Author: Joakim Book

Translated by: Tim, PANews

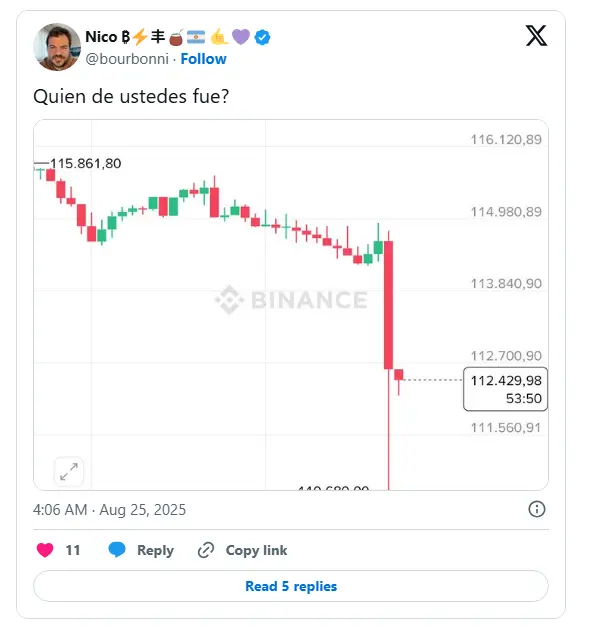

Last Sunday night, Bitcoin experienced a flash crash, resulting in a large bearish candle; even more bizarrely, Bitcoin continued to decline on Monday morning, dropping below $111,000.

In the circles of Bitcoin price analysis, it is often said that no one knows why prices fluctuate. But sometimes we can find clues, though the results may not be as clear-cut as we hope. Today, I will explore two things: the market turmoil of the past 24 hours and Federal Reserve Chairman Powell's speech over the weekend.

Unruly Bitcoin Prices

Sunday night in European time was truly distressing:

When Bitcoin prices exhibit such movements, it is hard to say "no one knows" the reason. In just a few minutes, Bitcoin's price plummeted nearly $3,000, and someone must know why. If it weren't for specific macro events like last week, only two scenarios could cause such a rapid breach of the order book: massive sell orders or (essentially stemming from the same source) large-scale liquidations.

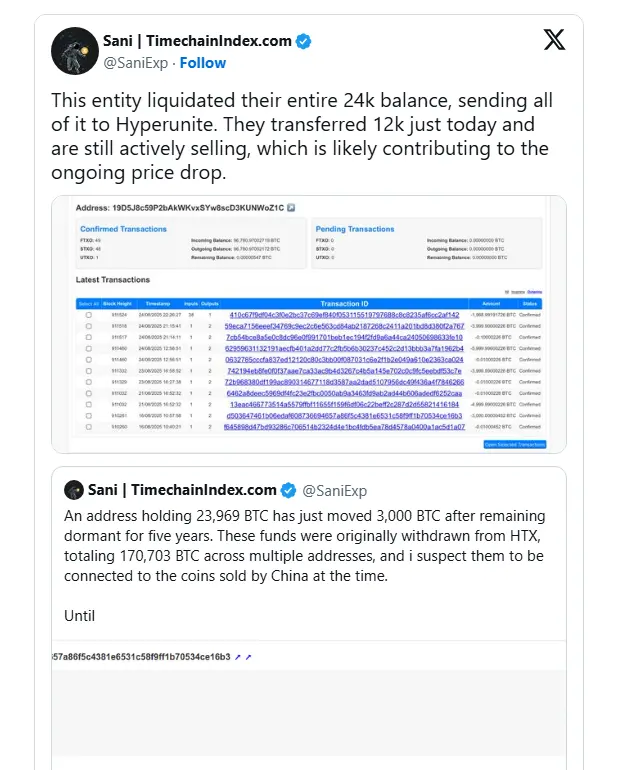

Yesterday, there were signs that both were present:

Or

This is an immature market; our small scale and the low liquidity of the Bitcoin market are simply absurd, and we can still be manipulated by a few individuals. (As is the norm in the Bitcoin world, there are always fools trying to beautify obvious bad situations into good ones.)

The sudden 2.5% drop in Bitcoin's price last night could have been a one-time event triggered by a whale sell-off or liquidation, but the diagonal decline that gradually appeared overnight and on Monday morning (with Bitcoin prices dropping below $111,000) is more concerning.

Forget about those restless whales for now, but another crash occurred later, so what is going on? It should be surging but is slowly declining, for heaven's sake!

Global macro trends point to an increase: why is Bitcoin's price declining in this range? Any reasonable assessment suggests its price should double or triple. (No, we did not drop below $111,000, whether related to Metaplanet's announcement of buying or not, or any connection.)

Bitcoin Prices at Whim, Altcoin Trends at Will

Bitcoin desperately needs therapy: its price movements are completely at whim, disregarding market rationality or rational assessments. Even in the most optimistic bull market environment, it doesn't care. I've heard this referred to as the "maximum pain theory," and even Saylor's "million-dollar cost" average strategy has had little effect.

