TRON builds a diversified stablecoin ecosystem of "mainstream stablecoin USDT + decentralized stablecoin USDD + compliant stablecoin USD1."

Since May 2, when TRON founder Justin Sun announced at the TOKEN2049 Dubai conference that TRON had reached a strategic cooperation with the decentralized stablecoin USD1 supported by the Trump family project World Liberty Financial (WLFI), the landing process of USD1 in the TRON ecosystem has been accelerated.

TRON has launched a series of rapid and efficient layouts: On June 11, Justin Sun announced the official minting of USD1 on the TRON network; on July 7, the one-stop decentralized trading platform Sun.io within the ecosystem launched multiple trading pairs for USD1, enabling on-chain instant exchanges; on August 19, the lending protocol JustLend DAO announced full support for USD1's deposit and lending services, further broadening the asset appreciation channels.

In just three months, TRON completed the process of integrating USD1 from technical access to comprehensive ecosystem integration, achieving full-chain support for the stablecoin on the TRON chain from minting, circulation, free trading to yield appreciation. This efficient advancement not only reflects TRON's high regard for the USD1 project but also benefits from its mature and complete DeFi infrastructure system, which can comprehensively assist a stablecoin project in achieving a rapid launch from 0 to 1.

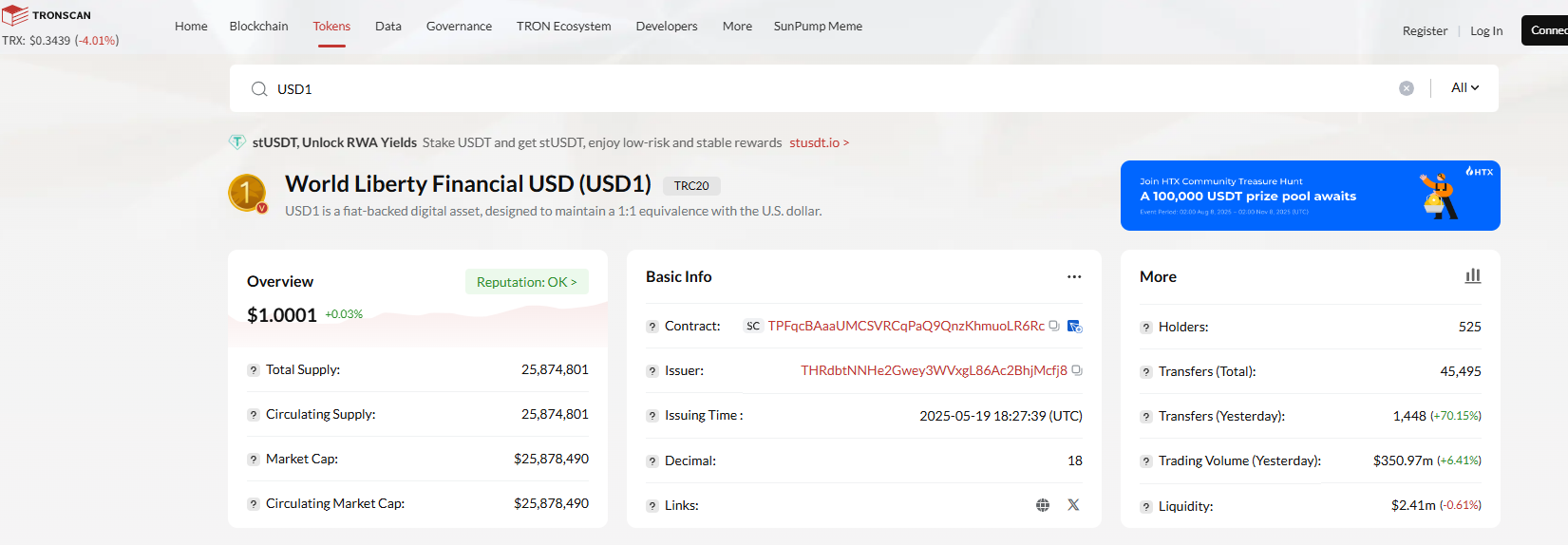

As of August 26, data from the TRONSCAN browser shows that the issuance of USD1 on the TRON chain has exceeded 25 million, with a 24-hour trading volume of over $350 million and more than 520 holding addresses. These figures not only reflect the strong expansion momentum and active liquidity of USD1 in the TRON ecosystem but also mark USD1 as an important component of the core stablecoin asset matrix of TRON.

