IRS Update: Secure Your $7500 EV Credit Even If Delivery Is Delayed

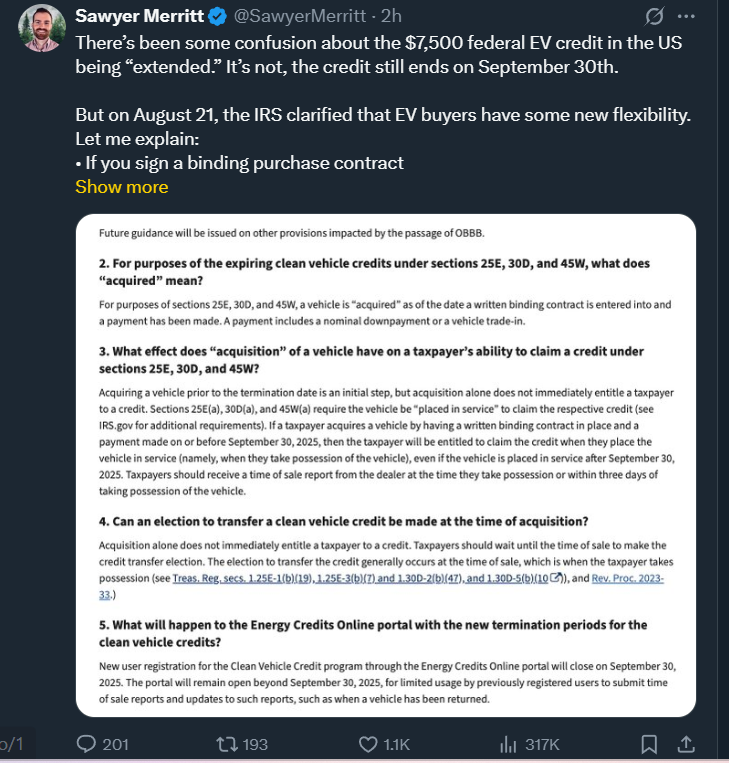

In the recent update, the U.S. Internal Revenue Service (IRS) has clarified the rules for the $7,500 federal electric vehicle (EV) tax credit, putting an end to confusion about whether the incentive has been extended. As opposed to speculations, the credit will still technically expire on 30 September 2025, as stipulated in the One Big Beautiful Bill Act (OBBB).

However, in an important update on 21 August 2025, the IRS said that purchasers are still eligible to claim the credit provided they enter into a binding purchase contract and pay (even a small down payment or trade-in) before the September 30 deadline. Notably, the vehicle is not required to be delivered before that date.

Source: Sawyer Merritt X

How the New Guidance Works

The updated guidance (FS-2025-05) provides a clear framework:

-

Eligibility lock: Paying before Sept. 30 will lock in eligibility with a written binding contract.

-

Late delivery is permitted: You can claim the credit even though the EV arrives weeks or months later.

-

CDelivery credit: It is not received when the contract is signed, but when the vehicle is put in service (delivered to you).

-

Dealer responsibility: The dealer should provide the dealer at delivery a time of sale report confirming eligibility to receive the credit.

This flexibility is particularly useful to buyers who place orders for custom-made vehicles or cars that are shipped to them by out-of-state dealers, whose delivery is often delayed.

Source: X

Impact of the OBBB Law on Energy Credits

The IRS guidance stems from the OBBB law passed on July 4, 2025, which accelerated the termination of several energy-related credits and deductions. Some of the earliest expiring provisions include:

Section 25E – For previously-owned clean vehicles, expiring Sept. 30, 2025.

Section 30D – New clean vehicle credit, expiring Sept. 30, 2025.

Section 45W – Qualified commercial clean vehicle, expiring Sept. 30, 2025.

Others, such as home energy efficiency improvements (25C) and the residential clean energy (25D), expire at the end of 2025, while tax incentives for charging stations (30C) and energy-efficient construction (45L, 179D) will run until mid-2026.

Why the Update Matters for EV Buyers

Previously, there was concern that buyers who signed contracts but faced delivery delays would lose access to the EV credit after Sept. 30. This was especially risky because a 2022 Treasury Department report concluded that about 15% of EV buyers experience delays. This may be caused by production shortages or shipping limitations.

The IRS has created certainty by explaining that eligibility is based on the contract date and not the delivery date. It eliminates a last-minute rush in the EV market. Such a move would assist in keeping the EV adoption pace going in the U.S. Even globally, the International Energy Agency’s 2021 EV Outlook showed that policy flexibility supported up to 35% growth in EV sales in countries like Japan. Do you know that Crypto Division head Trish Turner resigned from The RS ? If Not. See the update now.

What Buyers Should Do Now

In case you are intending to buy an Electric vehicle and wish to explore the benefits, then you need to consider the following factors.

-

Act fast- Sign a contract before September 30.

-

Any payment can be made- even a little down payment or trade-in will do.

-

Ask your dealer to confirm this to you. Ask your dealer to give you the necessary “time of sale” report when you receive the delivery.

-

Stay informed – IRS FAQs may be updated, so check IRS.gov for the latest details.

Conclusion

The Electric vehicle credit is still set to expire on September 30, 2025, but thanks to the IRS clarification, buyers can lock in eligibility before the deadline—even if delivery happens later. Go through the latest crypto market news for further updates on cryptocurrency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。