1. Market Observation

Federal Reserve Chairman Jerome Powell's speech at the Jackson Hole central bank conference has paved the way for market expectations of a rate cut in September, but he emphasized that the final decision will still depend on upcoming economic data. Traders in Goldman Sachs' fixed income department believe Powell's remarks have signaled a green light for a rate cut, especially in the context of recent employment data revisions that have raised the Fed's concerns about downside risks in the labor market. Goldman Sachs noted that if August's non-farm payroll growth is below 100,000, it would provide decisive support for a rate cut in September, and they predict that regardless of whether the economy slows or normalizes, the current rate cut cycle by the Fed is likely to end in the first half of 2026.

Investor sentiment has significantly shifted, with the market focus changing from "whether to cut rates" to "the pace and magnitude of rate cuts." CME tools show that the probability of a rate cut in September has reached 85%. Historical data indicates that the stock market often benefits after the Fed pauses rate hikes and then cuts rates; Carson Group strategist Ryan Detrick pointed out that in the past 11 such instances, the S&P 500 index rose in 10 of them over the following year. However, future data such as PCE and CPI could still introduce variables into the decision-making process.

Bitcoin fell to around $110,000 early this morning, likely due to a whale selling 24,000 BTC. Analyst Willy Woo noted that the slow price increase of Bitcoin in this cycle is related to early whales who built positions at extremely low costs (below $10) in around 2011 and are now continuously selling. Currently, selling one BTC requires over $110,000 in new capital to absorb, creating significant market pressure. Additionally, technical analysts have differing views on the market outlook; crypto analyst KillaXBT believes that Bitcoin's structure is bearish on lower time frames and needs to reclaim the weekly opening price of $113,400 to validate further upside, otherwise it may face the risk of retesting lows. He also pointed out a potential "gap" around $116,800 that could be tested. Meanwhile, analysts Rekt Capital and Daan Crypto Trades both emphasized that $114,000 is a key level for weekend closes (the weekend closing price for Bitcoin was $113,493).

On the Ethereum front, market sentiment is relatively positive. Arkham data shows that some Bitcoin whales are swapping BTC for ETH, indicating strong demand. Analysts have provided different levels of predictions for price movements; analyst Michaël van de Poppe warned investors to be cautious of weekend market traps (as gains on weekends often retrace back to Friday evening's starting point on Monday) and predicted that if the market retraces, the $4,100 to $4,200 range would be an ideal accumulation area, after which it may again challenge historical highs. Analyst Stoic is closely monitoring the price reaction in the $4,590 to $4,600 range, considering it a key point for controlling market trends. More optimistic analyst BitBull stated that if Ethereum's closing price this week can hold above $4,600 (the weekend closing price for Ethereum was $4,780), it would confirm that it is not a "bull trap" and lay the foundation for a target price of $5,200 to $5,500 this week. However, some analysts remain cautious; 0xENAS indicated that its target price of 0.04 for the ETH/BTC trading pair has been reached, marking a shift in its trading strategy to a more conservative approach.

Overall, BitMEX CEO Arthur Hayes predicts that the cryptocurrency bull market will continue until 2028, driven by changes in U.S. stablecoin policy. Analyst Pentoshi believes that while the likelihood of SOL reaching a new high against ETH in this cycle is low, it is expected to rebound to around $250 against the dollar. Additionally, Luca Netz, CEO of the NFT project Pudgy Penguins, revealed that the project is expected to achieve record revenues of $50 million this year and hopes to go public before 2027. Furthermore, the $WLFI token generation event contract has been fully deployed, with trading scheduled to start on September 1 at 8 PM, and users must "activate their accounts" to receive tokens.

2. Key Data (as of August 25, 12:00 HKT)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars)

Bitcoin: $112,535 (YTD +20.29%), daily spot trading volume $4.2572 billion

Ethereum: $4,705.87 (YTD +41.02%), daily spot trading volume $4.1462 billion

Fear and Greed Index: 46 (Neutral)

Average GAS: BTC: 1 sat/vB, ETH: 0.34 Gwei

Market share: BTC 57.2%, ETH 14.5%

Upbit 24-hour trading volume ranking: ETH, SOL, XRP, QTUM, BTC

24-hour BTC long/short ratio: 47.29%/52.71%

Sector performance: The crypto market faced a setback, with the RWAI sector down 4.37% and the NFT sector down 3.24%

