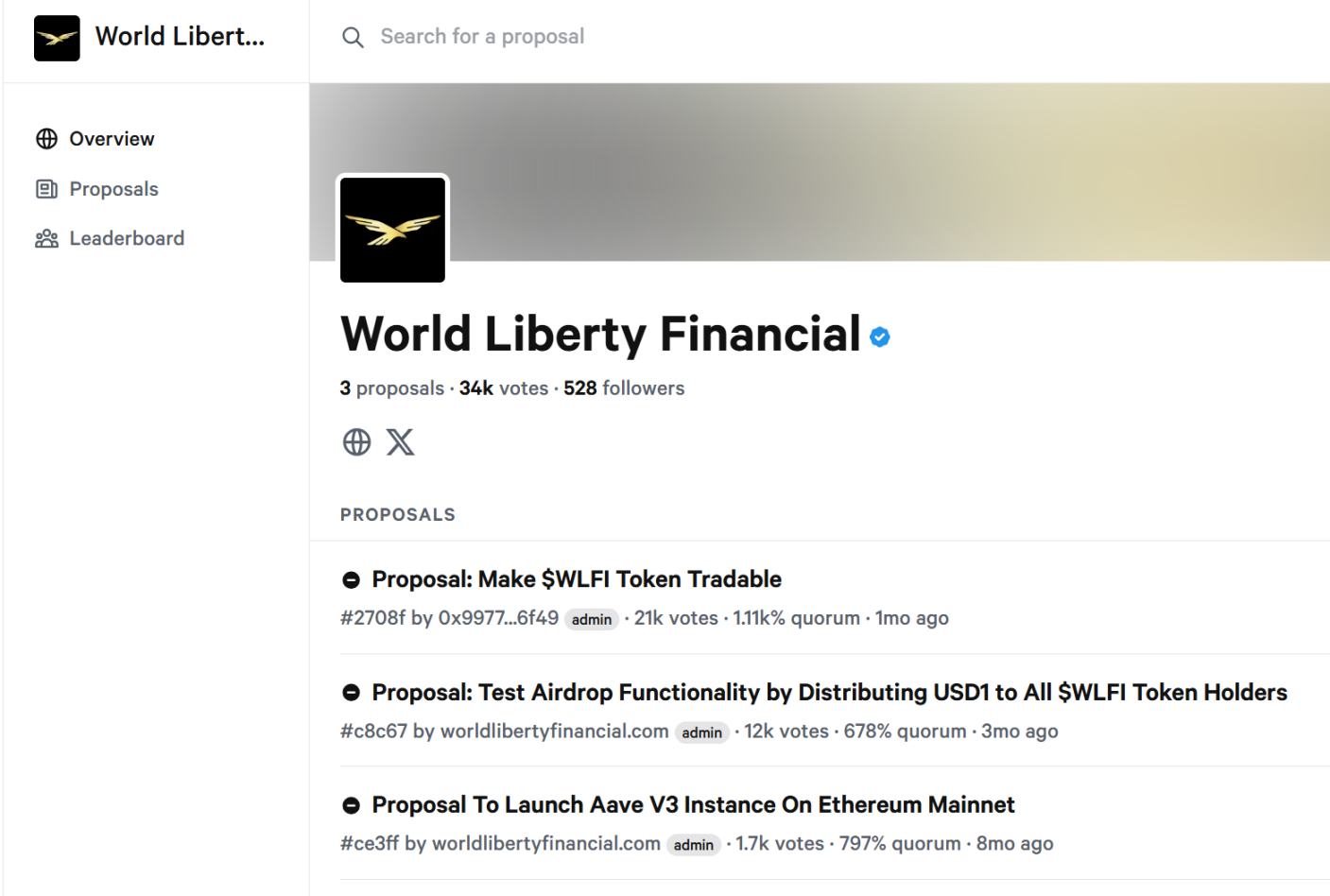

Previously, the Aave DAO (Decentralized Autonomous Organization) passed a proposal: WLFI would deploy its platform on Aave V3. In return, the Aave DAO would receive 20% of the fees generated by the WLFI protocol and approximately 7% of the total WLFI supply (i.e., 7 billion tokens).

This clause was initially seen as a positive—Aave, as a leading lending protocol, could inject new assets to enhance TVL, while WLFI could accelerate adoption by leveraging Aave's user base.

On August 23, Aave founder Stani.eth responded to questions about "Is the WLFI and AAVE protocol still valid? Are they really building on Aave? There are many different rumors outside" by stating that the protocol is still valid and publicly shared the view that "at the current price, the Aave treasury will receive WLFI worth $2.5 billion, making it one of the biggest winners in this cycle," calling it the art of the deal, after which AAVE surged to $385.

