"I don't want to be just a bystander; I want to participate personally."

Text: Nina Bambysheva

Translation: Lei&Rach

Vladimir Tenev first disrupted the fee model of the financial brokerage industry, and now, by actively embracing cryptocurrency, he has increased his wealth fivefold to $6 billion. He has reshaped global financial services through stock tokenization and AI-driven investments, and he is now focusing on the $124 trillion wealth that the "baby boomer generation" is about to pass on.

On the hillside of Cannes Bay sits a 25-acre estate—Château de la Croix des Gardes. This mansion, built in the "good old days," became famous for being the filming location of Alfred Hitchcock's movie "To Catch a Thief" and does not seem like a place that cryptocurrency financiers would visit.

However, on a sunny afternoon in June, Robinhood "requisitioned" this historically rich estate to host a cryptocurrency gala themed "To Catch a Token." The event was hosted by Johann Kerbrat, the general manager of Robinhood's crypto business, who resides year-round on the Côte d'Azur.

The gala opened with a cinematic scene: in a video, Robinhood co-founder and CEO Vladimir Tenev drove a midnight blue 1962 Jaguar E-Type convertible along the coastal mountain road, paying homage to Cary Grant's classic entrance in "To Catch a Thief." The scene gradually faded out, and Tenev appeared in a Tom Ford white pinstripe suit, paired with a black-and-white scarf, carrying a green briefcase, greeting over 300 invited guests. Ethereum founder Vitalik Buterin and executives from financial giants like JPMorgan, Mastercard, and Stripe were among the attendees.