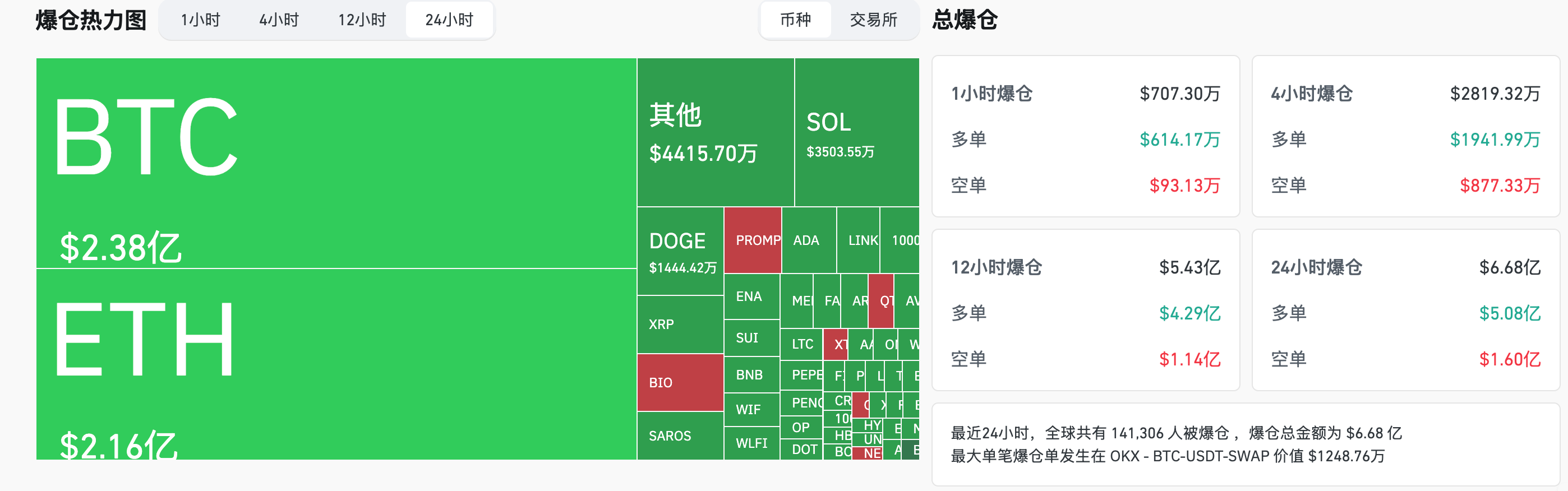

24-hour liquidation data: A total of 141,306 people were liquidated globally, with a total liquidation amount of $680 million, including $238 million in BTC, $216 million in ETH, and $14.44 million in DOGE

BTC medium to long-term trend channel: Upper line ($116,847.65), lower line ($114,533.83)

ETH medium to long-term trend channel: Upper line ($4,525.95), lower line ($4,436.32)

*Note: When the price is above the upper and lower lines, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (as of August 22)

Bitcoin ETF: -$23.1492 million, continuing six days of net outflows

Ethereum ETF: +$341 million

4. Today's Outlook

Binance Wallet Bonding Curve version TGE will launch on August 25 for OVERTAKE (TAKE)

Binance Alpha will launch Multiple Network (MTP) on August 25

Bio Protocol's first Ignition Sale project Aubrai will launch on August 25

Venom (VENOM) will unlock approximately 59.26 million tokens at 4 PM on August 25, accounting for 2.34% of the current circulation, valued at approximately $8.9 million;

AltLayer (ALT) will unlock approximately 240 million tokens at 6 PM on August 25, accounting for 6.01% of the current circulation, valued at approximately $8.5 million;

Sahara AI (SAHARA) will unlock approximately 84.27 million tokens at 8 PM on August 26, accounting for 3.97% of the current circulation, valued at approximately $7.3 million;

Huma Finance (HUMA) will unlock approximately 378 million tokens at 9 PM on August 26, accounting for 23.38% of the current circulation, valued at approximately $10 million;

Today's top gainers in the top 100 by market cap: VeChain up 4.4%, Hyperliquid up 3.8%, Story up 3.4%, Monero up 2.1%, Algorand up 2%.

5. Hot News

This Week's Macro Outlook: Don't Get Too Excited About Rate Cuts, Don't Panic About PCE

OKX Star: A $100 million X Layer ecosystem fund will be launched

WLFI public offering participants hold a total of 4.63%, TGE unlocks 20% worth $264 million

Stargate DAO has approved LayerZero's acquisition of Stargate (STG)

Trend Research has increased its holdings of 28.21 million NEIROETH, now holding 67% of the total

Story Foundation has launched a $82 million public market repurchase plan for $IP

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。