In the big casino of MEME, the habitual offender remains the same, while the injured retail investors may have changed from one batch to another.

Written by: David, Deep Tide TechFlow

Are you familiar with the guy in this picture?

The crypto world has its own painful memories. Retail investors who often lose money surely know him: Hayden Davis (also known as Kelsier), the founder of the crypto investment firm Kelsier Ventures.

He has engaged in insider trading and liquidity manipulation in celebrity token projects, extracting huge profits while leaving retail investors with nothing; the most well-known operations include $MELANIA, associated with the First Lady Trump, and $LIBRA, linked to Argentine President Milei.

Davis has publicly admitted to participating in the issuance strategy of the $MELANIA project, and on-chain data shows that insiders had already positioned themselves before the token was made public, subsequently selling at the peak of the price surge.

In the $LIBRA token launched on Valentine's Day, February 14 this year, Davis was not only a core promoter of the project but also claimed to be the "blockchain and AI advisor" to Argentine President Milei.

As a result, $LIBRA saw its market value evaporate by $4.6 billion within 6 hours, with the team extracting $87 million in USDC and SOL from the liquidity pool, and making an additional profit of $6 million through insider trading.

According to the latest post from on-chain analysis platform Bubblemaps exposing, this guy has likely struck again recently: he made $12 million overnight on the $YZY token launched by Kanye West (Ye) last week.

This is not the first time Davis has played this trick.

From MELANIA to LIBRA, and now to YZY, his methods are consistent: early positioning, lightning strikes, and profit-taking.

$YZY Token Launch, My Funds "Just Happened" to Unfreeze

On August 20, 2025, a U.S. court unfreezed $57.6 million in USDC funds previously related to the $LIBRA collapse.

These funds belong to Hayden Davis and his associates, with the court reasoning that there was "no evidence of evasion, no evidence of irreparable harm, and a low likelihood of winning the case."

Interestingly, Bubble Maps discovered a coincidental timing:

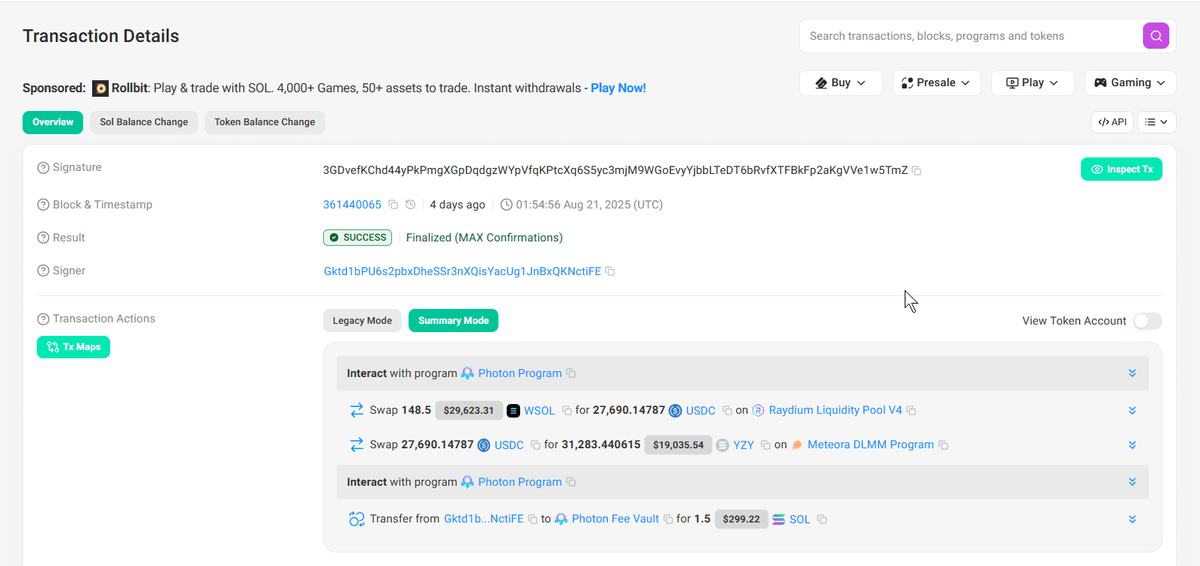

Just one day later, on August 21, Kanye West (Ye) announced the launch of the $YZY token.

