This article is specifically written for the fans of the public account, and you all can be considered as Lao Cui's private traffic. Many friends have been following Lao Cui for nearly five years, which is a form of feedback. Many friends started from the contract market, and I believe you have noticed that recently, Lao Cui has basically not been advocating for contracts. It can be said that Lao Cui himself rose in the contract market, which indeed provided him with an opportunity to accumulate initial capital, but it also caused some losses at the beginning of the year. It is not that Lao Cui simply rejects the contract market, but rather that he finds many friends' understanding of contracts to be too superficial. The number of contract users in Lao Cui's hands is basically maintained at around five, with a position size generally kept above 20 WU. Lao Cui personally pursues an extreme perfection, and due to regulatory restrictions, he does not engage in group chats, so five is already his personal limit. Other users are basically spot users, and although the overall returns are good, they cannot be compared with contracts.

Most users hope that Lao Cui will focus on explaining the contract market. In the early stages, he also focused on the contract market for two years, and for Lao Cui, the returns were actually more considerable than those from spot trading. But why give up the contract market? Because Lao Cui clearly knows that success in the cryptocurrency circle cannot be replicated, especially since he rode the wave when Bitcoin was at 7K. This article can be considered as opening the door to a discussion, so it will be quite straightforward, and I hope everyone can watch patiently. After reading, it will definitely greatly enhance your financial perspective. Since last week, Lao Cui has been emphasizing the financial crisis, a concept that continues to this day. The previous articles serve as a prelude to this one. Why will this financial crisis last so long? After observing for nearly five years, Lao Cui has a faint answer in his heart. There is a significant problem in the financial cycle chain, simply understood as funds flowing into markets they shouldn't be entering.

Even if interest rates are lowered, it is merely a temporary relief. You can observe the current markets where funds are flowing: Old A, the cryptocurrency circle, and the US stock market. These markets share a commonality: bubbles and virtuality. The inflow of funds does not drive the real economy and does not create actual value. This means jobs and income for the lower class are lacking in these two closed loops, which indeed leads to a drop in consumption. It seems that the economy is booming, with GDP continuously growing, but the actual returns are completely ineffective. You can also observe that in previous financial crises, whether it was the subprime mortgage crisis, the internet bubble, or the current real estate crisis, the flow of funds was very clear, able to timely fill the gaps, while the stock market was in a state of significant decline. The difference this time is that the stock market is booming while the real economy is in shambles. This is completely incomparable, which can only indicate one problem: funds do not know where to flow.

