The Crossroads of Western Union's Digital Currency: Decline or Rebirth?

Author: Stablecoin Blueprint

Translated by: Deep Tide TechFlow

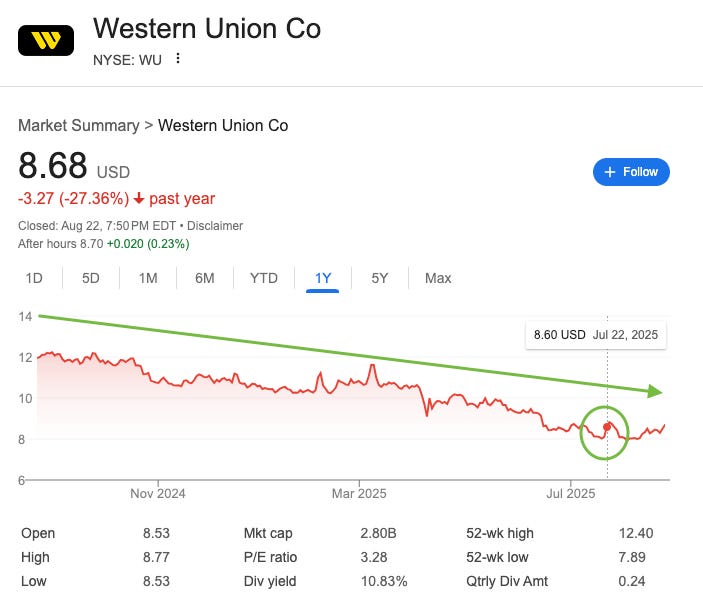

On July 22, Western Union seemed to welcome a long-awaited ray of hope. After its CEO mentioned in a Bloomberg interview that the company would delve into the stablecoin sector, the stock price of this traditional payment giant surged nearly 10% by the end of the day, attracting a "bottom-fishing" frenzy from investors not seen in years. However, this hope was short-lived. A week later, Western Union's financial report once again fell short of analysts' expectations, and the stock price quickly retreated to its lows, erasing earlier gains completely.

This brief market excitement not only concerns Western Union but also reflects Wall Street's new preference for stablecoins. Against the backdrop of the passage of the landmark genius bill and the astonishing fivefold increase in the stock price of stablecoin issuer Circle, investors have almost developed a conditioned reflex: flocking to anything associated with "stablecoins." However, this enthusiasm for "stablecoins" is more a misunderstanding of a buzzword than a genuine business strategy. Stablecoins cannot save Western Union's core business, but if the company can take the right actions, it may open up a new future.

The Decline of a Giant

Founded in 1851, Western Union was once a giant in the global remittance sector, but its financial performance tells the story of a giant struggling in a new era. In recent years, Wall Street has viewed this largest remittance company in the world as a gradually melting "ice cube," and data supports this view: since 2021, the company's revenue has shrunk from over $5 billion to an estimated $4.1 billion in 2025, while its market share has been continuously eroded by digitally-focused competitors. This decline is also reflected in its stock price—falling from a peak of $26 in 2021 to hovering between $8 and $9 today.

The foundational strength supporting this 172-year-old giant—its network of nearly 400,000 physical agent locations—has now become its biggest structural weakness. This reliance on agents is costly, accounting for about 60% of Western Union's service costs. This network primarily serves a key customer group: cash-dependent migrant workers who often lack access to banking services. For decades, this model has been Western Union's moat.

However, as the global digitalization process accelerates, this cash-dependent customer group is in a long-term structural decline. In the digital realm—the battlefield of the future—Western Union's performance lags far behind its competitors. In the last quarter, Western Union's brand digital revenue grew only 6%, while competitors like Wise and Remitly saw growth rates of 20%-30% or even higher. Once the undisputed king of the remittance field, it is now losing ground in the digital domain to its competitors.

An Alluring Yet Flawed Solution

On the surface, Western Union's proposed stablecoin plan seems quite comprehensive. In a recent earnings call, the company outlined four key strategies:

Improve its financial management;

Achieve global payments through stablecoins;

Provide buy, sell, and hold functions in digital wallets;

Most importantly, use its global network as an entry and exit point for the crypto ecosystem.

However, the company's current focus is clearly on the first strategy. As CEO Devin McGranahan stated, "We spend most of our time and energy in this area," namely solving backend operational efficiency issues through stablecoins.

The appeal of this strategy is undeniable. McGranahan emphasized that stablecoins can "significantly enhance settlement speed and reduce the amount of prepayment required from partners." He cited a recent liquidity crunch in India that caused payment delays, noting that stablecoins could provide real-time liquidity replenishment and service around the clock, greatly improving customer experience.