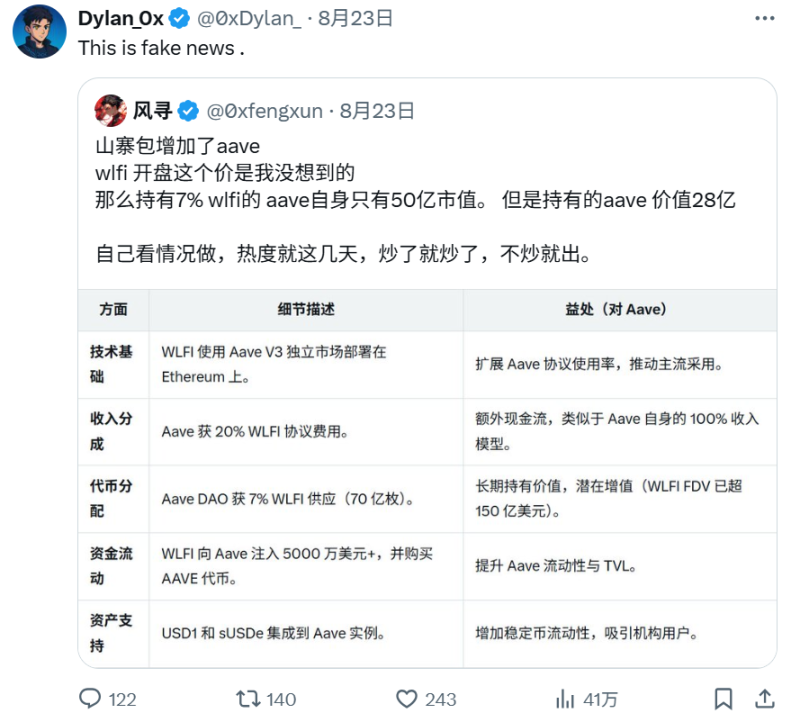

However, soon after, a suspected member of the WLFI Wallet team, Dylan0x (@0xDylan), posted to deny the proposal's association with "Aave will receive 7% of the total WLFI tokens," causing AAVE to drop 5% temporarily.

On August 24, the WLFI team told Wu said Blockchain that they denied the authenticity of the "7% token distribution," calling it "fake news." The WLFI official stated that while the proposal exists, the distribution terms are not factual and emphasized that the project's focus is on tokenization innovation rather than external revenue sharing.

Aave founder Stani.eth responded below his tweet, stating that the proposal created by the WLFI team had been voted on and passed in the Aave DAO, receiving approval from WLFI, and attached the proposal link.

As of now, the official WLFI account has not made a formal response to this matter, leading to various opinions in the market.

WLFI is set to launch on Ethereum on September 1, allowing for claiming and trading. Early supporters (at $0.015 and $0.05 rounds) will unlock 20%, while the remaining 80% will be decided by community voting. Tokens for the founding team, advisors, and partners will not be unlocked.

On September 25, according to Bitget market data, its pre-market price once reached $0.45, giving it a fully diluted valuation (FDV) of several billion dollars, which has now fallen back to $0.25. AAVE has also dropped below $350.

Does Governance Count?

The DAO governance dilemma has persisted since the last cycle.

Aave founder Stani.eth stated that the proposal is still valid, perhaps just a one-sided wishful thinking.

dForce founder Mindao commented on the matter, stating that the proposal "looks like it was written by a WLFI intern, completely unlike a deal that the Trump family would sign. Aave and Spark's cooperation only gave a 10% revenue share. WLFI has the Trump brand backing, so reasonably, Aave would have to subsidize a bit to make it justifiable. Even if WLFI was aiming for a public offering at the time, it wouldn't have come up with such poor terms. Later, with the new crypto policies taking off, WLFI issued USD 1, and the narrative jumped directly from 'crypto bank' to 'Aave + Circle,' with a 10x valuation. After all, Trump wrote the Art of the Deal; this kind of deal is absolutely disgraceful."

Additionally, Mindao speculated on the subsequent script: "WLFI completely abandons Aave, thus rendering the previous contract naturally void. A large-scale reduction in token distribution shares. Using the distribution to incentivize USD 1 lending minting, left hand and right hand, without loss, just consider it a targeted stablecoin minting operation subsidy."

Twitter KOL Laolu stated that if WLFI does not intend to give AAVE 7% of the tokens, it should not be surprising, "SPK defaulted on 10% of the revenue and only gave 1% in the end, and it ended up unresolved. WLFI said nice things during the public offering, now it has changed to partial unlocking."

Polygon and Aave Once Had a Similar Drama

In December 2024, a conflict erupted between Polygon and Aave, triggered by a proposal from the Polygon community: to use bridging funds (approximately $110 million) for yield strategies, such as staking rewards.

Aave contributor Marc Zeller opposed this, calling it a "risky strategy," and proposed that Aave withdraw support for Polygon to prevent fund misuse. Aave even adjusted the parameters of the Polygon lending platform, setting the LTV to 0, meaning that no matter how much was deposited, no loans could be taken.

Polygon founder Sandeep Nailwal accused Aave of "monopolistic behavior" and "sour grapes mentality," believing that Aave was trying to suppress competition and maintain its hegemony in the lending market.

The conflict escalated to private threats and public accusations, with Polygon CEO Marc Boiron and Zeller even betting: if Aave withdrew from Polygon, the latter would prove its independence.

Ultimately, the proposal was adjusted, and Aave did not fully withdraw, but the relationship remained tense. Polygon turned to develop a dual-token system (POL and MATIC) to enhance autonomy.

It is worth mentioning that in April 2021, Polygon (with a market cap of about $4 billion) offered $40 million worth of 1% MATIC to incentivize Aave (then with a market cap of about $6.5 billion).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。