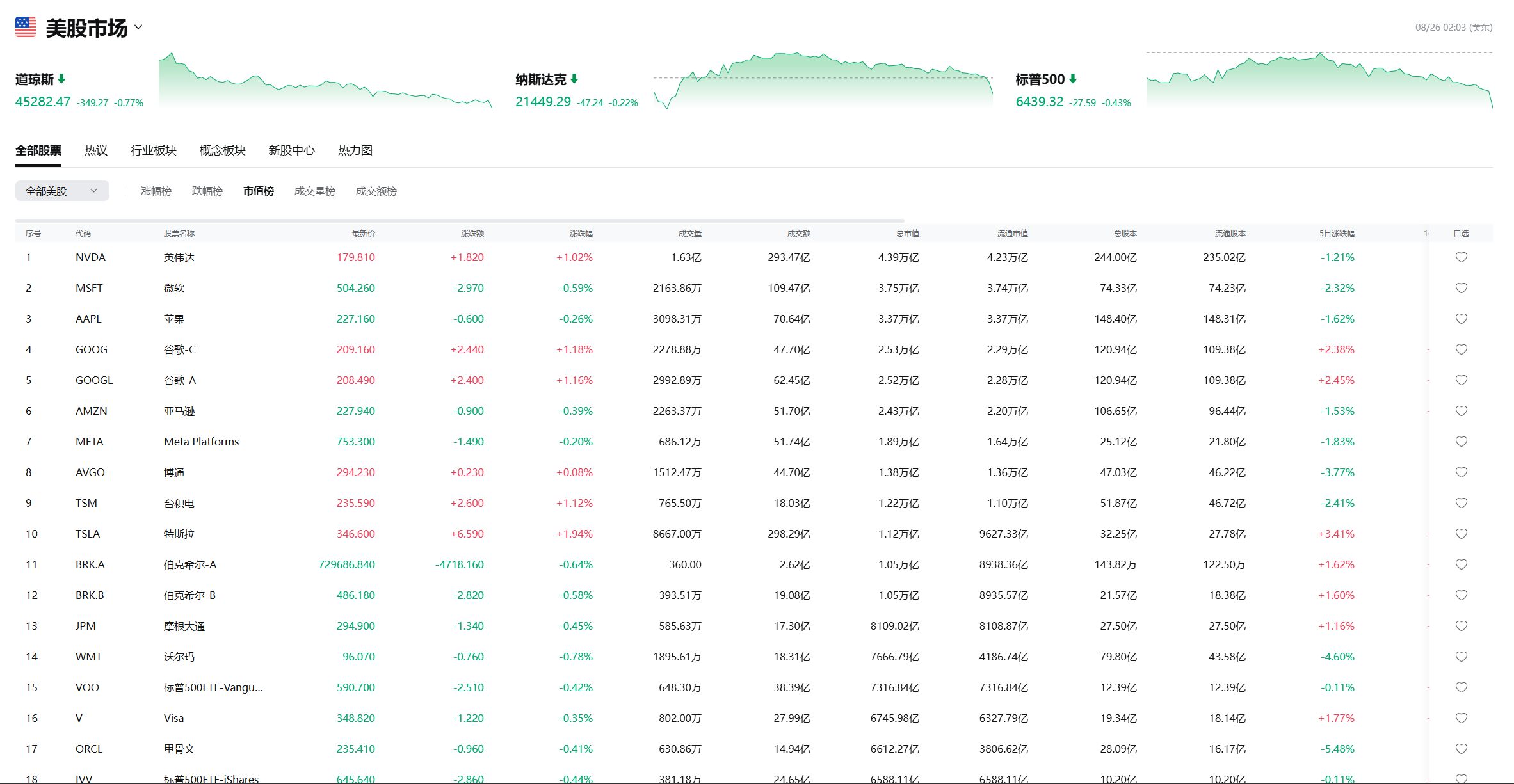

Currently, the companies receiving the most inflow of funds in the US stock market are none other than Nvidia, Apple, and Microsoft. The same goes for domestic markets, with rising companies like Cambricon, electric vehicles, Tencent, Huawei, etc., all being tech stocks. This creates a distorted closed loop: investing in R&D lacks job creation; increasing jobs leads to inflation. How to solve this problem? There are still reference points available domestically, which can drive domestic demand. However, to stimulate domestic demand, it is essential to ensure that bank funds can flow into the hands of ordinary people, but how to achieve this has again become a problem. The biggest issue still lies within the US, where the aggressive development of the financial industry has led to a lack of actual value. The return of manufacturing has become a problem, failing to drive domestic job creation, while illegal immigrants continue to occupy domestic welfare benefits. In such a cycle, external debt will only continue to expand. There will eventually be a day when the bubble bursts, and if there are no emerging industries capable of bearing such a large bubble, a true financial tsunami may sweep the globe again.

Everyone should be clear that the cryptocurrency circle we are currently operating in cannot drive the financial closed loop. At best, it merely reduces the manufacturing cost of currency, making assets more transparent, which belongs to the innovation of currency. It cannot achieve the redemption of the financial industry; rather, the continuous inflow after interest rate cuts will lead to a significant bubble problem. Even if the US once again absorbs assets from the black and gray industries, there will eventually be an end to it, merely extending the duration of the bubble. The current biggest problem is not the cryptocurrency circle, but the collision between the real and virtual financial industries. All indicators point to employment, yet the most critical employment issue is being fabricated in the US. This indicates that the US truly cannot solve this problem, and the inability to solve it is the biggest issue. Of course, these problems do not require us in the cryptocurrency circle to consider too much. What we need to do is simply ride the wave of the US's current situation to earn enough chips.

When Lao Cui thought about this issue, he was actually very pessimistic. Improving production efficiency will inevitably sacrifice the interests of the lower class, but from the current trend, the issues being considered by the upper class still stem from extracting benefits from the lower class. Continuing this way will inevitably lead to significant problems (specifically referring to the US). The current issue is not merely about lowering interest rates, nor can it be resolved by a few cuts. It is about the future of humanity. You can see that the electric vehicles, AI, and aerospace industries that were hyped up in previous years, all of which symbolize human progress, are undoubtedly facing significant bottlenecks. This has led to directional problems in the future of the financial industry. What should we do next? If these two interest rate cuts lead to inflows into this series of tech sectors, how will we resolve class conflict issues afterward? This world is indeed facing significant problems, and Lao Cui hopes everyone can have a clear judgment.