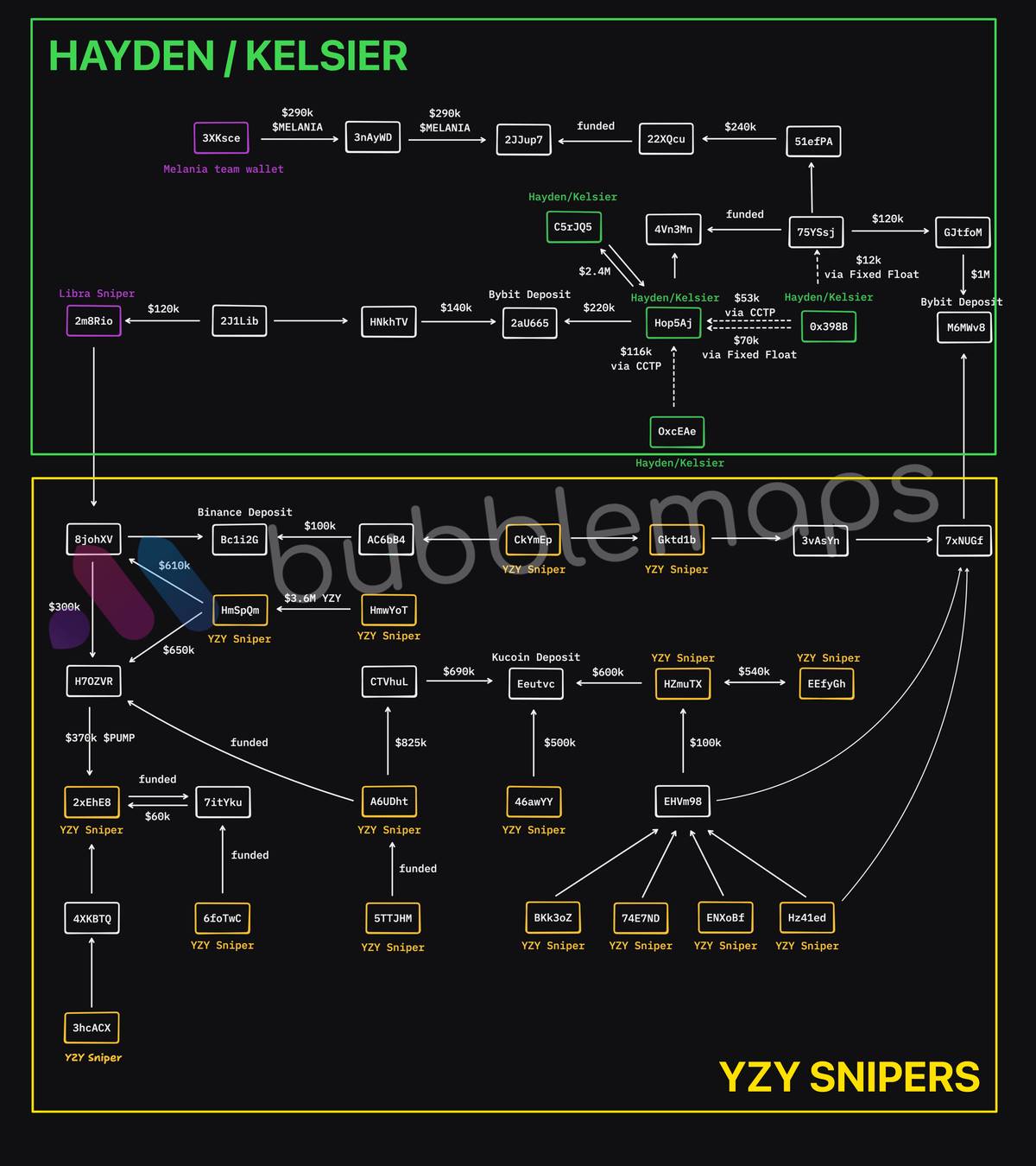

Even more coincidentally, 14 wallet addresses happened to receive funds from centralized exchanges 24 hours before the launch, linking back to certain addresses previously disclosed by Hayden Davis through fund transactions, CCTP (Cross-Chain Transfer Protocol) transfers, and shared deposits.

These addresses formed a sniper cluster, ready to "fire" when YZY went live.

While it cannot be confirmed whether Davis had insider information or direct contact with the YZY team, these 14 sniper addresses began buying just one minute after Kanye's token announcement (UTC time 1:54 AM), ultimately making a profit of $12 million.

As soon as YZY launched, my funds just happened to unfreeze; although I didn't say I participated, the sniper addresses for YZY have all interacted with me.

Old Tricks

Looking at these coincidences together, it is clearly impossible to say that Davis did not participate in the YZY sniping; at the very least, the actual controllers or teams of these addresses have close ties to this veteran celebrity token sniper.

In the comments section of the original Bubblemaps post, some even more conspiracy-minded individuals suspect that Davis not only sniped YZY but also participated in its issuance, with intentions of self-dealing.