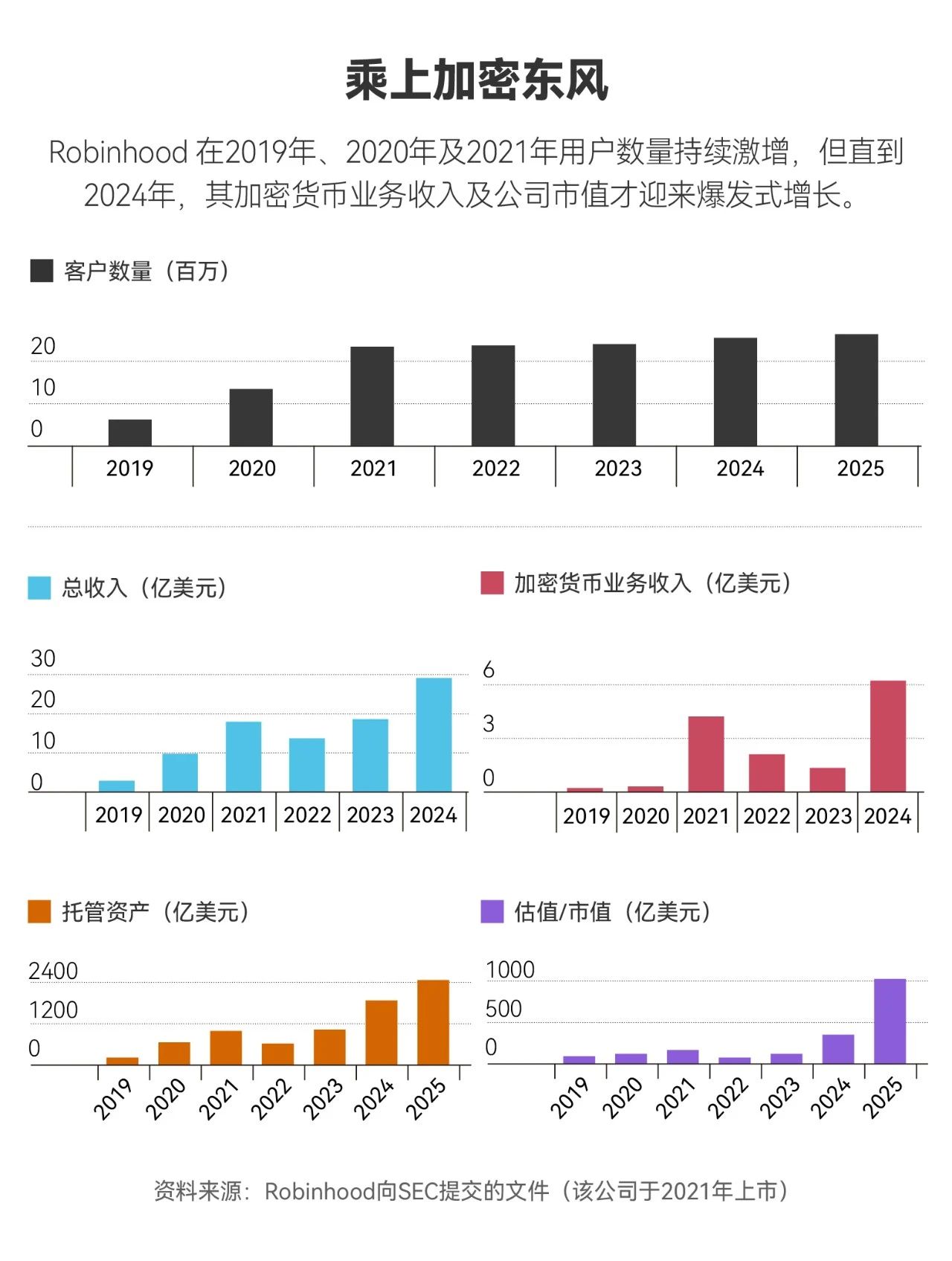

Such an extravagant affair was to be expected. Robinhood's stock price had soared to $111 per share, reaching an all-time high, up 384% from the previous year, directly boosting the brokerage's market value to nearly $98 billion, placing it among the top 250 most valuable companies in the world. In 2024, Robinhood is projected to achieve nearly $3 billion in revenue, $1.4 billion in profit, and $255 billion in assets under custody, with a net deposit growth rate of 44% over the past year. In terms of active or funded accounts, Robinhood, with 26 million accounts, is rapidly closing in on Charles Schwab's 37 million, while being three times the size of Morgan Stanley's E-Trade and six times that of Merrill Lynch. Meanwhile, Tenev's personal wealth has also surged fivefold in a year, reaching $6.1 billion.

Image source: GUERIN BLASK FOR FORBES

01

The 38-year-old CEO maintains a tight work schedule.

In late May, Tenev traveled to Las Vegas to explain to 35,000 Bitcoin supporters how cryptocurrency will further disrupt the global financial landscape through tokenization—transforming assets like stocks, bonds, and real estate into digital tokens that can be traded around the clock on blockchain networks. He then quickly flew to Tampa to attend a registered investment advisor conference, and a few weeks later, he appeared at Robinhood's luxurious Manhattan office to deliver a speech at the annual shareholder meeting. "This week I'm in New York, next I'll go to France, then to the UK," he recounted, detailing Robinhood's more than a dozen offices across Europe, America, and Asia. "I visit these offices at least once a year, and we are continuously expanding."

Tenev sports a short hairstyle and a goatee, resembling Errol Flynn's Robin Hood from the 1938 film. Although he still has a youthful appearance, this young leader speaks with the sophistication of a captain steering a financial giant. Emerging from the aftermath of the global financial crisis and the "Occupy Wall Street" movement, Robinhood has matured. The company is now targeting "digital natives," who prefer digital trading, hoping to become a one-stop financial service provider for them. According to Cerulli Associates, this group is expected to inherit about $124 trillion in assets over the next 20 years, primarily from their "baby boomer" parents.

Image source: MANDARIN ORIENTAL; ROBINHOOD

A week before the event at the French estate, Tenev elaborated on the planning concept behind Robinhood's event. "We have always been quick to innovate, and this event is a great opportunity to showcase our achievements to the world. We must think deeply about the story we want to convey behind each product, which can greatly inspire our team's motivation and enthusiasm."

