"In the long run, cash is a very poor investment."

Organized & Compiled by: Deep Tide TechFlow

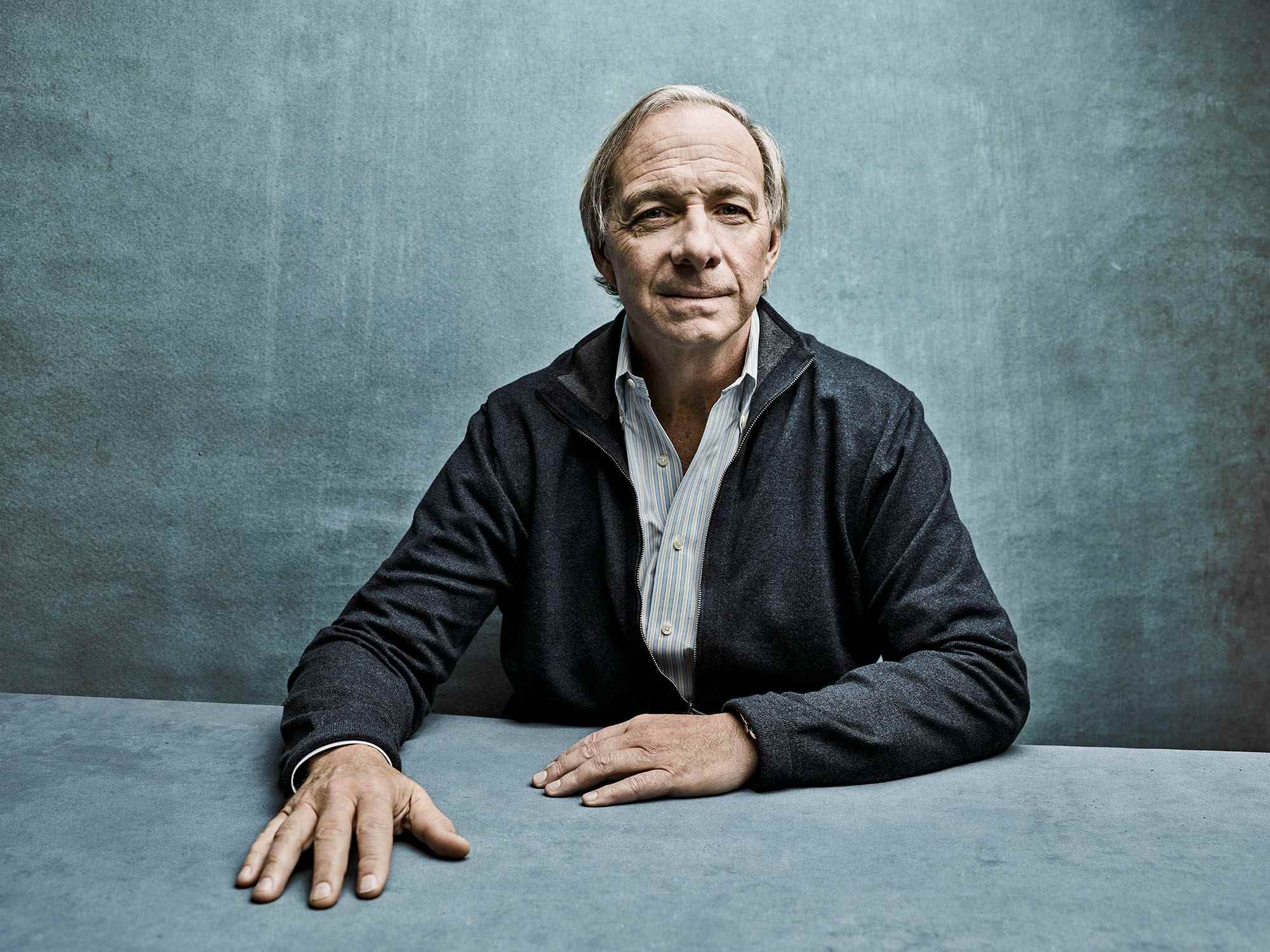

Guest: Ray Dalio, Founder of Bridgewater Associates

Host: Wang Liwei

Podcast Source: Xiansheng

Original Title: Dalio's First Chinese Podcast: Stock and Bond Market Split, 10 Financial Rules for Chinese Friends

Broadcast Date: August 20, 2025

Key Points Summary

Exclusive conversation with the founder of Bridgewater Associates, the A-shares are hot, bond funds are "tearful," how should we allocate our wealth? Cultivating financial literacy in children, why give gold coins and less toys?