This cooperation not only validates TRON's strategic foresight in the stablecoin field but also injects new DeFi momentum into the ecosystem through the rapid landing of USD1, laying a solid foundation for the subsequent construction of a diversified stablecoin matrix. As an important new DeFi asset within the ecosystem, USD1 will also bring new development opportunities to TRON.

TRON gathers USD1: Building a diversified stablecoin ecosystem, solidifying its global stablecoin dominance

With the strong entry of the compliant stablecoin USD1, along with the core advantages accumulated in the previous layouts of USDT and USDD, TRON has officially formed a diversified stablecoin ecosystem of "mainstream stablecoin USDT + native decentralized stablecoin USDD + compliant stablecoin USD1." This matrix not only enriches the layers of TRON's stablecoin ecosystem but also continuously strengthens its core discourse power and infrastructure value in the global stablecoin field through the complementary functions and scenario synergies of each currency.

USD1, a compliant dollar stablecoin issued by the Trump family-associated project WLFI, has rapidly gained market recognition since its launch in March this year with its "high transparency + strong compliance." This stablecoin is fully backed by cash equivalents such as short-term U.S. Treasury bonds and dollar deposits at a 1:1 ratio, with asset custody managed by professional institutions like BitGo, and it regularly discloses details of minting, redemption, and reserve assets, making it widely regarded as a representative project of compliant stablecoins.

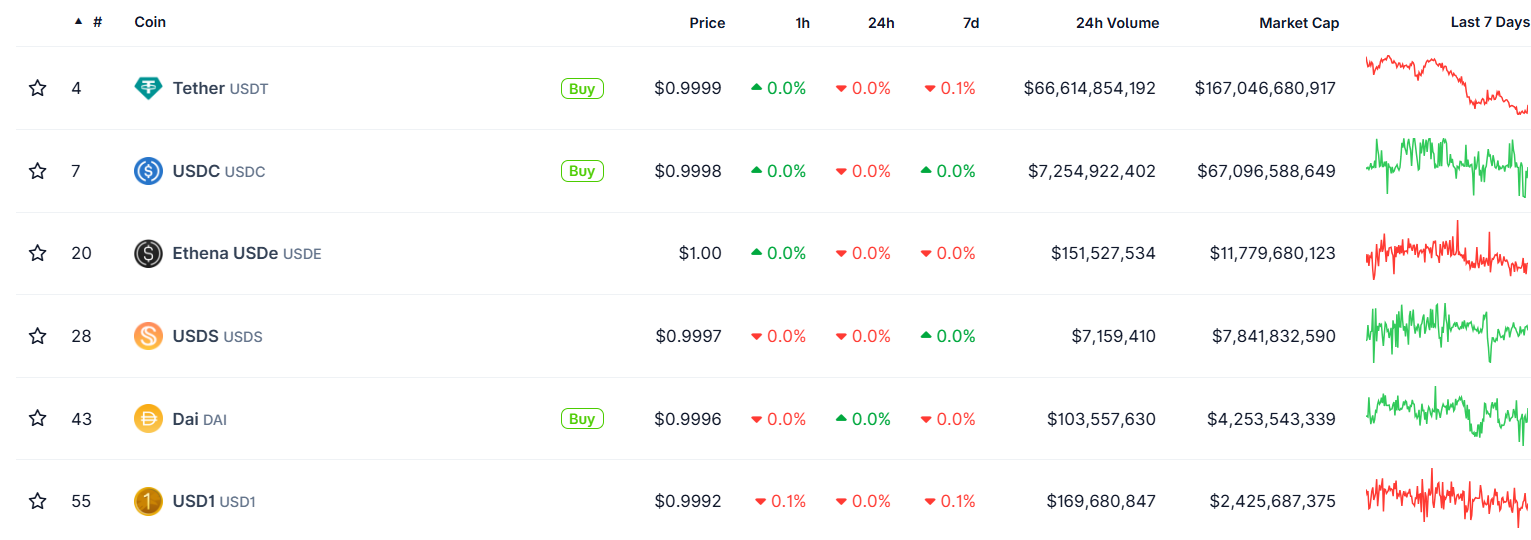

Leveraging the brand influence and compliance advantages associated with the Trump family, USD1 has rapidly expanded since its launch. As of August 26, the circulation of USD1 has approached $2.5 billion, making it the sixth-largest stablecoin globally.

Before cooperating with TRON, USD1 was primarily deployed on the Ethereum and BNB Chain networks, while TRON is its third core blockchain platform for expanding a multi-chain ecosystem. This cooperation is also seen as a key move for USD1 to accelerate its reach to the global user market.

