Original | Odaily Planet Daily (@OdailyChina)

Mainstream cryptocurrencies like ETH and SOL, which have performed well recently, are still "unable to hold on." With the continuous decline in BTC prices, the crypto market has once again entered a correction phase today.

According to OKX market data, BTC briefly fell below $110,000, hitting a low of just under $109,000 this morning, currently reported at $109,700, with a drop of over 3% in the last 24 hours; ETH's decline is even more severe, reaching a daily low of $4,311, down nearly 7%, currently reported at $4,400.

In terms of other assets, SOL briefly fell below the $186 mark, currently reported at $188.7; high-profile meme coins like DOGE, PEPE, and WIF also experienced corrections, with declines concentrated in the 8% to 10% range.

In the derivatives market, according to Coinglass data, the total liquidation amount across the network in the past 24 hours reached $935 million, with long positions accounting for $821 million. The liquidation amount for BTC was approximately $258 million, while ETH saw a liquidation of up to $321 million, becoming the current "disaster zone" for liquidations.

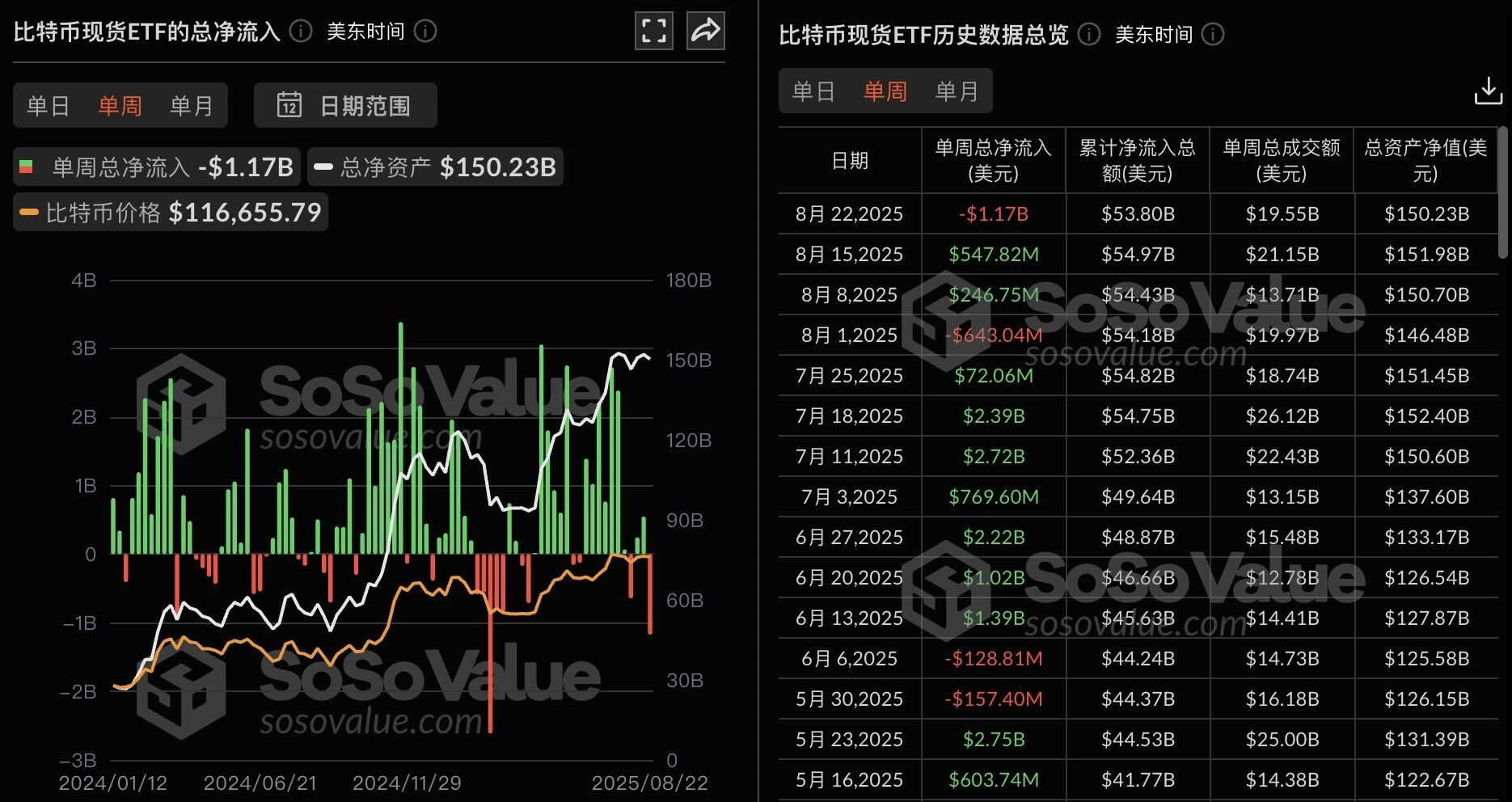

Bitcoin Spot ETF Saw a Net Outflow of $1.17 Billion Last Week

Institutional funds are no longer frantically "buying." According to SoSoValue data, from August 18 to August 22 (Eastern Time), the Bitcoin spot ETF saw a net outflow of $1.17 billion last week. The Bitcoin spot ETF with the highest net outflow last week was Blackrock's Bitcoin ETF IBIT, which had a weekly net outflow of $615 million, the second highest in history, with a total historical net inflow of $58.06 billion; followed by Fidelity's ETF FBTC, which had a net outflow of $235 million last week, with a total historical net inflow of $11.72 billion.