Recently, the A-shares have been booming, while the bond market has seen a significant decline. Some investment advisors have posed a soul-searching question: should we switch from bond funds to stock funds?

Ray Dalio has also been frequently in the spotlight lately, partly due to the release of his new book: "Why Nations Fail." Last weekend, news of Bridgewater clearing out Chinese concept stocks attracted considerable attention, and a friend even asked if Bridgewater had sold all its Chinese stocks.

In fact, the 13F filings disclosed in the U.S. do not reflect holdings in Hong Kong and A-shares (Bridgewater and several global funds significantly reduced their holdings in Chinese concept stocks; Chinese stocks are performing unevenly). Looking only at the onshore market, Bridgewater's domestic funds surpassed 40 billion last year, and based on the growth over the past year, the management scale should now be around 60 billion, accounting for nearly one-tenth of Bridgewater's total global assets under management.

Having followed Dalio for nearly a decade, I took the opportunity of his new book release to have a conversation with him. We first discussed his new book's calls and related controversies from a macro perspective (you can refer to the text version from Caixin Weekly); then we systematically talked about his investment advice for Chinese friends from a personal perspective. This is also his first appearance on a domestic podcast to discuss investments.

In my memory, Dalio rarely openly discusses investments or related advice, especially regarding domestic situations. However, we Chinese investors are facing a very unique environment. On one hand, the stock market is booming, while on the other hand, it is not easy to achieve decent returns in a low-interest-rate environment. Even in the recent bull market, some friends have said that they haven't made much profit over the past three years; meanwhile, bond funds that made many friends a lot of money over the past two years have recently inspired poetry: "Tears flow from countless households due to bond funds."

In the current low-interest-rate environment, how should we face significant market fluctuations? When the market is good, should we diversify across asset classes and regions? Does Dalio's bearish view on U.S. bonds and the dollar also extend to U.S. stocks?

If you care about investment, wealth management, and financial security, I believe you will gain a lot from this conversation.

Highlights of Insights

When certain markets rise, others may fall, reflecting different economic conditions. Achieving balance in these investments can reduce the cyclical volatility of the portfolio, thus obtaining good returns while lowering risk.

In the long run, cash is a very poor investment. The challenge facing China is that investors often hold large amounts of money in real estate or cash deposits, which is not a good diversified investment portfolio.

The returns of any asset typically consist of two parts: price changes and yield. When an asset's returns primarily depend on price increases rather than coupon payments, caution should be exercised.

Investors need to regularly rebalance their portfolios. If there is no clear market view, a simple rebalancing strategy can be adopted: when the price of a certain asset class rises, timely reduce some positions and transfer funds to other asset classes to maintain the long-term balance of the portfolio.

It is always a good time to diversify investments; individuals and investors must be very cautious when trying to time the market.

Diversification and risk balancing are important means to enhance returns and reduce risk.

Do not attempt to predict market trends; market timing is essentially a zero-sum game.

Do not look at the parts of the portfolio in isolation; consider how the parts combine to form a well-diversified investment portfolio.

Debt is money, and money is debt.

Gold is the second-largest reserve currency, with the first being the dollar, the second gold, the third euro, and the fourth yen.

Gold is more attractive to me. However, I still hold some Bitcoin as an alternative option.

Stablecoins have significant advantages in trading, especially favored by those who are less concerned about interest rates and are willing to forgo interest for the convenience of trading. However, stablecoins are not a good wealth storage tool.

Inflation-indexed bonds are an excellent tool for storing funds. They provide compensation based on the inflation rate while also offering a certain real interest rate. This asset has lower risk and is an ideal investment choice.

Everyone needs to recognize the importance of saving. Savings provide you with a foundation and security, and this security gives you freedom.

Ensuring the basic financial security of individuals and families is crucial. To achieve this, it is important to learn investment knowledge and make reasonable asset allocation.

Only after ensuring a basic standard of living can one consider taking on more risk to try to earn higher returns.

Every birthday and Christmas, I give the children in my family a gold coin. I tell them, you cannot sell this gold coin. You can only pass it on to the next generation on the day the monetary system collapses.