One of the divination methods of "magic tea leaves" (the 128-day moving average) tells us that our Bitcoin Magazine Pro team's current prediction is $108,500. So we are likely to reach that price. Saylor and others have sold their kidneys and chairs to buy Bitcoin, so I wonder what else they have left to sell.

What’s even scarier is that altcoins will continue to decline, constantly setting new lows. Our exclusive explanation is that all these altcoins, with Mr. Bailey, the owner of BTC Inc, being one of the institutions operating these altcoins, recently lost about $41 million. Earlier this spring, he gobbled up these coins, and now he has to spit them out: some are buried in the large bearish candle triggered by liquidations, while others are buried in the slow and torturous time-weighted price declines.

Some crypto punk OG seems to have realized this situation.

Bitcoin Prices and Powell's Movements

Sometimes we do know (to some extent) what is happening in the market, such as last week on August 22 at 10 AM Eastern Time: the Federal Reserve's official website released a statement and update on the monetary policy framework. The market generally interpreted this as a foregone conclusion that monetary policy would be loosened in the future. How do we know? Because all tokens jumped in that minute, while the dollar index fell in response:

- 9:59:49: Bitcoin price was $112,393, according to Bitcoin Magazine Pro's price chart.

- 10:00:49: One minute later, it was $113,459.

- Shortly after the announcement, Bitcoin's price soared to $115,000, an increase of 2.3%.

This is the kind of news that can shake the market, and the sudden large fluctuations make us quite certain this is the reason.

(Reference data: 9:59, the dollar index DXY was at 98.7; two minutes later it dropped to 98.15; another minute later, it fell to 97.8. In the blink of an eye, the drop reached 1%, and the dollar index experienced such a large fluctuation!)

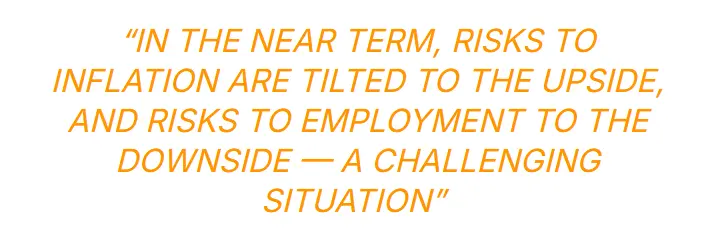

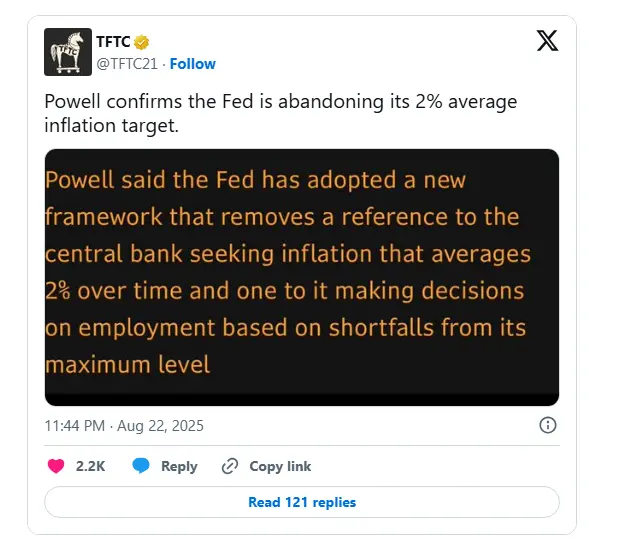

Now we have found the reason for the rise: Powell's dovish speech. Which part of his speech shook the market?

Data releases like this, such as inflation data and the unemployment report from the Bureau of Labor Statistics. Simple trading algorithms immediately scrape website content for real-time updates and make assessments in an instant, often triggering second-order trading effects. When human and intelligent assessments intervene, such market fluctuations usually reverse after ten, twenty minutes, or even half an hour; after all, it ultimately turns out to be a false alarm. But this time is different; Bitcoin's price continued to rise throughout the weekend (until someone disrupted the celebration on Sunday).

Powell's Remarks Last Week

- Inflation has risen slightly but is under control and is declining.

- GDP growth has significantly slowed.

- The unemployment rate remains stable and balanced (but this is "a peculiar balance," where supply and demand are both declining) → Overall risk is rising.

They will abolish this erroneous plan regarding the average inflation target (based on some unspecified time period).

However, Powell concluded that these risks "may necessitate adjustments to our policy stance."

Minutes and hours after Powell's speech and statement were released, Bitcoin's price soared to $117,000, then fell back to $116,000, indicating that market participants were organically analyzing and assessing the significance of this new situation.

The reason I insist on the viewpoint of "no one knows the reason" is crucial: no one can discern which part of Powell's statement truly had an effect, as new information is always intertwined with the expectations held by market participants beforehand, and we can almost never know what those expectations specifically are. When we engage in this kind of post-hoc interpretation, we are essentially playing a game of post-hoc rationalization, which is really nothing remarkable.

It is all too sad; what we need are wealthy Bitcoin players, not impoverished, distressed speculators.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。