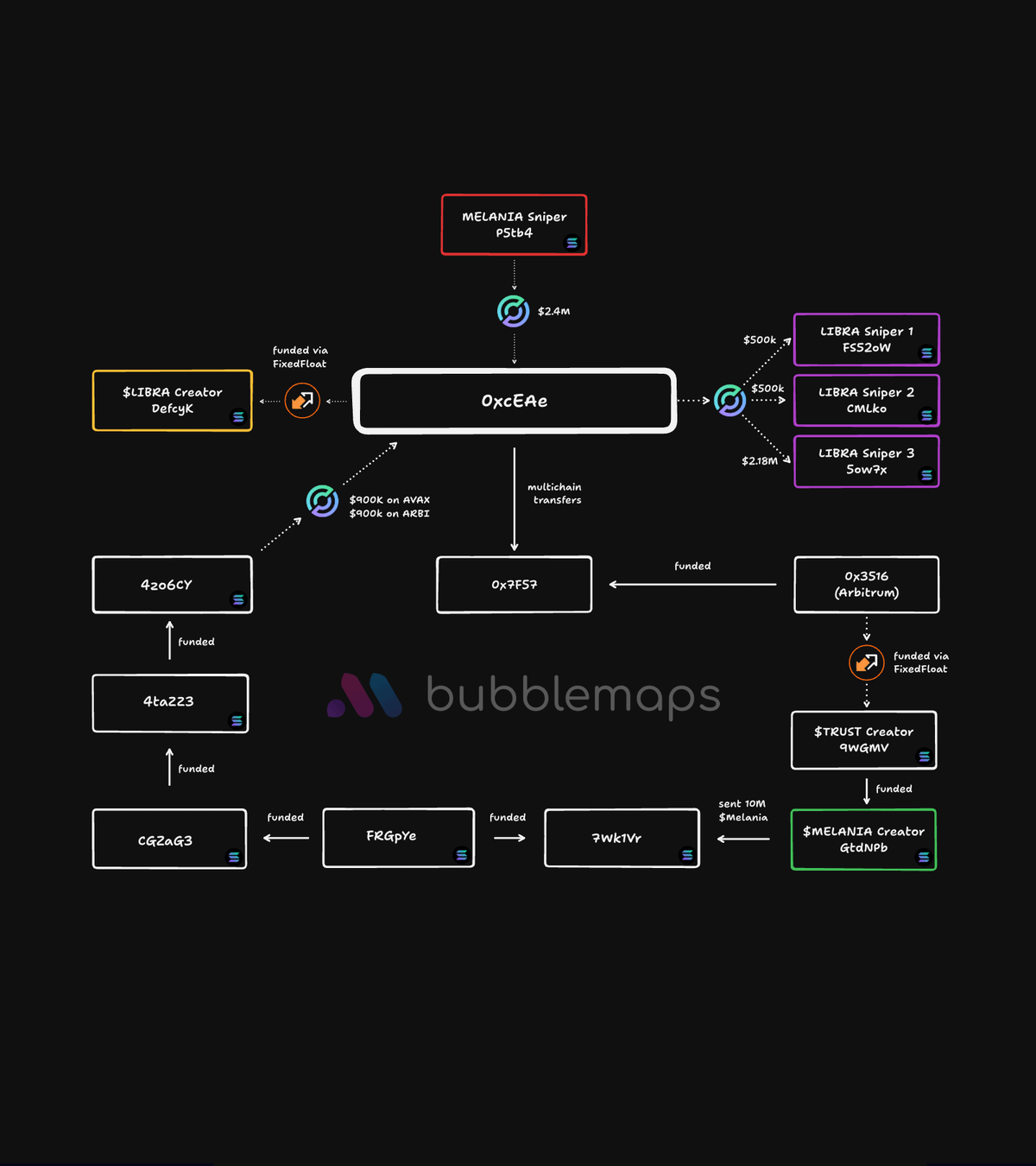

Such speculation is not unfounded, as Davis has already been a notorious insider trading veteran in LIBRA and MELANIA. Retail investors may forget the pain of losing money, but on-chain data has a memory:

Previously, the address (P5tb4) earned $2.4 million from sniping $MELANIA and transferred funds to 0xcEA (the creator of the Melania token). The latter then funded the $LIBRA creator address DEfcyK and sniped $LIBRA, earning $6 million.

Additionally, the team formed by these addresses has also been involved in trading other tokens that surged and then plummeted, such as $TRUST, $KACY, $VIBES, and $HOOD, with total profits exceeding $100 million.

On-chain data reveals a chain of fund transactions from a habitual insider trader of celebrity tokens. Combined with Davis's previous public admissions of actions in the issuance of tokens like LIBRA, this also demonstrates his systematic "criminal" pattern:

Utilizing celebrities (like Milei's brief endorsement of $LIBRA) to create hype, then extracting value, leaving chaos in the aftermath.

Previously, in an interview with Coffeezilla, Davis openly admitted to insider trading, sniper wallets, and market manipulation, even stating:

"This is a game for insiders. It's an unregulated casino."

In the big casino of MEME, the habitual offender remains the same, while the injured retail investors may have changed from one batch to another.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。