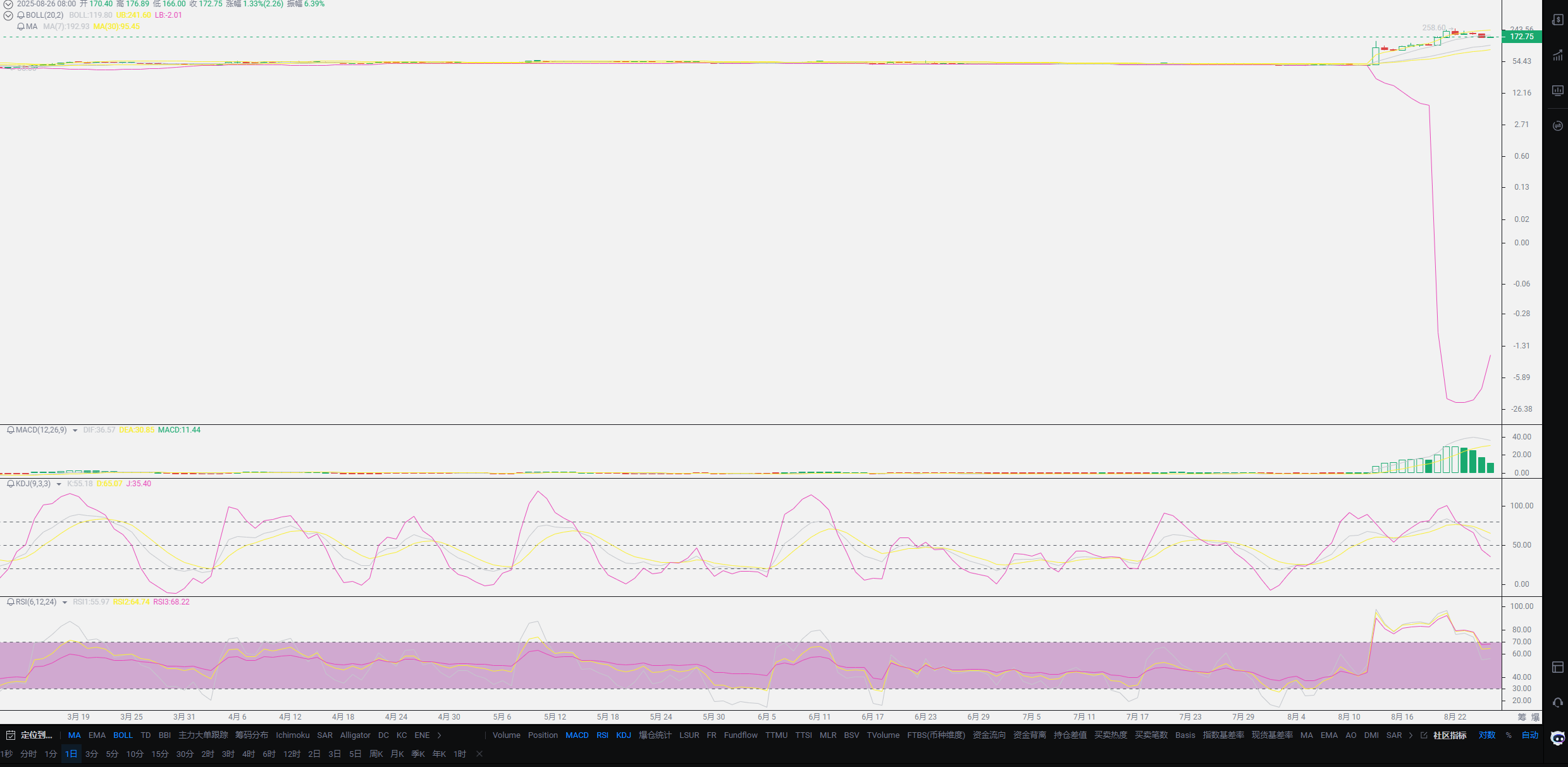

Lao Cui summarizes: The purpose of discussing the above is merely to hope that everyone can clearly understand the problems currently facing the financial industry. This is not a struggle between systems, but a global crisis. This kind of competition is not conducive to human progress. We are in the cryptocurrency circle, and naturally hope for its vigorous development, but from the perspective of global development, the growth of the cryptocurrency circle does not necessarily benefit the lower class. The cryptocurrency circle has provided the upper class with a harvesting channel, which will make the lower class suffer even more. From the perspective of fund flow, after the interest rate cuts, it is highly likely that funds will flow into technology and cryptocurrency-related markets. Your current layouts will definitely revolve around these markets, and in the short term this year, making profits is highly probable. However, afterward, you need to act cautiously. The cryptocurrency circle is a harvesting market, and I hope everyone is prepared to withdraw at any time after this year. If nothing unexpected happens, the financial tsunami is likely to affect everyone within three years. Before the interest rate cuts, the big players will definitely need a space for adjustment. You need not worry; the current depth of adjustment will be fully recovered within a week after the interest rate cut, and within 1-2 months, it will reach new highs again. After reaching new highs, you should be prepared to withdraw at any time, which only applies to the cryptocurrencies Lao Cui previously discussed. If anyone has questions, feel free to communicate with Lao Cui. If you want to choose a contract form during this volatility, it is acceptable, but try to approach it from the perspective of accumulating initial capital. At that time, Lao Cui will also notify everyone of the entry positions.

Original creation by the public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or territories, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only seeking short-term gains, resulting in frequent entrapment.

This material is for learning reference only and does not constitute trading advice. Trading based on this carries risks!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。