Author: Frank, PANews

The celebrity coin track has stirred again, as the globally influential yet controversial artist Kanye West suddenly announced the release of his personal MEME token YZY on August 21, quickly boosting its market value to over $3 billion. Within just a few hours, some profited millions of dollars from early positioning, while many others rushed in only to find themselves stuck at the peak.

PANews conducted an analysis of the initial trades of the top 1,000 holders of YZY. This time, the issuance of YZY seems to have completely torn apart the illusory link between celebrity coin issuance and wealth stories. Insider trading and bots profited, leaving no "civilian" winners in this game of celebrity coins.

Large Holders Entering but Still Stuck at the Peak

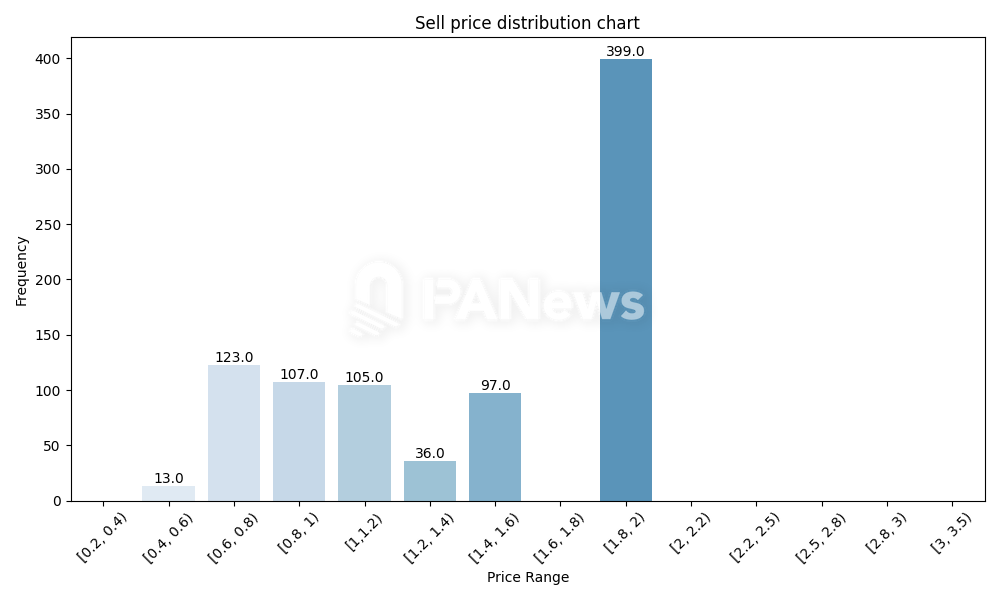

From the overall data, the average initial purchase price for the top 1,000 YZY holding addresses was about $1.45. A large number of these big holders had initial purchase prices in the range of $1.8 to $2, with approximately 44% of them buying within this range. Perhaps due to being trapped immediately after buying, most of YZY's large holders had not made their initial sell by August 25; out of 893 addresses that bought, about 275 sold some tokens, with a sell-off ratio of only around 30%.