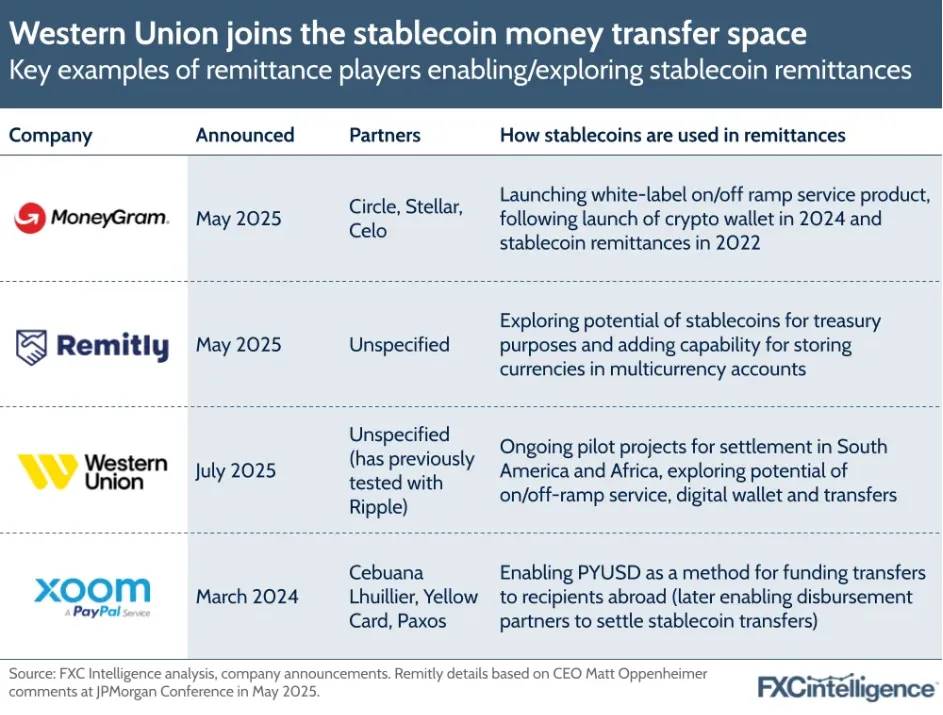

However, while optimizing financial management through stablecoins is a wise goal, it cannot deliver a long-term competitive advantage. Western Union's main competitors, such as MoneyGram and Remitly, are already implementing similar stablecoin-based settlement strategies. Any cost savings may be eroded under competitive pressure, especially against digital companies with inherently lower operating costs. This reduces the potential innovation to merely a "business operating cost," unable to reverse the company's current structural decline.

Source: FXC Intelligence

The Real Opportunity: A Cash Bridge to the Digital Economy

The future of Western Union does not lie in trying to catch up with competitors in the digital realm, but in becoming a role they cannot replace: the primary cash-to-stablecoin access layer globally. The company should fully leverage its network of 400,000 physical agent locations, viewing it as its most important strategic asset. By strengthening this network and relying on its trusted brand, Western Union has the potential to address a critical financial infrastructure issue: providing seamless connections between physical cash and the global digital economy, a service urgently needed in many emerging markets.

This strategic transformation can be achieved in two ways. First, own traffic.

Western Union can directly integrate cash-to-stablecoin conversion functionality into its highly-rated mobile app. Users can walk into a trusted Western Union agent location, deliver volatile local currency, and have USD stablecoins deposited into their digital wallets within minutes. This is an extremely attractive solution for those looking to protect their wealth with USD stablecoins, especially for those living in regions with volatile currencies.

The second, more powerful method is through platform traffic.

A more promising approach is to open its agent network to third-party wallets and fintech companies via API. These partners can embed buttons like "Pay with Western Union" or "Withdraw via Western Union" directly into their applications. The market demand for this has already emerged. McGranahan revealed during the company's earnings call that they were surprised by the "unexpectedly high demand" for deposit and withdrawal services. This approach transforms Western Union from a closed remittance service into an open infrastructure, becoming a key "last mile" connection between the rapidly growing digital ecosystem and the physical world.

Through deposit and withdrawal services alone, Western Union could achieve substantial financial returns. Based on current fee rates and the agent economic model (considering its pricing power in cash transactions), just $1 billion in deposit/withdrawal transaction volume could generate about $80 million in operating profit, a significant boost to the company's current total profit of around $800 million. In comparison, digital competitor Remitly saw a $5 billion increase in transaction volume in the most recent quarter compared to last year.

In addition to transaction fees, Western Union can offer more financial services through its digital wallet entry point, such as debit cards for online spending, credit products, and savings and investment services. Western Union is even considering issuing its own stablecoin, with its digital wallet and extensive cash deposit/withdrawal network forming an attractive service package and convenient distribution channel. More importantly, unlike Western consumers, the target users of these services are less sensitive to interest rates, which may allow Western Union to retain more of its earnings.

These new features will fundamentally redefine the role of Western Union agents. Agent locations will no longer just be places to pick up one-time remittances but will become efficient banking outlets in the digital age. For millions of unbanked or underbanked individuals, Western Union's local agents will become the physical bridge to global digital wallets, ultimately fulfilling the promise of "providing banking services to the unbanked."

Necessary Transformation, Full of Risks

This strategic transformation is fraught with challenges, from the enormous execution risks faced by a 172-year-old company to the long-term decline in cash usage and the threat of informal P2P networks. However, it is precisely the structural decline of its core business that makes this transformation particularly necessary.

While defending its traditional business, Western Union urgently needs to inject new growth momentum into the company through deposit/withdrawal strategies. This strategy not only allows the company to engage more deeply in the rapidly expanding digital asset economy but also leverages its global physical network as a powerful differentiating advantage, buying valuable time to become an indispensable cash bridge for the future—provided it can execute successfully.

Western Union recently announced the acquisition of Intermex, a company focused on cash remittance business in Latin America, for $500 million, indicating the company's preference for integrating the synergies of declining businesses and converting low-cost acquired users into digital users. While the acquisition may consume significant time and resources, becoming another major risk to Western Union's transformation, the new retail locations could also become strategic assets that align with its potential future role as a cash bridge.

Conclusion

The future of Western Union cannot be secured by merely tweaking old business models with new technologies. Today, the strategic choice is clear: either continue to struggle defensively under the rules set by digital-first competitors, or decisively transform into an indispensable cash bridge connecting the physical world with the rapidly evolving digital asset economy. Stablecoins cannot save the traditional remittance economy, but they are the key to unlocking the future platform economy. One path leads to an elegant conclusion; the other leads to a new meaning of existence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。