The cooperation between USD1 and TRON began at the TOKEN2049 Dubai conference in May this year: TRON founder Justin Sun, Eric Trump, the second son of Trump, and Zach Witkoff, co-founder of WLFI, jointly announced that they had reached a cooperation to issue the native stablecoin USD1 on the TRON network.

Regarding this cooperation, Eric Trump clearly stated: "TRON's strong technical strength and extensive user base provide a perfect platform for the promotion of USD1."

TRON founder Justin Sun further explained the value of the cooperation: "The integration of USD1 will inject new vitality into the TRON ecosystem. Our goal is to enable every user to easily use stablecoins through their mobile phones and participate in the global financial system. The cooperation between TRON and WLFI is an important step in the integration of DeFi and traditional finance. We hope that through USD1, global users can seamlessly use stablecoins in their daily lives, such as for hotel or store purchases."

From this perspective, this cooperation not only provides USD1 with a technical foundation and user base but also allows TRON's stablecoin ecosystem to incorporate a compliant currency for the first time, achieving full-scenario coverage of "mainstream + decentralized + compliant."

Since the announcement of the cooperation, TRON has rapidly advanced the ecological integration of USD1, achieving a series of key progress: On June 11, USD1 officially began minting on the TRON network, with an initial minting volume of 1,000 coins, marking USD1's formal integration into the TRON ecosystem; on July 7, the one-stop DEX Sun.io within the TRON ecosystem launched multiple trading pairs for USD1, providing users with convenient trading channels; on August 19, the lending protocol JustLend DAO fully supported USD1 deposits and loans, further expanding its yield application scenarios.

In just three months, TRON completed the full-process deployment of USD1 from technical access to DeFi infrastructure integration.

As of August 26, the issuance of USD1 on the TRON chain has exceeded 25 million, with a 24-hour trading volume of over $350 million, more than 520 holding addresses, and a total of 41,000 on-chain transactions, with the growth momentum just beginning.

Although the deployment of USD1 is later than that of Ethereum and BNB Chain, TRON demonstrates significant potential for later-stage expansion, with over 300 million users, a mature stablecoin ecosystem, and leading global infrastructure, making it likely to achieve rapid catch-up or even surpassing.

As the most widely used stablecoin globally, USDT has long maintained the largest circulation scale on the TRON network, making TRON the most popular stablecoin settlement network.

According to a report released by CoinDesk on August 2, titled "TRON Network Research Report," in a survey covering 50 countries, TRON became the most commonly used stablecoin transfer network in 35 countries (including regions in Asia, Africa, and Latin America). Additionally, in June alone, TRON's USDT transfer volume reached 65 million transactions, with a transaction amount exceeding $600 billion.

The "Stablecoin Payment Report" released by Artemis in June also pointed out that based on data from 31 stablecoin payment companies, USDT accounts for about 90% of stablecoin trading volume, while TRON is rated as the most popular stablecoin transfer blockchain.

Currently, the total circulating market value of stablecoins on the TRON network exceeds $83.4 billion, accounting for 30% of the global total market value of stablecoins (approximately $279.8 billion). Among them, the issuance of TRC20-USDT has reached $82.4 billion, with a cumulative increase of about 2.3 billion coins since 2025, an increase of 40%. Currently, the number of accounts holding USDT on the TRON chain exceeds 67 million, with an average of over 1 million active transfer accounts daily, fully demonstrating its leading position as the core infrastructure for stablecoins.

In addition to USDT, TRON's native decentralized over-collateralized stablecoin USDD provides an important decentralized stable solution for its ecosystem, forming a "centralized + decentralized" dual-track complement with USDT. Since its upgrade in January this year, USDD has also maintained stable growth, with its issuance approaching $500 million and the value of collateralized assets within the protocol exceeding $521 million.

By incorporating USD1, TRON has formed a diversified stablecoin ecosystem of "mainstream stablecoin USDT + decentralized stablecoin USDD + compliant stablecoin USD1," covering different user needs and scenarios through clear layered positioning:

- TRC20-USDT serves as the core tool for payment settlement, undertaking the main functions of high-frequency transfers and cross-border payments globally;

- USDD provides a decentralized algorithmic stability solution, meeting users' needs for decentralized finance (DeFi) through over-collateralization and algorithmic anchoring;

- USD1 targets high transparency scenarios for compliance needs.

Now, with the addition of USD1, not only does it inject new momentum into TRON's stable system, but it also further solidifies its position as a core infrastructure for global stablecoins.