Investment Strategies in a Low-Interest Environment

1. Can there be stable returns in a low-interest environment? The logic of the "All Weather" strategy

Host:

Currently, China is in a low-interest-rate environment, which usually means it is difficult to achieve ideal investment returns. However, I noticed that Bridgewater's China All Weather Fund has performed exceptionally well in recent years, achieving over 10% returns almost every year, while also experiencing relatively small drawdowns during market fluctuations.

Could you explain how Bridgewater has achieved such stable performance in this low-interest environment?

Ray Dalio:

I’m glad you asked this question. Bridgewater's performance over the past six years has indeed been very stable, with the worst year yielding between 10% and 14%. I can't recall the exact numbers, but the average return is around 16%. So how did we achieve this?

First, the key is to achieve balance in the investment portfolio through reasonable asset diversification. When certain markets rise, others may fall, reflecting different economic conditions. For example, when the stock market falls, the bond market may rise, and the gold market or inflation-hedging assets may also rise with currency depreciation. By achieving this balance in investments, we can reduce the cyclical volatility of the portfolio, thus obtaining good returns while lowering risk.

My investment motto is to have 15 or fewer uncorrelated return streams. (Note from Deep Tide TechFlow: Uncorrelated return streams refer to the performance of different assets that are not directly related, which can effectively diversify risk.) For instance, in a slow deflationary environment, stocks may perform poorly, but bond yields may improve. Conversely, if there is a lot of money printing in the economy, inflation-hedging assets (like gold) typically perform well. By balancing these assets, we can achieve very attractive returns at a lower risk level, which is the essence of investing.

In the long run, cash is a very poor investment. The challenge facing China is that investors often hold large amounts of money in real estate or cash deposits, which is not a good diversified investment portfolio. Therefore, the strategy of holding a diversified asset portfolio rather than cash is very attractive. This is our core strategy: how to achieve diversification without being constrained by traditional assets. Tactical adjustments based on current market conditions to achieve this balance.

As I mentioned, my goal now is to convey these principles. I am 76 years old and plan to launch an investment course to teach these investment principles. I hope to provide this knowledge to everyone in China as freely or at low cost as possible to help them understand how to achieve balance. Therefore, I am eager to convey how this process works. Overall, as I have described, this approach is effective.

2. The Dilemma of Bond Investment: When returns mainly come from price increases rather than coupon payments, you should feel "afraid"

Host:

Currently, the Singapore Wealth Management Institute is conducting some research, and we hope this research can be applied in the Chinese market.

In a low-interest environment, long-term bonds usually perform well, so many Chinese investors have entered this field over the past year. However, when some signs of economic recovery appear, long-term bonds have experienced significant drawdowns, just like the situation in the past few days. Do you think there are good ways to identify these signs and adjust investment strategies in a timely manner?

Ray Dalio:

I want to clarify that the returns of any asset typically consist of two parts: price changes and yield. During investment cycles, there are times when certain low-yield assets are pushed to high prices, becoming very expensive. At this point, investors' returns mainly come from asset price increases rather than coupon payments. When this happens, although it may seem profitable in the short term, future yields will become very low. This low yield is actually an important warning signal indicating that greater risks may arise in the future. Therefore, when you find that returns mainly depend on price increases rather than coupon payments, you should exercise caution.

To address this situation, investors need to regularly rebalance their portfolios. If there is no clear market view, a simple rebalancing strategy can be adopted: when the price of a certain asset class rises, timely reduce some positions and transfer funds to other asset classes to maintain the long-term balance of the portfolio. For example, Bridgewater has achieved stable investment returns through such a dynamic balancing strategy. By regularly adjusting asset allocation, risks can be effectively reduced while maintaining the stability of the portfolio.

3. Regional Diversification and Timing Traps: Abandoning Market Predictions

Host:

I believe that a good investment approach in a low-interest environment is to achieve regional diversification. Bridgewater has been doing this for many years. I think Japan has also achieved this through their NISA program. Now, China has recently provided more QDII quotas for Chinese investors.

Some Chinese people believe that the U.S. stock market is at a historical high and too expensive; the European stock market is also at a historical high. Do you think regional diversification is important? Is now a good time for regional diversification?