This castle gala marked Robinhood's first global product launch themed around cryptocurrency, announcing several significant updates.

Starting in July, European users will be able to trade blockchain-based "stock tokens" on Robinhood. These non-voting financial derivatives will track the prices of hundreds of U.S. stocks and ETFs, including private tech giants like SpaceX and OpenAI, with commission-free trading available 24/5. Meanwhile, the cryptocurrency staking service for U.S. users—locking digital assets on blockchain networks like Ethereum and Solana to earn yields—will finally be permitted. After acquiring the Luxembourg-based crypto exchange Bitstamp for $200 million in June, European users will also be able to trade perpetual contracts for Bitcoin and Ethereum. To support the entire system, Robinhood is building its own blockchain.

"Our entire industry is at a critical moment," Tenev told the guests fanning themselves in the heat of southern France, "This is a great opportunity to prove to the world that cryptocurrency is not just a speculative asset; it has the potential to become the cornerstone of the global financial system. Our mission is to turn this potential into a reality."

02

To understand the transformation Tenev intends to initiate, it is helpful to review Robinhood's tumultuous past.

In 2013, Tenev and co-founder Baiju Bhatt, both Stanford graduates in physics and mathematics, realized that the time had come to disrupt the traditional financial world. After graduation, they developed software for top hedge funds that dominated Wall Street through high-frequency trading.

This experience allowed them to see up close the insatiable demand these funds had for trading volume and their willingness to pay for it. Meanwhile, a large retail investor base accustomed to paying $10 or $25 commissions per trade on traditional brokerage platforms like Charles Schwab, Fidelity, and Merrill Lynch could become an excellent source of trading volume. Thus, Tenev and Bhatt developed a mobile app designed for novice investors, which was easy to use, engaging, and eliminated minimum balance requirements and trading commissions, knowing that hedge funds would pay to execute these retail trades. They then promoted their zero-commission platform with the slogan "Let investing be accessible to everyone," as if launching a blockbuster video game.

Even before its official launch, the app had nearly 1 million pre-registered users on the Apple App Store. By September 2019, traditional brokerages like Charles Schwab, E-Trade, Fidelity, and TD Ameritrade (which was later acquired by Charles Schwab in 2020) began eliminating trading commissions, establishing Robinhood's "zero-commission" model as the new industry standard.

However, the good times did not last long. In early 2021, spurred by pandemic lockdowns and government stimulus checks, trading volume on Robinhood surged, but it also became the focal point of regulatory scrutiny during the trading frenzy of GameStop's "meme stock."

Driven by the Reddit forum WallStreetBets community, GameStop's stock price skyrocketed, completely ignoring its dismal fundamentals. This unprecedented volatility prompted clearinghouses to demand substantial margin from Robinhood, forcing Tenev to suspend buying operations for GameStop stock on the platform. This led to intense user dissatisfaction, and the platform faced a media backlash, congressional inquiries, and even scrutiny following the suicide of a young Robinhood options trader.

But this turmoil did not deter Tenev; instead, it clarified for him how outdated, closed, and inefficient the U.S. stock trading system was, reinforcing a long-held belief. "Honestly, is it possible for us to put stocks on the blockchain? I have always believed that the real value lies in achieving round-the-clock trading," he said.

Initially, Robinhood attempted to extend trading hours by partnering with the alternative trading platform Blue Ocean in West Palm Beach, but ultimately to no avail. "I didn't realize how difficult it would be to change these core infrastructures; so much of the operation relies on them. I really underestimated it," Tenev admitted.