The full-chain DeFi ecosystem promotes the landing and advancement of USD1, with TRON's mature infrastructure becoming a "super stage" for stablecoin growth

The landing process of USD1 in the TRON ecosystem is continuously accelerating, from the launch of trading pairs on the ecosystem DEX Sun.io to the support of price support by the oracle WINkLink, and then to the support of storage and lending functions by the lending platform JustLend DAO. This series of developments not only reflects TRON's high regard for USD1 but also benefits from its already mature and complete DeFi infrastructure system, enabling USD1 to quickly achieve full-scenario coverage from liquidity to trading to yield appreciation, helping it rapidly integrate into the ecosystem and release value.

TRON has currently built a DeFi application matrix covering multiple scenarios, providing a solid foundation for the rapid landing and scenario expansion of stablecoin assets. From the DEX platform SunSwap that carries trading demands, the stablecoin trading-focused SunCurve, to the SunPump that lowers the issuance threshold for memes; from the oracle WINkLink that ensures on-chain data security, the JustLend lending platform that provides capital flow, to the BitTorrent protocol that enables cross-chain circulation, and the APENFT NFT market that connects digital art, to the RWA product stUSDT that anchors physical assets. This comprehensive infrastructure system not only quickly expands the application boundaries of stablecoins but also provides one-stop support for new entrants like USD1, assisting it in efficiently completing the startup loop from 0 to 1.

As the "trading entry point" for USD1's integration into the TRON ecosystem, on July 7, the one-stop DEX platform Sun.io within the ecosystem was the first to launch USD1, simultaneously opening three core trading pairs: USD1/USDT, USD1/TRX, and NFT/USD1, directly facilitating convenient trading channels for users. According to data from the Sunscan browser, the asset pool for USD1 reached $3 million at the initial launch, with a nearly 24-hour trading volume exceeding $1.44 million, laying a solid foundation for subsequent liquidity accumulation and user penetration.

After the trading scenarios were established, on-chain data support became key for USD1 to expand its DeFi scenarios. On July 21, WINkLink, the leading oracle project in the TRON ecosystem, announced the addition of USD1/TRX price services, providing a secure, reliable, and real-time price source for on-chain applications. This move not only improved the underlying data infrastructure for USD1 but also directly paved the way for its integration into complex DeFi scenarios such as lending, synthetic assets, and derivatives, eliminating technical application barriers.

