Digital asset manager Bitwise is preparing to launch a spot-based exchange traded fund (ETF) focused on holding the native token of Chainlink (LINK), a first in the U.S.

According to the S-1 registration statement filed with the U.S. Securities and Exchange Commission on Tuesday, the Bitwise Chainlink ETF aims to provide investors with direct exposure to LINK and named Coinbase Custody as the proposed custodian for the tokens.

The filing fits into a broader trend of asset managers seeking to launch altcoin-focused spot ETFs in the U.S. as regulatory headwinds receded under the Trump administration, following the success of bitcoin (BTC) and ether (ETH) vehicles.

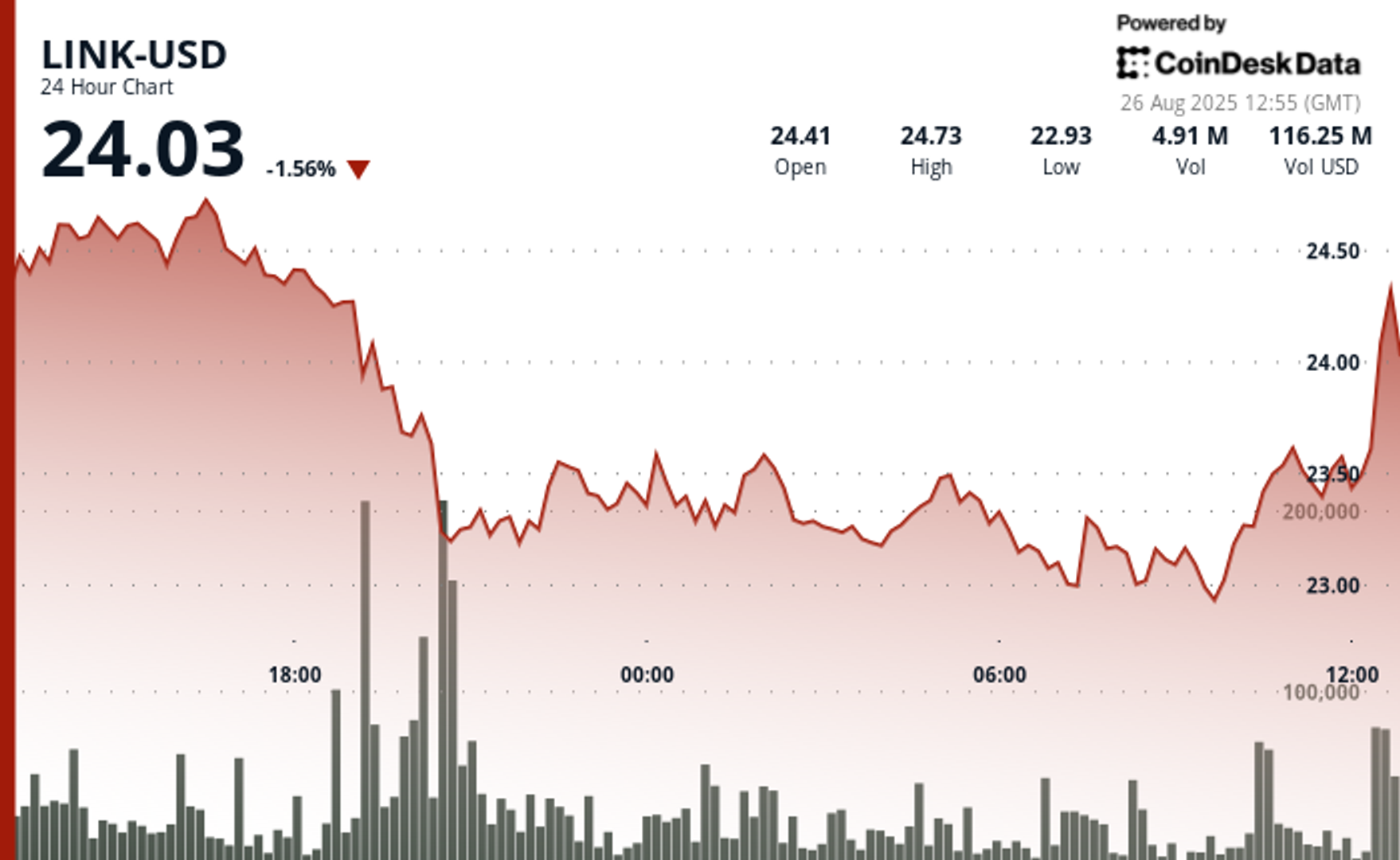

LINK bounced 5% from the overnight lows on the news, but was still down 1.6% over the past 24 hours, per CoinDesk data.

Despite the rebound, CoinDesk Research's technical analysis model suggested sustained bearish pressure for LINK as the crypto market is going through a consolidation period.

LINK encountered substantial downward pressure over the past 24 hours, falling from a session peak of $24.81 to a low of $22.90.

A notable recovery effort surfaced during 10:00-11:00 UTC, coinciding with the ETF filing, as the price rallied from $23.02 to $23.54 on heightened volume of 3.35 million units, indicating possible consolidation above the crucial $23.00 psychological threshold.

The model suggested that reclaiming the $24.00 level is key to halting the bearish momentum, while the recent rebound implies oversold conditions may be attracting value-seeking investors.

Technical indicators point to downward momentum

- Price declined 4.67% from $24.61 to $23.46 during the last 24-hours from Aug. 25 12:00 to Aug. 26 11:00 UTC.

- Trading range of $1.84 between a maximum of $24.81 and a minimum of $22.90.

- Volume surged to 6.58 million units, significantly above 24-hour average of 2.29 million.

- Strong resistance established around $24.30 with support near $23.00.

- Failure to reclaim $24.00 indicates continued bearish sentiment.

- Break below $23.40 support level suggests further downside risk toward $23.00.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。