Ray Dalio:

I believe it is always a good time for diversification. Individuals and investors must be very cautious when trying to time the market. They should first assume that they cannot accurately predict market trends and then ask themselves, if I have no opinion on the market, what kind of portfolio should I have? This portfolio should be a balanced diversified one because diversification means that if you do not know how a certain asset will perform, maintaining a balanced portfolio is the best choice, as individuals cannot successfully time the market.

Do not base your decision to build a portfolio on whether the U.S. stock market is booming; the key is to maintain balance. I would suggest that any investor consider keeping half of their funds locally, but in a diversified portfolio, adopt an "All Weather" approach. **The so-called "All Weather" portfolio includes gold, **bonds, and investments spread across about 10 different markets. But you need to know how to achieve balance; you want to balance risk, not just in dollars or any other currency.

Diversification and risk balancing are important means to enhance returns and reduce risk. Simply put, if I introduce uncorrelated assets, assuming I have one asset and then introduce a second and third asset that are uncorrelated but have similar expected returns, I can reduce risk by about one-third. If I can achieve 10 to 15 uncorrelated assets, I can reduce risk by 60% to 80% while maintaining the same returns. This means that the return-to-risk ratio can increase to five times the original. In other words, you can achieve the same expected return while taking on only one-fifth of the original risk. This is the game of investing.

4. The Art of Buying: Beyond Dollar-Cost Averaging?

Host:

You mentioned not to try to predict market timing. So, what is the correct approach to investing? For example, is dollar-cost averaging (DCA) a good choice? Or are there other better methods?

Ray Dalio:

When investing, it is essential to clarify the risks you are taking, not just focus on the amount invested. For example, the volatility of stocks is about twice that of bonds. Therefore, to achieve balance in the portfolio, you need to adjust the weights based on the volatility of different assets to ensure overall risk is balanced. If you can design this risk balance reasonably, you can achieve your expected investment goals. This may sound a bit complex, but dollar-cost averaging is indeed a good method because it avoids the risks of a lump-sum investment while gradually accumulating assets. However, the key is to understand how to build a balanced "neutral portfolio," which is a portfolio that can operate stably in different market environments.

Again, do not try to predict market trends, as market timing is essentially a zero-sum game. In every trade, there are buyers and sellers, and there are always some smart investors in the market. It's like playing cards at a poker table; you need to ask yourself: who are my opponents? Only a very few people can truly succeed in the market. Bridgewater invests hundreds of millions or even billions of dollars each year to study the market, yet we have seen that the overall market performance has generally been poor over the past six years. Therefore, if you want to achieve stable and good returns, I recommend adopting a risk-balanced investment approach rather than trying to predict the market.

Once again, I emphasize not to try to time the market because you must understand that market timing is a zero-sum game. Every buyer has a seller, and there are those smart individuals. It's like going to a poker table; do you know who you are up against? Only a small portion of people can truly do well. We invest hundreds of millions, possibly even billions, each year to try to play this game. Even if you look at the history of investment managers over the past six years, the overall market performance has been poor. Therefore, if you want to achieve good returns and consistency, I encourage adopting this balanced approach.

Host:

So, would you suggest a default All Weather portfolio for the Chinese market? I remember in 2014, you provided a version based on the U.S. market for Tony Robbins. What investment proportions would you suggest for Chinese investors?

Ray Dalio:

The same principles apply to any country; it is not about the country but about the available investment tools. In the Chinese market, we can also utilize local investment tools to achieve risk balance. The fund I mentioned is a local fund that can achieve this. I want to emphasize that there are available tools in the onshore market to achieve this goal.

Pros and Cons of Major Asset Classes

5. Gold: How to View the Allocation of This "Non-Yielding" Asset

Host:

Gold is an asset you value highly. It has performed quite well over the past year, and from a long-term perspective of 20 or 30 years, its performance has also been very good. However, many people prefer to invest in productive assets. How should we think about or persuade ourselves to invest in non-productive assets like gold?

Ray Dalio:

Gold is a non-productive asset, just like cash. If you put money in cash, it is also non-productive; the two are very similar. Therefore, you need to view gold as a form of currency. Its main characteristic is that it is an effective diversification asset; when currencies perform poorly, gold usually performs well.