Additionally, during the trading days from August 18 to August 22 (Eastern Time), the Ethereum spot ETF saw a net outflow of $238 million, ending a 14-week streak of net inflows.

The continuous decline in Bitcoin prices has led to a correction across mainstream cryptocurrencies, and market sentiment has turned pessimistic. Is the current adjustment a phase of volatility or a prelude to a major correction?

Odaily Planet Daily has compiled the latest views on the market for your reference.

Where is Bitcoin headed next?

The market generally remains optimistic about Bitcoin's long-term trend, with many institutions and analysts still bullish on the continuation of the bull market. However, in the short term, technical indicators and capital flows suggest that there is some downward pressure on the market, and short-term fluctuations cannot be ignored.

CoinDesk Analyst: Technical indicators lean bearish; to restore the bull market, prices need to return above last Friday's high of $117,440

CoinDesk analyst and chartered market technician Omkar Godbole stated that the daily chart shows Bitcoin forming a "lower high" near the previous bull market trend line extended from the April low, confirming the previous trend line breakdown, indicating that bearish momentum may continue. The Guppy multiple moving average indicates that the short-term moving average is about to cross below the long-term moving average, also showing enhanced bearish momentum. The key support level for Bitcoin is at $110,756, with further support near the 200-day moving average around $100,000. To restore the bull market outlook, prices need to return above last Friday's high of $117,440.

CryptoQuant: Bull market score index currently at 40, entering "bearish" phase

CryptoQuant analyst Julio Moreno indicated that the bull market score index is currently at 40, having entered a "bearish" phase.

Glassnode: $110,800 is a key support; if lost, a larger correction may follow

Glassnode posted on X platform that $110,800 is the average cost for new investors from May to July. If Bitcoin fails to hold this key support level, the market may often experience a prolonged weak trend for several months, potentially leading to a larger correction.

Greeks.live: Some traders believe Bitcoin's recent bottom may be $110,000

Greeks.live macro researcher Adam noted in an English community briefing that group sentiment has shifted from cautiously optimistic to bearish concerns due to a large-scale liquidation waterfall that pushed BTC down from nearly $114,000 to $110,000. Despite the severe fluctuations, traders remain divided; some believe $110,000 is the bottom for Bitcoin, while others expect further declines, though most agree that this volatility is a result of excessive leverage being washed out.

Santiment: Continuous capital outflow from Bitcoin ETF; retail sentiment may indicate market bottom

On-chain data platform Santiment stated that on-chain and market data show that Bitcoin ETFs have seen net outflows for six consecutive trading days, the longest outflow period since the peak of tariff concerns in early April. It has been observed that this round of inflows and outflows is increasingly driven by retail investors rather than being primarily controlled by institutions as in earlier periods.

Historical experience shows that when a large number of retail traders are extremely pessimistic and withdraw funds, believing the market has peaked, it may exacerbate short-term market declines but often signals potential market bottom (as seen in April), providing possible positioning opportunities for long-term investors.

Matrixport: Bitcoin is in a phase of weakness; some Wall Street investors are beginning to show higher interest in Ethereum

Matrixport's latest report indicates that a rotation of funds from Bitcoin ETFs to Ethereum ETFs is underway. Over the past six weeks, Ethereum products have consistently dominated capital flows, while Bitcoin has entered a phase of weakness, experiencing net outflows for six consecutive days last week. In contrast, Ethereum ETFs have continued to see net inflows, further solidifying their leading position.

Despite Powell signaling a dovish stance last week, Bitcoin's performance remains subdued, with the impact of capital rotation being significant. In addition to crypto market participants, some Wall Street investors are also beginning to show higher interest in Ethereum.

Arthur Hayes: Bitcoin could reach $250,000 by the end of the year; the Federal Reserve will align more with Trump's ideas

Arthur Hayes, co-founder of BitMEX and chief investment officer of Maelstrom, stated in an interview with Odaily Planet Daily: "Powell's recent easing will accelerate the pace of dollar issuance, and the Federal Reserve will align more with Trump's ideas. Bitcoin could reach $250,000 by the end of the year."

Bernstein: The cryptocurrency bull market may extend to 2027, with Bitcoin targets looking at $200,000

Bernstein analysts released a new report indicating that the current cryptocurrency bull market cycle may extend to 2027, driven by U.S. policy support and increased participation from institutional investors, and they expect Bitcoin prices to reach the $150,000 to $200,000 range in the next year.

Bitwise: By 2035, Bitcoin prices will reach $2.9 million

Bitwise outlined its bullish view in its first "Bitcoin Long-Term Capital Market Assumptions" report: by 2035, Bitcoin's price will reach $2.9 million.

Summary

In the long term, the bullish pattern of Bitcoin is still widely recognized, with most institutions and analysts remaining optimistic about future trends, and market attention also indicates that the overall consensus still acknowledges its long-term value.

However, in the short term, technical indicators are weak, and ETF capital continues to flow out, indicating that downward pressure on the market still exists. The risks of phase fluctuations and corrections cannot be ignored, especially when macro policies are not yet fully clarified and interest rate cut expectations have not been realized. Therefore, for investors, it is currently more suitable to remain patient and observe, waiting for the market's reaction after interest rate cuts to seek positioning opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。