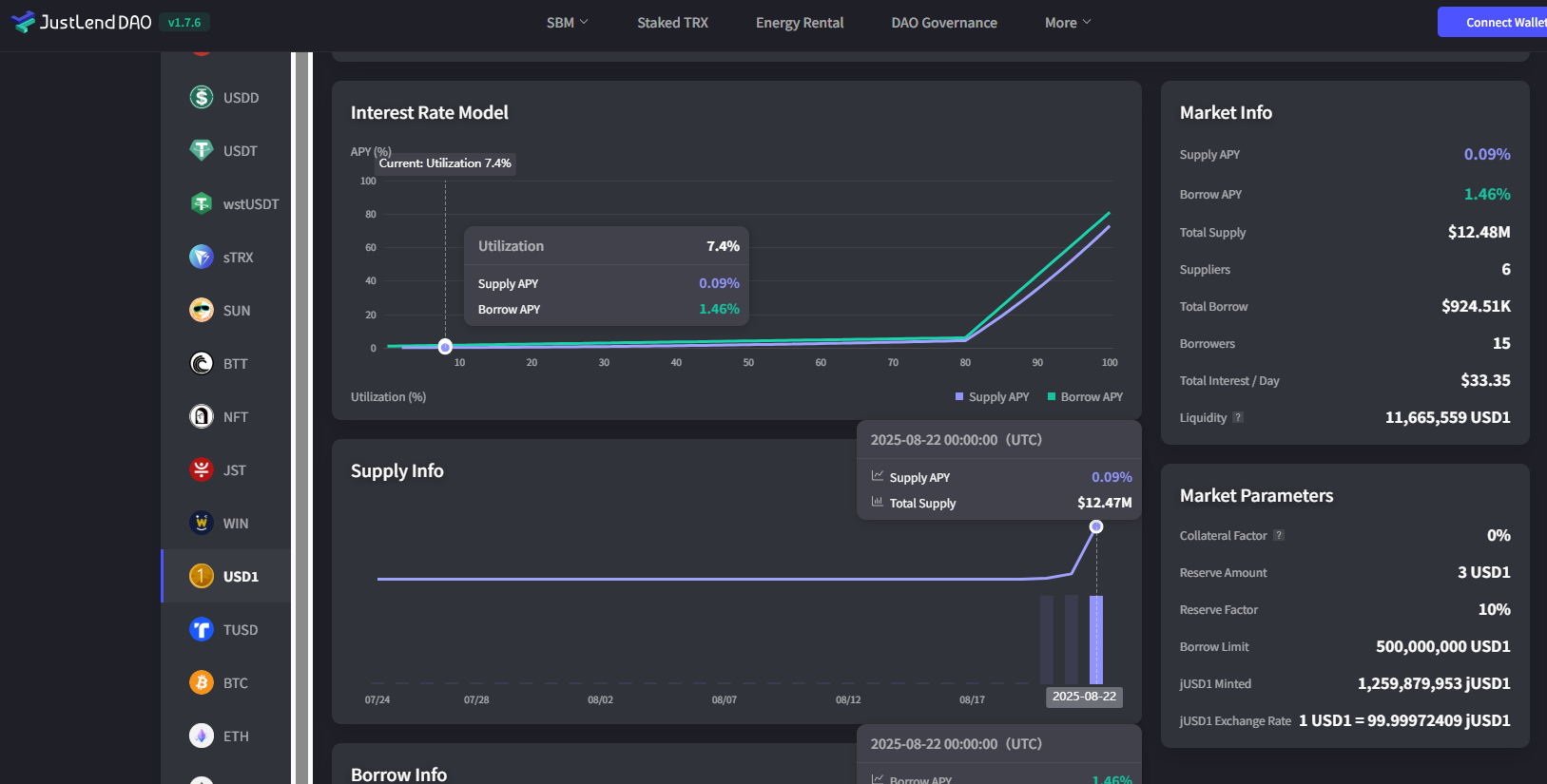

On August 19, the lending protocol JustLend DAO announced its official integration of USD1, fully supporting the stablecoin's deposit, lending, and yield mining functions. Users can now earn stable returns by storing (supplying) USD1 on JustLend DAO or by pledging assets like TRX and USDT to borrow USD1, thereby activating idle funds. Within three days of its launch, the value locked in the USD1 fund pool on the JustLend DAO platform reached $1,248. This move not only reinforced JustLend DAO's position as the core lending hub of the TRON ecosystem but also incorporated USD1 into a "trading-value-added" ecological closed loop, injecting new liquidity and growth momentum into the entire TRON DeFi ecosystem, driving it towards a more mature and diversified direction.

It is worth noting that the TRON version of USD1 has also gained support from mainstream centralized exchanges (CEX) such as HTX and Gate, allowing users to directly deposit and withdraw USD1 on the TRON chain through CEX platforms, further broadening the channels for acquisition and trading, achieving a dual-track circulation pattern of "DEX + CEX."

Currently, the landing of USD1 in the trading and lending fields is just the starting point for its integration into the TRON ecosystem. Relying on TRON's mature application matrix, USD1 is accelerating its extension into more scenarios, releasing diversified value: for example, the SunPump platform may support users in issuing Meme coins using USD1 in the future; the APENFT platform may open channels for purchasing NFT assets with USD1; the ecosystem's native stablecoin USDD could also achieve a 1:1 exchange with USD1, bridging the value circulation link between "decentralized" and "compliant" stablecoins; or leveraging the BitTorrent cross-chain protocol, USD1 could also cross into the BitTorrent ecosystem for transactions, further expanding its application boundaries.

This multi-scenario, deep-level ecological penetration reflects TRON's capability for "full-chain transformation" of stablecoins. By deeply binding USD1 with DeFi, NFT, Meme, cross-chain, and other scenarios within the ecosystem, it not only enhances the actual usage frequency of USD1 but also accelerates its adoption among a broader user base, promoting the expansion of stablecoin services from purely financial transactions to richer application areas such as digital consumption and content creation.

For TRON, the introduction of USD1 is not only a key supplement to the stablecoin matrix but also an important step in its entry into the global compliant financial system. With its compliant attributes, USD1 will inject new momentum into the TRON ecosystem and provide TRON with more adaptable tools when connecting with traditional finance and regional payment systems. In the long run, the deep integration of USD1 not only enriches TRON's stablecoin options but also synergizes with USDT and USDD to jointly provide more efficient, transparent, and diverse financial services to the global population of 8 billion users, broadening the coverage of inclusive finance.

From the leading global USDT ecosystem to the native decentralized USDD, and now to the compliant new force USD1, TRON has constructed a multi-dimensional stablecoin ecosystem pattern of "mainstream + decentralized + compliant," fully adapting to the multi-dimensional needs of public payments, DeFi innovation, and compliant scenarios. This diverse architecture will not only continue to solidify its leading position in the stablecoin field but also establish TRON as the "super infrastructure" for various stablecoins to achieve user growth and scenario landing, providing global users with a more flexible and resilient stablecoin service system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。