I believe most people view their portfolios and costs from a currency perspective, which can lead to misjudgments because they do not realize that their currency is depreciating. They see other assets rising, such as the price of gold or other assets. But if you look at these things in terms of inflation-adjusted dollars or inflation-adjusted currencies, that is the correct perspective. For a long time, gold has been a currency, and perhaps some digital currencies are viewed as alternative currencies. Overall, debt is also currency, and there is too much debt.

What I want to express is that during this period, the value of currency has indeed declined. I want to emphasize that when I mention gold, I am not saying you should hold more than an appropriate diversification proportion of gold. What I mean is that in an optimized portfolio, the proportion of gold is usually around 15%. But whether it is 10% or 5%, gold can provide diversification for the other parts of the portfolio. Therefore, it must be viewed as a risk-reducing tool to cope with the overall significant depreciation of currency due to excessive debt and money printing. Thus, gold should be part of the portfolio. But I reiterate, do not look at each part in isolation; consider how the parts combine to form a well-diversified investment portfolio.

6. The Dollar and U.S. Bonds: Why the Bearish Outlook

Host:

If we look at the value of currencies, such as the dollar, I believe you recently mentioned that the U.S. economy is relatively good while the global economy is relatively weak. This situation seems to favor the strength of the dollar. But in your view, is the dollar facing a structural downtrend?

Ray Dalio:

I want to emphasize the supply and demand relationship of debt, and debt is currency, and currency is also debt. Debt is a promise to provide you with a certain amount of currency. Therefore, debt can be seen as uncollected currency. When you store your funds, you are storing them in debt. This is what I mean by "debt is currency, and currency is debt."

When there is too much debt and it grows too quickly, debt problems arise. In this case, the way to deal with these problems inevitably faces a choice: either you choose hard currency, which will change the supply and demand relationship, and interest rates must rise, leading to reduced demand and thus causing the market to decline; or you alleviate the debt problem by increasing the money supply. In the current economic environment, this choice is a core issue.

7. Bitcoin and Gold: Dalio's Investment Perspective

Host:

You just mentioned digital currencies. I remember you have held some Bitcoin in recent years. So, how do you view the investment value of Bitcoin? What are its advantages and disadvantages compared to gold?

Ray Dalio:

I have held a small amount of Bitcoin for several years and have maintained that proportion. I view Bitcoin as a tool for diversification; compared to gold, it is a diversified option. What is a reliable currency for storing wealth? Bitcoin is undoubtedly very popular, but I think it has some drawbacks, such as I do not believe central banks will hold Bitcoin.

Gold is the second-largest reserve currency, the first is the dollar, the second is gold, the third is the euro, and the fourth is the yen, and so on. Central banks hold gold. There is a saying that gold is the only asset you can own that is not someone else's liability. This means that gold itself is currency; it does not rely on others' promises to pay you money. Gold has intrinsic value and can be held without these risks. This is particularly important in politically or geopolitically challenging environments, such as when Russia faces sanctions or when Japanese assets were frozen during World War II. Therefore, for these reasons, gold is more attractive to me. However, I still hold some Bitcoin as an alternative option.

8. The Truth About Stablecoins: Are They Suitable for Holding?

Host:

I noticed that you hold Bitcoin because it has the function of value storage. Nowadays, many people are starting to pay attention to stablecoins because they seem to achieve similar functions. What do you think about this?

Ray Dalio:

Stablecoins link currency to stablecoins. In other words, it represents a right to a pegged currency but usually does not provide interest. From a financial perspective, it is worse than holding a currency asset that provides interest. However, stablecoins do have significant advantages in trading, especially in international transactions. They can almost be seen as a clearing tool that simplifies cross-border capital flows. Therefore, they are particularly favored by those who are less concerned about interest rates and are willing to forgo interest for the convenience of trading.

In high-inflation countries, interest rates may be negligible, and people are more likely to choose stablecoins for transactions. For example, in places like Argentina, if they cannot obtain reserve currencies that provide interest, stablecoins may become an alternative choice. This is how stablecoins operate, but they do not fulfill the primary function of being a currency that is limited in supply and stable relative to other currencies. In contrast, inflation-indexed bonds are a better asset choice.

Currently, China has not yet launched inflation-indexed bonds, but these bonds are an excellent tool for storing funds. They can provide compensation based on the inflation rate while also offering a certain real interest rate. This asset has lower risk and is an ideal investment choice.

Host:

After hearing your analysis, I start to think about how large the demand for stablecoins will be. Can they really solve the U.S. debt problem?