At the same time, the head of the company's crypto business, Kerbrat, was exploring other paths to realize Tenev's vision. Under the Biden administration, U.S. regulators have maintained a cautious stance toward digital assets, so Kerbrat's team chose to experiment in Europe, where the regulatory framework is clearer. Tenev stated, "Sometimes, building new infrastructure from scratch is actually easier. We believe this technology can expand to any jurisdiction globally, and we are confident that we can promote it worldwide in the future." He understands that as millions of investors around the world begin trading U.S. stocks like they trade "meme coins," Robinhood's trading volume will also experience exponential growth, bringing in a continuous stream of profits.

03

While Kerbrat delves into asset tokenization in Europe, Robinhood is quietly reshaping itself elsewhere.

In March 2024, co-founder Baiju Bhatt, whose net worth had reached $6.7 billion, left the company (having previously stepped down as co-CEO in 2020) to pursue a new venture in space solar energy. Although the user lawsuits stemming from the GameStop incident have not completely subsided, Tenev is fully pushing for the launch of a series of new products—including Individual Retirement Accounts (IRAs), high-yield savings accounts, a 3% cashback credit card (with 3 million pre-registered users), on-demand cash delivery private banking services, and complex options tools that were previously exclusive to institutional investors. As Brett Knoblauch, general manager of Cantor Fitzgerald, stated, Robinhood is transforming into "a universal device that captures all trading opportunities."

This rapid series of product launches mirrors Tenev's own pace of life.

After a moment of reflection, the Bulgaria-born founder shrugged his shoulders, revealing a hint of helplessness: "My daily routine is to wake up, work, eat, exercise, and sleep. My wife doesn't like me saying this, but I do enjoy integrating work into my life, making the two one."

Tenev admitted that during Robinhood's explosive growth, he did not fully anticipate how this "zero-threshold" trading approach would resonate so deeply with entrepreneurial spirit.

Last year, the company held a private event in Miami, where top users included not only self-taught day traders but also small business owners and startup founders—facing the market, they maintained the same "do-it-yourself" mentality they had when starting their businesses. He believes this strong sense of autonomy is Robinhood's true moat: "Entrepreneurs don't like to rely on others. They prefer to do things themselves." Robinhood's products are tailored for this group of individuals who desire to take control of their wealth.

Tenev plans to conquer the new generation of investors in three phases.

The first phase aims to win over the active trader market, where investment returns are immediate, as evidenced by Robinhood's current impressive performance. In the medium term (about five years), the goal is to comprehensively cover users' asset management ecosystem, from credit cards and cryptocurrencies to mortgages and individual retirement accounts. The third phase will build a top-tier global financial ecosystem centered around Robinhood's own blockchain. "The scale of the third phase will far exceed the first two phases," Tenev stated while preparing for the next shareholder meeting, "Progress will be slow at the beginning of the opportunity, but over time, the effects will compound and amplify."

Tokenization may be Robinhood's grand vision, but its core cryptocurrency business is already gaining momentum.

In 2024, Robinhood's cryptocurrency business revenue reached $626 million, a significant increase from $135 million a year earlier, accounting for more than one-third of total trading revenue. By the first quarter of 2025, its crypto revenue had reached $252 million. Rob Hadick, a general partner at crypto venture firm Dragonfly, stated, "They are eating Coinbase's lunch in the U.S. market." Cantor Fitzgerald analyst Knoblauch noted that in May 2025, Robinhood's crypto trading volume grew by 36% month-over-month, while Coinbase experienced a decline. He acknowledged that although Coinbase still dominates the institutional client market ("their services are broader and include custody functions"), after Robinhood's acquisition of Bitstamp in June, it gained 5,000 institutional accounts and additional licenses in Europe and Asia.

Tenev and Kerbrat insist that Robinhood's operating model is fundamentally different from that of crypto exchanges like Coinbase. Kerbrat stated, "In this industry, people always talk about which layer of (blockchain) technology is superior, but they completely overlook the end user. We are not developing technology to show off; we want to create something that people can use every day, allowing them to truly feel the advantages of this over traditional financial systems."