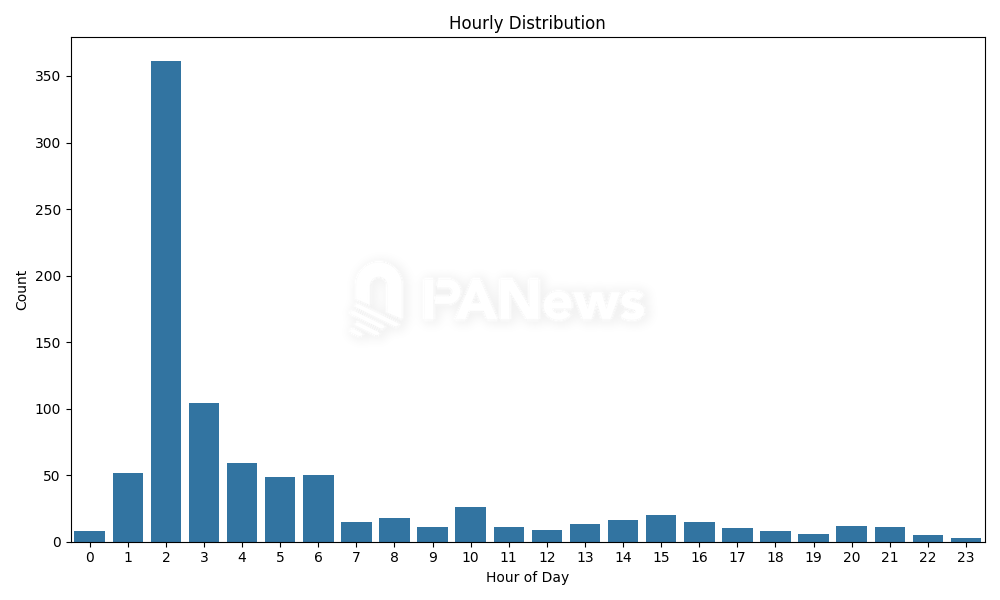

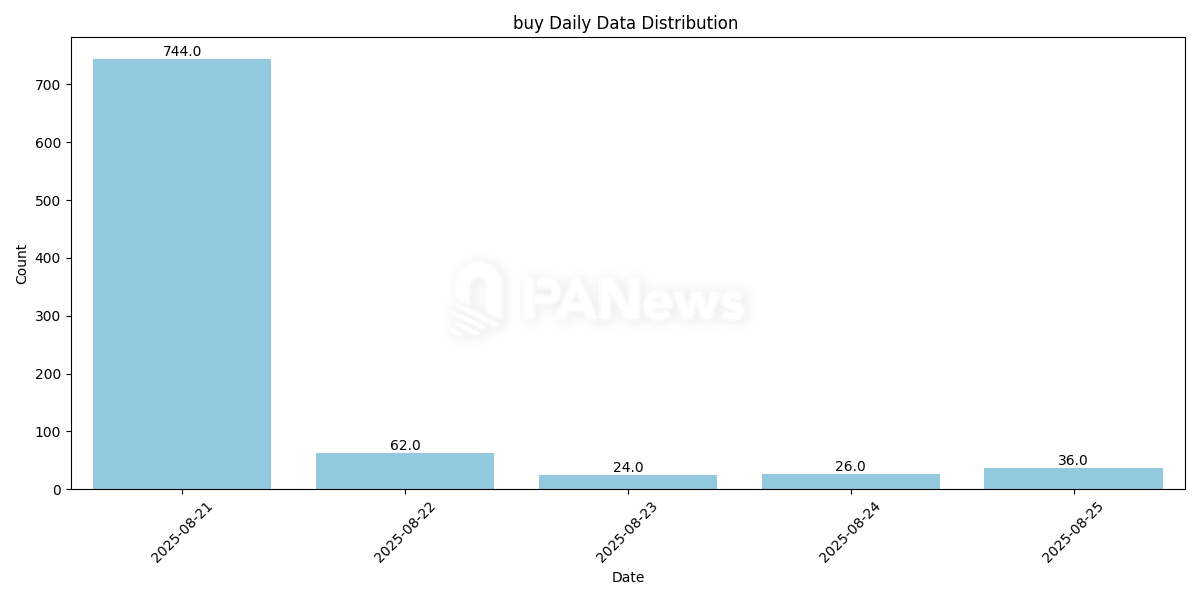

From a timing perspective, these large holders did not enter late. Most of them concentrated their purchases on August 21 (the day the token was made public), particularly within the first hour after Kanye's announcement. Over half of the addresses bought within two hours of the token's opening.

In terms of capital scale, the average initial investment amount for these large holders was about $285,000. This figure is significantly higher than the average of about $9,696 for the top 1,000 addresses of Libra, but much lower than the average purchase of $590,000 for the top 1,000 addresses of the TRUMP token. Overall, these large holders had a total holding of about $46.76 million (excluding team holdings), accounting for approximately 8.5% of the total market value and about 65.3% of the total circulation.

From the selling results, although only a portion of large holders made sell transactions, the data shows that these exiting large holders were generally selling at a loss. The average initial selling price was $1.19, which represents an average loss of about 18% compared to the average entry price of $1.45. Additionally, the average position sold was far less than the entry, at only $11,800.

From this perspective, the main participants in this YZY event seem to be the large holders rather than retail investors. Compared to the previous TRUMP and LIBRA, this time the large holders entered more quickly, all concentrated in the early opening phase. However, the subsequent market recognition seems insufficient; by August 22, although YZY's price had fallen below half of the initial prices for large holders, only a few large holders chose to enter at this stage.

Insider Trading and Bots in a Harvesting Game

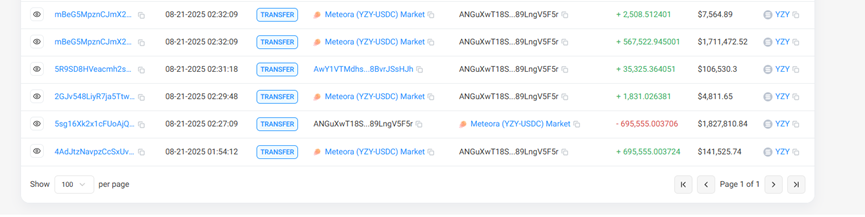

Among the large holders, the highest single purchase was made by the address ANGuXwT18StoX2Ghp3387x6vajPk3sEsxC89LngV5F5r, which spent $200,000 to buy 695,000 tokens just one minute after Kanye announced the address, with an average price of about $0.287. To complete this purchase, the address not only set a 40% slippage but also paid an additional 3.8 SOL to Jtio as a priority fee.

Of course, half an hour later, this address sold for $1.82 million, making a profit of over $1.6 million.