Ray Dalio:

This question still requires time to observe. The fundamental logic of stablecoins is that buyers will purchase them, especially in emerging market countries where economic instability is higher, and buyers are less concerned about interest rates; they will buy stablecoins for trading purposes.

Moreover, the law requires stablecoin producers to back them with government bonds and government debt. Therefore, the purchase of stablecoins will lead to the purchase of U.S. government debt, but there is a problem here: what is the source of these funds? If they hold U.S. debt, they will transfer it to stablecoins. So what is the new demand? I believe stablecoins are not a very good wealth storage tool.

The Underlying Logic of Household Wealth

9. Dalio's Family Finance Lesson: Insist on Giving Gold Coins to Grandchildren Instead of Toys?

Host:

In a 2019 interview, you mentioned that individual investors face some significant challenges. Can you provide some practical investment advice for the general public? I also heard that you have been educating your grandchildren on how to invest and manage personal finances.

Ray Dalio:

I believe that everyone needs to recognize the importance of saving. I personally calculate how many months I could maintain my lifestyle without any new income. Then, I double that number to account for potential unexpected situations, such as a significant economic downturn.

Savings provide you with a foundation and a sense of security, and this security gives you freedom. This is very important. What I do for my children (who are now all adults) and grandchildren is that every birthday and Christmas, I give them a gold coin. I tell them that they cannot sell this gold coin. They can only pass it on to the next generation on the day the monetary system collapses. This way, they can see the value of the gold coin being passed down through generations. I find this practice more meaningful than simply giving toys. Of course, I occasionally give some toys, but not too many, because toys quickly lose their appeal, while gold coins help them understand the process of saving and accumulating wealth.

My core point is that ensuring the basic financial security of individuals and families is crucial. To achieve this, it is essential to learn investment knowledge and make reasonable asset diversification allocations. Only after ensuring a basic standard of living can one consider taking on more risks to try to earn higher returns. For me, high-risk investments feel more like a game, and I enjoy the process very much because it is full of challenges and fun.

When saving, one must consider the impact of inflation on funds. Simply put, you are storing not just the currency itself but its purchasing power. For example, if the interest rate is 4% and the inflation rate is 3%, then your real return is only 1%. These are all my suggestions for ordinary people and the principles that I and my family have been practicing. Only after mastering this basic knowledge can one further explore higher-risk investment opportunities.

Host:

This is also why many people now choose to build different investment portfolios, such as a safe investment bucket and a more risky market investment bucket.

Ray Dalio:

But I want to remind everyone that the investment market is like a poker game, where you face many smart opponents who may invest hundreds of millions or even billions of dollars in this game. Therefore, beginners are best off starting with small investments to accumulate experience through practice. This way, you can observe the performance of professional investors, review their strategies and results over the past few years, rather than being blindly confident. Understanding this and maintaining humility is key to successful investing.

10. The Importance of Rebalancing: Overcoming Emotional Investing

Host:

One very interesting suggestion you gave me last time was to act against your intuition. But I think this is not easy for most people. So, what should one do when adjusting the investment portfolio?

I noticed that the Pure Alpha fund performed well in the first half of this year and also excelled in the global hedge fund industry last year. However, it also returned some cash to clients. Additionally, China's OS fund took similar actions earlier this year after achieving over 15% returns in the first half.

**Regarding **rebalancing, can you share some experiences or lessons? How do you view this?

Ray Dalio:

The core of rebalancing is to set a strategic asset allocation target to achieve balance in the portfolio. When certain markets perform well and asset prices rise while others perform poorly, rebalancing can help you adjust the portfolio according to the established goals. This not only allows you to sell at high prices for profit but also to buy at low prices, thus maintaining investment discipline. Therefore, rebalancing is very important in investing.

Host:

It indeed sounds like it requires strong discipline and psychological control.

Ray Dalio:

That is the essence of the game; like many things in life, it requires self-control. For decades, I have been recording my decision-making rules and organizing them into a set of "principles." Subsequently, I transformed these principles into computer programs to execute my investment plans in a systematic way. This helps avoid being influenced by emotions because I know what the expected outcomes of the plan are.

You must have a game plan. If you are going to do this, your game plan should be backtested so that you can understand how the plan performs. Then, you will be able to avoid emotional decisions leading to wrong choices.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。