Micky Malka, founder of Ribbit Capital and an early investor in Robinhood, Coinbase, and its European competitor Revolut, stated that focusing too much on the competitive landscape between Coinbase and Robinhood is shortsighted. He bluntly said, "In my view, the core issue in the next decade is how much market share they can capture from traditional financial institutions, rather than the battle between these two companies."

Knoblauch estimates that Robinhood's current $255 billion in assets under custody will match Interactive Brokers (which currently has client assets of $665 billion) within seven years. The next target for surpassing will be Charles Schwab, as this analyst calculates that Robinhood has been capturing market share from this traditional brokerage for 14 consecutive months.

04

Tenev is equally firm in his attitude toward business diversification.

Robinhood was once criticized for its over-reliance on payment for order flow (PFOF), a model that heavily depended on high-frequency trading volume and the most aggressive hedge funds on Wall Street. Although trading still accounts for 56% of its revenue (down from 77% in 2021), John Todaro, managing director at Needham & Company, pointed out that Robinhood has now laid out ten business lines, each expected to achieve over $100 million in revenue within two years.

Take Robinhood Gold, for example. It initially offered a membership service for $5 per month or $50 per year, providing margin trading access, professional research reports, and a small amount of balance yield, but it has now evolved into the core of Tenev's powerful subscription model. Current member benefits include a 4% yield on cash in brokerage accounts, interest-free margin loans up to $1,000, and a 3% contribution subsidy for individual retirement accounts. The newly launched Robinhood Gold credit card offers 3% cashback on all purchases and has already been issued to the first 200,000 customers. Knoblauch stated, "If the Gold user base reaches 15 million, annual subscription revenue will approach $1 billion. This marks a shift in the company's business model from being highly cyclical to stable recurring revenue, thereby diversifying the overall revenue structure."

Additionally, Robinhood has launched "Robinhood Strategies." This new human-machine collaborative intelligent advisory product, led by Tenev, targets the $60 trillion U.S. wealth management market dominated by traditional giants like Morgan Stanley and Merrill Lynch. The service charges an annual management fee of only 0.25%, with a cap of $250 on the annual fee for Robinhood Gold members, allowing users to receive customized stock and ETF portfolios managed by algorithms with human oversight. Since its launch in March, this disruptive platform has attracted $350 million in investments.

Tenev likens the company's new product development model to a scientific experiment—empowering small teams within Robinhood to validate hypotheses and directly obtain real-time user feedback on innovative solutions through social media channels.

Tenev stated, "Many companies just follow external trends and then copy a set of practices, doing some competitive benchmarking. We launch new products or features because we enjoy exploring and solving problems ourselves." The recently launched mortgage loan business—currently offering a fixed rate of 6.1% for 30 years with a $500 closing cost subsidy—originated from a secret online pilot that started in June. "Once the news leaked, it quickly swept through social media, and later I tweeted to acknowledge that we were conducting a pilot; that tweet might be the most popular one I've had this year."

Tenev's tokenization strategy has a bit of a "moonshot" quality.

Many crypto regulations are still under discussion in the U.S. Congress, while they have already been implemented in Europe, making Europe a testing ground for Robinhood. He explained, "The experiment we are conducting in Europe is: what would it look like if we completely rebuilt Robinhood based on a crypto underlying architecture? After that, we will evaluate the pros and cons and bring the essence of the EU version to the U.S. and other global markets."

Currently, the scale of stock tokenization is still very small. The emerging platform xStocks under Switzerland's Backed Finance is still a new entity but has already taken a leading position in the industry, having tokenized stocks of over 60 well-known public companies, including Apple and Amazon, and launched trading on major crypto exchanges like Kraken and Bybit. However, xStocks' daily trading volume is still less than $10 million. This model carries numerous structural risks: these tokens are essentially derivatives backed by off-chain assets, meaning that when regular corporate actions such as dividends or stock splits occur, or when other events happen during market closures on weekends, it could lead to collateral calculation chaos and even the risk of involuntary liquidation.