It is worth noting that this address is also considered by the community to be part of an insider group. From the operational behavior, there is indeed a possibility; this address was created on August 19 (the same day YZY's token was created) and withdrew about $200,000 in USDT and 49 SOL from Binance. After that, until YZY went live, this address did not engage in any other MEME coin transactions. Clearly, the creation of this address was aimed at ambushing the YZY token.

In the sampled statistics, four addresses bought YZY within one minute of the opening. However, there were also skilled bots that rushed the opening, such as the address 6xuMV6W6QVxrVmsZxEdLfV6kfhuBsg3ah1X8rydLfQvy, which invested 300 SOL to buy YZY within two minutes of the opening, ultimately profiting about $80,000. From the trading behavior, this address frequently trades MEME tokens, having conducted over 10,000 transactions to date.

Additionally, according to a survey released by Bubblemaps, Hayden Davis, who previously planned and targeted celebrity coins like MELANIA and LIBRA, once again took action by dispersing funds through multiple centralized exchange addresses and immediately targeted the YZY token, ultimately profiting about $12 million.

The Myth of Celebrity Coins Shattered

In the past year, after Trump issued TRUMP, the issuance track of celebrity coins entered a concentrated issuance period. However, the results show that these celebrity tokens generally experienced declines of over 90%, causing significant harm to investors.

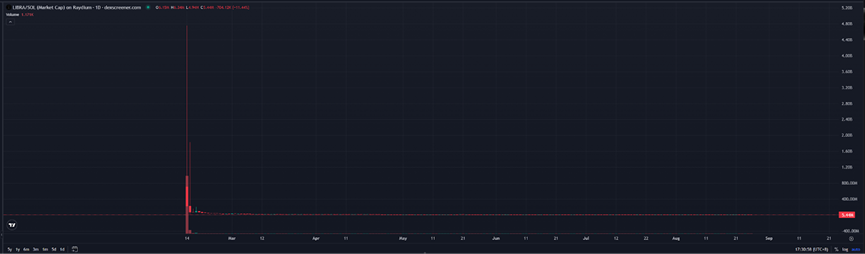

As of now, TRUMP's circulating market value is about $1.65 billion, down about 90% from its peak. The circulating market value of the First Lady token MELANIA is about $148 million, down about 99% from its peak. The token LIBRA issued by the President of Argentina has a market value of only $5.4 million, evaporating 99.9% from its peak market value of $4.7 billion. Moreover, the operational trajectories of these tokens all follow the same L-shape, reaching a peak shortly after issuance and then declining without further fluctuations.

Now, with the issuance of YZY, the number of holding addresses at 27,000 is far less than the previous celebrity coins' popularity. On the other hand, the high cost range of over $1.8 for large holders, along with the lack of follow-up participants, makes it exponentially more difficult to profit from early exits. From the candlestick chart, any large holder who failed to enter within 10 minutes of the opening was almost left hanging at the peak, and the decline was rapid, dropping 70% from the highest point in just 2 hours. This rate and speed of decline are even more exaggerated than some background-less MEME coins.

YZY's initial price trend chart

Looking back at the many celebrity coins from TRUMP to YZY, we can clearly see a similar trajectory:

Blitzkrieg and Head Effect: The launch of celebrity coins relies on the immense influence of the celebrities themselves, capable of instantly attracting global attention and funds. This leads to a price surge in the early opening phase, creating astonishing profit margins for a very small number of "insiders" or "early runners." They leverage information advantages and technical means to harvest before retail investors enter.

"Large Holders" Taking Over and Retail Investors' Confusion: Unlike ordinary MEME coins, the second wave of main participants in celebrity coins is often wealthy large holders. They may have missed the initial golden minute but, driven by a belief in the celebrity effect and a gambler's mentality, choose to take over at high prices. However, once the hype cannot be sustained and subsequent funds cannot keep up, these large holders find themselves trapped alongside the retail investors who rushed in.

Value Vacuum and L-shaped Trend: Stripping away the celebrity's halo, these tokens have almost no actual value or application scenarios to support them. When the hype subsides, market sentiment cools rapidly, and prices will "free fall," ultimately forming an unsightly "L" shaped candlestick. The myth of soaring prices exists only in the first few minutes or hours, followed by a long road to value zero. From TRUMP to LIBRA, and now to YZY, this "iron law" has been validated without exception.

The turmoil surrounding YZY once again proves that the celebrity coin track is not a blue ocean of value but a dangerous casino manipulated by information asymmetry and market sentiment.

In this game, the real winners are always those insiders and capital hunters who can position themselves early and harvest precisely. For the vast majority of ordinary investors, when they see news on social media, they often find themselves standing at the peak of risk. The rapid rise and sudden cooling of YZY serve as another wake-up call for the frenzied MEME market: beneath the glow of celebrity halos often lies an investment abyss that ordinary people find hard to bear.

When the next "Kanye" appears, investors might want to ask themselves first whether they want to become fuel for someone else's wealth myth or choose to stay away from this carnival that is destined to profit only a few.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。