Hadick from Dragonfly pointed out, "Market makers must take on this risk, but how can they hedge that risk when the market is closed? If they take on this risk, they can only significantly widen the bid-ask spread and charge high fees. The current off-chain infrastructure is still inadequate, and on-chain products are not yet mature… I worry that these early-stage products will ultimately become useless."

Despite this, it has not deterred other participants from entering the market.

In June of this year, the Winklevoss brothers' Gemini launched a tokenized trading service for MicroStrategy stocks for EU clients. Reports indicate that Coinbase is seeking approval from the U.S. Securities and Exchange Commission (SEC) to launch tokenized stock services, and even Larry Fink, CEO of BlackRock (with $12.5 trillion in assets under management), has urged the SEC to approve the tokenization of stocks and bonds. Robinhood is even more aggressive—beyond publicly traded stocks, its tokenization efforts have extended to private companies, recently announcing the launch of tokenized stocks for two companies valued at over $300 billion, OpenAI and SpaceX. OpenAI subsequently issued a statement distancing itself, emphasizing that the company has never authorized or recognized such tokens. Hadick warned, "No founder wants to see their equity circulating on-chain, especially in the hands of people they don't know at all."

05

In the face of skepticism, Tenev is already battle-hardened.

He admitted, "This system still has a bit of sediment," using a derogatory term from the programmer community to refer to software that is cluttered with unnecessary or outdated code. "Major brokerages do not want to easily let us siphon off their stock resources. But what if self-custody becomes a reality in the future? Once you can tokenize stocks and hold them yourself, you completely break free from the brokerage system—just like loading a crypto wallet on MetaMask, Robinhood, or Coinbase, in the future, you will be able to seamlessly hold and trade stocks through any trading interface in almost all scenarios."

This is why Tenev is so determined to make Robinhood the "only tool" for young users to handle all their financial affairs. In the retail financial services sector, the power of user inertia is second only to the effect of compound interest. Customers are inherently sticky, but Tenev knows that as the "baby boomer generation" transfers trillions of dollars to their digital-native descendants, traditional financial giants like Fidelity, Charles Schwab, and Merrill Lynch are showing defensive weaknesses. In fact, he believes that the biggest competitors are not institutions like Coinbase or Fidelity, but tech companies like Anthropic and OpenAI: "These companies act the fastest and do the most interesting things. However, it is still too early to assert that ChatGPT will disrupt the financial industry."

As an early investor in Robinhood, Malka is regarded by Tenev as a mentor. According to Forbes, his company has profited over $5 billion through its holdings. This investor does not hide his admiration for Tenev: "Robinhood has a leader who is under 40, possesses an innate AI mindset, understands AI development trends, is well-versed in tokenization technology, and can skillfully apply these two strategies—such individuals are rare. We have just built the infrastructure and are about to witness the 'internet moment' in the financial realm, where anyone in the world can use the same financial product for savings. As credit assessment systems become more accurate and efficient, the cost of loans will also decrease. All of this will become a reality."

Tenev firmly believes that Robinhood will ultimately replicate and enhance the services of high-net-worth family offices through AI agents, realizing the vision of a "family office in your pocket."

AI occupies a central position in Tenev's blueprint. The former math PhD candidate has recently personally co-founded the AI startup Harmonic and serves as its chairman. He co-leads the company with computer scientist Tudor Achim, who previously led the autonomous driving startup Helm.ai.

Tenev thoughtfully remarked, "If a mobile app could solve the Riemann Hypothesis or other millennium math problems, it would be extraordinary." He is referring to some of the most profound unsolved mysteries in mathematics, saying, "I don't want to be just a bystander; I want to be involved."

Wall Street titans like Jamie Dimon, Larry Fink, and Ken Griffin should take note.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。